Customizable rollup provider Eclipse announced that the startup is launching a scaling solution that is compatible with Solana and Polygon. Eclipse disclosed that the Layer 2 blockchain can run smart contracts on Solana, and decentralized applications (dapps) will be easily migratable to the Polygon Sealevel Virtual Machine (SVM). How Eclipse’s L2 Scaling Concept Hopes to […]

Customizable rollup provider Eclipse announced that the startup is launching a scaling solution that is compatible with Solana and Polygon. Eclipse disclosed that the Layer 2 blockchain can run smart contracts on Solana, and decentralized applications (dapps) will be easily migratable to the Polygon Sealevel Virtual Machine (SVM). How Eclipse’s L2 Scaling Concept Hopes to […]

While the collapse of FTX shaved $100 billion off of BTC's market cap in just four days last year, BTC has managed to fully recover and stack on another $65 billion.

A 48% Bitcoin (BTC) price surge since the start of the year has pushed BTC's market cap past that of payment processing giant Visa once again.

With the BTC price currently at $24,365, its market cap of $470.16 billion is now marginally above that of Visa with a market cap of $469.87 billion, according to CoinMarketCap.

This is the third time that BTC has "flippened" the market cap of Visa, according to Companies Market Cap.

The first time came in late December 2020 when BTC also happened to hit $25,000 for the first time. This was achieved during a price surge that saw BTC rally from $10,200 in September 2020 to $63,170 seven months later in April 2021.

Visa re-took the lead between June and October 2022, which then saw BTC surpass Visa for a very brief moment on Oct. 1 before the payments company re-captured the lead again.

This lead was widened when the collapse of cryptocurrency exchange FTX shaved off over $100 billion from the BTC in four days between Nov. 6-10, 2022.

However, since then, BTC has fully recovered and stacked an additional $65 billion on top of its Nov. 6 market cap of $408 billion to overtake the payment processing giant.

BREAKING: #Bitcoin market cap is now worth more than Visa ‼️#BTC #Crypto #CryptoNews #cryptocurrecy #cryptomarket pic.twitter.com/rZrLufkwLj

— Ajay (everything hindi) (@EverythingAjay) February 19, 2023

It should be worth noting that given the small difference in market cap between BTC and Visa, the two are currently flipping each other by the hour.

Related: What is the Lightning Network in Bitcoin, and how does it work?

As for BTC’s impressive start to 2023, its third “flippening” of Visa came on the back of 14 consecutive days of price increases between Jan. 4-17.

BTC is also well ahead of the second largest payment processing network Mastercard, which currently has a market cap of $345.24 billion, according to Google Finance.

The #Bitcoin Strategy is the Winning Strategy. pic.twitter.com/AR9R1Dxj5G

— Michael Saylor⚡️ (@saylor) February 17, 2023

BTC is still however down 63% from its all-time-high price of $69,044, which was reached on Nov. 10, 2021.

As Ordinal inscriptions approach the 150,000 mark, blocks larger than 3 MB have become commonplace, with many blocks near the 4 MB range. Meanwhile, after the average transaction fee on-chain rose 122% higher at the beginning of February 2023, the average fee has remained the same over the last few weeks and is currently coasting […]

As Ordinal inscriptions approach the 150,000 mark, blocks larger than 3 MB have become commonplace, with many blocks near the 4 MB range. Meanwhile, after the average transaction fee on-chain rose 122% higher at the beginning of February 2023, the average fee has remained the same over the last few weeks and is currently coasting […] The crypto world was jolted last week when the Securities and Exchange Commission (SEC) shut down Kraken’s staking program, much to the satisfaction of Chairman Gary Gensler and his team. But what does this mean for the future of cryptocurrency and, more specifically, staking? The following opinion editorial was written by Bitcoin.com’s Business Development Manager […]

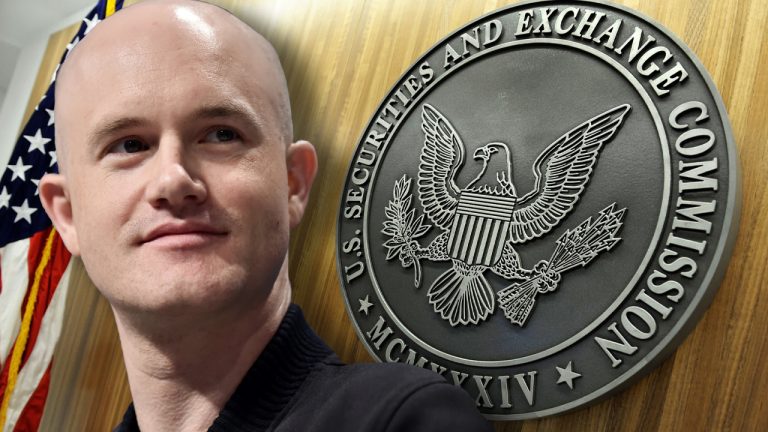

The crypto world was jolted last week when the Securities and Exchange Commission (SEC) shut down Kraken’s staking program, much to the satisfaction of Chairman Gary Gensler and his team. But what does this mean for the future of cryptocurrency and, more specifically, staking? The following opinion editorial was written by Bitcoin.com’s Business Development Manager […] Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Banning retail crypto staking in the US would result in even more businesses moving offshore, argues the Coinbase co-founder.

The CEO and co-founder of cryptocurrency exchange Coinbase, Brian Armstrong, believes that banning retail crypto staking in the United States would be a ‘terrible’ move by the country's regulators.

Armstrong made the comments in a Feb. 9 Twitter thread which has already been viewed over 2.2 million times, after noting they've heard “rumors” that the U.S. Securities and Exchange Commission “would like to get rid of crypto staking” for retail customers.

“I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.”

Armstrong did not share where the rumors originated from but continued to note that staking was “a really important innovation in crypto.”

“Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints,” he added.

2/ Staking is a really important innovation in crypto. It allows users to participate directly in running open crypto networks. Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Armstrong also referenced an Oct. 5 blog post from crypto investment firm Paradigm, which argued that Ethereum’s transition to proof-of-stake and its subsequent “staking” model does not make it a security.

The Paradigm post came just a few weeks after SEC Chairman Gary Gensler suggested that proof-of-stake (PoS) cryptocurrencies could trigger securities laws on Sep. 15, 2022, while speaking to reporters after a Senate Banking Committee meeting.

Armstrong also lambasted the current lack of regulatory clarity in the U.S. and subsequent “regulation by enforcement” that he says is driving companies offshore, such as crypto exchange FTX.

He has reiterated calls for regulation that provides clear rules for the industry while preserving innovation.

Related: Crypto exchange Kraken faces probe over possible securities violations: Report

According to Staking Rewards, the top four staked cryptocurrencies by market cap account for over $55 billion in staked assets, suggesting a country-wide ban would be a huge hit to the country’s crypto industry which has already seen an exodus of crypto-related businesses.

Some industry commentators have suggested that the SEC might go after centralized parties which offer staking services rather than the technology itself, believing the latter would be a losing battle which would “crush them in precedent.”

Timely reminder that https://t.co/splf30ft12 outlines the legal arguments of ETH staking under the Howey Test.

— Adam Cochran (adamscochran.eth) (@adamscochran) February 8, 2023

I believe the SEC would likely go after centralized parties offering staking, and not PoS itself as that'd be a harder fight that could crush them in precedent. https://t.co/YiD2Cpxx6z

The general counsel for Delphi Digital’s research and development arm, Gabriel Shapiro, suggested there is a strong argument that staking services provided by centralized exchanges like Coinbase constitute a security, drawing parallels between them and other “Earn” products.

Personally although I do think "Earn" programs offered by CEXs are debt securities, I think it is *possible* to offer pure PoS as a service, even on a CEX, without the offer being a security, depending on the details of the terms. But tbqh it's a close case.

— _gabrielShapir0 (@lex_node) February 8, 2023

Coinbase is currently subject to an ongoing SEC probe, which Coinbase revealed in an Aug. 9, 2022 SEC filing was in relation to its staking rewards amongst other offerings.

Seven days ago, finder.com, a product comparison website, published a forecast report based on predictions from several crypto and fintech experts, predicting bitcoin’s year-end price for 2023. Following the bitcoin price prediction report, Finder released another survey focused on ethereum, the second-largest crypto asset in terms of market capitalization. Finder specialists believe ethereum will reach […]

Seven days ago, finder.com, a product comparison website, published a forecast report based on predictions from several crypto and fintech experts, predicting bitcoin’s year-end price for 2023. Following the bitcoin price prediction report, Finder released another survey focused on ethereum, the second-largest crypto asset in terms of market capitalization. Finder specialists believe ethereum will reach […] The meme token shiba inu has seen a rise against the U.S. dollar during the last seven days as the coin’s supporters anticipate the beta launch of the layer two (L2) scaling solution Shibarium. Developers detailed on Jan. 15, 2023, that the L2 platform, “Shibarium beta,” is about to be launched on top of the […]

The meme token shiba inu has seen a rise against the U.S. dollar during the last seven days as the coin’s supporters anticipate the beta launch of the layer two (L2) scaling solution Shibarium. Developers detailed on Jan. 15, 2023, that the L2 platform, “Shibarium beta,” is about to be launched on top of the […]

Building an interoperable network of blockchains dedicated to a specific purpose appears to be a viable alternative to layer-2 scalability solutions.

App-specific blockchains, or appchains, are specifically designed to support the creation and deployment of decentralized applications (DApps). In an appchain, each app runs on its separate blockchain, linked to the main chain. This allows for greater scalability and flexibility, as each app can be customized and optimized for its specific use case.

Appchains are also an alternative solution for scalability to modular blockchains or layer-2 protocols. Appchains present similar characteristics to modular blockchains, as it is a type of blockchain architecture that separates the data, transaction processing and consensus processing elements into distinct modules that can be combined in various ways. These can be thought of as “pluggable modules” that can be swapped out or combined depending on the use case.

This separation of functions is why there’s greater flexibility and adaptability to appchains compared to traditional, monolithic blockchain architectures, where these functions are all built into one program. They allow for the creation of customized, sovereign blockchains — tailored to meet specific needs and use cases — where users can focus on specific tasks while offloading the rest to other layers. This can be beneficial regarding resource management, as it allows different parties to specialize in different areas and share the workload.

The scalability of blockchain technology is a key factor for its future success. Due to the scalability issues in layer-1 blockchain architecture, there has been a shift toward using modular blockchains or layer-2 protocols, which offer solutions to the limitations of monolithic systems.

As a result, the adoption of layer-2 networks is increasing, as they provide a way to address scalability and other issues in current blockchain networks, particularly for a layer-1 like Ethereum. Layer-2 protocols offer lower transaction fees, fewer capacity constraints and faster transaction speeds that paved the way for its growing adoption, catching the attention of 600,000 users.

Appchains are not entirely different from monolithic chains. Monolithic chains, like appchains, follow the fat-protocol thesis where a single chain handles most decentralized finance (DeFi) activity and settles everything on one layer with a valuable token. However, layer-1 blockchains are hard to scale. Appchains don’t currently have the same limited space issues as monolithic chains, but they can use modular solutions in the future if necessary.

“The fundamental value proposition of appchains is sovereign interoperability,” explained Stevie Barker, a researcher at Osmosis Labs, a decentralized trading protocol on the Cosmos ecosystem. He told Cointelegraph:

“Appchains are sovereign because they have precise control over their entire stack and any other area of blockchain structure and operations they want to customize. And they are interoperable because appchains can freely interact with each other.”

Appchains can optimize for user experience and make execution faster, easier and more efficient. They can also secure their chain by recruiting validators to implement code, produce blocks, relay transactions and more. Alternatively, they can borrow the security from another set of validators, interchain security, or combine both options to share security among the entire interchain.

Related: US federal agencies release joint statement on crypto asset risks and safe practices

Osmosis has developed a new take on proof-of-stake called “superfluid staking” that aims to improve both security and user experience. This approach allows liquidity providers to stake the tokens in their liquidity pool (LP) shares to help secure the chain. In return, they will receive staking rewards in addition to their LP rewards, which can help increase their capital efficiency. This can be a more seamless and integrated approach to staking, as liquidity providers can simultaneously earn rewards for their LP and staking activities.

With current advancements, the entire interchain will be able to use its staked assets for DeFi activities without risking centralization or compromising chain security, as is often the case with traditional liquid staking derivatives. This will allow users to take advantage of DeFi opportunities while maintaining the security and decentralization of their staked assets. Valentin Pletnev, CEO and co-founder of Quasar, a decentralized appchain designed for asset management, told Cointelegraph:

"Owning the entire stack from top to bottom allows for easy value generation and purpose for the token — it also allows for higher efficiency as chains can be designed around a specific use case and optimized for it."

Appchains also can effectively manage Maximal Extractable Value (MEV), which refers to the profits obtained by those who have the power to decide the order and inclusion of transactions. MEV has been a problem for DeFi users across various ecosystems. However, appchains can more quickly implement on-chain solutions that significantly reduce malicious MEV and redirect healthy arbitrage profits from third parties to the appchain itself. This can help improve the user experience and reduce the potential for exploitation in the DeFi ecosystem.

Appchains allow for radical blockchain experiments to be carried out quickly. While Tendermint and the Cosmos SDK are remarkable technologies that enable apps to spin up inter-blockchain communication (IBC) protocol-ready blockchains quickly, the whole Cosmos stack is not necessary to become an IBC-connected appchain. Barney Mannerings, a co-founder of Vega Protocol, an application-specific blockchain for trading derivatives, told Cointelegraph:

“As the space is moving toward a multichain and multi-layered world — in which assets can be moved between chains and specific scaling layers — a distribution of an application on multiple hubs can make sense.”

Appchains offer a path for the new communication standard of blockchains. Native token transfer between ecosystems eliminates bridges and allows for native token transfer cross-chain.

App-specific blockchains also offer several valuable benefits that make them attractive for developers and users alike. Their ability to improve applications’ scalability, performance, security and interoperability makes them a valuable tool for building the next generation of software. As the technology continues to evolve, we will likely see more and more developers adopting app-specific blockchains for their applications.

Related: Blockchain Interoperability, Explained

However, the use of multiple appchains can make them more complex and difficult to manage compared to other types of blockchain technology. Since each app runs on its blockchain, managing and maintaining multiple blockchains can be resource-intensive and time-consuming. Integrating different app chains can be challenging due to potential compatibility issues.

Overall, the benefits and drawbacks of app chains depend on the specific use case and requirements of the DApps under development. In some cases, app chains may provide the ideal solution for building and deploying DApps, while other types of blockchain technology may be more suitable in others.

Over 150 projects, including Chainlink, Uniswap and Aave, have signaled their intent to deploy on the layer-2 blockchain.

Matter Labs, the developer behind the Ethereum Virtual Machine (EVM)-compatible zkSync, has received major industry backing as it pledges to fully open source its platform — marking the first such initiative for a ZK-rollup technology.

Matter Labs confirmed on Nov. 16 that it had closed a $200 million Series C funding round co-led by Blockchain Capital and Dragonfly, with additional participation from LightSpeed Venture Partners, Variant and existing investor Andreessen Horowitz. The company has now raised $458 million in financing across all rounds, including $200 million from BitDAO that’s earmarked for funding ecosystem projects.

Founded in 2018, Matter Labs is working to scale Ethereum through zero-knowledge proofs, a digital authentication process that enables seamless data sharing between two parties. Ethereum has enjoyed widescale acceptance among developers in the blockchain community, but mainstream adoption of its technology has been partially hindered by scalability issues. As a ZK-rollup technology, zkSync provides a layer-2 scalability solution for Ethereum that maintains the network’s security or decentralization features.

Over 150 projects have signaled their intent to launch on zkSync’s mainnet, which was released on Oct. 28 as part of a multi-stage process to bring the protocol into full production. Some of its most notable partners include Chainlink, Uniswap, Aave, Curve, 1inch and SushiSwap.

In addition to the funding announcement, Matter Labs disclosed that its zkSync technology would be released through an MIT Open Source license later this quarter. This gives developers the ability to view, modify and fork the code.

In an interview with Cointelegraph, Matter Labs’ chief product officer Steve Newcomb said his firm wanted to “drive consensus in open source,” which is why everything in the mainnet release will be fully open sourced by MIT’s standard. He explained that, by open sourcing the protocol, zkSync could become the layer-2 standard for the industry.

“In crypto, one of the major things we want to stop is centralized censorship. Anything other than full open source is centralized censorship of code,” Newcomb said. “We can’t decide who is right or wrong or good or bad.”

Related: Ethereum-scaling protocol zkSync’s layer-3 prototype set for testing in 2023

Although venture capital has flowed freely into blockchain projects for the past two years, deteriorating market conditions have caused investors to be much more cautious in recent months. According to Cointelegraph Research, venture funding in the crypto and blockchain industry fell 66% quarter-on-quarter to $4.98 billion. Still, 2022 is shaping to be a record year in terms funding deals and total capital raised.