House Majority Whip Tom Emmer has criticized U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, accusing him of “regulation-by-harassment,” and calling for his dismissal. The congressman has consistently opposed Gensler’s regulatory practices, supporting legislative reforms for the SEC. He argues that Gensler’s approach undermines the securities regulator’s mission to protect investors and maintain orderly […]

House Majority Whip Tom Emmer has criticized U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler, accusing him of “regulation-by-harassment,” and calling for his dismissal. The congressman has consistently opposed Gensler’s regulatory practices, supporting legislative reforms for the SEC. He argues that Gensler’s approach undermines the securities regulator’s mission to protect investors and maintain orderly […]

Mark Cuban thinks the SEC could have saved U.S. customers from FTX had it adopted Japan’s approach to crypto regulation, but John Reed Stark disagrees.

Billionaire entrepreneur Mark Cuban has again locked horns with former securities chief John Reed Stark, this time over who was ultimately to blame for FTX’s collapse and the impact on creditors.

During a heated back-and-forth exchange, Cuban argued had the United States Securities and Exchange Commission set “clear regulations,” no one would have lost money from its collapse.

Stark earlier suggested cryptocurrency and stablecoins — including central bank digital currencies — solve no problems and that the crypto industry operates without regulatory oversight, consumer protections and audits, among other things.

You should read up on how Japan deals with regulation. https://t.co/yHCVwZAqvG

— Mark Cuban (@mcuban) July 4, 2023

When FTX crashed, NO ONE IN FTX JAPAN LOST MONEY.

If the USA/SEC had followed their example by setting clear regulations that required the separation of customer and business funds and clear… https://t.co/Msvn9o9PCU

Cuban argued that Japanese regulators — an increasingly Web3 friendly jurisdiction — are an example of a regulator that has done it right.

“When FTX crashed, NO ONE IN FTX JAPAN LOST MONEY,” he said.

Stark — a cryptocurrency skeptic — shot back, saying it “seems a bit of a stretch” to blame the SEC for the collapses of FTX, BlockFi, Celsius, Terra and Voyager, or what he called “dumpster fires.”

While Stark conceded that the SEC isn’t always right, he claimed the regulator saved investors “millions, perhaps even billions” in crypto losses.

The ex-SEC official claimed while the cryptocurrency industry seeks regulatory clarity, whenever rules are promulgated or proposed, “the crypto industry cries foul” and often responds by filing a “flashy legal challenge to its enactment.”

Cuban hit back, explaining the “best way” to prevent cryptocurrency fraud is to implement “brightline investor protection regulations.” He added:

“Anyone who doesn't register is de-facto in violation, can't operate and will be shut down. That's how you protect crypto investors.”

Stark, however, claims that the SEC only charged the likes of Binance, Coinbase, Beaxy and Bittrex months after the regulator made it clear that those firms were not in compliance.

Related: Lawmakers are wrong to target Gary Gensler

“[These firms] opted to ignore the SEC — and reap profits for as long as possible without registering,” Stark added.

That is worthy of study Mark, thanks.

— John Reed Stark (@JohnReedStark) July 4, 2023

The laws in Japan require crypto exchanges to register with authorities, to keep customer money separate from their own accounts, to hold at least 95% of customers’ digital assets in a cold wallet and to entrust clients’ holdings of…

It is the second time in three weeks that the pair have clashed over how cryptocurrency should be regulated.

On June 11, Cuban called out the SEC for purportedly failing to provide cryptocurrency firms with a clear registration process.

He claimed it’s “near impossible to know” what constitutes security because the SEC’s “Framework for ‘Investment Contract’ Analysis of Digital Assets” document fails to explain how cryptocurrency firms can come into compliance.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

Blockchain Australia, the country’s peak crypto industry body has announced a new CEO who wants to speed up the crypto regulatory process.

Blockchain Australia’s new CEO Simon Callaghan hopes the Federal Government will take its cues on crypto regulation from the United Kingdom, Hong Kong, and Singapore — and definitely not the United States.

In his new position, Callaghan aims to steer crypto rule-making in the country and avoid making similar moves to the U.S. Securities and Exchange Commission — which is suing the world’s two largest exchanges and has branded at least 68 tokens as securities.

“Regulation by enforcement is the equivalent of having a hammer and seeing everything as a nail. I don’t think that’s the right approach for Australia to be taking.”

On June 26, Callaghan was announced as the industry peak body’s new CEO. He was most recently the digital assets program lead for Cambridge University and a co-founder of corporate service provider MOOPS Tech.

Callaghan’s previous roles include a year as the Asia lead for crypto lender Celsius as, but he left several months before the firm’s collapse. He has also had a brief stint at crypto lender Vauld.

His appointment comes after nearly a year of limbo following the departure of former CEO and industry advocate Steve Vallas in July 2022. The CEO role was briefly filled by Laura Mercurio in September last year, but she parted ways with the organization just weeks later over a difference of vision, effectively leaving Australia’s blockchain industry without an advocate for the better part of a year.

In his new role, Callaghan will represent the association’s 112 members, including Binance Australia, Circle, Ripple, and Mastercard, all of who are calling for clearer regulation, adding:

“Everyone wants to know where the goalposts are so people can operate their businesses, build their technologies and create jobs."

The Australian government has not taken a hardline stance on crypto, unlike American regulators and the Biden administration, Callaghan told Cointelegraph.

The Treasury has a “token mapping exercise” underway to determine how to classify various digital assets ahead of any legislation, which isn’t expected until at least 2024.

“We haven’t seen a strong position really one way or the other from this current government. That could be because they’re looking to take a considered approach, which I would argue is a good approach,” he said.

Consultation open! Today we released the token mapping consultation paper. This consultation is part of a multi step reform agenda to develop an appropriate regulatory setting for the #crypto sector. Read paper & submit views @ https://t.co/4W2msjhP9B @ASIC_Connect @AUSTRAC pic.twitter.com/OGHuZEGvDp

— Australian Treasury (@Treasury_AU) February 2, 2023

He hopes legislators take inspiration from Singapore, Hong Kong and the U.K. which are all developing regulatory schemes that aim to balance innovation with consumer protection.

“They see the benefit from the technology, the innovation, and the jobs it creates, as well as benefits to the broader financial sector.”

Related: Australia’s crypto laws risk being outpaced by emerging markets: Think tank

Reports earlier in June suggest the Hong Kong central bank has been putting pressure on major banks to accept crypto exchanges as clients, amid moves from the city to attract international crypto firms and investors.

“The fact that the Hong Kong monetary authorities are encouraging banks to work with the sector, I think that's the right approach,” Callaghan remarked.

In 2021, an Australian Senate committee report on digital assets recommended that crypto firms should be able to challenge debanking decisions and that banks should be required to conduct due diligence on firms rather than adopt blanket bans on the sector.

Two major Australian banks however recently imposed pauses, limits and outright blocks on certain payments to local crypto exchanges, both citing the growing threat of financial scams.

“I don't think you can just blanket everything in crypto as a scam, you actually need to look at the data,” said Callaghan, who revealed he’s already scheduled meetings “in the coming weeks” with the banks to further understand their position.

Opinion: GOP crypto maxis almost as bad as Dems’ ‘anti-crypto army’

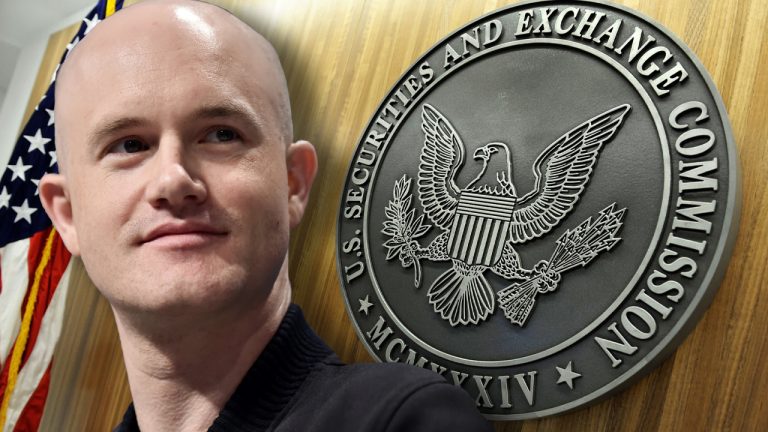

The Coinbase CEO has been hugely critical of the U.S. failure to provide the crypto industry with regulatory clarity and has long argued it will push firms offshore.

“Adversary nations” like China could ultimately benefit from restrictive crypto policies in the United States, warns Coinbase CEO Brian Armstrong.

In a May 30 op-ed for MarketWatch, Armstrong again warned that while recent turbulence in crypto markets might tempt U.S. policymakers “to write it off as an unstable asset class,” doing so could see the U.S. cede its status as a financial leader and innovation hub.

In today's @MarketWatch I'm sharing an op-ed encouraging policymakers to see the big picture with crypto. It's important for American technology leadership and national security that this industry be built (at least in part) in America. https://t.co/I1702aHDGf

— Brian Armstrong ️ (@brian_armstrong) May 30, 2023

Armstrong urged policymakers to see that crypto is “about much more than individual transactions,” but represents a “transformative technology” that can revolutionize a variety of sectors — highlighting its ability to provide creators with royalties for secondary market transactions as an example and adding:

“Crypto, like the internet before it, has the potential to modernize finance and numerous other sectors, from supply chains to social media, by offering a faster, cheaper, more private, and accessible platform.”

Through his status as a public figure and head of Coinbase, Armstrong has long been pushing for U.S. policymakers to provide the crypto industry with regulatory clarity that can help realize crypto’s potential whilst protecting consumers.

Coinbase has continued to ask for clarity from the U.S. Securities and Exchange Commission around which digital assets qualify as securities and has argued against the agency’s “regulation by enforcement” approach. SEC chair Gary Gensler has previously argued that digital assets already fall under existing securities regulations.

Related: SEC settles case against Wahi brothers for Coinbase insider trading

In the op-ed, Armstrong added it was unsurprising that Hong Kong is positioning itself to be a global crypto hub, as China looks to challenge the U.S.’s role as the global financial leader in a variety of ways — such as the recent launch of the digital yuan and Belt and Road Initiatives.

Xi calls for deep alignment between Belt and Road Initiative and Eurasian Economic Union #BRI #China

— Zhang Heqing (@zhang_heqing) May 25, 2023

Chinese President Xi Jinping on Wednesday called for a deeper synergy between the Belt and Road Initiative (BRI) and the Eurasian Economic Union (EAEU) as China looks to enhance… pic.twitter.com/bwFcXIvgk4

He warned that failing to pass comprehensive crypto legislation would result in the U.S. needing to play catch-up and spend billions to bring innovation back to the U.S., but noted that even with a “colossal and sustained effort” it might be too late by then.

Coinbase's vice president of international policy told Cointelegraph the meetings took place in Canberra and Sydney and touched on the government’s token mapping efforts.

The Reserve Bank of Australia (RBA) and Treasury have been holding private meetings with executives from Coinbase, with discussions revolving around the future of crypto regulation in Australia.

Responding to Cointelegraph’s request for comment, an RBA spokesperson confirmed recent reports that these private meetings had occurred, stating that Coinbase met with the RBA’s Payments Policy and Financial Stability departments this week, “as part of the Bank’s ongoing liaison with industry.”

Tom Duff Gordon, Coinbase’s vice president of international policy who was reported to have been flown in for the meetings, also confirmed to Cointelegraph that meetings took place with Treasury in Canberra and Sydney.

Consultation open! Today we released the token mapping consultation paper. This consultation is part of a multi step reform agenda to develop an appropriate regulatory setting for the #crypto sector. Read paper & submit views @ https://t.co/4W2msjhP9B @ASIC_Connect @AUSTRAC pic.twitter.com/OGHuZEGvDp

— Australian Treasury (@Treasury_AU) February 2, 2023

Gordon said that the meetings touched on the government’s token mapping efforts, and Coinbase also “shared insights on global best practices concerning licensing and custody.”

The Australian Treasury's token mapping exercise was announced on Aug. 22, 2022, and is aimed at categorizing digital assets in a way to work them into existing regulatory frameworks.

A consultation paper was released by the Treasury on Feb. 3, for which the Treasury sought feedback from the crypto industry.

Gordon praised efforts from the Treasury, noting that “The Australian Treasury teams continue to impress us with their high level of sophistication and active involvement,” and adding:

“The Australian Treasury's token mapping exercise provides one of the most detailed and thoughtful papers we have encountered on the topic, setting a strong foundation for their forthcoming draft rules for crypto exchanges and custodians.”

Gordon expressed his desire to see the rules “later this year,” adding that he appreciated “the Treasury's comprehensive groundwork.”

In contrast, Coinbase’s co-founder and CEO Brian Armstrong has been critical of the approach to crypto regulation in the United States, echoing accusations that the Securities and Exchange Commission (SEC) is “regulating by enforcement” and claiming that the SEC wants firms to register with them despite there being no way to register.

Well said. There was no way to register (a disingenuous offer).

— Brian Armstrong (@brian_armstrong) February 9, 2023

“Using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating.” https://t.co/6wVZZbQt23

Related: National Australia Bank makes first-ever cross-border stablecoin transaction

Documents recently obtained by the Australian Financial Review under freedom of information laws suggested that crypto legislation in Australia could be dragged out past 2024 and beyond, however, as final submissions to the cabinet are not expected until late in the year.

Coinbase expanded to Australia on Oct. 4, 2022, with Coinbase’s vice president of international and business development — Nana Murugesan — telling Cointelegraph at the time that it was “very impressed with the open door that we’ve received in Canberra and with different policymakers.”

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Lawyer and former SEC official John Reed Stark came out in defense of the SEC’s enforcement efforts in the crypto space.

A former Securities and Exchange Commission (SEC) official has slammed "cryptocurrency lobbyists" for labeling SEC enforcement actions as "regulation by enforcement" — calling the term a "Bogus Big Crypto Catch Phrase."

John Reed Stark, a former chief of the Securities and Exchange Commission Office of Internet Enforcement and a crypto skeptic, opined in a Jan. 22 post that the argument is "sorely misguided" as it was just how securities regulations worked.

"Litigation and SEC enforcement are actually how securities regulation works," he argued. "The flexibility of SEC statutory weaponry is an SEC hallmark, enabling SEC enforcement to keep fraud in check."

"In fact, the repetitive chorus of RBE [Regulation by Enforcement] is not only a misguided, deflective effort designed to tap into sympathetic libertarian and anti-regulatory mores – it's also utter nonsense."

According to Stark, when the SEC Office of Internet Enforcement was created in 1998, there were critics who said SEC regulations were too vague and regulation by enforcement would stifle the growth of the Internet.

"In hindsight, relying upon the flexibility of securities regulation to police the Internet cleared out the more egregious instances of early online securities fraud," he argued.

"Moreover, vigorous online SEC enforcement efforts also paved the way for legitimate technological innovations to flourish, rendering markets more efficient and transparent, thereby allowing investors more opportunities for success,” he said.

Over the last few years, the SEC has launched more than a few high-profile cases against crypto companies such as Ripple and LBRY, prompting some critics to label the SEC as using enforcement actions to develop the law on a case-by-case basis rather than creating clear regulations.

Regulation by enforcement has a terrible chilling effect, and rhetoric matters - we've already seen a huge amount of crypto talent, asset issuers, and startups go offshore.

— Brian Armstrong (@brian_armstrong) September 20, 2022

Ripple General Counsel Stuart Alderoty has also previously questioned the approach in a Nov. 28, 2022 post, citing the high-profile collapse of FTX and the related contagion that claimed BlockFi as evidence it doesn't.

Another SEC “regulation by enforcement” success story.

— Stuart Alderoty (@s_alderoty) November 28, 2022

Months after $100M BlockFi/SEC deal BlockFi in b/cy. $275M loan outstanding to FTX from BlockFi. Unknown amounts owed to BlockFi from FTX. Nothing ever registered. Fines paid? With whose money? Consumers decimated. https://t.co/XWflfRDIMk

In Starks opinion however, the SEC is following the law with its actions, citing the legal wins where courts have found in its favor.

"Indeed, courts have upheld a broad array of SEC cases involving crypto-related offerings. In fact, in the 127 crypto-related enforcement actions already filed by the SEC, the SEC has not lost a single case," Stark said.

"The SEC's approach is rarely improperly expansive, nor does it involve rogue SEC enforcement efforts."

"Rather, the SEC typically adopts a reasoned, common sense application of the basic requirements of the federal securities laws to new and evolving market conditions and technologies," he added.

Timothy Cradle, a former Celsius employee and current Director of Regulatory Affairs at the Blockchain Intelligence Group replied to Stark's tweet, questioning whether clear regulations would ultimately be a better policy than regulation by enforcement.

"I agree with the argument, however, would it be too much to ask that the SEC and CFTC issue guidance much in the same way FinCEN did in 2019?" he said.

"If big crypto is saying it needs clear rules of the road, wouldn't it make sense for the regulators to clarify in an official communication, such as guidance, that their rules do apply to cryptocurrencies?" Cradle added.

Related: CFTC slammed for ‘blatant regulation by enforcement’ over Ooki DAO case

Chris Hayes, a former Advisory Board Member for the PA Blockchain Coalition also commented, arguing that "A sensible regulatory approach would be for the SEC to issue a request for comment on how digital assets might not be able to meet the registration obligations due to their digital nature on blockchain."

"Take that information and then propose a rule on how these tokens can comply under the 33 act, taking into account the technological differences that impact custody, secondary sales and settlement time/structure in comparison to traditional securities."

The U.S. Securities and Exchange Commission (SEC) has been heavily criticized for its approach to regulating the crypto sector. The criticism followed the securities regulator’s action against a former Coinbase employee in an insider trading case, in which the SEC named nine crypto tokens listed on Coinbase as securities. SEC Slammed for Regulation by Enforcement […]

The U.S. Securities and Exchange Commission (SEC) has been heavily criticized for its approach to regulating the crypto sector. The criticism followed the securities regulator’s action against a former Coinbase employee in an insider trading case, in which the SEC named nine crypto tokens listed on Coinbase as securities. SEC Slammed for Regulation by Enforcement […]

The future of crypto adoption will largely depend on which of the competing narratives about digital assets and blockchain’s environmental effects prevails.

Regulation by enforcement, a fast and economical substitute for thorough rulemaking, is widely regarded as some of the U.S. executive agencies’ preeminent approach to crypto regulation. It could be summed up as letting crypto firms explore the boundaries of what is permissible by themselves and then punishing industry participants in case their exploratory actions come to look like a transgression. Others will take heed and learn from the explorer’s negative experience.

While it is the United States Securities and Exchange Commission that gets accused of over-reliance on regulation by enforcement most frequently, other federal agencies do that as well. Last week, the U.S. Office of the Comptroller of the Currency, or OCC, announced cease and desist proceedings against Anchorage Digital, the nation’s first crypto custody firm to be awarded a national bank charter.

The reason is the crypto bank’s alleged failure to implement a compliance program in line with the Bank Secrecy Act and Anti-Money Laundering standards. As Anchorage Digital races to remedy the shortcomings that the OCC pointed out, other industry players hoping to secure a bank charter will be watching closely.

One of the most contentious policy debates around blockchain and cryptocurrency currently unfolds over the industry’s sustainability and environmental effects. From the European Union to individual U.S. states, regulators are continuously on the offensive on this front. The latest push came from a group of U.S. representatives who called for the Environmental Protection Agency, or EPA, to assess crypto mining companies’ compliance with federal environmental statutes. While some of the concerns related to mining operations that use “dirty” energy might be justified, some policymakers’ efforts to ratchet them up to vilify the entire industry are clearly misguided. On Earth Day, Cointelegraph reviewed some of the many blockchain-powered projects designed to do the environmental good and zoomed in on the technology’s capacity to contribute to the climate change fight. The future of crypto adoption will largely depend on which of the competing narratives about digital assets and blockchain’s environmental effects prevails.

Australian regulators were busy last week. Financial compliance enforcement agency AUSTRAC, noting that cybercrime was rising apace with crypto acceptance in the country, released two guides for regulated entities on spotting illicit use of cryptocurrency and payments related to ransomware by customers. The Prudential Regulation Authority was not quite as productive, but it did send out a letter to its regulated entities presenting the roadmap of a regulatory framework for exposure to crypto assets, operational risk and stablecoins to take effect by 2025. It also outlined risk management measures that should be undertaken now. On the bright side, Cosmos Asset Management has received approval for Australia’s first Bitcoin (BTC) exchange-traded fund (ETF) after beating out three competitors to meet regulatory requirements. The fund is to begin trading on April 27 and reportedly stands to take in up to $1 billion. It will be traded on CBOE Australia.

Russian Central Bank governor Elvira Nabiullina spoke before the State Duma on Thursday and hinted that the bank may soften its stance on the digital asset industry as the government struggles to counteract the effects of Western sanctions. Nabiullina also said that the central bank expects to conduct its first settlements with a digital ruble in 2023. The Russian central banker has good reason to be worried as sanctions continue to be piled on. The same day she was speaking, Binance announced that Russian nationals and residents who hold over 10,000 euros, or $10,800, would be restricted from trading, and if they have open futures or derivatives positions, they will have 90 days to close them. These measures are due to the EU’s fifth round of sanctions. One day earlier, the U.S. Treasury announced it was blocking the assets of Russia-based crypto mining services provider BitRiver and its subsidiaries for facilitating sanctions evasion.