An analyst who nailed the bottom of Bitcoin’s (BTC) 2018 downtrend says that stocks with exposure to the crypto industry look far more bullish than the digital asset markets. Pseudonymous analyst Bluntz tells his 223,900 Twitter followers that the stocks of crypto exchange Coinbase (COIN), business analytics firm MicroStrategy (MSTR), digital asset mining companies Marathon […]

The post Top Analyst Predicts Rallies for Coinbase and Three Other Crypto-Proxy Stocks, Updates Outlook on Bitcoin (BTC) appeared first on The Daily Hodl.

Publicly listed Bitcoin miners sold off nearly everything they mined in 2022 but appear to have started accumulating reserves once again.

Publicly listed Bitcoin (BTC) miners sold off almost all of the Bitcoin they mined throughout 2022, leading to a debate over whether the sales created "a persistent headwind" for the Bitcoin price or not.

Analyst Tom Dunleavy from blockchain research firm Messari shared the data in a Dec. 26 tweet, indicating that approximately 40,300 of the 40,700 BTC mined by Core Scientific, Riot, Bitfarms, Cleans Park, Marathon, Hut8, HIVE, Iris Energy, Argo and Bit Digital from Jan. 1 to Nov. 30 was sold off.

BTC miners sell roughly 100% of the coins they mine

— Tom Dunleavy (@dunleavy89) December 26, 2022

The 10 public bitcoin miners

detailed here mined ~40.7k BTC and sold ~40.3k in 2022

This is a persistent headwind for BTC and for no other reason a good thesis to be bullish the ETHBTC ratio trade pic.twitter.com/L1iI6Z07p7

The reserves held by mining firms have decreased considerably during the latter half of 2022, particularly throughout November, as the crypto industry reeled from the effects of the FTX fallout.

Dunleavy believes that miners consistently selling off newly produced Bitcoin places downward pressure on the price of the leading cryptocurrency.

However, some industry commentators such as BitMEX’s former CEO, Arthur Hayes, believe the selling pressure created by the increased sales of Bitcoin miners is negligible.

He opined in a Dec. 9 blog post that “even if miners sold all the Bitcoin they produced each day, it would barely impact the markets at all.”

According to Bitcoin Visuals, on Dec. 26 the daily trading volume for Bitcoin was $12.2 billion. The outflow from miners on the same day, according to CryptoQuant, was 919 BTC ($15.35 million), which represents just 0.13% of the total volume traded.

Miner's reserves have rebounded slightly during December, increasing by nearly 1%. The figure contributes to the view shared in a Dec. 27 post by crypto analyst IT Tech that the situation for miners appears to be stabilizing.

#Bitcoin miners - update. Is there anything to worry about?

— IT Tech (@IT_Tech_PL) December 27, 2022

1.

Miner Outflow

Miner Inflow

Miner Reserve

White line on the bottom - miner to Exchange flow

2. Mining difficulty

3. Miner selling power

4. Hashrate 7D MA

Full analysishttps://t.co/E3o0cgaNxu

Related: BTC price dips 1% on Wall Street open as Bitcoin miners worry analysts

Miners have faced significant headwinds throughout the year, with high electricity prices, falling crypto market prices and a higher mining difficulty eating into their bottom line.

With the cost of production for miners increasing while the Bitcoin price has been decreasing, miners such as Core Scientific have been forced to sell some of their reserves at a loss to fund their ongoing operations and efforts to expand.

Bitcoin, altcoins and crypto-linked stocks correct sharply after FTX officially files for bankruptcy with BTC price slipping below its June lows again.

Bitcoin (BTC), Ether (ETH) and cryptocurrency-linked stocks like MicroStrategy are seeing a sharp downturn after news broke that FTX announced filing for Chapter 11 bankruptcy and Sam Bankman-Fried stepping down as CEO.

MicroStrategy (MSTR), led by the outspoken advocate of Bitcoin Michael Saylor, is down 32.57% on Nov. 11 in a 5-day period. MicroStrategy holds about 130,000 Bitcoin and, therefore, its stock price is heavily correlated with BTC/USD. Meanwhile, the tech-heavy NASDAQ has gained 0.79%.

Mining stocks have seen losses today, with the Hashrate Index Crypto Mining Stock Index showing a 0.14% loss at midday Nov. 11. Top miners' market performance is much lower. Marathon (MARA) is down 4.95%, Riot (RIOT) is down 5.74%, and Hive (HIVE) is down 16.08%.

Meanwhile, ETH price saw a 22% decrease this past week despite Ether becoming deflationary for the first time since the Merge. Over 8,000 Ether have been burned in the last seven days bringing the yearly rate to -0.354%.

In addition to the FTX debacle hindering the Ether price, a mass amount of futures liquidations caused the price to hit a 4-month low of $1,070 this week.

Data from Cointelegraph Markets Pro shows Bitcoin has lost 20% of its value in the past week as well. In addition, Bitcoin reached a new yearly low of $15,742 due to the FTX collapse.

Moreover, Bitcoin’s price crunch is leading miners to sell at an accelerated rate further increasing downward pressure.

According to Charles Edwards, founder of the Capriole Fund, Bitcoin miners reached the red level on an open-source Bitcoin Miner Sell Pressure chart, which shows the most selling in almost five years.

Bitcoin miners are in pain and selling more than they have in almost 5 years!

— Charles Edwards (@caprioleio) November 11, 2022

Introducing: Bitcoin Miner Sell Pressure.

A free, open-source indicator which tracks on-chain data to highlight when Bitcoin miners are selling more of their reserves than usual. pic.twitter.com/sXpxXXdUiW

The uptick in miner selling has also coincided with a Bitcoin whale moving 3,500 BTC for the first time since 2011.

But analysts are mixed on whether BTC has bottomed. For instance, trader Mags sees two possibilities.

He tweeted:

"Bottom is in already ($15.5k) and we front run everyone waiting for $14k," Otherwise, "We see a deep re-test & go way lower than $14k , maybe $11.5k - $12k."

Other popular analysts like John Wick don't believe the bottom is in.

"I gave everyone heads up and said if this lower end of the support broke that I would short again,"he said." I also mentioned that I did not think the lows were in. I hope you put in your orders ahead of time"

#BTC

— John Wick (@ZeroHedge_) November 11, 2022

I gave everyone heads up and said if this lower end of the support broke that I would short again. I also mentioned that I did not think the lows were in.

I hope you put in your orders ahead of time

Dots again catching the move early and have predicted every move https://t.co/FVF0aMSq3X pic.twitter.com/ADlgNyBcC8

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

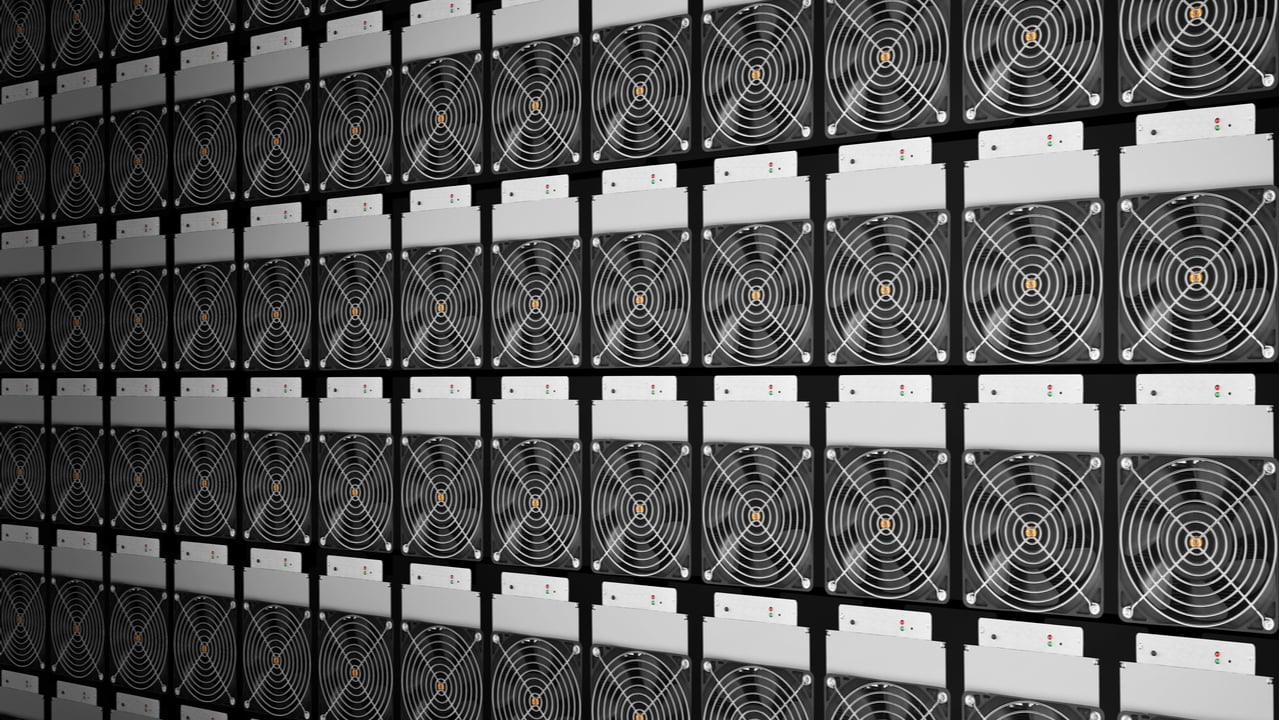

On Nov. 1, 2022, the bitcoin miner Cleanspark revealed it acquired 3,853 Bitmain-brand Antminer S19J Pro mining rigs for $5.9 million. According to Cleanspark, the company has purchased 26,500 bitcoin mining machines since the crypto winter started in June. Cleanspark Purchases 3,853 Antminer S19J Pro Units at $15.50 per Terahash After the bitcoin (BTC) mining […]

On Nov. 1, 2022, the bitcoin miner Cleanspark revealed it acquired 3,853 Bitmain-brand Antminer S19J Pro mining rigs for $5.9 million. According to Cleanspark, the company has purchased 26,500 bitcoin mining machines since the crypto winter started in June. Cleanspark Purchases 3,853 Antminer S19J Pro Units at $15.50 per Terahash After the bitcoin (BTC) mining […] On October 25, the bitcoin mining operation Cleanspark announced that the firm’s hashrate now exceeds 5 exahash per second (EH/s), a milestone achieved more than two months ahead of the company’s original year-end goals. Cleanspark says it now aims to surpass 5.5 EH/s by the year’s end by increasing the miner’s hashrate goal by 10%. […]

On October 25, the bitcoin mining operation Cleanspark announced that the firm’s hashrate now exceeds 5 exahash per second (EH/s), a milestone achieved more than two months ahead of the company’s original year-end goals. Cleanspark says it now aims to surpass 5.5 EH/s by the year’s end by increasing the miner’s hashrate goal by 10%. […] According to findings stemming from a report published by Arcane Research, Bitcoin’s hashrate is steadily going public as an increasing share is deployed by publicly listed companies. Current data shows that the publicly listed miners’ share of Bitcoin’s hashrate is roughly 19% today, up 3% since January 2021. Publicly Listed Bitcoin Miners Continue to Grow, […]

According to findings stemming from a report published by Arcane Research, Bitcoin’s hashrate is steadily going public as an increasing share is deployed by publicly listed companies. Current data shows that the publicly listed miners’ share of Bitcoin’s hashrate is roughly 19% today, up 3% since January 2021. Publicly Listed Bitcoin Miners Continue to Grow, […] The bitcoin mining startup Primeblock has announced plans to go public via a special purpose acquisition company (SPAC) deal. Primeblock will merge with a blank-check firm 10X Capital Venture Acquisition Corp. II, and the company’s shares will be listed on Nasdaq. Primeblock Reveals SPAC Merger With Plans to Be Listed on Nasdaq in the Second […]

The bitcoin mining startup Primeblock has announced plans to go public via a special purpose acquisition company (SPAC) deal. Primeblock will merge with a blank-check firm 10X Capital Venture Acquisition Corp. II, and the company’s shares will be listed on Nasdaq. Primeblock Reveals SPAC Merger With Plans to Be Listed on Nasdaq in the Second […] Bitcoin mining companies are now increasingly experimenting with immersion cooling, a form of cooling that allows them to get more hashpower out of existing miners. According to industry insiders, this cooling alternative will become mainstream in the future, as leading companies are already taking advantage and retrofitting these cooling devices to existing mining operations. Immersion […]

Bitcoin mining companies are now increasingly experimenting with immersion cooling, a form of cooling that allows them to get more hashpower out of existing miners. According to industry insiders, this cooling alternative will become mainstream in the future, as leading companies are already taking advantage and retrofitting these cooling devices to existing mining operations. Immersion […] The Lone Star State of Texas is solidifying its role as a bitcoin mining and blockchain hub. This week two major bitcoin mining companies established operations in Texas. The company Riot Blockchain purchased a mining site in Rockdale and the bitcoin mining firm Blockcap announced establishing headquarters in Austin. Blockcap Sets Up Headquarters in Austin, […]

The Lone Star State of Texas is solidifying its role as a bitcoin mining and blockchain hub. This week two major bitcoin mining companies established operations in Texas. The company Riot Blockchain purchased a mining site in Rockdale and the bitcoin mining firm Blockcap announced establishing headquarters in Austin. Blockcap Sets Up Headquarters in Austin, […]