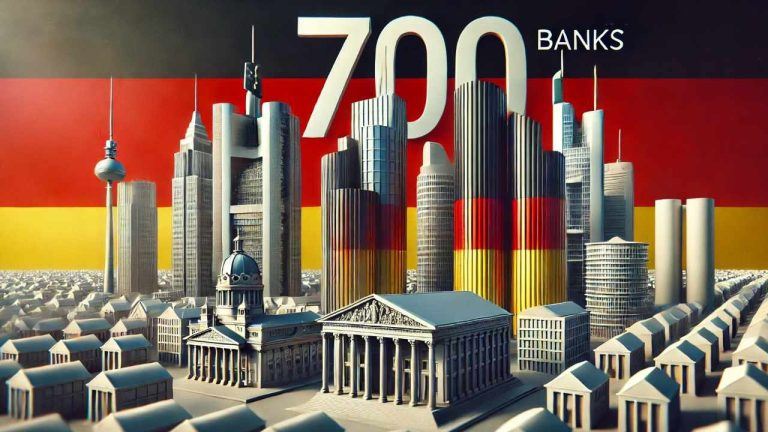

Boerse Stuttgart Digital is collaborating with DZ Bank to bring secure cryptocurrency trading and storage to over 700 cooperative banks across Germany. The move marks a significant step toward mainstream crypto adoption in Europe, with banks now offering regulated crypto services to retail customers. This collaboration will help meet the growing demand for digital assets, […]

Boerse Stuttgart Digital is collaborating with DZ Bank to bring secure cryptocurrency trading and storage to over 700 cooperative banks across Germany. The move marks a significant step toward mainstream crypto adoption in Europe, with banks now offering regulated crypto services to retail customers. This collaboration will help meet the growing demand for digital assets, […] Metaplanet and SBI VC Trade have formed a strategic partnership to enhance bitcoin trading, storage, and management. This alliance aligns with Metaplanet’s “bitcoin first, bitcoin only” strategy, emphasizing BTC’s scarcity and decentralized nature. The partnership provides Metaplanet access to SBI VC Trade’s tax-efficient corporate custody services and the ability to use bitcoin as collateral, supporting […]

Metaplanet and SBI VC Trade have formed a strategic partnership to enhance bitcoin trading, storage, and management. This alliance aligns with Metaplanet’s “bitcoin first, bitcoin only” strategy, emphasizing BTC’s scarcity and decentralized nature. The partnership provides Metaplanet access to SBI VC Trade’s tax-efficient corporate custody services and the ability to use bitcoin as collateral, supporting […]

Cryptocurrency exchange Bitget has released a MPC wallet to improve asset security and user experience.

Cryptocurrency exchange and derivatives platform Bitget has launched a new wallet service using multi-party computation (MPC) to improve security and key management for users.

Following the launch of its account abstraction wallet service powered by Ethereum scaling protocol Starknet in July 2023, Bitget has employed MPC to overhaul private key and asset management.

MPC technology uses a distributed key generation mechanism that distributes multiple key shares to different locations that are controlled by multiple parties. This enables a process that requires the owners of distributed private key shares to sign and authorize the transaction.

The MPC wallet features a "mnemonic-free" user experience, removing a long-time industry standard that relied on users storing or memorizing mnemonic phrases and private keys. Assets are instead managed using password-based authentication, which Bitget touts to eliminate the risk of a single-point private key exposure.

The exchange notes that the development is aimed to mirror the user experience typically found in traditional Web2 products and services. At a more technical level, Bitget’s MPC wallet relies on a threshold signature scheme, uses secure “large prime numbers” and features a 2/3 threshold setup.

The latter feature is designed for consumer-grade users, introducing a minimum number for signature authorization requiring just two-thirds of the total key shares to complete a signature to authorize a transaction.

Related: Trezor releases new hardware wallet and metal private key backup

The last key share is securely stored on a backup cloud server, ensuring an elevated level of decentralization and security.

The MPC wallet also introduces a reshare mechanism that invalidates key shares on old devices when newer devices are connected. This is aimed at removing the risk of key shares potentially being compromised on outdated or forgotten devices.

Users can also configure standalone transaction passwords which ensure that key shares that are held by Bitget’s server can only be used to complete signatures with the users' active consent.

Cryptocurrency self-storage has become an increasingly important part of the wider ecosystem in the wake of major failures of centralized players like FTX. In March 2023, hardware wallet manufacturer Ledger raised $109 million to increase its hardware production and explore the creation of new products.

Magazine: Ethereum restaking: Blockchain innovation or dangerous house of cards?

The storage platform turned to metered storage after discovering its Advanced plan was being used by some for crypto mining and other resource-intensive tasks.

The online storage platform Dropbox has binned its unlimited storage plan after discovering some of its users were using the service for resource-intensive purposes like mining crypto.

In an Aug. 24 blog post, Dropbox said its unlimited Advanced plan has instead moved to a metered storage plan with new users getting 15 terabytes of storage — apparently enough to house 100 million documents.

It added it knew its “all the space you need” plan would result in uneven usage levels but in recent months it had seen a surge in some users consuming “thousands of times more storage than our genuine business customers.”

“A growing number of customers were buying Advanced subscriptions not to run a business or organization, but instead for purposes like crypto and Chia mining.”

Dropbox said other high-resource uses included some reselling its storage or multiple individuals pooling storage for personal use.

Dropbox cited the increased unintended usage growth following “other services making similar policy changes.” Microsoft and Google have also scrapped their unlimited storage plans in recent months.

The company said it understands the move is “disappointing” but added it would be unsustainable and difficult to enforce a list of unacceptable use cases.

Related: The future of BTC mining and the Bitcoin halving

In the past, hackers have used cryptojacking malware that’s inserted into a victim's internet-connected device or cloud-storage account.

The malicious program uses the resources of the device or cloud service to create a virtual machine that mines cryptocurrencies.

In 2021, Google said some attackers targeting its storage platform users could compromise an account and install mining software within 22 seconds.

Magazine: Hall of Flame: Crypto Banter’s Ran Neuner says Ripple is ‘despicable,’ tips hat to ZachXBT

"My Bitcoin was taken. How?" A Reddit user thought they were following best practices until two days ago when their Bitcoin wallet was completely cleaned out.

A Reddit user has become the latest example of why crypto users should be more careful when using wallet generators — after the user lost a few thousand dollars worth of Bitcoin (BTC) from their "secure" paper wallet.

On July 24, a Redditor by the name /jdmcnair posted on the r/Bitcoin subreddit, asking for an explanation on how a hacker could have been able to steal over $3,000 worth of Bitcoin from their supposedly secure paper wallet — which was even generated on an offline computer.

“I was doing self-custody, generated my key and printed it on paper on an offline computer, transferred my BTC to this offline wallet, and kept it stored in a safe that only I have the key for,” the user wrote.

“I thought I was keeping it in one of the more secure ways possible.”

In an update to his initial post, the Redditor revealed that they used the wallet creation tool walletgenerator.net to create their wallet’s private keys, which some users highlighted have been infamous for vulnerabilities in the past.

Speaking to Cointelegraph, blockchain security firm CertiK's director of security operations Hugh Brooks said users should think twice before using a crypto wallet generator.

Such online wallet generators have served as a viable hacking tool for a while now, Brooks said:

“Some of these wallet generators could be straight-up scams. The website that the post claims returns an IP address in Russia. When looking at a tool such as Criminal IP we can see that the address has several abuse reports filed against it.”

Paper wallet generators have been known to contain serious vulnerabilities since 2019, Brooks said, adding that if anyone has generated wallets using walletgenerator.net then it's likely “the same keys have been given to different users.”

The Profanity wallet generator exploit was a textbook example of this security vulnerability which led to the $160 million hack on algorithmic market maker Wintermute in September.

The solution is simple, according to Brooks. Users wanting safe crypto storage should use a “trusted hardware wallet provider such as Ledger and Trezor.”

Related: Almost $1M in crypto stolen from vanity address exploit

The Redditor was baffled as to why the exploiter waited over 12 months to exploit the funds, prompting another to offer a possible explanation.

“[The hackers] wait for enough noobs to think they generated secure private keys, wait for them to deposit significant amounts, and then, one day, swipe all the funds, so there is no time to react to reports of the site being compromised.”

With a sudden increase in long-dormant Bitcoin wallets waking up — many with funds in the millions — some pundits think it’s due to wallet generators being hacked.

Unpopular crypto opinion: the fact that wallet generators can be cracked and people can lose their funds with no recourse is terrifying. I’m going to tell you what I believe to be the answer, and I know the “make everything decentralized” crew will hate it

— Jesse Hynes (@jesse_hynes) April 25, 2023

Hackers managed to snatch over $300 million in Q2 2023, according to CertiK, a 58% decline from the same period last year.

Magazine: $3.4B of Bitcoin in a popcorn tin — The Silk Road hacker’s story

Although utilization rose, protocol and supply revenue declined, as more providers slashed fees to incentivize adoption.

According to a July 13 report by Messari, Filecoin currently averages 954.2 pebibytes (1.07 billion gigabytes) worth of storage deals on its network, compared with 12.2 exbibytes (14.1 billion gigabytes) worth of raw storage capacity. Until recently, uptake had been sluggish due to high storage costs compared with centralized alternatives such as Amazon Web Services.

During the most recent quarter, the protocol generated 2.5 million of its own Filecoin (FIL) in revenue, amounting to $11.5 million, representing a decline of 40.7% compared to last year’s second quarter in dollar terms. However, the decline was partly due to a sharp drop in the price of FIL tokens due to the 2022 cryptocurrency bear market, which was somewhat offset by the sharp increase in active storage deals.

The price plunge also affected supply-side revenue, or money earned from block rewards, anchored storage deals and transaction tips. Supply-side revenue fell 66.9% year-over-year to $85.7 million in Q2 2023.

In addition, many storage providers had begun charging near-zero fee storage to incentivize adoption. A vast majority of stored data stems from the information technology sector (41%), followed by natural resources (31.3%), healthcare (16.7%) and social services (9.2%). A total of 1,750 clients have onboarded data onto Filecoin. Researchers also wrote:

"To serve storage retrieval needs, a content delivery network (CDN) for Filecoin and IPFS — called Project Saturn — is currently being developed. Saturn aims to serve Filecoin’s retrieval market through fast and low-cost content delivery."

Earlier in March, Filecoin released the Filecoin Virtual Machine (FVM), bringing Ethereum-style smart contracts to the network. Since then, over 2,300 smart contracts have been deployed on FVM, consuming 7% of the blockchain’s gas fees in Q2 2023.

Magazine: BlackRock bullish on Bitcoin, Gemini CEO’s ‘delusion,’ and CEXs’ unhappy staff

On Thursday, digital asset custody provider, Bitgo, announced the launch of its storage and tracking solution for Bitcoin-based Ordinal inscriptions. Moreover, users can use Bitgo’s Ordinal inscription storage system to inscribe their own inscriptions onto the Bitcoin blockchain. Bitgo’s New Solution Allows for Safe Sending of Ordinal Inscriptions Bitgo has announced a new storage solution […]

On Thursday, digital asset custody provider, Bitgo, announced the launch of its storage and tracking solution for Bitcoin-based Ordinal inscriptions. Moreover, users can use Bitgo’s Ordinal inscription storage system to inscribe their own inscriptions onto the Bitcoin blockchain. Bitgo’s New Solution Allows for Safe Sending of Ordinal Inscriptions Bitgo has announced a new storage solution […] The largest crypto-asset exchange by global trade volume, Binance, announced that its custody business has launched an off-exchange settlement solution for institutional clients. With this solution, institutions can lock a specified amount of crypto with a qualified cold storage wallet, and assets will be mirrored on their Binance exchange account with a 1:1 balance. Binance […]

The largest crypto-asset exchange by global trade volume, Binance, announced that its custody business has launched an off-exchange settlement solution for institutional clients. With this solution, institutions can lock a specified amount of crypto with a qualified cold storage wallet, and assets will be mirrored on their Binance exchange account with a 1:1 balance. Binance […] Telegram users can now send and receive toncoin directly within the application’s chats, according to a tweet by The Open Network (TON) Foundation. In addition to the toncoin support, users can also purchase bitcoin via the software’s bot system. TON Foundation Reveals Telegram Toncoin Support, Users Can Purchase Bitcoin via Bot The ability to send […]

Telegram users can now send and receive toncoin directly within the application’s chats, according to a tweet by The Open Network (TON) Foundation. In addition to the toncoin support, users can also purchase bitcoin via the software’s bot system. TON Foundation Reveals Telegram Toncoin Support, Users Can Purchase Bitcoin via Bot The ability to send […]

Decentralized storage and computing network Aleph.im raised fresh funds to face Amazon Lambda as a decentralized alternative.

The competition among the computing networks is warming up, with decentralized players coming into the stage with backing from the crypto ecosystem.

Decentralized storage and computing network Aleph.im completed a $10 million funding round led by Stratos Technologies. Zeeprime, NOIA Capital, Theia, Bitfwd Capital, Token Ventures and Seven Capital have contributed to the funding, among others. The cross-blockchain network aims to provide fully decentralized computing power and censorship-resistant data storage, according to the announcement.

Aleph.im scheduled its first computing resource node rollout for January following the funding round. The nodes would eventually become the decentralized network’s main processing power source.

Aleph.im rewards its core channel nodes with the network's native token, ALEPH. The new funding would enable Aleph.im to increase its minimum wage payment capabilities from the current 70 core channel nodes to 150 node operators. This expansion aims to create a distributed virtual machine network to make full-stack decentralization possible for key blockchain and decentralized application (DApp) developers.

After kicking off the network’s computer nodes, Aleph.im also plans to activate storage nodes in 2022, according to Aleph.im founder Jonathan Schemoul. Decentralized storage would enable Web3 developers, DApps and protocols “to fully decentralize up to the last piece of their development stack,” he added.

Related: Solana-based DeFi protocol Hubble raises $10M, prepares for mainnet launch

Stratos Technologies’ Rennick Palley noted that Web3 development would continue to rely on a small number of service providers until the full stack supporting compute and processing power is decentralized.

“Aleph.im’s efforts benefit the industry as a whole, and, for this reason, we are proud to be contributing to the larger effort and movement toward truly decentralized full-stack architecture.”

Last year, Aleph.im introduced a DApp to let users automatically back up the data underlying their nonfungible tokens. Gaming giant Ubisoft picked Aleph.im to participate in the sixth season of Ubisoft’s Entrepreneurs Lab. Despite facing backlash from the gaming community, Ubisoft joined the Aleph.im network as a channel node operator.