According to the startup Starkware, the team’s Ethereum layer two (L2) service Starknet has been integrated by the blockchain API and node service Alchemy. Developers can now leverage Alchemy’s infrastructure tools alongside Starknet’s zero-knowledge (ZK) rollup technology. Israel-Based Startup Starkware Partners With Alchemy On Monday, the blockchain startup Starkware announced the team has inked a […]

According to the startup Starkware, the team’s Ethereum layer two (L2) service Starknet has been integrated by the blockchain API and node service Alchemy. Developers can now leverage Alchemy’s infrastructure tools alongside Starknet’s zero-knowledge (ZK) rollup technology. Israel-Based Startup Starkware Partners With Alchemy On Monday, the blockchain startup Starkware announced the team has inked a […]

Since its inception in 2018, the firm has received a total of $44 million from institutional investors in two funding rounds.

BlockFills, a digital asset electronic market making, trading and prime brokerage, has announced the completion of a $37 million Series A funding round.

Institutional investors, including Susquehanna Private Equity Investments LLLP, CME Ventures, Simplex Ventures, C6 Ventures, and Nexo Inc., led the round. Since its inception in 2018, the firm has received a total of $44 million from institutional investors in two funding rounds.

We’re excited to announce the successful close of our Series A #funding round totaling $37 million! See how this funding will support our global expansion and help institutions safely and efficiently engage #digitalasset markets: https://t.co/lfXHHxCaS1. #VC #fundingnews

— BlockFills (@blockfills) January 19, 2022

As per the announcement, the funding round will help Blockfills' worldwide expansion and support technology debuts aimed at enticing global Fortune 500-sized businesses, hedge fund/asset managers, banks, and other institutions into the digital assets sector as well as miner development.

“The successful close of our Series A funding round will help ensure that BlockFills and our technology platforms are industry leading and continue to meet the demand for end-to-end solutions that help institutions safely and efficiently engage digital asset markets,” stated Nick Hammer, co-founder and CEO of BlockFills.

The company began as a bootstrapped business and raised its first external capital last year in May. The majority of the investors from that round retained their interest in the firm by investing again this time around. Over the years, it has seen a 400% yearly growth in top-line revenue, with spot trading volumes growing by more than 20 times on an average monthly basis since January 2020. The firm now has over 600 institutional clients.

Related: Checkout.com raises $1B in Series D, bringing valuation to $40B

In Nov. 2019, Blockfills teamed up with New York-based fintech firm Tassat to offer an institutional Trade at Settlement service for spot Bitcoin (XBT/USD). At present, Blockfills is concentrating on international growth and technological developments. It went on to say that the new cash will be used to fulfill its objectives of expanding new verticals and strengthening its market position.

The world's sixth-largest cryptocurrency exchange by volume is making its move into the metaverse.

KuCoin Labs, the company behind the world's sixth-largest cryptocurrency exchange by trading volume with more than 500 crypto assets listed, announced on Wednesday that it would be launching a $100 million metaverse fund for early-stage projects. The money is also available for entities that develop blockchain-based games, nonfungible tokens, and decentralized applications. In addition, Kucoin will also provide business incubation services, branding, incentives, and business partnerships for developers selected into the fund.

Johnny Lyu, CEO of Kucoin, said the following in a prepared statement obtained by Cointelegraph:

"KuCoin Metaverse Fund will be launched to accelerate the evolution of the Internet industry. We hope to mature the emerging blockchain industry by further strengthening the application of blockchain technology to the metaverse projects."

Lou Yu, the head of KuCoin Labs, added:

"The concept of metaverse has remained at the theoretical level since it was proposed in the last century. It was not until the birth of the blockchain that metaverse became the next migration destiny for mankind."

The concept of a metaverse, or augmented virtual reality with its own digital economy, has been gaining traction ever since Facebook rebranded itself as Meta last month to focus on its development. Shortly afterward, Microsoft ventured into the metaverse with Team updates and Xbox upgrades. Then, Animoca Brands unveiled its plans for a K-pop NFT Metaverse. As more global brands move in, the total addressable market of the Metaverse is projected to grow to over $1.5 trillion by the end of 2030. Meanwhile, debates are ongoing as to whether or not the Metaverse should be centralized.

“We believe that NFTs can significantly accelerate the development of women’s sports,” Sorare CEO Nicolas Julia told Cointelegraph.

Following a $680 million funding round, nonfungible token (NFT) marketplace Sorare is looking to be an active player in bridging the gap between sports and digital entertainment.

Now valued at $4.3 billion, Sorare told Cointelegraph that the company plans to use the fresh capital to expand its business with new hires and partnerships, as well as support community-led programs.

Besides working with community-led football programs aimed at helping young people from disadvantaged backgrounds and backing underprivileged entrepreneurs in sports and gaming, Sorare CEO Nicolas Julia explained via email that the NFT unicorn would also support female representation in sports. He said:

“We believe that NFTs can significantly accelerate the development of women’s sports. We will actively invest in this by beginning with women’s football.”

Sorare, a Paris-based NFT marketplace focused on sports, made headlines in September following a SoftBank-led $680 million Series B funding.

Julia further detailed how Sorare would use the raised capital for business purposes, starting with the new hires to expand the team. “We’re looking to fill many new roles,” he said, both in Europe and the United States.

He added that new partnerships would introduce new football leagues and national teams to the NFT marketplace. Such partnerships require an upfront payment, and Sorare is loaded enough to sign the deal with the top 20 leagues and top 50 national teams, thanks to the hefty funding.

Related: Sports-themed NFTs spark gold rush as projects raise $930M in a week

Sorare also plans to reserve some part of the funds for mobile and marketing efforts. “Our fantasy game will be a mobile-first experience,” Julia explained, adding that the company’s growth was organic till now.

The last topic on Sorare’s agenda is to bring new sports to the platform. “We’ve received interest from leagues and fans across the globe to replicate our model in other sports,” Julia said.

The central bank of Laos intends to explore issuing its own digital currency, according to a media report that provided details on the plan. A study on the matter will commence soon and will be conducted with the support of a fintech startup based in Japan. Central Bank of Laos Joins Race to Develop Digital […]

The central bank of Laos intends to explore issuing its own digital currency, according to a media report that provided details on the plan. A study on the matter will commence soon and will be conducted with the support of a fintech startup based in Japan. Central Bank of Laos Joins Race to Develop Digital […]

"NFTs represent the future of content on blockchains," said Roll co-founder and CEO Bradley Miles.

Social token infrastructure provider Roll raised $10 million in Series A funding, bringing the company’s total funds raised to $12.7 million to help creators tokenize their interactions with communities.

Led by IOSG Ventures, the funding round saw participation from Animoca Brands, Alchemy, Huobi Ventures, Weekend Fund, Mischief Fund, Audacity and existing investors like Galaxy Interactive, Hustle Fund, Gary Vaynerchuk, Trevor McFederies, Ryan Selkis and Balaji Srinivasan.

Social tokens are blockchain-based digital currencies that have the potential to be used as the basis of a decentralized creator economy. “Through Roll, decentralized autonomous organizations (DAOs) and communities can tokenize, trade, and gate-keep content for those that are part of the community,” IOSG Ventures Founding Partner Jocy Lin explained, adding a social token enables its holders to join and contribute to a community.

Defining the explosive growth and popularity of nonfungible tokens (NFTs) as a “cultural bull market,” Roll Co-founder and CEO Bradley Miles said that this bull market became a renaissance for artists, musicians and creators worldwide: “NFTs represent the future of content on blockchains. At some point this decade it will emerge as a new normal for art, videos, games, music and any other content that creators want to make ownable.”

Speaking to Cointelegraph, Miles explained that the launch of a social token is similar to the launch of a YouTube channel or Patreon: "Let your closest supporters know beforehand and broadcast it out on your largest platform when you are ready."

On the technical side, Roll helps integrate social tokens into web applications such as marketplaces, streaming services and DAOs, by providing the infrastructure and application programming interfaces or APIs. Powered by Ethereum smart contracts, Roll’s social tokens can interact with traditional web platforms and DeFi protocols.

Related: Sports-themed NFTs spark gold rush as projects raise $930M in a week

The company said that the service is currently being used by over 350 creators, including Whaleshark and Terry Crews. Listing some of Roll’s social tokens, crypto exchange Huobi is among the investors via its venture arm. Jerry Yip of Huobi Ventures commented on Roll’s expansion, saying: “Roll’s platform for social tokens has stepped on the two relatively clear trends of influence tokenization and a new emerging economy for communities.”

The company plans to open up its APIs to more developers as early as next year.

The $25 million funding round, led by Valley Capital Partners, would enable Simba Chain to dedicate resources to new trends in the blockchain space.

The United States-based blockchain startup Simba Chain, which provides technology for several U.S. defense organizations, raised fresh funds to scale the business and tap new opportunities like nonfungible tokens (NFTs).

The $25 million Series A funding round was led by Valley Capital Partners with the participation of Notre Dame Pit Road Fund, Elevate Ventures and Stanford Law School Venture Fund, according to an official announcement.

Simba Chain would use the new funding to scale several departments within the company and to dedicate resources to emerging trends like NFTs. The company aims to be the tech provider for business enterprises, academic institutions and others who want to monetize digital and physical assets.

As a startup incubated at the University of Notre Dame, Simba Chain offers a cloud-based smart contract platform with enterprise-level security for organizations that wants to deploy blockchain technology.

The company says that its technology is currently used by the U.S. Air Force, Army, Navy and Marines as well as Boeing. Simba has grown its revenue by 360% over the last 18 months and surpassed 6,000 users.

“Users across multiple spectrums have embraced and validated the SIMBA Chain model, which simplifies the development of smart contracts,” said Simba Chain CEO and co-founder Joel Neidig. “The market has also responded positively to our support of multiple blockchains, including Ethereum, Avalanche, RSK, Stellar, and many others, making SIMBA Chain-based applications simple, highly portable and sustainable.”

Related: US Air Force prioritizes blockchain security with new Constellation Network contract

Simba Chain first drew attention when the startup was picked by the U.S. Air Force in 2019 to provide a blockchain-based supply chain for the organization. Six months later, a California-based research group of the U.S. Navy paid Simba Chain $9.5 million to develop a secure messaging platform on the blockchain for the Department of Defense (DoD).

The company scored another contract from the U.S. DoD, this time to develop a proof-of-concept for a blockchain-based data management system. Last year, Simba Chain won the Advanced Manufacturing Olympics, organized by DoD, with its use of blockchain to provide a secure network for a virtual wargame.

Earlier this year, Simba Chain received a $1.5 million grant from the U.S. Office of Navy Research to revamp the supply chain of the United States military with a blockchain-based solution to enable demand sensing for critical military weaponry parts.

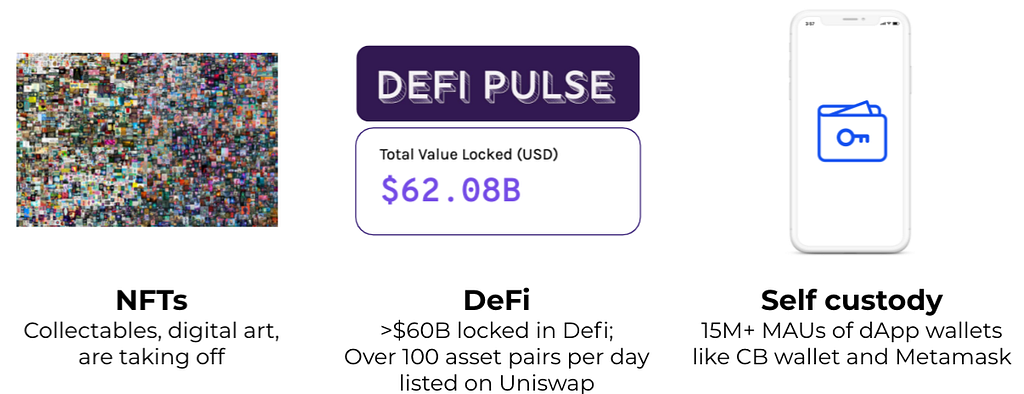

The cryptoeconomy is still in its early stages, but it is clear that every year more and more economic activity will take place on crypto rails. Coinbase is the trusted bridge to the cryptoeconomy today, but we need to become the place people also go to actually participate in the cryptoeconomy.

We’re seeing crypto quickly mature from its initial use case of trading bitcoin to the trading of thousands of new assets, and the adoption of new use cases like Decentralized Finance (DeFi), NFTs, smart contracts, Decentralized Autonomous Organizations (DAOs), and more. Much of this is relatively new and there are challenges to using it, but I see it as the future of where this industry is going. In the same way we helped people access Bitcoin for the first time in a trusted, easy way — we need to do the same for the decentralized cryptoeconomy.

For years, people outside of crypto would ask me, “Where are the use cases?!” We’re finally seeing a wide range of emergent applications and products get traction. From NFTs, to a broad array of new dApps (decentralized apps), the cryptoeconomy is growing at an incredible pace, and I think this will continue to accelerate. Like the internet, or the mobile app stores, we’re seeing developers rush into the space to use new tools to develop innovative use cases that we couldn’t have imagined before.

Our centralized (CeFi) products will continue to play a critical role in the growth of the cryptoeconomy. But the decentralized cryptoeconomy will also be a major area of growth. With all of this new innovation coming to crypto, we have a massive opportunity to give our customers access to these new products and features. Here are some of the ways we’re going to tackle this:

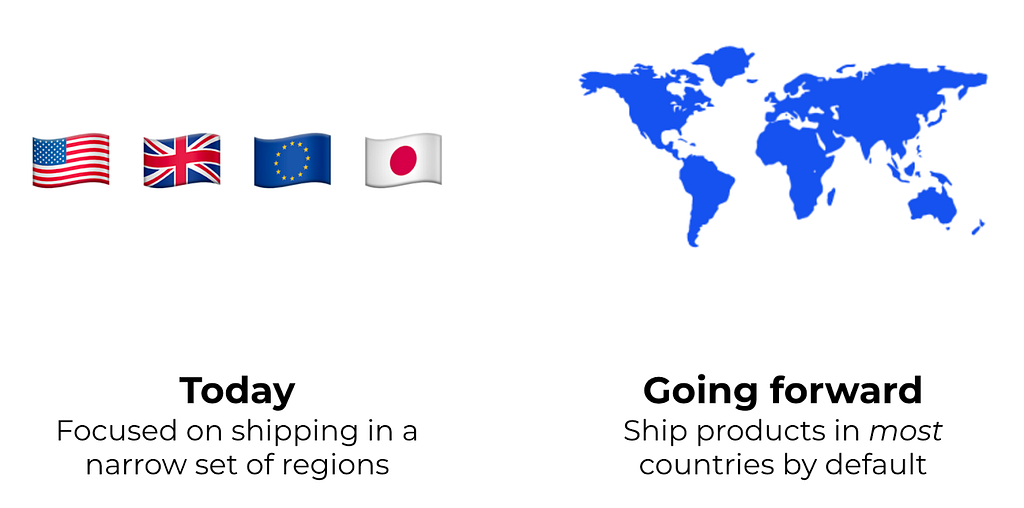

We put a huge amount of effort into working with regulators in the US, UK, EU, etc. which has generated an enormous amount of value for customers in these regions, but it can also lead to products that are hyper focused on the western world. We’re going to flip this approach on its head by shipping more products in international markets on day one, while still partnering with regulators in more established markets to ensure our products are compliant with their local rules. This is also better aligned from a mission point of view, because sometimes international markets are even more in need of the economic freedom that crypto can provide.

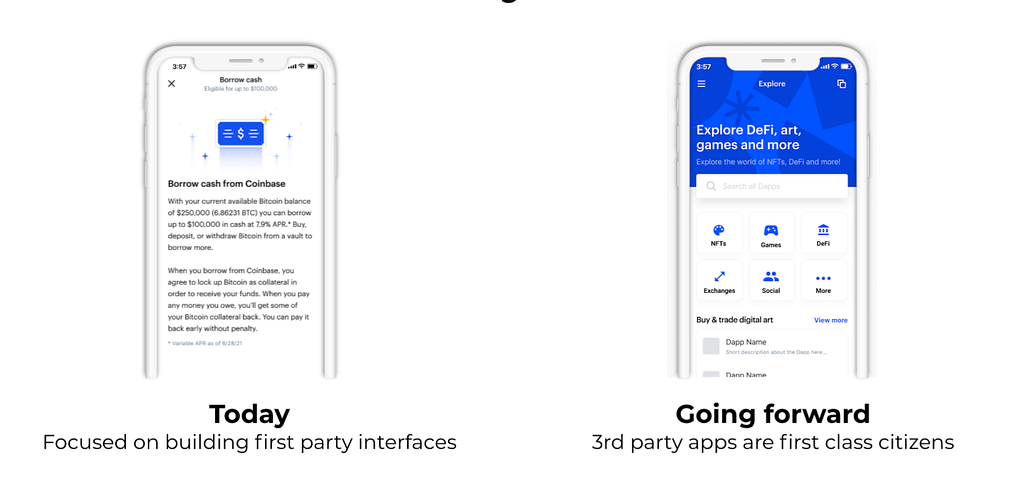

Soon any app built on decentralized crypto rails will be accessible to users of the Coinbase app. Our customer’s wallet and identity should seamlessly integrate into any of these apps. Part of this change will be embracing new wallet technologies, including those that allow for safe and easy self custody. In the future you will have the option to do self-custody of your crypto, right in the main Coinbase app.

The crypto industry is changing rapidly. The products that the most crypto-forward people are using today will be used by mainstream customers in a year, and by institutions a few years after that. We need to start integrating them today. Coinbase has shown that it can be a great crypto 1.0 company. Our next step is to show that we can be a great crypto 2.0 company.

This effort all ties back to our mission, which is to increase economic freedom in the world. Many of the most innovative use cases in crypto are being created in decentralized apps. By fully embracing this trend we can put crypto in the hands of more people around the world and thereby increase their economic freedom.

If these challenges excite you, please join our amazing team and come help build the cryptoeconomy.

Embracing decentralization at Coinbase was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

U.K.-based crypto payments provider Bottlepay has started offering services in other European countries. Users on the Old Continent will be able to send and receive even small amounts of euro and also buy, store and spend bitcoin with merchants accepting cryptocurrency. Bottlepay Promises Low-Cost Transactions in Euro and Bitcoin The Bottlepay app will allow Europeans […]

U.K.-based crypto payments provider Bottlepay has started offering services in other European countries. Users on the Old Continent will be able to send and receive even small amounts of euro and also buy, store and spend bitcoin with merchants accepting cryptocurrency. Bottlepay Promises Low-Cost Transactions in Euro and Bitcoin The Bottlepay app will allow Europeans […]Every tech company should go direct to their audience, and become a media company.

As Coinbase and the cryptoeconomy grow, we’ve seen more interest from the media, government, and the general public in our business and in crypto overall. This increased awareness has been great. Unfortunately, we also see misinformation published frequently as well, whether in traditional media, social media, or by public figures.

This doesn’t always come from negative intentions. Our business, and crypto, can be difficult to understand, and often people are rushed to post first impressions online, making mistakes in the process. At other times, misinformation comes from people pushing their own agenda, or from those who have a conflict of interest.

This is not unique to our business or industry of course. Every company experiences this to some degree, and it can be incredibly frustrating.

So how should companies respond to misinformation?

Option 1: turn the other cheek

The most common advice you’ll hear from PR firms and boards is to work behind the scenes to correct misinformation, but never engage in public fights. This might mean working with journalists to fact check a story, or to send internal emails to employees when misinformation is spreading on social media.

Pejoratively, one could call this the pacifist’s approach. Yes, you’re taking regular beatings from a bully, but don’t fight back. Just focus on building a great product and helping the industry grow, and everything will work out in the long run.

On the surface, this approach makes a lot of sense. Why pick a fight with someone who buys ink by the barrel, or with internet trolls who have too much time on their hands. After all, most of your customers probably never see the misinformation, and it can just draw more attention to respond publicly. Companies should never lose focus on the primary objective: building great products.

On the other hand, it can be very damaging to a company’s brand to let misinformation spread unchecked, and working through third parties to share your side of the story rarely is effective. You might, at best, get a short quote in a narrative that someone else controls.

If you look at companies like Facebook, they suffered enormous brand damage when traditional media coverage of them went south (although their business metrics seem to be unaffected). Accurate or not, traditional media has a conflict of interest when covering this topic, as they are in the process of being disrupted by tech. Yet to a large degree, Facebook turned the other cheek and didn’t respond or point out this conflict.

Option 2: fight

The opposite end of the spectrum is to actively fight back. Any time someone posts false information about your company, it’s war. Come out swinging and never back down.

This is a legitimate strategy that some companies have engaged in. Amazon’s recent responses to Andrew Yang or Elizabeth Warren are in this direction, along with FedEx’s CEO aggressively pushing back on a story they found inaccurate. And Peter Thiel’s takedown of Gawker may be the canonical example.

The advantage of this approach is that you are standing up for yourself. The downside is that warfare can be time-consuming, taking your energy away from building. You need to be prepared to go all the way, and it needs to be in line with your brand. There is an old quote which says “never wrestle with a pig, you both get dirty and the pig likes it”.

Option 3: publish the truth

I believe there is a reasonable middle ground between these first two options, which is to simply publish the truth, in a thoughtful and respectful way, and build a direct relationship with your audience. Companies no longer need to go through biased intermediaries to communicate with their customers and stakeholders. They often have equal or greater reach via their blog, podcast, or YouTube channel. In many cases, the only organization that knows what really happened is the company itself.

Tesla is a great example of this middle ground approach, in their Most Peculiar Test Drive blog post. Other examples include Apple debunking the claims of a cover piece or our own post correcting facts in the New York Times. These examples take a reasonable middle ground of trying to just share the facts.

This “fact check” approach is not about antagonizing or embarrassing others, but simply sharing what happened through your own channels. It also means sharing the good along with the bad, with radical transparency. Companies are often reticent to share negative facts, in their inherent desire to look good, and therefore also have a conflict. To become a source of truth, companies will increasingly need to be comfortable sharing facts which paint them in a negative light as well. There is nothing like sharing mistakes, to build trust.

Traditional media has been a powerful source of accountability for centuries. In more recent years, social media has as well, as any individual can share what is actually happening. The power of both these institutions is staggering, and they serve an important function. But traditional media and social media each come with a healthy dose of misinformation, and I believe people’s trust in these institutions has been in decline in recent years.

Companies are now emerging as a third source of truth, and can create accountability when misinformation is spread via other channels.

Amazon and Netflix built their own studios, Hubspot acquired the Hustle, a16z is going direct, Stripe has Stripe Press, and many more tech companies are quickly ascending the stack from mere “content marketing” to full-on media arms, complete with editors-in-chief and original content. As Balaji Srinivasan points out, this is the mirror image of legacy media corporations hiring engineers and declaring their aspiration to become world-class tech companies. There is no distinction anymore between app, distribution, and content — everyone is going full stack.

Today we’re announcing a section of our blog called “Fact Check”. We will use this section of the blog to combat misinformation and mischaracterizations about Coinbase or crypto being shared in the world.

We’re seeding the Fact Check section of our blog with these articles:

Currently, these fact checks have been more reactive, responding to misinformation in the news as it happens. However as we build this out, we will get more proactive in helping dispel myths in the crypto space in order to be a powerful source for people just coming in and learning about the cryptoeconomy.

We will continue to update this section of our site over time and when new misinformation appears that is materially incorrect and being distributed broadly.

Here are a few guidelines we’ve created for ourselves in publishing Fact Check articles:

There is too much misinformation in the world for us to respond to everything. A lack of us posting should not be considered an indication that an external statement is true. We will only tackle misinformation that reaches some materiality threshold.

In the future, we will need to move beyond fact checking, and start creating more of our own original content to communicate with our audience, and tell the stories of crypto that are happening all over the world. Many of these stories are not being told by traditional media. Fact checking is still largely reactive, but we need to move to a more proactive stance on content creation to have a true media arm.

Distribution of our content will happen through podcasts, YouTube, our blog, Twitter, and every other channel we own. But in the future, it will also likely move to more crypto native platforms, like Bitclout, or crypto oracles. Long term, the real source of truth will be what can be found on-chain, with a cryptographic signature attached.

Many readers have probably experienced the Gell-Mann amnesia effect: you read an article about something where you have first-hand knowledge, find it to be half true at best, and then turn the page to the next post/article and resume assuming it must be true. It takes this happening a number of times to change one’s estimates of what they are reading on every topic.

Crypto is a rapidly emerging space with growing attention and focus on it right now. Unfortunately, with this attention comes a lot of misinformation that is damaging, not only for companies like Coinbase, but for the space broadly. We want to do our best to ensure that when a customer, a regulator, or another important stakeholder is doing their research on crypto that they’re seeing information that is accurate and objective.

Over time, my prediction is that more and more companies will go direct, building their own media arm, while remaining focused on their primary goal of building great products. The tools for distribution have become democratized, and every company can become a source of truth.

Announcing Coinbase Fact Check: Decentralizing truth in the age of misinformation was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.