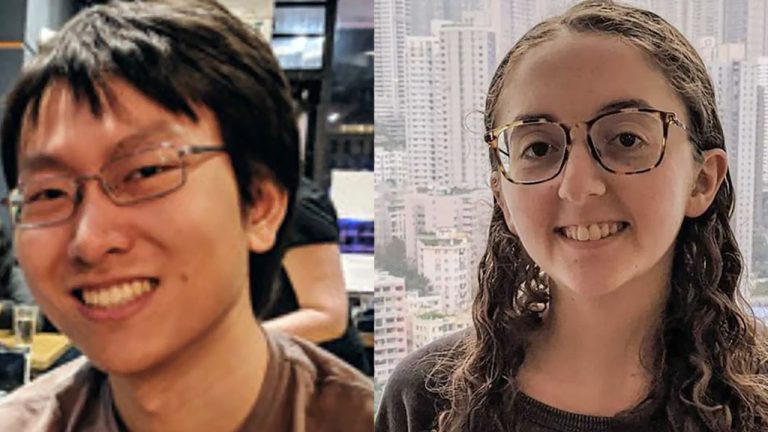

On Dec. 21, U.S. law enforcement officials from the Southern District of New York (SDNY), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) revealed they imposed fraud charges against FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison. After Wang’s and Ellison’s surrender announcement, the public has been wondering […]

On Dec. 21, U.S. law enforcement officials from the Southern District of New York (SDNY), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) revealed they imposed fraud charges against FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison. After Wang’s and Ellison’s surrender announcement, the public has been wondering […] On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

Both former executives of FTX and Alameda Research have been charged for their role in the "frauds" that led to FTX's collapse.

Former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang have pleaded guilty to federal fraud charges and are cooperating with prosecutors as part of the criminal case against the former CEO of FTX, Sam Bankman-Fried.

United States Attorney for the Southern District of New York (SDNY), Damian Williams made the announcement on Dec. 22, emphasizing that the latest major development is unlikely to be the last.

"As I said last week, this investigation is ongoing and moving very quickly. I also said last week's announcement would not be our last and let me be clear once again, neither is today's," he said, adding that:

I'm announcing that SDNY has filed charges against Caroline Ellison [...] and Gary Wang [...] in connection with their roles in the frauds that contributed to FTX's collapse. Both Ms. Ellison and Mr. Wang have plead guilty to those charges and both are cooperating with the SDNY.

Williams also confirmed that SBF is now in the custody of the Federal Bureau of Investigation (FBI) and is "on his way back to the United States" where he will be transported directly to the Southern District of New York to appear before a judge "as soon as possible."

Statement of U.S. Attorney Damian Williams on U.S. v. Samuel Bankman-Fried, Caroline Ellison, and Gary Wang pic.twitter.com/u1y4cs3Koz

— US Attorney SDNY (@SDNYnews) December 22, 2022

Williams also used the statement to send a stark warning to anyone that may have participated in misconduct at FTX or Alameda:

"Now is the time to get ahead of it. We are moving quickly and our patience is not eternal."

SBF was officially handed over from Bahamanian custody to U.S. authorities on Dec. 21 after he waived his right to a formal extradition process that could have taken weeks. His lawyer claimed that SBF wanted to speed up the process as he is currently driven to "put the customers right."

Related: What blockchain analysis can and can't do to find FTX's missing funds: Blockchain.com CEO

Meanwhile, Ellison's recent guilty plea and cooperation with the SDNY may be unsurprising for some, given that she was reportedly spotted at a coffee shop just a short walk away from the U.S. Attorney’s Office and the New York FBI office on Dec. 5.

On Tuesday, the former CEO of FTX, Sam Bankman-Fried (SBF), appeared in court with his newly appointed lawyer Mark Cohen, and his legal team asked the Bahamian judge Joyann Ferguson-Pratt to release SBF on bail with an ankle bracelet. Amid the lengthy court hearing reports detail that SBF’s parents Joseph Bankman and Barbara Fried attended […]

On Tuesday, the former CEO of FTX, Sam Bankman-Fried (SBF), appeared in court with his newly appointed lawyer Mark Cohen, and his legal team asked the Bahamian judge Joyann Ferguson-Pratt to release SBF on bail with an ankle bracelet. Amid the lengthy court hearing reports detail that SBF’s parents Joseph Bankman and Barbara Fried attended […]

SBF has finally been slapped with criminal charges and will be extradited to the U.S., once there, he will have to face separate charges from the SEC.

The worst isn’t yet over for the disgraced founder of crypto exchange FTX, Sam Bankman-Fried.

On Dec. 12, the United States Securities and Exchange Commission (SEC) said it is preparing to file charges against Sam Bankman-Fried, which will be separate from the ones leading to his most recent arrest in The Bahamas.

In a statement on Twitter, the SEC tweeted a quote from its division of enforcement director Gurbir Grewal on Dec. 12 stating that the agency has “authorized separate charges relating to his violations of securities laws.”

Gurbir Grewal: We commend our law enforcement partners for securing the arrest of Sam Bankman-Fried on federal criminal charges. The SEC has authorized separate charges relating to his violations of securities laws, to be filed publicly tomorrow in SDNY. https://t.co/ON0LgY4mf4

— U.S. Securities and Exchange Commission (@SECGov) December 13, 2022

Grewal said the charges will be filed publicly “tomorrow” on Dec. 14 at the Southern District of New York (SDNY).

Related: FTX was an 'utter failure of corporate controls at every level of an organization', says new CEO

The SEC’s announcement comes only hours after news broke of Sam Bankman-Fried’s arrest in The Bahamas on Dec. 12.

In a statement from Senator Ryan Pinder, the Attorney General of the Bahamas, Pinder said the arrest followed receipt of formal notification from the United States that it has filed criminal charges against SBF and is likely to request his extradition.

Specific details on the charges have not yet been confirmed, though it is understood to be in relation to wire and securities fraud, conspiracy to commit wire and securities fraud and money laundering.

In his latest statement, Grewal commended its SEC’s “law enforcement partners” for securing the arrest of Bankman-Fried on federal criminal charges.

The Department of Justice's U.S. Trustee overseeing FTX’s bankruptcy case has moved for the court to appoint an independent examiner.

The United States Trustee handling FTX’s bankruptcy proceedings has referred to the now-defunct exchange as the "fastest big corporate failure in American history," and is calling for an independent probe to look into its downfall.

In a Dec. 1 motion, U.S. Trustee Andrew Vara noted that over the course of eight days in November, debtors "suffered a virtually unprecedented decline in value" from a market high of $32 billion earlier in the year to a severe liquidity crisis after a "proverbial 'run on the bank.'"

"The result is what is likely the fastest big corporate failure in American history, resulting in these “free fall” bankruptcy cases."

Vara has called for an independent examination of FTX, stating it was "especially important because of the wider implications that FTX’s collapse may have for the crypto industry."

Independent examiners are typically brought into bankruptcy cases when it is in the interest of creditors, or when unsecured debts exceed $5 million.

This type of examiner has been called in other high-profile bankruptcy cases such as Lehman Brothers, and more recently to look into allegations of mismanagement by Celsius as part of its ongoing chapter 11 case.

"Like the bankruptcy cases of Lehman, Washington Mutual Bank, and New Century Financial before them, these cases are exactly the kind of cases that require the appointment of an independent fiduciary to investigate and to report on the Debtors' extraordinary collapse," the Trustee said.

Vara added that in regards to FTX’s collapse, “the questions at stake here are simply too large and too important to be left to an internal investigation.”

According to the motion, the appointment of an examiner — which requires the approval of the judge — would be in the interest of customers and other interested parties as they would be able to “investigate the substantial and serious allegations of fraud, dishonesty, incompetence, misconduct, and mismanagement” by FTX.

Additionally, the motion suggests an examiner could look into the circumstances surrounding FTX’s collapse, customers' funds being moved off the exchange, and whether entities that have lost money on FTX are able to claim back losses.

Related: Former FTX CEO Sam Bankman-Fried denies "improper use" of customer funds

FTX’s CEO John J. Ray III, who replaced Sam Bankman-Fried on Nov. 11, has been highly critical of the firm's operations since taking control, noting on the first day in court that there was a use of “software to conceal the misuse of customer funds” and “a complete absence of trustworthy financial information,” with control concentrated “in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals.”

While the Trustee acknowledges interested parties will be concerned that the appointment of an examiner will have costs and may intersect with FTX’s internal investigation, he suggests that these concerns don’t negate the need for an examiner.

In related news, the U.S. Attorney’s Office for the Southern District of New York and U.S. Securities and Exchange Commission have reportedly sent a number of requests to investors and firms that worked closely with FTX, asking for information on the company and its key figures.

So far, the authorities are yet to make any charges but appear to be closely investigating the defunct exchange.

On September 27, 2021, at the Southern District of New York courthouse, the trial against former Ethereum developer Virgil Griffith started at 9:30 a.m. (EST). Griffith was facing 20 years behind bars for discussing blockchain technology in North Korea. Around 10:30 a.m., Griffith pleaded guilty and accepted a plea deal with up to six and […]

On September 27, 2021, at the Southern District of New York courthouse, the trial against former Ethereum developer Virgil Griffith started at 9:30 a.m. (EST). Griffith was facing 20 years behind bars for discussing blockchain technology in North Korea. Around 10:30 a.m., Griffith pleaded guilty and accepted a plea deal with up to six and […] According to reports stemming from investigative journalist Matthew Russell Lee, from Inner City Press, former Ethereum developer Virgil Griffith has violated the terms of his bail and has been taken into custody. According to the reports, the U.S. Attorney’s Office revoked Griffith’s bond because he allegedly tried to access the crypto exchange Coinbase. Report Says […]

According to reports stemming from investigative journalist Matthew Russell Lee, from Inner City Press, former Ethereum developer Virgil Griffith has violated the terms of his bail and has been taken into custody. According to the reports, the U.S. Attorney’s Office revoked Griffith’s bond because he allegedly tried to access the crypto exchange Coinbase. Report Says […]