Tesla and Spacex CEO Elon Musk has launched a $1 million daily giveaway campaign, encouraging swing-state residents to sign a petition in battleground states. The billionaire gave the first $1 million to one man at a rally as he highlighted concerns about the country’s future and the urgent need for reform. The daily cash prizes […]

Tesla and Spacex CEO Elon Musk has launched a $1 million daily giveaway campaign, encouraging swing-state residents to sign a petition in battleground states. The billionaire gave the first $1 million to one man at a rally as he highlighted concerns about the country’s future and the urgent need for reform. The daily cash prizes […] A petition initiated by freedom advocate Aaron Day, calling for the release and pardon of Roger Ver, has gathered 245 signatures out of a goal of 500. Ver, the founder of Bitcoin.com, is facing extradition to the U.S. on charges of tax evasion. Petition Presses for the Release of Roger Ver as U.S. Pursues Extradition […]

A petition initiated by freedom advocate Aaron Day, calling for the release and pardon of Roger Ver, has gathered 245 signatures out of a goal of 500. Ver, the founder of Bitcoin.com, is facing extradition to the U.S. on charges of tax evasion. Petition Presses for the Release of Roger Ver as U.S. Pursues Extradition […] The XRP Army is ramping up efforts to push back against the U.S. Securities and Exchange Commission (SEC)’s appeal in the Ripple lawsuit, calling it unnecessary and damaging to the cryptocurrency market. XRP supporters claim that the SEC’s actions create instability in the crypto sector, directly contradicting the agency’s mission. XRP Army’s Petition Calls for […]

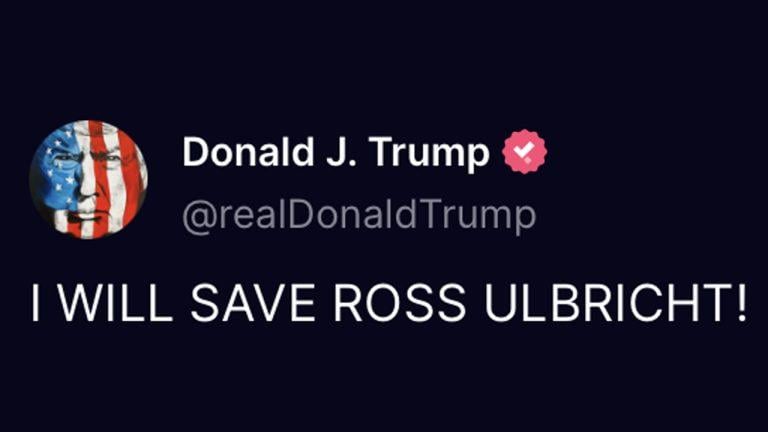

The XRP Army is ramping up efforts to push back against the U.S. Securities and Exchange Commission (SEC)’s appeal in the Ripple lawsuit, calling it unnecessary and damaging to the cryptocurrency market. XRP supporters claim that the SEC’s actions create instability in the crypto sector, directly contradicting the agency’s mission. XRP Army’s Petition Calls for […] Former President Donald Trump once again affirmed his intention to commute Ross Ulbricht’s sentence, the founder of the darknet marketplace Silk Road. On Truth Social, Trump shared a post featuring Ulbricht discussing his 12th year in prison, and Trump declared in all capital letters, “I WILL SAVE ROSS ULBRICHT!” Petition for Ross Ulbricht’s Freedom Gathers […]

Former President Donald Trump once again affirmed his intention to commute Ross Ulbricht’s sentence, the founder of the darknet marketplace Silk Road. On Truth Social, Trump shared a post featuring Ulbricht discussing his 12th year in prison, and Trump declared in all capital letters, “I WILL SAVE ROSS ULBRICHT!” Petition for Ross Ulbricht’s Freedom Gathers […]

Ben Horowitz, one of the firm’s founders, has pledged to support any politician that helps push crypto and AI technology forward.

Venture capital firm Andreessen Horowitz (a16z) is hoping to push pro-crypto and AI regulation forward with seemingly new strategy: Throwing money at politicians.

“If a candidate supports an optimistic technology-enabled future, we are for them. If they want to choke off important technologies, we are against them,” wrote Ben Horowitz, one of the firm’s founders, in a Dec. 14 post, adding:

Horowitz said it would be the “first time” a16z pursues the lobbying route to promote tech-friendly politicians. However, it reportedly held a fundraiser for a New York congressman in October 2022, according to Forbes.

The DeFi Education Fund says a patent owned by True Return Systems is being used to try to profit from lawsuits against decentralized protocols.

A decentralized finance (DeFi) advocacy body has petitioned the United States Patent and Trademark Office (USPTO) to review a patent owned by a company it has accused of being a a “patent troll” — a firm that aims to profit from patent lawsuits.

In a Sept. 11 blog post, the DeFi Education Fund (DEF) said on Sept. 7 that it filed an over 90-page petition to the Patent Trial and Appeal Board in a bid to cancel a patent owned by True Return Systems.

Granted in 2018, the patent lays claim to a process for “linking off-chain data to a blockchain,” DEF legal chief Amanda Tuminelli said in a Sept. 11 X (Twitter) post.

Tuminelli claimed True Return tried to sell its patent as a nonfungible token (NFT). After no buyer, it filed suit against the DeFi protocols MakerDAO and Compound Finance in October.

4/ When that didn’t work, in October 2022, TRS sued MakerDAO and “Compound Protocol” in two separate federal court proceedings, alleging patent infringement.

— Amanda Tuminelli (@amandatums) September 11, 2023

Docket links: https://t.co/w47v7fAAEthttps://t.co/ExTapxhKNq

“Clearly [True Return’s] goal was to name defendants who could not answer the complaint so [it] could get a default judgement,” Tuminelli said.

She claimed True Return would try to enforce the court’s ruling against token holders and repeat the process with other protocols “that either can’t challenge them in court or don’t have the resources to do so.”

DEF claimed True Return’s tech in the patent isn’t new at the time it was granted and claims to highlight similar existing tech such as the InterPlanetary File System (IPFS) along with the decentralized storage platforms Sia, Storj and Swarm.

8/ In our petition, we make the point that the “invention” in the patent was not new in 2018. There are many examples of “prior art” the Patent Board can look at - examples - a NASDAQ patent that links price data off-chain to on-chain transaction historyhttps://t.co/amz3jREab7 pic.twitter.com/RJ3VVGFeEj

— Amanda Tuminelli (@amandatums) September 11, 2023

True Return Systems acknowledged Cointelegraph’s request for comment but did not immediately provide a comment.

Related: SEC’s Gary Gensler to hold firm on crypto enforcement in Senate hearing

DEF said it launched the petition with USPTO to defend the ability to use and develop open source software, to stop any potential plans by True Return to sue crypto projects and help MakerDAO and Compound’s legal defence.

True Return has three months to optionally respond to the petition, after six months the USPTO must make a decision if it will move forward with reviewing the patent where it has 12 months to decide if the patent should be cancelled.

Magazine: Hall of Flame: Crypto lawyer Irina Heaver on death threats, lawsuit predictions

The appeals court judge said Robinhood “had the right” to impose restrictions on meme trade purchases.

A United States federal appeals court has upheld a decision to dismiss an investor class action lawsuit against online brokerage firm Robinhood Markets over its meme stock trading debacle in early 2021.

A total of 16 investors took part in a class action lawsuit against the trading platform in September 2021, alleging the firm restricted them from purchasing 13 “meme stocks” when hedge funds were being short squeezed in January 2021.

This stopped them reaping the profits and also caused the share prices of these stocks to plummet, they alleged.

Robinhood won a motion to dismiss the complaint in January 2022, citing the plaintiff's failure to state a claim, plaintiffs then went on to argue the decision in the U.S. appeals court in March 2023.

However, it appears the investors have hit another setback as the appeals judge has upheld the decision to dismiss the lawsuit, with U.S. Appellate Court Judge Britt Grant saying the arguments lacked legal merit.

She explained that Robinhood “had the right to do exactly what they did” because they were not legally obligated to protect these investors from pure economic loss.

This is because Robinhood was, and still is legally permitted to restrict its customers’ ability to trade securities and to refuse to accept any of their transactions, Judge Grant added.

If the investors decide to pursue the matter further, their next and final route will be through the U.S. Supreme Court — the highest court in the U.S. However, they will need to file a petition for a "writ of certiorari," which is a document asking the Supreme Court to review the case.

The Supreme Court takes on about 100-150 cases from over 7,000 reviews, so the plaintiff’s chances of having its case heard once more are likely slim.

Related: Robinhood turns profitable in Q2, but crypto revenue declines

The GameStop short squeeze happened in January 2021, which was initially triggered by users of the /wallstreetbets subreddit.

The strategy of the short squeeze was to cause big losses for Wall Street firms shorting these particular stocks, and by doing so, profiting themselves.

Another 12 stocks became part of the frenzy, including AMC Entertainment, American Airlines Group, Blackberry, Bed, Bath & Beyond, and Trivago.

GameStop stocks were however one of the largest gainers of the Reddit-fueled price pump, increasing over 9,900% from $0.86 to over $86 between Apr. 2020 and Jan. 2021, according to Macrotrends.net.

Magazine: Blockchain games aren’t really decentralized… but that’s about to change

The comment from the crypto exchange came after the SEC asked for more time to respond to Coinbase's rulemaking petition.

Coinbase has slammed the United States securities regulator for failing to answer questions asked in the U.S. Court of Appeals as part of its ongoing legal battle with the regulator.

In a June 17 letter filed in the Court, lawyers for the crypto exchange accosted the Securities Exchange Commission for continuing to offer “no straight answers” to the Court in relation to Coinbase’s rulemaking petition, which calls on the SEC to establish a regulatory framework for digital assets.

“When ordered by this Court to address the stark inconsistency between its litigating position and its actions and statements elsewhere, the SEC still offers no straight answers and instead repeats its talking points,” Coinbase’s letter said.

The letter was in response to the SEC’s June 13 submission requesting an additional 120 days to reply to Coinbase’s rulemaking petition.

Coinbase claimed the SEC is reluctant to inform the Court of updates on its decision, saying it “bristles even at being ordered to update the Court on its progress.”

The firm claimed the impact of the SEC’s silence, the lengthy delays and its enforcement actions continue to weigh on the crypto industry and SEC chair Gary Gensler "continues to charge well down the path to irreparably damaging a U.S. public company and an entire industry.”

On June 17, Coinbase’s chief legal officer, Paul Grewal, said in a series of tweets that it’s “unusual for the government to defy a direct question from a federal court.”

We couldn't wait until our deadline next week to address the SEC's response to the June 6 order from the Third Circuit. It is unusual for the government to defy a direct question from a federal court. But the SEC’s evasive response goes further, as we set out today. 1/5 pic.twitter.com/ssULmUpzi2

— paulgrewal.eth (@iampaulgrewal) June 17, 2023

Related: Hong Kong legislator invites Coinbase to the region despite SEC scrutiny

Grewal said he’s hoping for the Court to grant a writ of mandamus — a court order to a government official ordering them to fulfill their official duties under the law — given thathe SEC knocked back Coinbase’s petition.

Coinbase is also submitting that the court instead set a deadline of 60 days or less starting from June 13 — the date of the SEC’s request.

In a separate case, the SEC sued Coinbase on June 6, alleging the trading platform broke various securities rules, most notably for purportedly offering cryptocurrencies that the regulator considers to be unregistered securities.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

The securities regulator said it would make a recommendation within 120 days on Coinbase’s rulemaking request, but says the action has “no merit.”

The United States securities regulator has asked for four more months to provide a response to Coinbase’s request for crypto regulatory clarity.

In a June 13 letter submitted to the U.S. Court of Appeals for the Third Circuit, the Securities and Exchange Commission (SEC) said it needs an additional 120 days to reply to Coinbase’s request that it adopt new rules and provide further clarity on the laws governing crypto.

The letter was in response to the court’s June 6 order to the SEC which asked the regulator to address if it’s denying the rulemaking or if it needs more time to respond.

The SEC said it “has not decided what action to take on that petition in whole or in part” and claimed Coinbase’s request for a writ of mandamus has “no merit.”

The regulator claimed that the mandamus petition “should be denied” but anticipated it would be able to make a recommendation on Coinbase’s petition for rulemaking “within the next 120 days.”

In response to the letter, Coinbase chief legal officer Paul Grewal informed his 40,000 Twitter followers that the SEC had repeated the “fallacy” that it was yet to decide on any new regulation.

Related: Hinman documents suggest SEC is the wrong agency to govern digital assets, crypto lawyer says

He added the letter ignored clear statements from SEC chair Gary Gensler that the SEC has “no intent to issue new rules.”

“[The SEC] instead conflate the evidence of a decision those statements provide with an argument that the statements are themselves a decision,” Grewal said.

4) they ignore the clear statements of the Chair that confirm they have no intent to issue new rules, and instead conflate the evidence of a decision those statements provide with an argument that the statements are themselves a decision. 3/5

— paulgrewal.eth (@iampaulgrewal) June 13, 2023

“They refuse to commit to any deadline despite the Court's explicit order,” Grewal added.

The court’s order to the SEC came the same day the regulator sued Coinbase for offering unregistered securities and operating an unregistered securities exchange.

Magazine: Joe Lubin — The truth about ETH founders split and ‘Crypto Google’

The Coinbase CEO has a lot of faith in Congress in making a “clear rule book” for crypto firms to follow. But the SEC? Not so much.

United States-founded cryptocurrency exchange Coinbase has no plans to move its operations out of the U.S., CEO Brian Armstrong told investors in an Q1 earnings call.

On May 5, Armstrong assured shareholders the firm is “100% committed” to the U.S. market over the long term despite regulatory uncertainty in the U.S.

“So let me be clear, we're 100% committed to the U.S. I founded this company in the United States because I saw that rule of law prevails here. That's really important, and I'm actually really optimistic on the U.S. getting this right.”

The “optimism” alluded to by Armstrong comes from his confidence in Congress soon passing a clear set of rules for crypto firms to follow:

“When I go visit DC, there is strong bipartisan support for Congress to come in and create new legislation that would create a clear rule book in the U.S. and I think it's really important for America to get this right.”

However, Armstrong’s comments weren’t entirely “optimistic.”

The chief executive is concerned about the unpredictable enforcement action of the Securities Exchange Commission, which comes in light of the firm being served with a Wells Notice by the securities regulator in late March:

“Despite our ongoing engagement with the commission, they have not been as clear about what their specific concerns are with Coinbase as we might like, and so I have to refrain from speculating too much.”

“It's especially difficult to predict the timeline of any potential SEC litigation that we might face,” Armstrong added.

The troubles led Coinbase to file an action in a U.S. federal court seeking to compel the SEC to answer a petition that has been pending since July.

Today, to provide greater transparency in our long-standing engagement with the SEC, we are sharing our response to the Wells notice we received last month. https://t.co/aquuWmxmRM

— Coinbase ️ (@coinbase) April 27, 2023

The back and forth comes as Coinbase launched Coinbase International Exchange (CIE) on May 2, which prompted many pundits to believe that Coinbase was looking for an escape route from the U.S.

The exchange is open to customers in 30 countries worldwide, including Singapore, Hong Kong, El Salvador, Philippines, Thailand and Bermuda — where CIE is now licensed from.

Today Coinbase launched Coinbase International Exchange @CoinbaseIntExch and will begin by offering BTC & ETH perpetual futures settled in USDC with up to 5x leverage to institutional clients in eligible jurisdictions outside of the U.S.https://t.co/OzhbgJlZ2K

— Coinbase ️ (@coinbase) May 2, 2023

Related: SEC has 10 days to respond to Coinbase complaint: Legal exec

Armstrong said the European Union is “in front” in terms of regulatory progress with its Markets in Crypto Assets (MiCA) legislation set to enter into effect in mid-2024 or early 2025:

“They've adopted comprehensive crypto legislation called MiCA, creates a single clear rule book for the entire region. It's pretty powerful.”

“I just got back from a trip from the U.K. and D.C. Both of those, both have draft bills in the works that are working on things like around stable coins and market structure Singapore, Hong Kong, Australia, Brazil, all are essentially following in this direction,” Armstrong added.

The CEO’s remarks come as Coinbase managed to increase its revenue 22% and slashed its net income loss over $475 million to $79 million in Q1.

Our Q1'23 financial results are in and our letter to shareholders can be found on the Investor Relations website at https://t.co/8ovHEtPRgf pic.twitter.com/4iWAPGZNMh

— Coinbase ️ (@coinbase) May 4, 2023

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?