- Home

- Stanford University

Stanford University

Stanford to return millions in crypto donations from FTX

The university said it intends to return the “entirety” of funds received from former cryptocurrency exchange FTX, which it claims were mainly for pandemic-related prevention and research.

The California-based university Stanford University said it plans to return all funds it received from the now defunct cryptocurrency exchange FTX, according to a report from Bloomberg.

Stanford received a total of $5.5 million in gifts from FTX-related entities in the timespan between November 2021 and May 2022. In an email statement on Sept. 19, a university spokesperson said:

“We have been in discussions with attorneys for the FTX debtors to recover these gifts and we will be returning the funds in their entirety.”

The statement from Stanford clarified that it “received gifts from the FTX Foundation and FTX-related companies largely for pandemic-related prevention and research.”

Both parents of former FTX CEO Sam Bankman-Fried (SBF), Allan Joseph Bankman and Barbara Fried, are legal scholars who have taught at Stanford’s law school.

Stanford’s renouncement of the monetary support from FTX comes as SBF’s parents are accused of stealing millions from the crypto exchange.

FTX debtors launched a lawsuit on Sept. 18 against the two, alleging they misappropriated funds via their involvement with the exchange to, “enrich themselves, directly and indirectly, by millions of dollars,” according to the court papers. Bankman has been alleged to have been a “de facto officer” at FTX Group.

Related: FTX bolsters claims portal security measures following cyber breach

Court documents from these latest accusations claim that Bankman included Fried, when he raised concerns regarding his annual salary of $200,000 that were not addressed by SBF or FTX US.

According to the documents, Bankman was expecting an annual salary of $1 million.

On Sept. 19, SBF’s lawyers argued in front of a three-judge panel for early release from jail in order to prepare for his upcoming trial scheduled to begin in October.

One of the judges in the hearing reportedly said the argument played by SBF’s legal team regarding his First Amendment rights “has no play anymore” due to his attempts to intimidate witness and former CEO of Alameda Research Caroline Ellison.

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

FTX founder’s parents sued, accused of stealing millions from crypto exchange

According to the allegations, Sam Bankman-Fried’s father Joseph Bankman was a “de facto officer” at the FTX Group.

Debtors of the bankrupt cryptocurrency exchange FTX have launched action against the parents of FTX founder Sam Bankman-Fried, alleging that they misappropriated millions of dollars through their involvement in the exchange’s business.

The counsel for FTX debtors and debtors-in-possession, represented by the law firm Sullivan & Cromwell, on Sept. 18 filed a lawsuit against SBF’s parents, Joseph Bankman and Barbara Fried.

The plaintiffs argued that Bankman and Fried exploited their access and influence within the FTX empire to enrich themselves at the expense of the debtors in the FTX bankruptcy estate. The debtors alleged that SBF’s parents were “very much involved” in the FTX business from inception to collapse, contrary to what SBF has claimed.

“As early as 2018, Bankman described Alameda as a ‘family business’ — a phrase he repeatedly used to refer to the FTX Group. Even as the FTX Group descended into insolvency, Bankman and Fried profited handsomely from this ‘family business’,” the complaint reads.

According to plaintiffs, SBF’s father, a Stanford Law School professor, had broad authority to make decisions for the FTX Group as its “de facto officer.” Bankman also held executive positions on the FTX Group’s management team, the debtors argued.

SBF’s mother — also a Stanford Law School professor — was actively involved in FTX’s political donations, the plaintiffs wrote. According to the allegations, Fried served as the “single most influential advisor” in FTX Group’s political contributions, repeatedly calling upon FTX to donate millions directly to Mind the Gap (MTG), a political action committee that she co-founded.

According to the complaint, Bankman and Fried extracted significant unearned rewards from their involvement in the FTX Group, including a $10 million cash gift and a $16.4 million luxury property in The Bahamas. Bankman also siphoned off FTX Group’s money to cover costs including privately-chartered jets and $1,200 per night hotel stays, the plaintiffs alleged.

Related: FTX bolsters claims portal security measures following cyber breach

By draining FTX Group’s funds to their benefit, Bankman and Fried either knew or ignored red flags revealing that their son was orchestrating a fraudulent scheme to promote their personal and charitable interests at debtors’ cost, the plaintiffs said. The debtors called on the court to hold Bankman and Fried accountable for their misconduct and recover assets for the debtors’ creditors, stating:

“Award plaintiffs punitive damages in an amount to be determined at trial resulting from defendants’ conscious, willful, wanton, and malicious conduct, which exhibits a reckless disregard for the interests of plaintiffs and their creditors.”

As previously reported, Bankman and Fried began facing professional issues at the Stanford Law School soon after FTX collapsed. In late 2022, SBF’s parents also reportedly told friends that their son’s legal bills will likely wipe them out financially.

Once a major cryptocurrency exchange, FTX stopped operating and filed for Chapter 11 bankruptcy in mid-November 2022. FTX founder and former CEO SBF was subsequently arrested and charged with 13 counts, including fraud, money laundering as well as bribing officials. SBF's first of two trials is scheduled to start on Oct. 3, where he will face seven charges related to fraudulent activities involving user funds at FTX and Alameda Research.

Stanford Alumni Revealed as Co-Signers of FTX Co-Founder’s $250M Bond

According to the latest court documents in the fraud case involving former FTX CEO Sam Bankman-Fried in Manhattan, the New York judge presiding over the case unsealed the co-signers of Bankman-Fried’s bond on Wednesday. The names of the two bail bond co-signers that were previously redacted from court documents are Stanford University alumni Larry Kramer […]

According to the latest court documents in the fraud case involving former FTX CEO Sam Bankman-Fried in Manhattan, the New York judge presiding over the case unsealed the co-signers of Bankman-Fried’s bond on Wednesday. The names of the two bail bond co-signers that were previously redacted from court documents are Stanford University alumni Larry Kramer […]Ex-Stanford dean says SBF’s parents helped his family battle cancer

One of the previously undisclosed guarantors of Sam Bankman-Fried’s bond told Cointelegraph why he helped out the former FTX CEO.

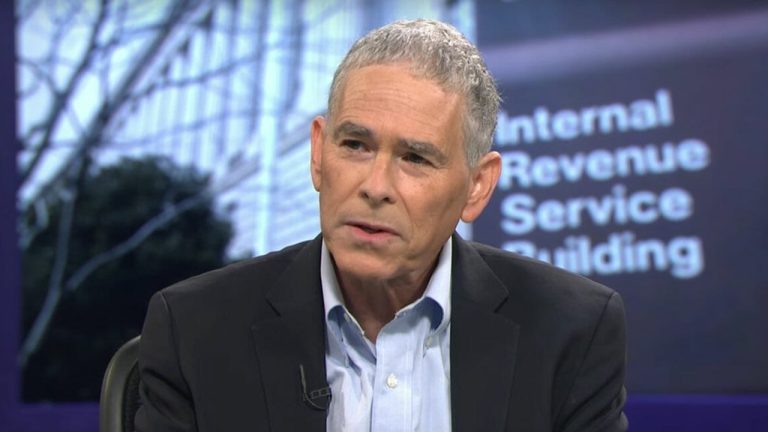

A former dean of Stanford Law School who co-signed Sam Bankman-Fried’s bail said he did so because SBF’s parents have been “the truest of friends” and helped his family through a “harrowing battle with cancer.”

In an emailed statement to Cointelegraph on Feb. 16, Larry Kramer said he co-signed Bankman-Fried’s bail as a way to return the favor.

“Joe Bankman and Barbara Fried have been close friends of my wife and I since the mid-1990s,” said Kramer.

He said that over the past two years, Bankman and Fried provided food and moral support while “frequently stepping in at moment’s notice to help” during his family’s battle with cancer.

“In turn, we have sought to support them as they face their own crisis,” he added.

Kramer emphasized that he had not been influenced to act as guarantor by any payments made to him by any FTX-related entity, writing:

“My actions are in my personal capacity, and I have no business dealings or interest in this matter other than to help our loyal and steadfast friends.”

Previous statements by Bankman-Fried reportedly corroborate this claim, with the former FTX CEO said to have denied that either of the two previously undisclosed guarantors had received any payments from FTX or sister-firm Alameda Research.

The names of SBF’s bail guarantors have been released: Larry Kramer, former dean of Stanford Law School, signed for $500K & Andreas Paepcke, computer scientist, signed for $200K.

— Tiffany Fong (@TiffanyFong_) February 15, 2023

In our last conversation, Sam denied that either guarantor has received payments from FTX or Alameda… https://t.co/cJq2Txi5zY

Kramer refrained from commenting on the legal predicament faced by Bankman-Fried, noting that this “is what the trial will be for.”

The other guarantor is Andreas Paepcke, a senior research scientist at Stanford University. He did not respond to questions by the time of publication.

The crypto community has been searching the web looking for more details on Paepcke, but there appears to be little information connecting him to Bankman-Fried outside of their association at Stanford University, where Bankman and Fried used to be law professors.

Via his Stanford bio: "Dr. Andreas Paepcke is a Senior Research Scientist at Stanford University. His interests include user interfaces and systems for teaching and learning. He uses data analytics to create tools that benefit these online efforts." pic.twitter.com/xWEDVeNOId

— Molly White (@molly0xFFF) February 15, 2023

United States District Judge Lewis Kaplan had allowed the identities of the two former law professors to be made public on Feb. 15, after being petitioned by eight major media outlets in a Jan. 12 letter.

Related: Charity tied to former FTX exec made $150M from insider deal on FTT tokens: Report

Bankman-Fried’s lawyers had sought to keep the two anonymous, arguing that the pair could be subject to intrusions, threats and harassment if their names were made public.

Kaplan disagreed, however, noting that the pair had voluntarily signed individual bonds in a “highly publicized criminal proceeding,” and had therefore opened themselves up to public scrutiny.

New FTX CEO Told Members of Congress SBF’s Family ‘Certainly Received Payments’ From the Business

According to multiple reports, FTX co-founder Sam Bankman-Fried’s parents face scrutiny over their reported involvement with their son’s business operations. The two Stanford professors Joseph Bankman and Barbara Fried have not been charged with any wrongdoing, but the current FTX CEO, John J. Ray III, recently told members of the U.S. Congress that Joseph Bankman […]

According to multiple reports, FTX co-founder Sam Bankman-Fried’s parents face scrutiny over their reported involvement with their son’s business operations. The two Stanford professors Joseph Bankman and Barbara Fried have not been charged with any wrongdoing, but the current FTX CEO, John J. Ray III, recently told members of the U.S. Congress that Joseph Bankman […]Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

Joseph Bankman and Barbara Fried have started facing professional consequences for their child Sam Bankman-Fried's illegal actions.

The domino effect of FTX CEO Sam Bankman-Fried’s actions came full circle as his reputation began impacting the professional lives of his parents — Stanford Law professors Joseph Bankman and Barbara Fried.

SBF’s father, Bankman, had to cancel his winter session course on tax policy, which according to The Standford Daily, was at a time when the family was accused of acquiring an FTX-owned $16.4 million vacation home before the crypto exchange’s collapse.

On the other hand, SBF’s mother, Fried, was surprisingly not even listed as an instructor for any of the courses. While this event coincides with FTX’s fallout, where Fried became a focal point of discussion owing to her political ties, she distanced the move from the ongoing investigations, saying it was a “long-planned” decision to retire. Speaking to The Daily, Fried shared her “hopes to” return as a teacher in the future.

As if karma was real, SBF’s plan to dupe FTX investors came back to haunt his family members. However, Bankman-Fried continues to attempt to destabilize the crypto market. Most recently, SBF accused Binance CEO Changpeng Zhao of FTX’s fall, claiming that CZ “threatened to walk at the last minute.”

Related: FEC probe demanded after SBF 'admitted' making dark money donations

On Dec. 9, Bankman-Fried revealed his willingness to testify at a United States House hearing about FTX’s collapse in the future.

1) I still do not have access to much of my data -- professional or personal. So there is a limit to what I will be able to say, and I won't be as helpful as I'd like.

— SBF (@SBF_FTX) December 9, 2022

But as the committee still thinks it would be useful, I am willing to testify on the 13th. https://t.co/KR34BsNaG1

However, the fugitive controversially missed the deadline to respond to a Senate Banking Committee request to appear and testify during a hearing focused on FTX’s bankruptcy in early December.

Tech talent migrates to Web3 as large companies face layoffs

Web3 companies continue to hire amidst a bull market as tech giants undergo layoffs and hiring freezes.

As inflation continues to grow, coupled with a looming recession, many tech firms are having to cut portions of their staff. To put this in perspective, data from Layoffs.fyi found that over 700 tech startups have experienced layoffs this year, impacting at least 93,519 employees globally. It has also been reported that tech giants like Google, Netflix and Apple are undergoing massive job cuts.

While many of these layoffs are likely due to an economic downturn, this has resulted in an overwhelming amount of talent flocking to early-stage Web3 companies. For example, Andrew Masanto, a serial entrepreneur who has founded a number of startups, told Cointelegraph that he recently launched Nillion, a startup specializing in decentralized computation, to help ensure privacy and confidentiality for Web3 platforms.

Although Nillion is still in its early stages, the technological innovation behind the company has already proven to be appealing. Since the company’s inception in October this year, leading talent from companies like Nike, Indiegogo and Coinbase have joined the growing startup.

For instance, Slava Rubin, founder of the crowdfunding website Indiegogo, told Cointelegraph that he had recently joined Nillion as the company’s chief business officer based on the opportunity to join a startup with an innovative business model.

“The tech behind Nillion is massively innovative, as it focuses on advancing secure multiparty computation (MPC). MPC is known for being slow and unable to work for certain use cases. The risk of failure doesn’t concern me here since it’s such a huge opportunity to solve this problem,” he said.

The notion of building technology to advance MPC also attracted Lindsay Danas Cohen to Nillion. Cohen previously served as associate general counsel at Coinbase before joining Nillion this year as the company’s general counsel.

Although Coinbase announced in June that it was cutting its staff by 18%, Cohen explained in a recent blog post that she left Coinbase to join Nillion due to the opportunity to help advance privacy and data sharing through MPC. “This would be a true zero-to-one innovation,” she wrote.

While the crypto industry continues to face a bear market, it’s clear that the projects being built during this period are seen as an exciting opportunity. “I built Indiegogo during the 2008 bear market, and I think we will see the same thing in this market. In about three to five years, we will see some very strong companies emerge that know how to use capital efficiently,” Rubin remarked.

Indeed, well-funded Web3 companies continue to hire, while large tech companies face layoffs and hiring freezes. Sebastien Borget, co-founder and chief operating officer of The Sandbox, told Cointelegraph that the popular metaverse platform currently has a total of 103 job openings. “The excitement of working in the front row of Web3 is big, and we are enjoying this interest towards our open positions,” he said.

According to Borget, The Sandbox has grown to 404 employees this year, almost doubling in size from its 208-employee workforce it had in December 2021. Borget added that The Sandbox’s virtual real estate known as “LANDs” is now worth over $1 billion in total market cap.

Moreover, as Web3 companies continue to bring on both new and acquired talent, young jobseekers seem to be displaying a greater desire to obtain the skills needed to join these firms.

Priyanka Mathikshara Mathialagan, president of the Stanford Blockchain Club, told Cointelegraph that she has seen an increasing number of undergraduate students at Stanford taking blockchain-focused courses in preparation for careers after graduation.

Recent: What the Russia-Ukraine war has revealed about crypto

“This year, we had more students enrolled in professor Dan Boneh’s cryptography class than those enrolled in traditional computer science courses,” she remarked.

Despite the bear market, Mathialagan also believes that there have been significant improvements made within the Web3 space, resulting in a more positive outlook toward the sector. For example, she mentioned that the Ethereum Merge that took place on Sept. 15 has helped ensure a more energy-efficient platform, creating appeal for students that may want to leverage the Ethereum network for Web3 projects. Mathialagan added that while a numerous amount of theoretical research has been performed for years within fields like computer science, Ph.D. students are considering Web3 due to new opportunities for advancement. She said:

“The math used in theoretical computer science and cryptography is similar to the math needed to advance zero-knowledge proof-based applications. There is now an industry that wants to pay Ph.D. students for their research and put these findings to use. For example, there is a large demand for distributed system engineers since every single blockchain is really a distributed system. These are the people who can design consensus algorithms and new architectures for scalable and secure blockchains.”

This seems to be the case, as Masanto shared that Nillion has hired 10 engineers within the last six months. Borget added that The Sandbox is currently hiring 17 engineers, along with game designers, architects and other individuals capable of supporting brands building in the company’s metaverse.

Skepticism remains

While it’s notable that Web3 companies are actively hiring, a number of concerns remain. For instance, although companies remain focused on building during a bear market, fundraising may be problematic.

Given this, it’s important to point out that Nillion is currently being bootstrapped by its founding team. A spokesperson from Delphi Digital, a crypto-focused research firm, also told Cointelegraph that while the company is currently hiring across the board, no funds have been raised.

“We have been completely bootstrapped up until now.” While impressive, running a company based on personal finances or operating revenue may be concerning for job seekers. For instance, Mathialagan noted that students starting a career in Web3 want to be assured that the company will exist two to three years down the road.

Jessica Walker, chief marketing officer of Fluid Finance — a fintech company focused on revolutionizing banking with blockchain — further told Cointelegraph that it is a waiting game to see what companies have the strongest communities and teams capable of withstanding the crypto winter, adding:

“It’s important for organizations to build partnerships and roll out products, while also being able to budget their overhead costs during this time.”

Moreover, Mathialagan believes that it’s challenging for students, along with individuals within the Web2 sector, to get connected with Web3 companies. For instance, while companies like Nillion have brought on individuals from organizations like Coinbase, Indiegogo and Nike, Masanto shared that he already knew a handful of these people prior to hiring.

Recent: Does the IMF have a vendetta against cryptocurrencies?

Walker also remarked that due to the bear market, recruiters need to pay additional attention to detail when onboarding new team members. “Some uncertainty comes from new hires about the security of their role, especially during a bear market. At Fluid, we often try to hire from our community first,” she said.

Although strategic, Mathialagan mentioned that the Stanford Blockchain Club is compiling a list of job postings to help students connect better with Web3 firms as more hiring takes place: “For students, hiring remains the biggest single problem even beyond security issues faced by Web3 companies today.”

Blockchain firms fund university research hubs to advance growth

Universities implement physical and virtual research hubs dedicated to advancing blockchain technology through scientific and educational knowledge.

The demand for organizations to adopt blockchain technology is growing rapidly. Recent findings from market research and advisory firm Custom Market Insights found that the global blockchain technology market size was valued at $4.8 billion in 2021, yet this amount is expected to reach $69 billion by 2030. While notable, it’s become critical for the industry to enable rigorous research into the development of the blockchain sector.

Tim Harrison, vice president of community and ecosystem at Input Output Global (IOG) — the developer arm behind the Cardano blockchain — told Cointelegraph that during the past year, the blockchain ecosystem has witnessed various risks from projects that have taken a “go fast and break things” approach.

“Not only do these companies run these risks for themselves, but mistakes and failures can also negatively impact their end consumers,” he said. As such, Harrison believes that peer-reviewed research can help prevent such situations while also resolving issues that continue to linger from earlier iterations of blockchain development.

Companies fund university-led research hubs

In order to ensure that blockchain projects are thoroughly researched moving forward, Harrison noted that IOG recently funded a $4.5 million Blockchain Research Hub at Stanford University. According to Harrison, the hub’s goal is to enrich the body of scientific knowledge within the blockchain and distributed ledger industry while driving a greater focus on fundamental research.

Although the Blockchain Research Hub at Stanford was just announced on August 29, 2022, Aggelos Kiayias, chief scientist at IOG and a professor at the University of Edinburgh, told Cointelegraph that he believes the center will help the industry collectively solve current challenges.

For instance, Kiayias pointed out that IOG previously donated $500,000 to fund research for blockchain scalability with Stanford. This was an important initiative, as blockchain scalability remains one of the biggest issues hampering industry adoption. Yet, Kiayias noted that Stanford’s new Blockchain Research Hub will take this a step further since the projects being funded will come from researchers across a range of disciplines and backgrounds.

Kiayias added that research hubs associated with universities will likely add more value than typical blockchain-focused courses. “Stanford’s research hub will allow researchers to investigate the kinds of subjects that they are specifically interested in, giving them more freedom than taking a standard class,” he remarked. While many universities currently offer blockchain courses within their curriculum, research hubs funded by the industry may be the next step for universities aiming to advance the industry.

For example, Dawn Song, founder of Oasis Labs and a professor at the University of California at Berkeley, told Cointelegraph that Oasis Protocol, along with a number of other blockchain companies, has provided funding for the Berkeley Center for Responsible, Decentralized Intelligence (RDI). According to Song, RDI was founded about one year ago as a multi-disciplinary, campus-wide initiative focused on advancing the science, technology and education of decentralization.

Song explained that the research at RDI is focused on areas including blockchain scalability, security and privacy, usability and decentralized autonomous organizations (DAOs). For example, Song noted that research for zero-knowledge proofs is critical for ensuring scalability and privacy for blockchain projects.

Given this, she pointed out that RDI researchers have started working on a project called Orion, which is a new zero-knowledge argument system. Song also mentioned that RDI researchers are developing a new type of key maintenance mechanism that will ensure greater usability. The project is known as the “multi-factor key derivation function” and expands upon password-based key derivation functions with support from other popular authentication factors.

While innovative, Song added that RDI’s research is unique in the sense that the center is interdisciplinary:

“RDI contains faculty from Berkeley’s computer science department, finance and economics and the law school. RDI’s research covers many different disciplines that are more in-depth in comparison with blockchain courses. We focus on research, education and entrepreneurship, which can then help develop courses to train a new generation of students entering this industry.”

In addition to physical research facilities at universities like Stanford and Berkeley, virtual research hubs are being established. For example, Klaytn, an Asia-based layer-1 blockchain, recently committed $20 million in funding for a virtual research institute to support industry growth. Known as the “Blockchain Research Center” (BRC), this program will be run by a global consortium led by researchers from the Korea Advanced Institute of Science and Technology (KAIST) and the National University of Singapore (NUS).

Sangmin Seo, representative director of the Klaytn Foundation, told Cointelegraph that researchers from KAIST and NUS will also work closely with an international team of principal investigators from six other universities, such as UC Berkeley, Princeton University and Georgia Institute of Technology. “With BRC operating in an open-source manner, other researchers beyond these universities will be able to participate in ongoing research projects or submit their own proposals,” he remarked.

Seo shared that BRC research will span seven pillars focused on topics such as consensus, privacy, smart contacts, decentralized finance (DeFi) and the Metaverse. He added that although BRC is virtual, the program will regularly conduct community outreach efforts such as hosting conferences and workshops.

In addition, the Alogrand Foundation, which is responsible for maintaining the Algorand blockchain ecosystem, has committed $50 million in funding for a virtual research program. The Algorand Centres of Excellence (ACE) program started in August 2022 and takes a strong focus on the development of real-world blockchain solutions, along with social impact and sustainability projects.

Hugo Krawczyk, principal researcher at Algorand Foundation and head of the ACE program, told Cointelegraph that research teams are located across the globe to ensure a focus on local communities. He added that ACE researchers are tackling a number of problems associated with cryptography since this is the backbone of blockchain security:

“We are also analyzing errors in smart contracts as errors in these can lead to huge losses of money and confidence.”

Importance of university-led blockchain research hubs

While it’s noteworthy that blockchain projects are supporting the development of university-led research programs, the scope of these initiatives extend far beyond marketing tactics or research for a company’s own project. Shedding light on this, Krawczyk explained that although the Algorand Foundation is committed to developing its own ecosystem, emerging research hubs such as ACE are focused on advancing the entire blockchain industry:

“This is not just about educating developers to work on our own projects, but it’s about researching multiple projects that can help advance the blockchain sector. Even though we compete with each other, collaborating with others is beneficial for the space to mature and evolve.”

Echoing this, Harrison mentioned that although there is a lot of competition in the blockchain space, healthy competition is a vital part of any growing industry. “Especially in its early days, every player also needs to play its part in growing the space as a whole,” he remarked.

Indeed, collaboration seems to be key when it comes to these research centers. For instance, Song mentioned that Berkeley’s RDI will work closely with Stanford’s blockchain research hub. Krawczyk added that there is an ACE research center at Yale University that collaborates with Columbia University and the City College of New York.

Another important point to note is that while it’s innovative for universities to offer blockchain courses as part of their curriculum, research hubs go a step further. Steven Lupin, director of the Center for Blockchain and Digital Innovation at the University of Wyoming, told Cointelegraph that university research hubs offer distinctive, hands-on learning opportunities. He said:

“These programs allow students to roll up their sleeves and develop and deploy blockchain and digital asset projects in a real-world environment. Universities also take a leading role in developing standards and governance that’s more difficult for the industry to create due to competitive pressures.”

For instance, Lupin mentioned that the University of Wyoming Center for Blockchain and Digital Innovation — which was founded in 2019 and is focused on developing educational programs and applied projects across campus — is working on a smart contract research group to develop standards, governance and interoperability to allow smart contracts to be deployed more effectively.

While university-led blockchain research centers may be the next logical step for advancing the blockchain ecosystem, more work needs to be done to ensure that such programs are created.

“With Web3 still in its early stages, one research center alone is unable to solve all the challenges that lie ahead. More research centers are required to collectively solve such challenges,” Seo remarked. He added that research centers such as Klaytn’s BRC are multi-year projects that take time and effort to develop.

Top universities have added crypto to the curriculum

Universities have been helping with blockchain-related research for quite some time and, now, some world-class universities have added the technology to their curriculum.

The world of digital assets saw a significant rise last year. The total cryptocurrency market cap reached $3 trillion, making more people, governments and universities take a closer look at the asset class.

The presence of crypto in the world’s major economies has created a big opportunity for diverse startups in the industry, leading to a massive demand for digital assets. This newly born market has helped develop more working and educational opportunities, among other things.

Furthermore, some of the world’s top universities and educational institutions including MIT, the University of Oxford and Harvard University, have added pieces of the burgeoning technology to their curriculums.

Here are some of the top universities that have added blockchain-related subjects to their syllabus.

Massachusetts Institute of Technology

When it comes to research, few come close to the Massachusetts Institute of Technology (MIT). MIT is renowned for its groundbreaking research and competitive academic curriculum and is ranked second only to Harvard University. The institution is, without doubt, the leading university in terms of blockchain technology, taking a research-driven approach to the decentralized ecosystem.

The institution boasts of impressive academic staff, with current United States Securities and Exchange Commision Chair Gary Gensler teaching a blockchain course at the university. On-campus, it has one of the oldest Bitcoin (BTC) clubs called the MIT Bitcoin Club, which serves as the epicenter of blockchain discussions at the university.

The university famously launched the MIT Digital Currency Experiment back in 2014 and distributed Bitcoin to students in a bid to foster cryptocurrency adoption. The university has gone ahead with its peer-reviewed journal on Blockchain technology to catalog the growing interest of researchers in the field. True to the ethos of decentralization, the journal is distributed freely.

Courses offered at the university include:

- Blockchain Ethics: The Impact and Ethics of Cryptocurrency and Blockchain Technology

- B Digital Frontier: Emerging Blockchain Havens

- Shared Public Ledgers: Cryptocurrencies, Blockchains, and Other Marvels

Harvard University

Harvard is one of the oldest universities in the United States and has earned a reputation as part of the most prestigious universities in the world. Founded in 1636, the Ivy League college has churned out a record eight U.S. presidents, fourteen Turing Award winners and multiple Nobel laureates.

In line with the principles of excellence and innovation, Harvard has added blockchain education to its curriculum. For starters, the university teamed up with Coursera to provide six free courses on cryptocurrencies that cover the fundamentals all the way to intermediate levels. An online introductory course titled “Breakthrough Innovation with Blockchain Technology” explores the combination of AI and blockchain across several industries.

Harvard also offers a thriving blockchain student community with over 200 members. Weekly “Crypto 101” discussions are held and the presence of an incubator on the campus allows students to build and scale their cryptocurrency projects.

National University of Singapore

Singapore is one of the leading cryptocurrency hubs in Southeast Asia and the National University of Singapore (NUS) is at the core of the crypto adoption. The university was founded in 1905 and its dedication to original research has consistently put it among the leading universities on the continent.

The university’s blockchain offering centers strongly around research and entrepreneurship with interesting essays being published on harnessing blockchain for decentralized computing and improving distributed consensus and smart contracts. NUS offers an in-depth blockchain curriculum that cuts across several fields and levels from beginners to CEOs and mid-level managers.

The school boasts of courses at both undergraduate and postgraduate levels with vibrant student-led crypto clubs. Furthermore, these crypto clubs allow students to learn from their peers and publish essays on the use and future of blockchain technologies.

Leading courses in the curriculum include:

- Enterprise Blockchain And DLT for Executives

- Blockchain, Digital Currencies, And Distributed Ledgers Start From Here

Oxford University

Oxford University occupies a leading place among world universities and holds the record of being the second-oldest university in operation. The English university ranks as having the largest university press and the largest academic library system that sets it apart from its peers.

In terms of blockchain, Oxford is one of the leading centers of learning for the new technology in Europe, thanks to an expansive research center. The blockchain research center has produced a litany of interesting blockchain essays, with the Oxford-Hainan Blockchain Research Institute recording significant strides.

Oxford Foundry, the university’s entrepreneurship hub, has struck interesting partnerships with Ripple to facilitate a wider blockchain technology. The university has a vibrant student-run community called the Oxford Blockchain Society that competes favorably with its contemporaries in other institutions. In terms of learning, the university has one of the most comprehensive blockchain learning. Top courses include:

- Blockchain Software Engineering

- Blockchain For Managers

- Oxford Blockchain Strategy Program

Cornell University

Cornell University was founded in 1865 and has carved a niche for itself as one of the leading research universities in the world. The university is among the top five schools with graduates going on to pursue their PhDs and with an average of over $500 million spent annually on research and development, it’s easy to see why.

The university boasts an impressive alumni list that includes 33 Rhodes Scholars, 10 CEOs of Fortune 500 companies and 35 billionaires. Cornell University also offers undergraduate and postgraduate courses focused on blockchain technology. The caliber of the academic staff is impressive and made up of persons like Emin Gun Sirer, with multiple papers presented at blockchain conferences as far back as 2014.

Students from the university have secured roles in leading blockchain firms like Coinbase and ConsenSys through the help of the Cornell Blockchain Club. The club is student-run and has gone on to publish interesting papers on blockchain technology and famously hosted its annual conference with an impressive lineup of speakers from the cryptocurrency ecosystem. Courses offered at the university include:

- Cryptocurrencies and Ledgers

- Applications of Blockchain Technology

- Introductions to Blockchains, Cryptocurrencies, and Smart Contracts

- Cryptography Essentials

University of California, Berkeley

Founded in 1868, the University of California, Berkeley is a leading institution for blockchain enthusiasts. The university’s diversity is evident in its fourteen colleges and over 350-degree programs that it offers to thousands of students.

Research is one of the core reasons why the university makes the list as it has one of the longest streaks of blockchain research. The Berkeley Haas Blockchain Initiative is the main driver of blockchain research and is largely funded by Ripple Labs. Research grants are made available to students to dive deep into the applications of the nascent technology, with particular progress being made in the areas of stablecoins.

The university also offers a “Blockchain Fundamentals Professional Certificate Program” through the online education platform edX. In terms of curriculum, the University of California, Berkeley offers students an expansive blockchain offering that includes:

- Lattices: Algorithms, Complexity, and Cryptography

- Blockchain, Cryptoeconomics, and the Future of Technology, Business and Law

- Blockchain Fundamentals