On Friday, Michael Barr, the vice chair for supervision at the U.S. Federal Reserve, published a report on the vulnerabilities that led to the ultimate failure of Silicon Valley Bank (SVB). In addition, Marshall Gentry, the chief risk officer of the Federal Deposit Insurance Corporation (FDIC), released a similar report on Signature Bank’s collapse and […]

On Friday, Michael Barr, the vice chair for supervision at the U.S. Federal Reserve, published a report on the vulnerabilities that led to the ultimate failure of Silicon Valley Bank (SVB). In addition, Marshall Gentry, the chief risk officer of the Federal Deposit Insurance Corporation (FDIC), released a similar report on Signature Bank’s collapse and […]

In April there hasn’t been a single day where total sellers on the market haven’t exceeded total buyers.

Recent data has revealed that throughout April, the nonfungible token market has consistently seen more sellers than buyers, without a single exception.

According to data from the analytics platform NFTGo, there were only 7,907 buyers on April 26, while there were 8,641 attempting to sell their NFTs.

Days before, on April 19, the NFT market hit its second lowest point in the past twelve months, with only 5,893 buyers — a slight increase from the lowest recorded date in the past twelve months, which was on June 18, 2022, with 5,343 buyers.

On April 5, while there were more buyers on the market — 18,495 — there were also 36,423 sellers.

Based on the data, there hasn’t been a single day in April where the number of buyers outnumbered the number of sellers in the NFT market, indicating a potential lack of demand that could be concerning for thosplanning to sell their NFT soon.

The last recorded day buyers exceeded sellers was on March 11, when there were 9,756 buyers and 9,754 sellers.

The turbulent market conditions have been met with various community reactions on Twitter.

Ovie Faruq, the co-founder of Canary Labs, stated in a tweet on April 26 that the NFT market is “not functioning” at the moment.

For the last year, daily NFT traders ranged from 20-60k.

— Mando (@rektmando) April 26, 2023

In the last few days it dropped to 7k

This market is not functioning atm. pic.twitter.com/akqKuWHmxr

Cointelegraph previously reported that the NFT market experienced a decline on March 12, after the collapse of Silicon Valley Bank caused fear in traders.

Before the bank’s collapse, NFT trading volumes were hovering between $68 million to $74 million on March 10; however, on March 12, they fell to $36 million.

The dip was also accompanied by a 27.9% drop in daily NFT sales count between March 9 and March 11.

Related: Utility and long-term profits top reasons for NFT purchases: CoinGecko study

According to a March 20 CoinGecko report, the top six NFT marketplaces saw a rise in wash trading in February for the fourth month straight, with a total volume of $580 million.

The report revealed that the market witnessed a 126% increase from the previous month’s volume of $250 million — with the report attributing the overall recovery of the NFT marketplace as the reason for the increase.

Magazine: From SNL and The Tonight Show to Sotheby’s: NFT creator Bryan Brinkman

Janet Yellen called for further regulation of nonbank institutions, claiming they pose a systemic risk to U.S. financial stability.

The United States Treasury and a number of top U.S. financial regulators suggested new rules to make it easier for the Federal Reserve to designate nonbank institutions as systemically important, making it easier to supervise and regulate them.

In remarks from the Financial Stability Oversight Council (FSOC) Council Meeting on April 21, U.S. Treasury Secretary Janet Yellen raised concerns over “nonbank” financial institutions due to their current lack of supervision and the potential for wider financial contagion to take hold when these firms suffer through periods of distress.

“Nonbank” is an umbrella term for any entity that does not hold a bank license but still provides specific financial services. Unlike traditional banking institutions, these entities are not insured by the Federal Deposit Insurance Corporation (FDIC). Nonbanks include venture capital firms, crypto companies and hedge funds.

Today, the FSOC took action and issued proposals to revise existing guidance on nonbanks designations and release a new financial stability framework. These efforts will strengthen US financial stability and enhance transparency into the Council’s important work.

— Treasury Department (@USTreasury) April 21, 2023

“The existing guidance — issued in 2019 — created inappropriate hurdles as part of the designation process,” Yellen said.

Yellen said the new guidance measures remove these hurdles to designating nonbank status to major financial firms, a process that currently takes up to six years.

According to officials at the meeting, the new, shorter oversight and designation process will still allow for plenty of time for regulators and institutions to communicate and discuss specifics.

Additionally, the new guidance will replace the 2019-era rules with an analysis process where the council determines if “material financial distress at the company or the company’s activities could pose a threat to U.S. financial stability.”

Related: Banking crisis could spark the first 'extended duration Bitcoin bull market,' says Swan Bitcoin CEO

In the wake of last month’s collapses of crypto- and tech-friendly banks Silvergate Bank, Signature Bank and Silicon Valley Bank in the worst banking crisis since 2008, Yellen reassured both investors and everyday citizens that the U.S. banking sector remains robust and secure.

Nodding directly to the new guidance, she warned the recent banking crisis is a cut-and-dry example of why greater oversight and emergency provisions should be granted to FSOC and the Fed.

“Last month’s events show us that our work is not yet done. The authority for emergency interventions is critical. But equally as important is a supervisory and regulatory regime that can help prevent financial disruptions from starting and spreading in the first place,” Yellen said.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

The market capitalization of Tether is nearly a billion dollar away from reaching a new lifetime peak while rival stablecoins struggle.

Tether (USDT) has emerged as a clear winner amid the ongoing banking crisis and crypto crackdown in the U.S.

On April 17, the U.S. dollar-pegged stablecoin's circulating market valuation reached nearly $81 billion, just 1.5% below its record high of $82.29 billion from a year ago. It has grown about 20% year-to-date (YTD) already and is now eyeing new all-time highs.

USDT's growth came as Tether ate up the market share of its stablecoin rivals, USD Coin (USDC) and Binance USD (BUSD). That is due to crypto traders' belief that Tether's operations have no exposure to the potential banking crisis contagion.

For instance, the circulating market capitalization of the USD Coin, the second-largest stablecoin, has dropped over 25% YTD to $31.82 billion, its worst since October 2021, primarily due to its exposure to the failed Silicon Valley Bank.

BUSD, on the other hand, has witnessed a 60% drop in market capitalization in 2023 to $6.68 billion, its lowest since April 2021, as the New York Department of Financial Services (NYDFS) ordered Paxos, a regional crypto firm, to stop its mint and issuance.

Moreover, the U.S. Securities and Exchange Commission (SEC) asserts that BUSD is a "security." Conversely, the U.S. Commodity Futures Trading Commission (CFTC) alleges that the stablecoin is a "commodity."

This capital shift likely helped Tether boost its dominance above 65% in the global stablecoin sector for the first time since May 2021, according to Glassnode data.

On April 16, the U.S. House Financial Services Committee published a draft version of its potential stablecoin bill to create definitions for issuers. It says that non-U.S. firms like Tether must register if they cater to Americans, albeit without mentioning the specific agency that would regulate stablecoins.

Despite Tether's market capitalization growth, its supply across crypto exchanges has been declining in 2023.

Related: BTC price heading under $30K? 5 things to know in Bitcoin this week

As of April 16, cryptocurrency exchanges had 12.94 billion USDT in their reserves compared to 17.89 billion USDT at the year's beginning. On the whole, the stablecoin supply across exchanges has dropped 42% YTD to $21.53 billion.

This dynamic coincides with the 21% YTD increase in the crypto market's valuation from $1 trillion in January to $1.21 trillion, suggesting that Q1 has seen a trend shift from "safe" stablecoins to risk-on cryptocurrencies.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

During the weekend, discussions about central bank digital currencies, or CBDCs, trended on social media as many people believe the idea will result in increased financial surveillance and a totalitarian monetary system. In a recent interview, Lynette Zang, the chief market analyst at ITM Trading, warned that CBDCs will “take the world into a full […]

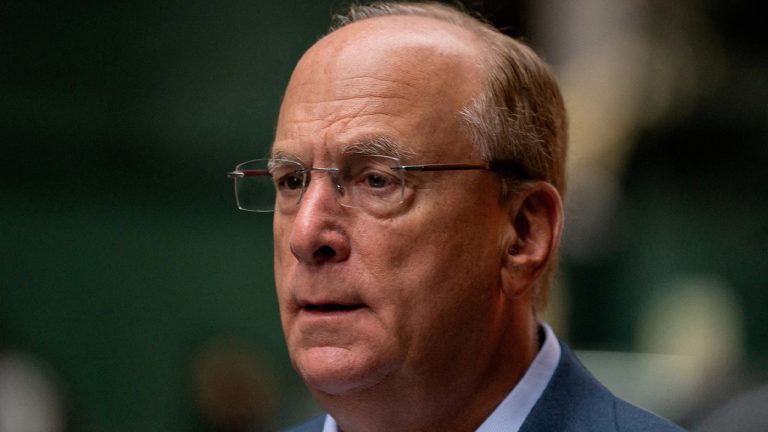

During the weekend, discussions about central bank digital currencies, or CBDCs, trended on social media as many people believe the idea will result in increased financial surveillance and a totalitarian monetary system. In a recent interview, Lynette Zang, the chief market analyst at ITM Trading, warned that CBDCs will “take the world into a full […] Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […] Andrew Bailey, the governor of the Bank of England, has asserted that stablecoins “will need to have the characteristics of, and be regulated as, inside money” before they function as money. Bailey also described crypto as a “highly speculative investment” with no intrinsic value. Stablecoins Purport to Be Money According to the Bank of England […]

Andrew Bailey, the governor of the Bank of England, has asserted that stablecoins “will need to have the characteristics of, and be regulated as, inside money” before they function as money. Bailey also described crypto as a “highly speculative investment” with no intrinsic value. Stablecoins Purport to Be Money According to the Bank of England […]

US senators are demanding answers from crypto companies about their affiliation with the collapsed Silicon Valley Bank (SVB). In an open letter to 14 of SVB’s biggest clients, Massachusetts senator Elizabeth Warren and New York senator Alexandria Ocasio-Cortez (AOC) inquire about what they see as a “cozy relationship” between the bank and its depositors. Among […]

The post Alexandria Ocasio-Cortez and Elizabeth Warren Hunt Down Crypto Companies To Interrogate About SVB Deposits appeared first on The Daily Hodl.

The account services for crypto firms come at a time when United States-based companies are struggling to find local banking partners and are frequently looking abroad.

ZA Bank, Hong Kong’s biggest virtual bank by assets, is reportedly set to provide crypto account services and facilitate crypto-to-fiat exchanges.

According to an April 12 Bloomberg report, the bank will act as a settlement bank to allow token deposits at licensed exchanges to be withdrawn in Hong Kong dollars, Chinese yuan and United States dollars, and is also offering account services to crypto firms.

The accounts for local crypto firms follow a trial in a regulatory sandbox that saw approximately 100 firms participate, but ZA Bank CEO Ronald Iu noted that clients from mainland China would not be offered the service due to the country’s restrictions.

Goodbye Silvergate & Signature

— T ⛩ てぃ (@TeongH_SR) April 12, 2023

Hello ZA Bank https://t.co/c6pmuycjev

Iu added that currency conversions are currently being offered by the only two licensed crypto exchanges in Hong Kong, HashKey and OSL.

He said ZA Bank will provide the same service at other exchanges after they become licensed.

Related: Europe and Asia — not the US — will lead in blockchain

As crypto firms in the U.S. struggle to find banking partners following the downfall of crypto-friendly banks Silicon Valley Bank, Silvergate Bank and Signature Bank, the Hong Kong-based ZA Bank appears to be offering the firms a potential solution, with Iu adding:

“For the dozens of interested firms, big or small, from abroad and local, top of their concern is to have a path to make things work.”

The announcement from ZA Bank follows a concerted effort by Hong Kong regulators to turn the region into a crypto hub, and many from the crypto community believe Hong Kong’s approach compared to hostility from U.S. regulators will help it succeed in its efforts.

Chinese state-owned banks have also reportedly seen an interest in the crypto firms moving to the city and are either offering banking services to crypto firms or making inquiries with them.

Asia Express: Zhu Su’s exchange did $13.64 in volume akshually, Huobi in crisis

Circle and BlockFi executives were questioned after the lawmakers accused SVB of “coddling” and giving “white glove” treatment to its largest depositors.

Executives at the stablecoin issuer Circle and the bankrupt cryptocurrency lender BlockFi have been questioned by two members of Congress investigating the so-called “mutual backscratching arrangements” alleged to have taken place with the now-failed Silicon Valley Bank (SVB).

On April 9, letters from Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez (AOC) were sent to Circle, BlockFi and 12 other non-crypto tech firms asking a series of questions on each firm's relationship with SVB.

The lawmakers stated that more needs to be known about SVB’s reported “coddling” and “white glove” treatment towards its largest depositors in order to understand if these firms played a role in SVB’s collapse.

Jeremy Allaire and Zac Prince, the respective chief executives of Circle and BlockFi, were questioned on the length of their financial relationships with SVB, amounts deposited with the bank along with what “agreements” were made between their firms.

In addition, the pair wanted to know if SVB offered “perks” such as low-interest rate mortgages or SVB-sponsored “ski trips, conferences and fancy dinners.”

“Congress, bank regulators, and the public are owed an explanation for the bank’s hyper-reliance on tech industry firms and investors," Warren and AOC wrote.

Related: Polls suggest Elizabeth Warren’s anti-crypto army strategy won’t pay off

They added the extent of SVB's depositors in the tech industry resulted "in an abnormally high percentage of deposits" not insured by the Federal Deposit Insurance Corporation (FDIC) and questioned the executives on "the role that companies like yours might have played in precipitating the $42 billion single-day-run on SVB.”

“Obtaining information on these factors is important for understanding how SVB failed and how to prevent the next failure,” they added.

Warren and AOC said they believe it may explain why some customers, such as Circle, placed extremely large amounts of uninsured deposits at SVB.

Shortly after SVB collapsed, Circle disclosed that they had $3.3 billion tied up at SVB. While BlockFi was found to have $227 million in uninsured deposits with the bank.

Magazine: Magazine: Unstablecoins: Depegging, bank runs and other risks loom