As of 9 a.m. EDT on Monday, the crypto market experienced a $1.15 billion loss in derivatives positions, with $975.93 million of these being long positions. Of that total, approximately $403.82 million came from BTC positions, while $364.98 million resulted from ETH positions being liquidated. Mass Liquidation Madness On Monday morning, the crypto market faced […]

As of 9 a.m. EDT on Monday, the crypto market experienced a $1.15 billion loss in derivatives positions, with $975.93 million of these being long positions. Of that total, approximately $403.82 million came from BTC positions, while $364.98 million resulted from ETH positions being liquidated. Mass Liquidation Madness On Monday morning, the crypto market faced […]

Bitcoin’s price continues to correct, but BTC options markets reflect traders’ interest in the $62,000 level.

Bitcoin (BTC) price plunged 5.5% between July 31 and Aug. 1, reaching its lowest level in over two weeks at $62,498. This movement has been attributed to reduced expectations of interest rate cuts in the United States and the distribution of 47,000 BTC from the estate of defunct exchange Mt. Gox. Traders fear that Bitcoin’s price could further correct to retest the $57,000 support level, but derivatives markets show resilience and no signs of stress.

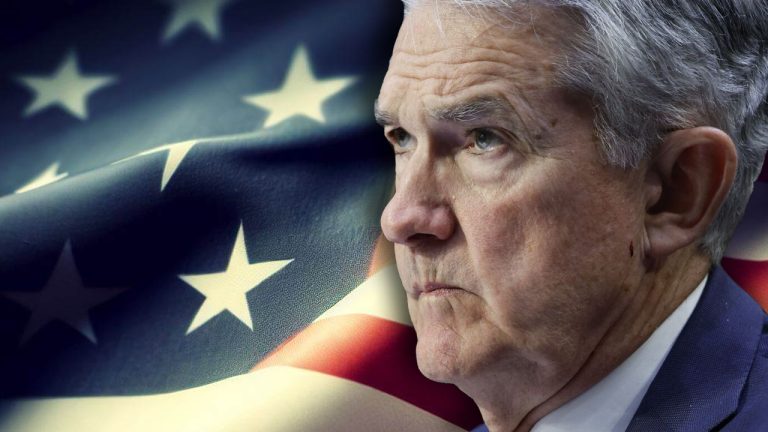

On July 31, the United States Federal Open Market Committee announced its decision to leave interest rates unchanged at 5.25%, aligning with market expectations. Fed Chair Jerome Powell cited solid signs of gross domestic product expansion and confidence in the current rate of inflation reduction, potentially supporting a rate cut in September. In short, Powell’s statement suggests a more cautious approach to rate cuts.

Investors increased their bets in US Treasurys, causing the five-year yield to reach its lowest level in six months. Part of this movement can be explained by escalating tensions in the Middle East, leading traders to seek protection in the asset deemed safest. Another confirmation of this theory comes from the precious metal gold, as its price increased to $2,450, just 1.5% below its all-time high.

The bitcoin market recently saw a significant sell-off, absorbing over 48,000 BTC from the German government. Amidst this and upcoming Mt Gox distributions, a report from Glassnode researchers explores how these sell-side forces and exchange-traded funds (ETFs) impact bitcoin’s price action. Glassnode Report Analyzes Sell-side Forces and ETF Impact on Bitcoin Centralized exchanges and ETF […]

The bitcoin market recently saw a significant sell-off, absorbing over 48,000 BTC from the German government. Amidst this and upcoming Mt Gox distributions, a report from Glassnode researchers explores how these sell-side forces and exchange-traded funds (ETFs) impact bitcoin’s price action. Glassnode Report Analyzes Sell-side Forces and ETF Impact on Bitcoin Centralized exchanges and ETF […]

The government of Germany is continuing its Bitcoin (BTC) sell-off, bringing its total number of tokens down below 4,000. According to new data from blockchain “de-anonymizing” platform Arkham Intelligence, during the last 24 hours, the German government has sold hundreds of millions of dollars worth of BTC, continuing its trend of selling off the crypto […]

The post German Government Resumes Bitcoin Selling Spree, Currently Holding Less Than 4,000 BTC appeared first on The Daily Hodl.

According to the latest data, $305.43 million was liquidated across crypto derivatives exchanges when bitcoin dipped below $57,000. One analyst predicts that with the Mt Gox and German government sell-offs, “supply will likely outstrip demand.” Conversely, QCP Capital notes that despite the current crypto sell-off, the options market remains hopeful. Crypto Liquidation Tops $305M as […]

According to the latest data, $305.43 million was liquidated across crypto derivatives exchanges when bitcoin dipped below $57,000. One analyst predicts that with the Mt Gox and German government sell-offs, “supply will likely outstrip demand.” Conversely, QCP Capital notes that despite the current crypto sell-off, the options market remains hopeful. Crypto Liquidation Tops $305M as […] On Monday, Morgan Stanley’s equity strategist, Michael Wilson, shared his thoughts on the state of Wall Street. He expressed his belief that a sell-off could be imminent, and that this could occur as a result of U.S. Federal Reserve chairman Jerome Powell’s upcoming remarks on Wednesday. Furthermore, there has been a great deal of conjecture […]

On Monday, Morgan Stanley’s equity strategist, Michael Wilson, shared his thoughts on the state of Wall Street. He expressed his belief that a sell-off could be imminent, and that this could occur as a result of U.S. Federal Reserve chairman Jerome Powell’s upcoming remarks on Wednesday. Furthermore, there has been a great deal of conjecture […] Famed “Big Short” investor Michael Burry tweeted Thursday, telling his 1.4 million followers, “I was wrong to say sell.” The tweet follows Burry’s warning for months that the U.S. was headed for an “extended multi-year recession” and his decision to dump all of his stocks but one in August 2022. Burry: ‘I Was Wrong to […]

Famed “Big Short” investor Michael Burry tweeted Thursday, telling his 1.4 million followers, “I was wrong to say sell.” The tweet follows Burry’s warning for months that the U.S. was headed for an “extended multi-year recession” and his decision to dump all of his stocks but one in August 2022. Burry: ‘I Was Wrong to […] It’s been a turbulent week in finance with the so-called crypto-friendly Silvergate Bank announcing its liquidation, U.S. Senator Elizabeth Warren blaming the event on “crypto risk,” and individuals on social media pointing out that Warren is “terribly misinformed.” Additionally, U.S. Regulators closed Silicon Valley Bank after reports of a bank run and other troubles. In […]

It’s been a turbulent week in finance with the so-called crypto-friendly Silvergate Bank announcing its liquidation, U.S. Senator Elizabeth Warren blaming the event on “crypto risk,” and individuals on social media pointing out that Warren is “terribly misinformed.” Additionally, U.S. Regulators closed Silicon Valley Bank after reports of a bank run and other troubles. In […] Monday saw eos remain in the green, despite the latest red wave in cryptocurrency markets. Today’s rally sees the token move almost 20% higher in the last seven days. Flow, on the other hand, extended its recent declines and is now down by almost 30% in the same period. EOS EOS was trading mostly higher […]

Monday saw eos remain in the green, despite the latest red wave in cryptocurrency markets. Today’s rally sees the token move almost 20% higher in the last seven days. Flow, on the other hand, extended its recent declines and is now down by almost 30% in the same period. EOS EOS was trading mostly higher […]

XRP Scan shows the former Ripple founder’s “Tacostand” wallet has only $16 worth of XRP left at the time of writing.

Former Ripple Labs founder Jed McCaleb has finally ended the eight-year dump of his XRP holdings, leaving only 46.7 XRP left sitting in his famed “~tacostand” wallet.

According to blockchain explorer XRP Scan, the former Ripple founder executed his last outgoing XRP transfer of 1.1 million XRP (worth $394,742.18) at 6:31 am (UTC) on July 17.

Hours later, the account listed an “ACCOUNT DELETE” transaction, meaning the account will no longer exist on XRP’s ledger.

The transaction marks the end of a 9 billion XRP sell-off initiated by McCaleb after leaving Ripple Labs to co-found rival payment protocol Stellar in 2014.

The amount McCaleb has released over the last eight years represents around 18.6% of the total circulating supply of XRP and has been taken as welcome news by the crypto community.

The moment we have all waited for is finally upon us. @JedMcCaleb has finally emptied his taco stand. His dumping of $XRP is now over after many years. Party time!!! https://t.co/lS9kfCf98A

— Rob XRP ☀️ (@robxrp1) July 18, 2022

XRP proponent “XRP whale” proclaimed to his 57,500 followers on Twitter that with the final sell-off, one can finally own more XRP than McCaleb.

BREAKING: Recently Jed McCaleb has sold off his remaining 5M $XRP. You now own more XRP then him#XRP

— XRP whale (57.5k Followers) (@realXRPwhale) July 17, 2022

On Friday, a satirical article from “The Crypto Town Crier” led some to believe that McCaleb decided to hold onto his last five million XRP “just in case it moons.”

“McCaleb, who has sold multiple billions of XRP since leaving Ripple in 2014, said he woke up in a cold sweat Thursday night and realized he just couldn’t let the last of his holdings go,” wrote the authors behind the satire piece.

The Crypto Town Crier is a satirical news site with the tagline “Where truth matters more than accuracy.”

Related: Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The price of XRP is currently sitting at 0.3564, up 0.82% over the last 24 hours. The asset is down almost 90% from its January 2018 all-time high of $3.40.

Ripple Labs has been embroiled in a lawsuit filed by the Securities and Exchange Commission (SEC) since late 2020, with the latter alleging Ripple and its executives had offered XRP as unlicensed security to investors.

Last week, the SEC suffered a blow in its case against Ripple after a U.S. judge ruled that the SEC must produce internal documents relating to the “Hinman speech,” which could be a pivotal piece of evidence in support of Ripple’s defense.

Should Ripple be successful in arguing that XRP is not a security, some believe this ruling could set a precedent for other similar crypto token issuers while boosting XRP prices.