The U.S. Federal Reserve has raised the benchmark bank rate seven times during the course of 2022, leading many to question when the central bank will cease or change course. The Fed has stated that it aims to bring inflation down to the 2% target, and the increases to the federal funds rate are intended […]

The U.S. Federal Reserve has raised the benchmark bank rate seven times during the course of 2022, leading many to question when the central bank will cease or change course. The Fed has stated that it aims to bring inflation down to the 2% target, and the increases to the federal funds rate are intended […] Gold is on the rise in 2023 and in the first week of the new year alone, the precious metal has jumped 2.36% against the U.S. dollar. Over the past 65 days, gold has soared 14.55% while silver has skyrocketed 22.31% against the greenback since Nov. 3, 2022. According to the head of metals strategy […]

Gold is on the rise in 2023 and in the first week of the new year alone, the precious metal has jumped 2.36% against the U.S. dollar. Over the past 65 days, gold has soared 14.55% while silver has skyrocketed 22.31% against the greenback since Nov. 3, 2022. According to the head of metals strategy […]

Bitcoin, stocks or else, there is now no light at the end of the Fed rate hike tunnel in 2023, says Jim Bianco.

Bitcoin (BTC) and other bulls will not benefit from a major change in United States inflation policy in 2023, one analyst says.

In a Twitter thread on Dec. 20, Jim Bianco, head of institutional research firm Bianco Research, said that the Federal Reserve would not “pivot” on rate hikes next year.

In light of the surprise yield curve control (YCC) tweak by the Bank of Japan (BoJ), analysts have become all the more bearish on the prospects for risk assets this week.

As Cointelegraph reported, the move spelled immediate pain for the U.S. dollar, and with the Wall Street open in sight, equities futures were trending down in step at the time of writing.

For Bianco, the fact that the BoJ was now seeking to follow the Fed in tightening policy to ward off inflation meant that the latter was unlikely to loosen its own policy.

“Again, if JAPAN! is NOW hiking to changing policy NOW because of inflation, remind me why the Fed would be pivoting anytime in 2023?” part of one post read.

“The answer is they will not. You can forget a pivot.”

The real tangible consequences of Japan’s decision may only be felt later, Bianco continued. With bond yields rising, Japan should attract capital back home and away from the U.S.

“The dollar is getting crushed against the Yen (or the Yen is soaring versus the dollar). Japan is getting a yield again. That should drive funds back into Japan,” he wrote.

A return to lowering interest rates is a key eventuality being priced in by markets beyond crypto, and this is something that simply no longer pays, Binanco said. Despite BTC/USD already down nearly 80% in just over a year in tandem with the Fed’s quantitative tightening (QT), the pain may thus still be far from over.

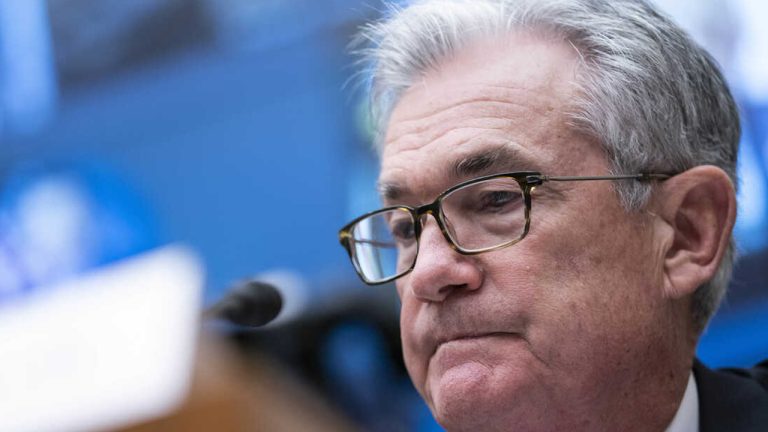

“Powell is hawkish,” he concluded, referring to last week’s speech by Fed Chair, Jerome Powell, in which he sought to steer markets away from anticipating any policy loosening.

“ECB head Legarde (Madam Laggard) is now talking hawkish. Kuroda and the BoJ are (now) making moves that show concern about inflation. Markets may need to rethink their view about central banks pivoting.”

Other perspectives sought to offer a more hopeful view of the coming year, while avoiding implicitly bullish language.

Related: 'Wave lower' for all markets? 5 things to know in Bitcoin this week

Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, forecast 2023 as a "sideways" trading environment for equities.

"My sense is that 2023 will be a sideways choppy market, with one or more retests of the 2022 low, but not necessarily much worse than that," he tweeted on Dec. 19.

"Either way, I don’t think we are close to a new cyclical bull market yet."

In subsequent comments, Timmer added that while he believed a secular bull market had been in place ever since 2009, the "question is whether the secular bull market is still alive."

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

The best-selling author of Rich Dad Poor Dad has tipped Bitcoin and two other commodities as buying opportunities, noting a U.S. dollar crash could occur by January.

Robert Kiyosaki, businessman and best-selling author of Rich Dad Poor Dad has called Bitcoin, silver and gold a “buying opportunity” amid the strengthening United States dollar and continued interest rate hikes.

In an Oct. 2 Twitter post to his 2.1 million followers, the author noted the prices of the three commodities — sometimes referred to as "safe haven" assets — would continue getting lower as the U.S. dollar strengthens, proving its worth once the “FED pivots” and drops interest rates.

BUYING OPPORTUNITY: if FED continues raising interest rates US $ will get stronger causing gold, silver & Bitcoin prices to go lower. BUY more. When FED pivots and drops interest rates as England just did you will smile while others cry. Take care

— therealkiyosaki (@theRealKiyosaki) October 2, 2022

In a post the day before, Kiyosaki predicted this “pivot” could happen as soon as January 2023, which would see the U.S. dollar “crash” in the same way as the recently collapsed English Pound Sterling.

“Will the US dollar follow English Pound Sterling? I believe it will. I believe US dollar will crash by January 2023 after Fed pivots,” said Kiyosaki, adding he “will not be a victim of the F*CKed FED.”

Since as early as May. 2020, Kiyosaki has been a proponent for asset classes that the Fed cannot directly manipulate, having once warned investors to “Get Bitcoin and save yourself” following the Fed’s immediate mass money printing episodes in response to the COVID-19 pandemic.

Interestingly, Kiyosaki’s liking for Bitcoin stands despite not believing there’s any value to it, he said in a recent interview on Rich Dad. The author appears to be standing behind Bitcoin again in his most recent tweet, noting:

“When FED pivots and drops interest rates as England just did you will smile while others cry.”

In a September letter to his mailed subscribers, Kiyosaki stressed the need to invest in digital assets now in order to score outsized returns over the long term:

"It's not enough to WANT to get into crypto [...] Now is the time you NEED to get into crypto, before the biggest economic crash in history."

The U.S. dollar has been gradually gaining strength over other major global currencies over the last year, with the GBP/USD, EUR/USD, and JPY/USD falling 18.24%, 15.54%, and 23.33% respectively, according to Trading Economics.

At the same time, the Fed’s interest rate hike, along with a strengthening USD has coincided with a 55% drop in the crypto market cap over the last 12 months.

Related: The British pound collapse and its impact on cryptocurrency: Watch the Market Report

Last month, hedge fund co-founder CK Zheng said he expected October to be a “very volatile” month for BTC.

“October is a pretty volatile period of time, especially when combined with high inflation, with a lot of debate in terms of the Fed and policy change. The concern is that if the Fed tightens too much, the U.S. economy may actually go into a severe recession.”

Kickstarter, one of the leading crowdfunding platforms on the market, has decided to abandon its current business model and migrate to a blockchain-based platform. This will be built by an independent organization funded initially by Kickstarter to work on the protocol. The new platform will be built on top of the Celo blockchain. Kick-Starting a […]

Kickstarter, one of the leading crowdfunding platforms on the market, has decided to abandon its current business model and migrate to a blockchain-based platform. This will be built by an independent organization funded initially by Kickstarter to work on the protocol. The new platform will be built on top of the Celo blockchain. Kick-Starting a […] The Chinese mining crackdown forced many miners to stop their operations and relocate. But another group of miners is planning to pivot to new, more efficient mining schemes to keep operating in the country. Lesser-known tokens and proof-of-stake-based systems are now in the sights of these miners as ways to continue their work away from […]

The Chinese mining crackdown forced many miners to stop their operations and relocate. But another group of miners is planning to pivot to new, more efficient mining schemes to keep operating in the country. Lesser-known tokens and proof-of-stake-based systems are now in the sights of these miners as ways to continue their work away from […]