Sam Bankman-Fried (SBF), the former CEO of FTX, now faces a 13-count indictment as U.S. officials have added new charges. One of the new charges alleges that SBF leveraged $40 million to influence “one or more Chinese government officials.” Details of the Bribery Charges Against Sam Bankman-Fried Sam Bankman-Fried (SBF), the co-founder and former CEO […]

Sam Bankman-Fried (SBF), the former CEO of FTX, now faces a 13-count indictment as U.S. officials have added new charges. One of the new charges alleges that SBF leveraged $40 million to influence “one or more Chinese government officials.” Details of the Bribery Charges Against Sam Bankman-Fried Sam Bankman-Fried (SBF), the co-founder and former CEO […]

Derivatives liquidity protocol Synthetix seals new partnership with DWF Labs, landing a $20 million investment from the quantitative trading firm.

Tokenized asset issuance platform Synthetix has secured a $20 million investment through a new partnership with Web3 investment and quantitative trading firm DWF Labs.

The market making and algorithmic trading company acquired $15 million worth of Synthetix’ native token SNX paid for with USD Coin (USDC) in March 2023. DWF Labs will be tasked with increasing SNX token liquidity and market making across centralized and decentralized exchanges.

Synthetix’ perpetual futures will be integrated into DWF Labs’ trading business as part of the deal. DWF Labs has also committed to purchase another $5 million worth of SNX tokens once the integration of Synthetix’ services has been completed.

Synthetix allows users to tokenize a variety of real-world assets into derivatives called Synths, which provide exposure to a range of different assets. Holding SNX tokens allows users to create Synths by locking tokens into a smart contract and minting Synths against the corresponding value.

Users can trade Synths using Synthetix’ pooled collateral model, with trades between Synths generating fees for SNX collateral providers.

The creation of on-chain synthetic assets tracks the value of real-world assets, which includes synthetic fiat currencies or commodities like Gold and financial instruments like equity indices.

DWF Labs managing partner Andrei Grachev highlighted the partnership’s provision of streamlined trading mechanisms in the Decentralized Finance (DeFi) space:

"By leveraging Synthetix's deep liquidity and composability, platforms can now deliver better trades with lower slippage, allowing for innovative hedging strategies and unique use cases.”

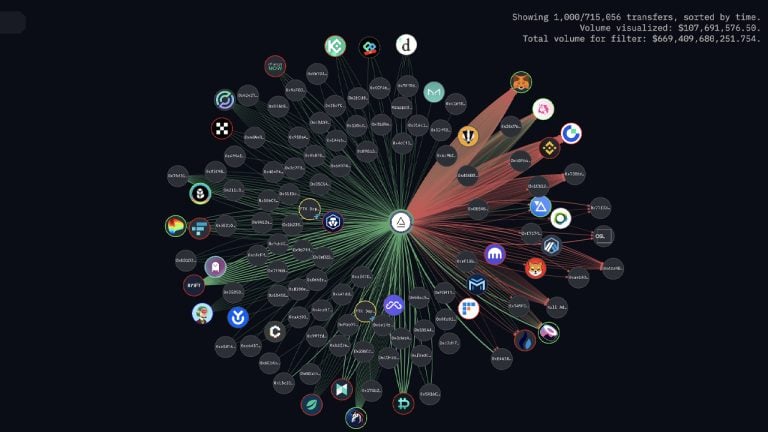

Synthetix’ V2 platform surpassed $400 million in perpetual swap daily trade volume in March 2023 according to data from Dune Analytics.

Related: KuCoin leads $10M funding for Chinese yuan stablecoin issuer

The derivatives liquidity protocol saw a surge in daily fees in June 2022 after a collaboration with liquidity provider Curve Finance to create Curve pools for Synthetic Ether (sETH)/Ether (ETH), Synthetic Bitcoin (sBTC)/Bitcoin (BTC) and Synthetic U.S. dollar (sUSD)/3CRV.

The partnership allowed users to convert Synths like sETH to ETH seamlessly and saw the SNX token value increase by over 100% during the depths of the prolonged cryptocurrency bear market.

According to a presentation recently submitted by the FTX debtors on March 16, Sam Bankman-Fried’s companies had a $6.8 billion hole in their intercompany balance sheet when they filed for Chapter 11 bankruptcy protection. FTX and its conglomerate of firms have debts of around $11.6 billion, including customer claims and various other liabilities. FTX’s $6.8 […]

According to a presentation recently submitted by the FTX debtors on March 16, Sam Bankman-Fried’s companies had a $6.8 billion hole in their intercompany balance sheet when they filed for Chapter 11 bankruptcy protection. FTX and its conglomerate of firms have debts of around $11.6 billion, including customer claims and various other liabilities. FTX’s $6.8 […] This week, FTX debtors issued a press release and a 20-page document noting that bankruptcy administrators had located $5.5 billion in liquid assets. The document details that investigators discovered fiat currencies, crypto assets, and securities as part of FTX’s and Alameda Research’s cache. However, the disclosure to unsecured creditors does not mention the extremely large […]

This week, FTX debtors issued a press release and a 20-page document noting that bankruptcy administrators had located $5.5 billion in liquid assets. The document details that investigators discovered fiat currencies, crypto assets, and securities as part of FTX’s and Alameda Research’s cache. However, the disclosure to unsecured creditors does not mention the extremely large […] Following the court filing that shows FTX co-founder Sam Bankman-Fried (SBF) wants access to FTX’s $460 million in Robinhood shares, Delaware bankruptcy court documents show tens of millions were spent by the FTX team in 2022 on living accommodations, hotels, food, and flights. Moreover, SBF’s quantitative trading firm allegedly owes more than $55,000 to Jimmy […]

Following the court filing that shows FTX co-founder Sam Bankman-Fried (SBF) wants access to FTX’s $460 million in Robinhood shares, Delaware bankruptcy court documents show tens of millions were spent by the FTX team in 2022 on living accommodations, hotels, food, and flights. Moreover, SBF’s quantitative trading firm allegedly owes more than $55,000 to Jimmy […] Before FTX collapsed it was assumed that Alameda Research was one of the top quantitative trading firms and market makers within the industry. However, much of that perception may have been a facade as a recent report details that Alameda suffered from financial troubles as early as 2018. People familiar with the matter said Alameda […]

Before FTX collapsed it was assumed that Alameda Research was one of the top quantitative trading firms and market makers within the industry. However, much of that perception may have been a facade as a recent report details that Alameda suffered from financial troubles as early as 2018. People familiar with the matter said Alameda […]