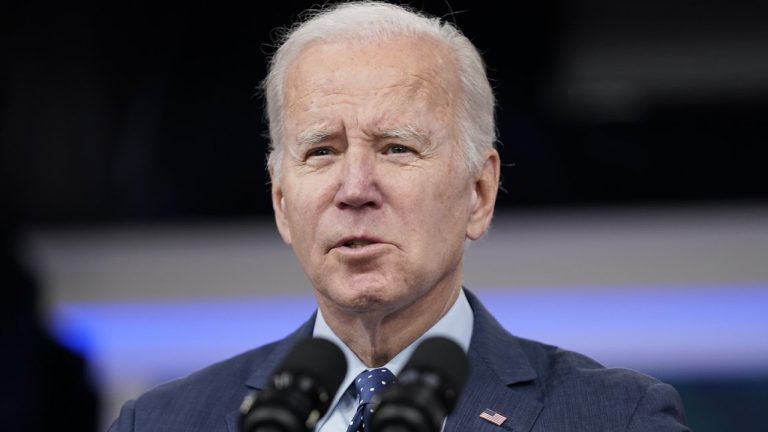

Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.” Biden Expresses Confidence in American Banking System Despite […]

Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.” Biden Expresses Confidence in American Banking System Despite […]

Cointelegraph analyst and writer Marcel Pechman explains how a U.S. debt default could impact Bitcoin and the larger cryptocurrency market.

Macro Markets, hosted by crypto analyst Marcel Pechman, airs every Friday on the Cointelegraph Markets & Research YouTube channel and explains complex concepts in layperson’s terms, focusing on the cause and effect of traditional financial events on day-to-day crypto activity.

The risks of a United States debt default are the first topic of this week’s show, which comes from none other than Treasury Secretary Janet Yellen. Yellen warned of potential mass unemployment, payment failures and broad economic weakness if the U.S. failed to pay its debts. This issue emerges every couple of years, creating some tension within Congress, but at some point, they agree to raise the debt limit. So, no harm done, right?

That’s partially true because if the government doesn’t have a majority, which happens to be the case, the opposition has the upper hand to bargain their demands. In this case, Republicans want President Joe Biden to drop $4.5 trillion in unsound projects, such as letting go of some of the student debt or hiring thousands of Internal Revenue Service employees.

Pechman explains how the event, whatever the outcome, is bullish for Bitcoin (BTC) and discusses the odds of a government debt default and how the debt ceiling increase drives liquidity to the markets, favoring scarce assets.

The next segment of Macro Markets focuses on Tesla, the EV automaker controlled by Elon Musk. Firstly, he’ll go over its importance for Bitcoin holders and the cryptocurrency sector then proceed to summarize the company’s financial conditions and why the 9,200 BTC held by Tesla doesn’t pose a risk for Bitcoin’s price.

The show concludes by examining how short-selling works. Unlike futures contracts, to sell a stock on margin, one needs to borrow it from a holder. Typically, those rates are negligent, maybe between 0.3% and 3% per year. However, when there’s excessive betting against the stock price and the demand for shorts increases, this rate can go as high as 50% per year or become unavailable.

In the semi-failed First Republic Bank’s case, which saw net redemptions of $100 billion in the previous quarter, short sellers are having trouble borrowing the stock, but Pechman explains how that does not pose a problem to those interested in betting on the bank’s stock price decline. According to Marcel, the bailout of First Republic Bank can further catapult Bitcoin above $30,000.

If you are looking for exclusive and valuable content provided by leading crypto analysts and experts, make sure to subscribe to the Cointelegraph Markets & Research YouTube channel. Join us at Macro Markets every Friday.

Market analyst Charles Edwards says that while there are good reasons to exercise caution, investors’ risk off sentiments and expectation of a recession could be overblown.

The U.S. stock market approaches a crucial turning point as uncertainty over inflation rises after hotter-than-expected economic data released in February. Despite mounting investor worries, the economy is showing signs of resilience that could protect against a significant downside move.

The escalating risk-off sentiment in the market is also creating volatility for Bitcoin (BTC). The leading crypto asset, which has had a strong correlation with the U.S. stock market, moved oppositely to the stock market in February. The correction between BTC and Nasdaq turned negative for the first time in two years. However, with the crypto bulls pausing at the $25,200 level, the risks of a downturn alongside stocks are increasing.

While there’s certainly a reason to maintain caution until the release of new economic data and the United States Federal Reserve meeting in March, some indicators suggest that the worst could still be over in terms of new market lows.

The biggest worries of the current bear cycle, which began in 2022, have been decade-high inflation. In January, the Consumer Price Inflation (CPI) level came in hotter than expected, with a 0.2% increase versus the previous month.

There are some additional signs that inflation may remain sticky. The housing sector inflation, which commands more than 40% of the weightage in CPI calculation, has shown no sign of a downturn.

It appears that the market is slipping back into the 2022 trend where increasing inflation corresponds to higher Fed rate hikes and poor liquidity conditions. The market’s expectation of a 50 basis point rate hike in the upcoming March 22 meeting has increased from single-digit percentages to 30%. Fed President Neel Kashkari also raised concerns that there is a lack of signs showing that Fed rate hikes are curbing services sector inflation.

A report from Charles Edwards, founder of Capriole Investments, however, argues that inflation has been in a downtrend with a minor setback in January, which is non-conclusive.

“Until we see this chart plateau out, or increase, inflationary risk is overstated and the market so far has overreacted.”

The release of February CPI on Mar. 12 will be instrumental in creating market bias in the short term.

Despite high inflation levels, the risk of a recession in stock markets has reduced considerably. Edwards noted in the report that the job sector remains robust with low unemployment levels, which is striking, especially at the "late end of the cycle." He added,

"Ultra low unemployment paired with high interest rates increases the odds of an unemployment bottom being in (or forming)."

However, the market is also more sensitive to rising unemployment from here. If the unemployment levels react to Fed's hawkishness, a stock market downturn due to recession risks could rise quickly. February's job sector report is set to release on Mar. 10.

According to the report, the worst downturns in the S&P 500 index over the past 50 years when similar recessionary fears were prevalent have been -21%, -27% and -20%. The latest 2022 bottom also tagged the 27% downturn mark, which is encouraging for buyers. It raises the possibility that the bottom for the S&P 500 might be in.

Currently, the S&P 500 and the tech-heavy Nasdaq-100 index threaten to break below the 200-daily moving average at 3,900 and 11,900 points, respectively. It raises the possibility that the late 2022 and early 2023 increase may have been another bear market rally instead of the start of accumulation with the bottom tagged for this cycle. A move below the 200-day M.A. for the stocks market would add additional pressure on the crypto market.

Notably, in December, when the stock market was surging higher, crypto markets stayed flat due to the aftermath of the FTX collapse. In early 2023, the crypto markets likely played catch up to the stock market, and currently, it might be experiencing the tail end of the opposite reaction.

Related: Bitcoin on-chain data highlights key similarities between the 2019 and 2023 BTC price rally

As the Fed prepares for renewed hawkishness, it adds more pressure to the upcoming debt limit crisis of the U.S. Treasury. Since mid-2022, when the Fed started quantitative easing, the U.S. Treasury facilitated backdoor liquidity injection. However, the added liquidity from the Treasury will be drained entirely by June 2023.

The market's optimism earlier this year was probably from the fact that the Fed would start easing interest rates by that time the Treasury's funds dried out. However, if inflation props back up and the Fed continues increasing rates. By June, the economy will be in a precarious position with expensive credit and limited liquidity from the Treasury.

Still, as Edwards mentioned, "there is no doubt risk in the market," but the economy is in a much healthier position than expected. The probability of a recession is down to 20% from 40% in December. The current weakness could be a bear trap before sentiments improve again. A lot will depend on the economic data release this month and price action around crucial support levels.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The U.S. will pay over $1 trillion in debt interest next year, the equivalent of three or more Bitcoin market caps at current prices.

Bitcoin (BTC) bulls do not need to wait long for the United States to start printing money again, commentators believe.

The latest analysis of U.S. macroeconomic data has led one market strategist to predict quantitative tightening (QT) ending to avoid a “catastrophic debt crisis.”

The Federal Reserve continues to remove liquidity from the financial system to fight inflation, reversing years of COVID era money printing.

While interest rate hikes look set to continue declining in scope, some now believe that the Fed will soon have only one option — to halt the process altogether.

“Why the Fed will have no choice but to cut or risk a catastrophic debt crisis,” Sven Henrich, founder of NorthmanTrader, summarized on Jan. 27.

“Higher for longer is a fantasy not rooted in math reality.”

Henrich uploaded a chart showing interest payments on current U.S. government expenditure, this now hurtling toward $1 trillion a year.

A dizzying number, the interest comes as a result of U.S. government debt being over $31 trillion, the Fed having printed trillions of dollars since March 2020 alone. Since then, interest payments themselves have gone up by 42%, Henrich noted.

The phenomenon has not gone unnoticed elsewhere in crypto circles. Popular Twitter account Wall Street Silver compared the interest payments as a portion of U.S. tax revenue.

“US paid $853 Billion in Interest for $31 Trillion Debt in 2022; More than Defense Budget in 2023. If the Fed keeps rates at at these levels (or higher) we will be at $1.2 trillion to $1.5 trillion in interest paid on the debt,” it wrote.

“The US govt collects about $4.9 trillion in taxes.”

Such a scenario might be music to the ears of those with significant Bitcoin exposure. Periods of “easy” liquidity have corresponded with increased appetite for risk assets across the mainstream investment world.

The Fed’s unwinding of that policy accompanied Bitcoin’s 2022 bear market, and a “pivot” in interest rate hikes is thus seen by many as the first sign of the “good” times returning.

Not everyone, however, agrees that the impact on risk assets, including crypto, will be all-out positive prior to that.

Related: Bitcoin ‘so bullish’ at $23K as analyst reveals new BTC price metrics

As Cointelegraph reported, ex-BitMEX CEO Arthur Hayes believes that chaos will come first, tanking Bitcoin and altcoins to new lows before any sort of long-term renaissance kicks in.

If the Fed faces a complete lack of options to avoid meltdown, Hayes believes that the damage will have already been done prior to QT giving way to quantitative easing, or QE.

“This scenario is less ideal because it would mean that everyone who is buying risky assets now would be in store for massive drawdowns in performance. 2023 could be just as bad as 2022 until the Fed pivots,” he wrote in a blog post this month.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin price has been on a tear, but analysts warn that resolving the U.S debt limit issue could trigger sharp downside for risk assets like BTC.

For much of 2022, the crypto market focused on the U.S. Federal Reserve's actions. The central bank created a bearish environment for risk-on assets like stocks and cryptocurrencies by increasing the interest rates on borrowing.

Toward the end of 2022, positive economic data, healthy employment numbers and a decreasing inflation rate provided hope that a much-awaited slowdown in the rate of interest rate hikes would occur. Currently, the market expects the rate hikes to reduce from 50 basis points (bps) to 25 bps before the complete end of the hike regime by mid-2023.

From the perspective of the Fed's goal of constraining liquidity and providing headwinds to an overheated economy and stock market, things are starting to improve. It appears that the Fed's plan of a soft-landing by quantitative tightening to curb inflation without throwing the economy into a deep recession might be working. The recent rally in stock markets and Bitcoin can be attributed to the market's trust in the above narrative.

However, another essential American agency, the U.S. Treasury, poses significant risks to the global economy. While the Fed has been draining liquidity from the markets, the Treasury provided a countermeasure by draining its cash balance and negating some of the Fed's efforts. This situation may be coming to an end.

It invokes risks of constrained liquidity conditions with the possibility of an adverse economic shock. For this reason, analysts warn that the second half of 2023 may see excess volatility.

The Fed started its quantitative tightening in April 2022 by increasing the interest rates on its borrowings. The aim was to reduce inflation by constraining the market's liquidity. Its balance sheet shrank by $476 billion during this period, which is a positive sign considering that inflation dropped and employment levels stayed healthy.

However, during the same time, the U.S. Treasury used its Treasury General Account (TGA) to inject liquidity into the market. Typically, the Treasury would sell bonds to raise additional cash to meet its obligations. However, since the nation’s debt was close to its debt ceiling level, the federal department used its cash to fund the deficit.

Effectively, it’s a backdoor liquidity injection. The TGA is a net liability of the Fed’s balance sheet. The Treasury had drained $542 million from its TGA account since April 2022, when the Fed began rate hikes. Independent macro market analyst, Lyn Alden, told Cointelegraph:

“U.S. Treasury is drawing down its cash balance to avoid going over the debt ceiling, which is adding liquidity into the system. So, the Treasury has been offsetting some of the QT that the Fed is doing. Once the debt ceiling issue gets resolved, the Treasury will be refilling its cash account, which pulls liquidity out of the system.”

The U.S. Treasury's debt totaled approximately $31.45 trillion as of Jan. 23, 2023. The number represents the total outstanding of the U.S. government accumulated over the nation's history. It is crucial because it has reached the Treasury's debt ceiling.

The debt ceiling is an arbitrary number set by the U.S. government that limits the amount of Treasury bonds sold to the Federal Reserve. It means that the government can no longer take on additional debts.

Currently, the U.S. has to pay interest on its national debt of $31.4 trillion and spend on the welfare and development of the country. These expenditures include salaries of public medical practitioners, educational institutions, and pension beneficiaries.

Needless to say that the U.S. government spends more than it makes. Thus, if it can't raise debt, there'll have to be a cut in either interest rate payments or government expenditures. The first scenario means a default in U.S. government bonds which opens a big can of worms, starting with a loss of trust in the world's largest economy. The second scenario poses uncertain but real risks as failure to meet public goods payment can induce political instability in the country.

But, the limit is not set in stone; the U.S. Congress votes on the debt ceiling and has changed it many times. The U.S. Treasury Department notes that "since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents."

If history is any indication, the lawmakers are more likely to resolve those issues by raising the debt ceiling before any real damage is done. However, in that case, the Treasury would be inclined to increase its TGA balance again; the department's target is $700 billion by 2023 end.

Either by draining out its liquidity completely by June or with the help of a debt ceiling amendment, the backdoor liquidity injections into the economy would come to a close. It threatens to create a challenging situation for risk-on assets.

Bitcoin’s correlation with the U.S. stock market indices, especially the Nasdaq 100, remains near all-time highs. Alden noted that the FTX collapse suppressed the crypto market in Q4 2022 when the equities rallied on slower rate hike expectations. And while the congress delays its decision on the debt ceiling, favorable liquidity conditions have allowed Bitcoin’s price to rise.

However, the correlation with the stock markets is still strong, and movements in S&P 500 and Nasdaq 100 will likely continue influencing Bitcoin’s price. Nik Bhatia, a financial researcher, wrote about the importance of the stock market’s direction for Bitcoin. He said,

“…in the short term, market prices can be very wrong. But over the more intermediate term, we have to take trends and trend reversals seriously.”

With the risks from the ongoing Fed’s quantitative tightening and stoppage of Treasury liquidity injections, the markets are expected to stay vulnerable through the second half of 2023.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

A recently published forecast stemming from the Federal Reserve Bank of Cleveland’s Inflation Nowcasting data indicates upcoming U.S. consumer price index (CPI) metrics will likely be elevated. The newly predicted CPI levels were recorded the same day America’s gross national debt surpassed $31 trillion on October 4, as the country’s growing debt continues to rise […]

A recently published forecast stemming from the Federal Reserve Bank of Cleveland’s Inflation Nowcasting data indicates upcoming U.S. consumer price index (CPI) metrics will likely be elevated. The newly predicted CPI levels were recorded the same day America’s gross national debt surpassed $31 trillion on October 4, as the country’s growing debt continues to rise […] As July begins and markets remain bearish, there’s still no shortage of dynamic developments in the crypto space. In this week’s Bitcoin.com News Week in Review, ‘sleeping bitcoins’ from 2010 make moves, Rich Dad Poor Dad author Robert Kiyosaki says he is waiting for bitcoin to test $1,100, Russia denies debt default allegations, and Mark […]

As July begins and markets remain bearish, there’s still no shortage of dynamic developments in the crypto space. In this week’s Bitcoin.com News Week in Review, ‘sleeping bitcoins’ from 2010 make moves, Rich Dad Poor Dad author Robert Kiyosaki says he is waiting for bitcoin to test $1,100, Russia denies debt default allegations, and Mark […]

Podcaster and Bitcoin educator, Natalie Brunell, believes the current market turmoil could lead to regulation favouring Bitcoin over alts.

Natalie Brunell, the host of Coin Stories podcast, thinks that the recent incidents involving Terra and Celsius and the following market sell-off will lead to regulatory action that will likely favour Bitcoin over the rest of cryptocurrency.

“I'm going to be watching for regulation developments, just signifying that Bitcoin is a digital property and that maybe there's more fair accounting that can be done to allow institutions to invest", she said in a latest interview with Cointelegraph. "And the other cryptocurrencies, I think will be deemed securities”, she continued.

Brunell defines herself as a Bitcoin maximalist and therefore sees Bitcoin as a fundamentally different asset class from the rest of crypto, mainly because of its trustlessness nature.

"I see it [Bitcoin] as digital property, as a savings technology, and that's why I focus my energy on that." she points out, ading that other cryptocurrencies are much more vulnerable to third-party risks.

"I have to worry about: who's creating them [altcoins], who's expanding the supply, who might be hired or fired, what experiment are they trying?",

After a brilliant career in Journalism, Natalie went full time in crypto after discovering Bitcoin. She then launched the Coin Stories podcast, where she interviews the leading voices of the crypto industry.

Don’t miss the full interview on our YouTube channel and don’t forget to subscribe!

A warning by Tesla and Spacex CEO Elon Musk about the mounting national debt in the U.S., government spending, and the proposal to tax unrealized capital gains has highlighted the benefits of cryptocurrencies, particularly bitcoin. Elon Musk Says ‘Spending Is the Real Problem’ Tesla CEO Elon Musk made several tweets about the U.S. national debt […]

A warning by Tesla and Spacex CEO Elon Musk about the mounting national debt in the U.S., government spending, and the proposal to tax unrealized capital gains has highlighted the benefits of cryptocurrencies, particularly bitcoin. Elon Musk Says ‘Spending Is the Real Problem’ Tesla CEO Elon Musk made several tweets about the U.S. national debt […]

Bitcoin should be there to allow people to save in the event of governments fail, Senator Cynthia Lummis said.

Amid the United States President Joe Biden signing legislation to raise the government’s debt limit to $28.9 trillion, Senator Cynthia Lummis said that Bitcoin (BTC) is a blessing of God.

Republican Senator Lummis gave a speech to the Senate on Thursday, providing her perspective on how digital currencies like Bitcoin could potentially help countries like the U.S. address the looming crisis when the state runs out of cash.

Lummis said that one of the reasons she became so interested in non-fiat digital currencies like Bitcoin is because they are not issued by the government and thus aren’t beholden to the debts that are “run up by governments” such as the United States.

As cryptocurrencies are not beholden to governments and political elections, they should grow and be there, allowing people to save in the event if governments fail, Lummis argued:

“Time and again, presidents of both parties have run up the debt irresponsibly, with no plan to address it. So thank God for Bitcoin, and another non-fiat currency that transcends the irresponsibility of governments, including our own.”

Thank God for #Bitcoin pic.twitter.com/W9BtWZAiU4

— Michael Saylor⚡️ (@saylor) October 15, 2021

U.S. President Biden officially signed legislation temporarily raising the state’s borrowing limit on Thursday, pushing off the deadline for debt default only until December. The legislation would extend the debt ceiling by $480 billion from the current national debt of $28.4 trillion.

Related: US lawmaker is most concerned about Treasury's response to crypto

A Republican from Wyoming, Lummis has emerged as one of the most vocal advocates of Bitcoin in the U.S. Senate. The senator is known for accumulating significant amounts of Bitcoin, with one of the latest purchases worth between $50,001 and $100,000.

In February, Lummis launched the Financial Innovation Caucus to educate fellow lawmakers about Bitcoin and other cryptocurrencies. The pro-Bitcoin senator is also known for joining a laser-eye flash mob on Twitter earlier this year, projecting Bitcoin to reach $100,000 by the end of 2021.