The idea to blacklist former SEC regulators who have been openly hostile to the crypto industry was recently brought up by Coinbase CEO Brian Armstrong. Coinbase’s Call to Arms To Blacklist SEC ‘Bad Actors’ Heeded by Winklevoss and Selkis Cryptocurrency exchanges Coinbase and Gemini said they will no longer work with any law firms that […]

The idea to blacklist former SEC regulators who have been openly hostile to the crypto industry was recently brought up by Coinbase CEO Brian Armstrong. Coinbase’s Call to Arms To Blacklist SEC ‘Bad Actors’ Heeded by Winklevoss and Selkis Cryptocurrency exchanges Coinbase and Gemini said they will no longer work with any law firms that […] Ryan Selkis, founder of Messari, has stepped down as CEO, following controversial social media posts. He will transition to Senior Advisor, while Eric Turner takes over as interim CEO. “This week was the first week in 6.5 years that my politics and rhetoric put the team in harm’s way,” he stressed. Ryan Selkis Resigns as […]

Ryan Selkis, founder of Messari, has stepped down as CEO, following controversial social media posts. He will transition to Senior Advisor, while Eric Turner takes over as interim CEO. “This week was the first week in 6.5 years that my politics and rhetoric put the team in harm’s way,” he stressed. Ryan Selkis Resigns as […]

The chief executive of a leading crypto research company is stepping down after making a series of polarizing statements on the social media platform X. Messari CEO Ryan Selkis says he is resigning over concerns that his “politics and rhetoric” may be causing damage to his company. “A leader’s first responsibility is to his team. […]

The post CEO of Crypto Research Firm Messari Resigns After Series of Politically-Charged Tweets appeared first on The Daily Hodl.

Ryan Selkis, founder and CEO of Messari, a cryptocurrency market intelligence firm, has called out “Pharma Bro” Martin Shkreli for supposedly acting with federal agencies to hurt Donald Trump’s campaign. Shkreli, allegedly the creator of DJT, disregarded this notion, calling out Selkis for “watching too many movies.” Messari’s Ryan Selkis Accuses Martin Shkreli of Organizing […]

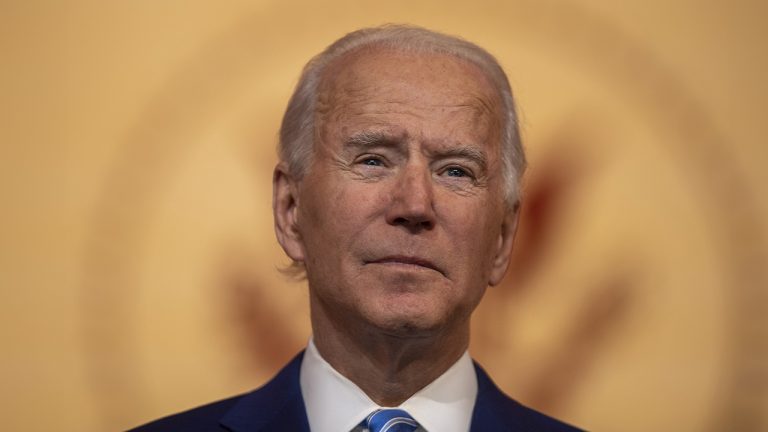

Ryan Selkis, founder and CEO of Messari, a cryptocurrency market intelligence firm, has called out “Pharma Bro” Martin Shkreli for supposedly acting with federal agencies to hurt Donald Trump’s campaign. Shkreli, allegedly the creator of DJT, disregarded this notion, calling out Selkis for “watching too many movies.” Messari’s Ryan Selkis Accuses Martin Shkreli of Organizing […] Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.” […]

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.” […]

Many prominent crypto commentators are concerned that this will make crypto firms even more reluctant to do business in the United States.

Several prominent crypto commentators have criticized the new crypto tax reporting rules recently put forth by United States president Joe Biden.

On Aug. 25, in an effort to catch crypto users avoiding taxes, the Internal Revenue Services (IRS) proposed brokers follow new rules for selling and trading digital assets. Brokers would use a new form to make tax filing easier and prevent cheating on taxes.

The Treasury indicated that the proposed rules would make digital asset reporting similar to reporting on other kinds of assets.

However, many in the crypto community believe the stringent rules will push the crypto industry even further away from the U.S.

Messari CEO, Ryan Selkis was among those who responded unfavorably to the news, believing that if Biden secures re-election, the crypto industry will not flourish in the country.

There's no future for crypto in the US if Biden is reelected. I'm sorry.

— Ryan Selkis (@twobitidiot) August 25, 2023

Move abroad, draft Newsom and hope for the best, or vote GOP where at least we know the top three candidates are less terrible on this issue.

Crypto has always been political.

Have a nice weekend.

Likewise, Chris Perkins, president of crypto venture firm CoinFund holds the viewpoint that other countries have surged ahead of the U.S., and these rules will inevitably result in reduced innovation flowing into the country.

Rather than resorting to harsh crackdowns, he believes that simple and detailed rules that will allow safe innovation across the crypto industry is needed.

To clarify, I agree that other jurisdictions have seized the initiative and the U.S. has sadly fallen behind. We need proactive, nuanced policies that encourage and unlock responsible innovation across crypto verticals. Clarity is coming, one way or another. The time to engage…

— Christopher Perkins NYC (@perkinscr97) August 26, 2023

Meanwhile, others remain skeptical that neither the Democrats or the Republicans would adequately champion crypto interests in the U.S.

“I'm not confident that either party would be good for crypto. Though it definitely feels worse now than last presidency,” one user stated, as another pointed that the new rules raise privacy concerns:

“US devotion to income tax means they can NEVER accept private transactions on public ledgers without tax and sanction surveillance.”

On Aug. 25, Cointelegraph reported that Kristin Smith, CEO of the Blockchain Association, held reservations about merging digital asset reporting with traditional assets.

“It’s important to remember that the crypto ecosystem is very different from that of traditional assets, so the rules must be tailored accordingly and not capture ecosystem participants that don’t have a pathway to compliance," Smith stated.

This follows Biden’s suggestion to impose taxes on crypto mining in order to decrease mining operations.

In a budget proposal dated March 9, it was proposed that there would be an "excise tax equal to 30 percent of the costs of electricity used in digital asset mining.”

Related: US crypto's future could fall on these 4 digital asset bills

The crypto industry in the U.S. has repeatedly voiced concerns about regulatory choices affecting innovation within the nation.

On Aug. 13, Grayscale Investments CEO Michael Sonnenshein warned that the Securities and Exchange Commission (SEC) constantly resorting to enforcement action will drive crypto firms out of the country.

“If every crypto issue needs to go to a court of law, then as a country, we are squashing the innovation taking place here,” Sonnenshein stated.

In the same vein, Brad Garlinghouse, CEO of Ripple, recently indicated that the crypto industry is shifting away from the U.S. due to its slower crypto regulation process compared to other countries like Australia, United Kingdom and Singapore.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

The high stakes of crypto applications mean developers often need to prioritize security — but that comes at the cost of poor user experience.

The current Web3 user experience (UX) is akin to driving a manual transmission car — there’s more control, but most users will find it unnecessarily clunky, according to several UX designers.

Over the years, discussion around mainstream adoption of Web3 has centered around the need to improve crypto’s user experience and “ease of use.”

However, in a July 12 tweet, Web3 UI/UX designer 0xDesigner argued that certain properties of blockchain make it challenging to build easy-to-use Web2-like applications.

Web2 vs Web3 UX

— 0xDesigner (@0xDesigner) July 12, 2023

I was asked by a reporter from a crypto publication about the disparity between web2 and web3 UX. It’s a meaningful line of questioning that isn't covered enough. So I’m going to share some half-baked thoughts in hopes that it triggers more discourse.

Why is…

According to 0XDesigner, one of the main issues with cryptocurrency applications is that every action is “irreversible” — there’s no “undo button” on the blockchain and mistakes are expensive. They added:

“Think of it this way: Web2 is like driving an automatic car. It’s straightforward; you get in, press the pedal and off you go. Web3, on the other hand, is more like driving stick.

“You need to understand the gears, the clutch and constantly monitor the tachometer; otherwise, you’ll damage the transmission or stall the car,” they added.

Speaking to Cointelegraph, 0xDesigner argued most of the “broader population” may not even care about the sovereignty (control and ownership) that blockchain offers.

Thomas Ling, a former user interface (UI) designer for blockchain tech firm Immutable and Web2 gaming studio Riot Games, told Cointelegraph that UI is typically more simple in Web2 because with Web3, ownership and control are vested with the user.

While this makes Web3 unique, it adds more complications on the backend, Ling explained:

“Where a Web2 app may only need to show one step out of five, a Web3 app needs to show all five in order for a user to achieve an action and retain the value proposition of Web3.”

Because of this, Web3 UI/ UX designers are “limited” in the way that they can make “magic” happen in creating an easy-to-use application, explained Ling.

Got me thinking about UX/UI in crypto, oh and GM pic.twitter.com/ayEIbWQPDg

— irena (@irena_clarke) July 4, 2023

Ling said this is particularly challenging when product teams are faced with making design decisions with tradeoffs:

“It’s a bit of a paradox — by making Web3 flows simpler, we have to take away some control from the user, which starts to take away from the point of Web3.”

0xDesigner believes another problem lies in the lack of priority given to user experience in Web3 projects.

“From what I’ve seen, most product teams are engineering driven. The designer-to-developer ratios are lower than in Web2. That usually results in more technical solutions.”

This could be because of the high stakes in Web3, especially regarding financial applications, meaning that more staff will be focused on security and error prevention.

Related: This platform improves UX by providing CEX users with ENS names

0xDesigner believes mass adoption of Web3 will come when there’s a truly useful application of it, like gaming and music.

“The adoption problem is usefulness first, not usability. It needs to be a good game or good music. I don’t think it will matter that it’s Web3.”

Cryptocurrency applications should also “feel invisible,” they added.

“I think the next crypto cycle will be driven by consumer apps that are powered by crypto, but users won’t know it’s crypto unless they look closely.”

In a contrasting view, Messari CEO Ryan Selkis downplayed the problem of UX/UI on adoption during a July 11 Twitter Spaces.

Just under 1 hour until our next On the Road to #Mainnet2023 Spaces! Join @twobitidiot, @bloomberg_seth & @mikeykremer as they dive into current crypto product solutions and their usefulness.

— Messari (@MessariCrypto) July 11, 2023

https://t.co/StNxv2kOoG pic.twitter.com/DzS8Vuxasg

“The wallets are fine, there’s definitely some things to be desired [...] but it’s really a lot of the off-chain, social and regulatory things that cloud long term adoption.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Web3 Gamer: Apple to fix gaming? SEC hates Metaverse, Logan Paul trolled on Steam

Speaking in a Twitter Space hosted by Coinbase on June 7, Ryan Selkis praised the new crypto bill for providing new firms with a clear path to compliance.

Messari CEO Ryan Selkis has praised a newly proposed Republican crypto bill, commenting it is a “10x improvement” on all other crypto bills introduced to the United States Congress so far.

The “Digital Asset Market Structure” (DAMS) bill, introduced on June 1, proposes to establish a framework to fill the gaps in the regulatory process between the U.S. Commodity Futures Trading Commission and Securities Exchange Commission on activities related to crypto-assets.

Speaking at a Coinbase-hosted event on Twitter Spaces on June 7, Selkis explained that U.S. Representatives Patrick McHenry and Glenn Thompson have drafted a pathway for tokens to reach compliance through decentralization without instantly triggering securities laws.

— Coinbase ️ (@coinbase) June 7, 2023

“How could tokens in their earliest stage come into compliance with securities laws on a temporary basis unless and until they were sufficiently decentralized?” Selkis asked rhetorically.

He went on to acknowledge the former work of U.S. Securities Exchange Commission Chair Hester Pierce, who released a “Safe Harbor” proposal in February 2020.

“A lot of the language that she had included in those proposals is now being worked out in legislative text [and] that's kind of made its way into this new bill.” He added:

“I do think that this is probably a 10x improvement versus anything that we've seen so far.”

The last similar crypto bill to hit the floor of Congress was the Digital Commodities Consumer Protection Act, which was introduced on August 3 to provide further supervision over the crypto industry following the collapse of FTX.

The Messari CEO’s comments were backed by TuongVy Le, head of regulatory and policy at Bain Capital Crypto, who added that DAMS finally gives token issuers “a path to compliance.”

“The issue that a lot of crypto issuers or token projects face is when you're launching a token, you don't become decentralized right away, right?” said Le.

Great to be on today with @iampaulgrewal @JBSDC @twobitidiot! @coinbase thanks for having me. There’s a lot going on right now, but we are fighting for progress and innovation and something better than the status quo. And we will get there! - onward! https://t.co/oHGhh6wssP

— TuongVy Le ️ (@TuongvyLe12) June 7, 2023

She explained that token issuers “need time to work towards that,” but while that’s in the works, the SEC can swoop in and “bring enforcement action against you.”

While Le considered this to have always been the “fundamental problem,” she remains hopeful that DAMS can resolve it once and for all:

“I think this bill addresses that. It gives token issuers a path to get there [...] in a really thoughtful way.”

Paul Grewal, the chief legal officer at Coinbase, also acknowledged the problems that many token issuers are tackling:

“Under the current law there really is no reasonable pathway for those assets that start out life as a security to evolve and involve in large part by decentralizing in a way that's recognized under the law.”

While there are many details to be ironed out, the Digital Asset Market Structure Discussion Draft is a strong step towards developing a regulatory regime that embraces innovation, maintains US industry presence and protects consumers.

— paulgrewal.eth (@iampaulgrewal) June 5, 2023

Related: Crypto lawyers flame Gensler over claims that all crypto are securities

The bill was discussed in light of the SEC’s recent lawsuits filed against the two largest cryptocurrency exchanges — Binance on June 5 and Coinbase on June 6 — for allegedly breaking securities laws by offering tokens as unregistered securities.

The SEC now considers at least 67 cryptocurrencies to be classed as securities.

Among the most notable tokens the financial regulator deems to be securities are Binance Coin (BNB), Solana (SOL), Cardano (ADA), Polygon (MATIC) and Cosmos (ATOM).

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Messari founder and CEO Ryan Selkis says Bitcoin (BTC) is poised to go on a massive rally as US banks fall like dominoes. The head of the crypto intelligence firm tells his 307,400 Twitter followers that Bitcoin is likely to hit six figures within the next 12 months. He names five main reasons for his […]

The post Bitcoin (BTC) Primed for Over 270% Explosion, Predicts Messari CEO Ryan Selkis – Here’s the Timeline appeared first on The Daily Hodl.

During the last two days, the cryptocurrency community has been dealing with the FTX fiasco after Binance revealed that it was backing out of the deal to acquire the rival exchange. Between Nov. 8-9, the crypto economy shed more than $230 billion in value as FTX’s troubles shook investors. The following is an in-depth look […]

During the last two days, the cryptocurrency community has been dealing with the FTX fiasco after Binance revealed that it was backing out of the deal to acquire the rival exchange. Between Nov. 8-9, the crypto economy shed more than $230 billion in value as FTX’s troubles shook investors. The following is an in-depth look […]