On Thursday, bitcoin (BTC) soared to a peak of $63,882, marking a 7.8% increase against the U.S. dollar over the past month. During this same period, approximately $6.36 billion worth of BTC was pulled from crypto exchanges, hitting levels not seen since early November 2018. More Than 100,000 Bitcoin Removed From Digital Currency Trading Platforms […]

On Thursday, bitcoin (BTC) soared to a peak of $63,882, marking a 7.8% increase against the U.S. dollar over the past month. During this same period, approximately $6.36 billion worth of BTC was pulled from crypto exchanges, hitting levels not seen since early November 2018. More Than 100,000 Bitcoin Removed From Digital Currency Trading Platforms […] Over the past 158 days, starting from the beginning of the year, the quantity of bitcoin held by exchanges and miners has decreased by 183,253 BTC, valued at nearly $13 billion. Roughly 90.95% of this bitcoin withdrawal originated from cryptocurrency exchange reserves. Exchanges and Miners See Massive Reductions From Jan. 1 to June 7, 2024, […]

Over the past 158 days, starting from the beginning of the year, the quantity of bitcoin held by exchanges and miners has decreased by 183,253 BTC, valued at nearly $13 billion. Roughly 90.95% of this bitcoin withdrawal originated from cryptocurrency exchange reserves. Exchanges and Miners See Massive Reductions From Jan. 1 to June 7, 2024, […]

Many analysts are looking at how the cryptocurrency’s inflation rate will compare to gold’s after the halving, expected on April 19.

With the Bitcoin (BTC) halving expected to occur in the next four days, many analysts have suggested that the event could affect the cryptocurrency’s status as a store of value.

At the time of publication, roughly 630 blocks are left to mine before the Bitcoin halving occurs, meaning the monumental event in the crypto space will happen around April 19. In March, the BTC price reached an all-time high of more than $73,000 after the United States Securities and Exchange Commission approved the listing and trading of spot Bitcoin exchange-traded funds on exchanges in January, with the crypto asset continued to show volatility in its price.

Many crypto users and financial analysts claim that Bitcoin could be an effective hedge against inflation as countries’ central banks, including the U.S. Federal Reserve, devalue fiat currency by printing money. In contrast, there is a fixed supply of 21 million BTC, roughly 19.7 million of which have already been mined.

The next Bitcoin halving is on the horizon, drawing closer with each passing block and anticipated to take place anywhere between April 18 to April 22, 2024, at the milestone of block 840,000. Following this event, the reward for mining a block will halve from 6.25 bitcoins to 3.125 bitcoins. The following is a thorough […]

The next Bitcoin halving is on the horizon, drawing closer with each passing block and anticipated to take place anywhere between April 18 to April 22, 2024, at the milestone of block 840,000. Following this event, the reward for mining a block will halve from 6.25 bitcoins to 3.125 bitcoins. The following is a thorough […]

Discover how a reduction in supply affects the price of Bitcoin, and how market participants perceive and react to halving events in the dynamic cryptocurrency market.

Bitcoin (BTC), the pioneering cryptocurrency that sparked a global revolution in digital assets, operates on a unique monetary policy. One of the defining features of Bitcoin is its halving event, which occurs approximately every four years.

This article will explore the economics behind Bitcoin’s halving, examining its effects on price movements and market sentiment. By understanding these factors, investors and enthusiasts can gain valuable insights into the cryptocurrency’s market behavior.

Related: How does the monetary supply affect cryptocurrencies?

A Bitcoin halving, also known as a “halvening,” refers to the predetermined reduction in the rate at which new BTC are created. It is programmed into the Bitcoin protocol and occurs every 210,000 blocks, which is roughly every four years. The halving event halves the block reward, reducing the number of newly minted Bitcoin awarded to miners.

A Bitcoin halving directly impacts the supply and demand dynamics of the cryptocurrency. By reducing the rate at which new BTC enters the market, halving effectively reduces the available supply. As the supply decreases, assuming demand remains constant or increases, basic economic principles suggest that the price of Bitcoin should rise.

Supply and demand is the basic economic principle supporting a price increase in response to Bitcoin’s halving. The law of supply and demand states that prices tend to increase when a commodity’s supply declines, and demand either stays the same or rises. The Bitcoin halving slows the rate of new Bitcoin creation and market release.

As a result, there are fewer newly created BTC available for purchase. The diminished supply produces a scarcity effect, which might push the price upward if demand for Bitcoin stays the same or rises.

Bitcoin’s controlled supply is a key factor contributing to its value proposition. The total supply of Bitcoin is limited to 21 million coins, and the halving mechanism gradually reduces the rate at which new BTC are produced until the maximum supply is reached. This scarcity aspect, coupled with the increasing recognition and adoption of Bitcoin, can create a perception of limited availability and drive up demand, thereby impacting the price.

Halving events have frequently been associated with increases in the price of Bitcoin, with significant upward momentum both before and after previous halvings. For example, during the 2012 halving, Bitcoin’s price soared from about $12 to over $200 in just one year. Similarly, Bitcoin experienced a stunning recovery after its 2016 price halving, reaching a high of about $19,700 in December 2017.

Following the most recent halving event in May 2020, Bitcoin’s price surged. Starting at $8,787 during the halving, the cryptocurrency experienced a remarkable rally, eventually reaching its all-time high of nearly $69,000 in November 2021.

Bitcoin halving events often generate increased market attention and hype. Expectations of lower supply and likely price increases may fuel positive feelings among investors and traders. This optimism could result in higher demand for Bitcoin as traders try to profit from the expected price gain. As a result, a Bitcoin halving can result in the self-fulfilling prophecy of rising market sentiment and demand.

It is crucial to remember that during halving occurrences, market sentiment isn’t always favorable. Market participants may also experience FUD around the potential effects of a price halving. Short-term price swings and heightened volatility may result from this conflicting sentiment.

The Bitcoin halving event may also impact mining economics. Block rewards and transaction fees are the primary sources of income for miners, which are essential to confirming transactions and safeguarding the Bitcoin network.

The decrease in block rewards caused by a halving event directly affects miner profitability. After a halving event, miners operating with increased expenses might find it less profitable to mine Bitcoin, which could result in a drop in mining activity.

Related: ‘Don’t short when it’s dark green’: How to trade the 2024 Bitcoin halving

Bitcoin’s halving may initially impact mining economics, but it also plays a critical role in preserving the network’s long-term security and stability. Miners are encouraged to continue their activities and secure the network through transaction validation due to the carefully managed decline in block rewards.

The network becomes more robust and less dependent on freshly created currencies for security as the mining industry adapts to the decreased block rewards.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

According to current statistics, the Bitcoin network is fewer than 56,000 blocks away and less than 400 days away from the next reward halving. After the next halving, the block reward will be reduced by 50%, and the current block subsidy of 6.25 bitcoins will drop to 3.125 bitcoins per block post-halving. In addition to […]

According to current statistics, the Bitcoin network is fewer than 56,000 blocks away and less than 400 days away from the next reward halving. After the next halving, the block reward will be reduced by 50%, and the current block subsidy of 6.25 bitcoins will drop to 3.125 bitcoins per block post-halving. In addition to […] Amid the controversy surrounding the Ordinals project and the debate over what types of data should be stored on the Bitcoin blockchain, the network mined its largest block, nearly 4 MB in size, containing just 63 transactions. One of the transactions was a 3.94 MB Ordinal inscription featuring an image of a wizard, and the […]

Amid the controversy surrounding the Ordinals project and the debate over what types of data should be stored on the Bitcoin blockchain, the network mined its largest block, nearly 4 MB in size, containing just 63 transactions. One of the transactions was a 3.94 MB Ordinal inscription featuring an image of a wizard, and the […] Non-fungible token (NFT) assets have existed since at least 2014, but interest in them began to rise in January 2021, according to Google Trends data. Approximately one year later, the search term “NFT” reached its highest score on Google Trends. During that time the top five NFT collections, in terms of all-time sales volume, have […]

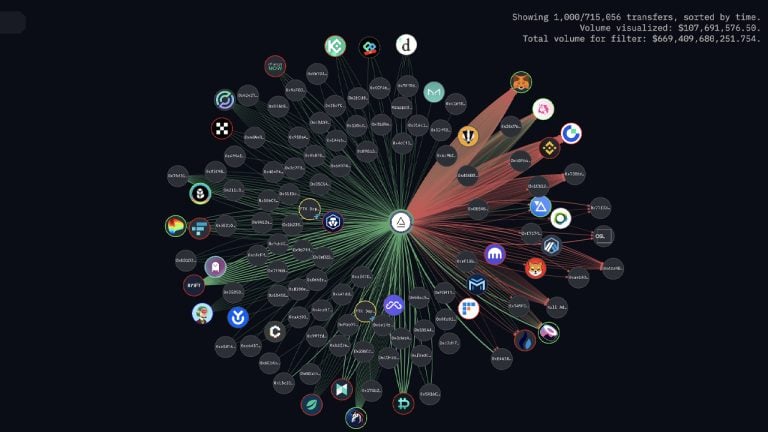

Non-fungible token (NFT) assets have existed since at least 2014, but interest in them began to rise in January 2021, according to Google Trends data. Approximately one year later, the search term “NFT” reached its highest score on Google Trends. During that time the top five NFT collections, in terms of all-time sales volume, have […] This week, FTX debtors issued a press release and a 20-page document noting that bankruptcy administrators had located $5.5 billion in liquid assets. The document details that investigators discovered fiat currencies, crypto assets, and securities as part of FTX’s and Alameda Research’s cache. However, the disclosure to unsecured creditors does not mention the extremely large […]

This week, FTX debtors issued a press release and a 20-page document noting that bankruptcy administrators had located $5.5 billion in liquid assets. The document details that investigators discovered fiat currencies, crypto assets, and securities as part of FTX’s and Alameda Research’s cache. However, the disclosure to unsecured creditors does not mention the extremely large […] Following the launch of Donald Trump’s non-fungible token (NFT) card collection, winners of the Trump-themed prizes are selling prize NFTs on secondary NFT marketplaces such as Opensea. The Polygon-minted NFTs act as passes for a one-on-one Zoom meeting with the 45th president of the United States and a gala dinner with Trump. During the past […]

Following the launch of Donald Trump’s non-fungible token (NFT) card collection, winners of the Trump-themed prizes are selling prize NFTs on secondary NFT marketplaces such as Opensea. The Polygon-minted NFTs act as passes for a one-on-one Zoom meeting with the 45th president of the United States and a gala dinner with Trump. During the past […]