The hedge fund manager instead wants to see an “inflation-linked coin” be brought to the masses which would serve to ensure consumers secure their buying power.

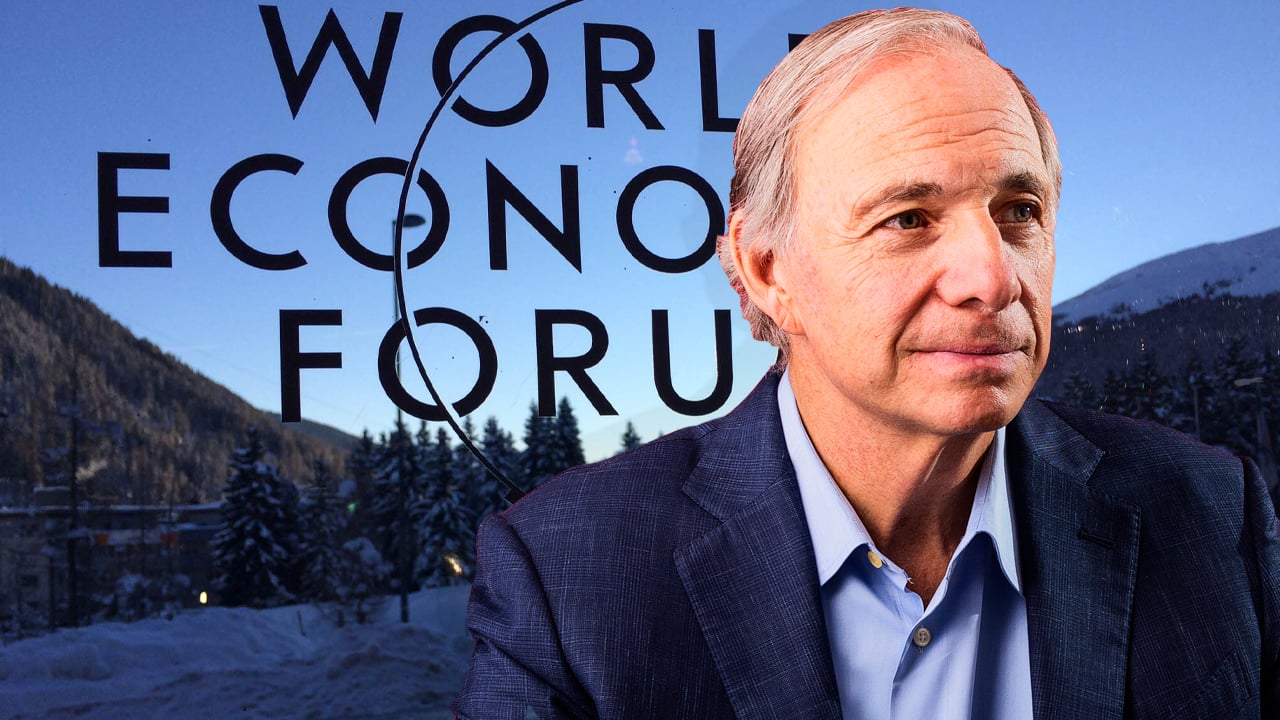

Billionaire investor Ray Dalio has described fiat currency as being in serious “jeopardy” as an effective store of wealth but doesn’t believe Bitcoin (BTC) and stablecoins will be the solution either.

Dalio, the founder of hedge fund firm Bridgewater Associates explained on CNBC Squawk Box on Feb. 2 that the mass money printing of the United States Dollar and other reserve currencies has him questioning whether they are forms of “effective money.”

“We are in a world in which money as we know it is in jeopardy. We are printing too much, and it's not just the United States, it is all the reserve currencies.”

However, Dalio was quick to add his thoughts on whether Bitcoin was a potential solution, acknowledging that despite what it has accomplished in “12 years,” it is still too volatile to serve as money:

"It's not going to be an effective money. It's not an effective store holder of wealth. It's not an effective medium of exchange," he argued.

He also dismissed stablecoins as an effective form of money as it is a replica of state-backed fiat currency.

Instead, Dalio proposed the creation of an “inflation-linked coin” that would serve to ensure consumers secure their buying power.

“The closest thing to that is an inflation index bond, but if you created a coin that says OK this is buying power that I know I can save in and put my money in over a period of time and transact in anywhere, I think that would be a good coin,” he said.

"#Bitcoin has no relation to anything. It's a tiny thing that gets disproportionate attention," says @RayDalio on #crypto. "The value of $BTC is less than 1/3 of $MSFT stock. It's not an effective store of wealth. But we are in a world where money as we know it is in jeopardy." pic.twitter.com/Cc7o2TwkxG

— Squawk Box (@SquawkCNBC) February 2, 2023

"So I think you're going to see the development of coins that you haven't seen that probably will end up being attractive, viable coins. I don't think Bitcoin is it," he added.

However, not everyone agreed with Dalio’s take on Bitcoin and the viability of an inflation-linked coin.

Digital asset manager Eric Weiss of Bitcoin for Family Officers was one, who told his 38,300 Twitter followers that such a coin could not exist:

"According to Ray, [Bitcoin] is very close to being the solution to the world's problems but its too volatile. He's waiting for and vaguely describes a solution that doesn't and can't exist," said Weiss.

ARK Invest CEO Cathie Wood also had a different view of Bitcoin, referring to it as a defense against wealth confiscation in parts of the developing world:

“I’m struck that the market is now leading the Fed,” @ARKinvest Founder @CathieDWood says on bond market downtrends.https://t.co/DDNw4dbOPD pic.twitter.com/AAS0UWf0kh

— Yahoo Finance (@YahooFinance) February 2, 2023

“Those populations need a fallback, an insurance policy like Bitcoin,” she said.

Related: Crypto-friendly Ray Dalio steps back from Bridgewater’s $150M fund

Dalio’s latest views on Bitcoin come despite recently labeling it “one hell of an invention” that could serve as a viable inflation hedge. However, these remarks were made on Jan. 28, 2021 — before the current bear market took effect.

The billionaire investor has also previously recommended BTC should make up 1-2% of an investors portfolio on Jan. 6, 2022.

As an investment product, the hedge fund manager said in May. 24, 2021 that he would rather buy BTC over bonds but later stated on Aug. 5, 2021, that he still prefers gold.

On Oct. 4, Dalio stepped down as a co-chief investment officer, but remained on board as a mentor.