The Dutch government wants to align its data collection rules for crypto service providers with the rest of the EU, saying it would “create more transparency.”

The Dutch government has asked for public input on proposed laws that would require crypto service providers, such as exchanges, to collect and share user data with the local tax authority — aligning with European Union rules.

“The aim of the bill is to create more transparency about the ownership of cryptocurrencies, which can prevent tax avoidance and evasion,” the Netherlands Ministry of Finance said in an Oct. 24 press release.

It added “nothing will change” for crypto owners under the proposed rules as they’re already required to file a tax return of their holdings to the country’s tax authority, the Belastingdienst.

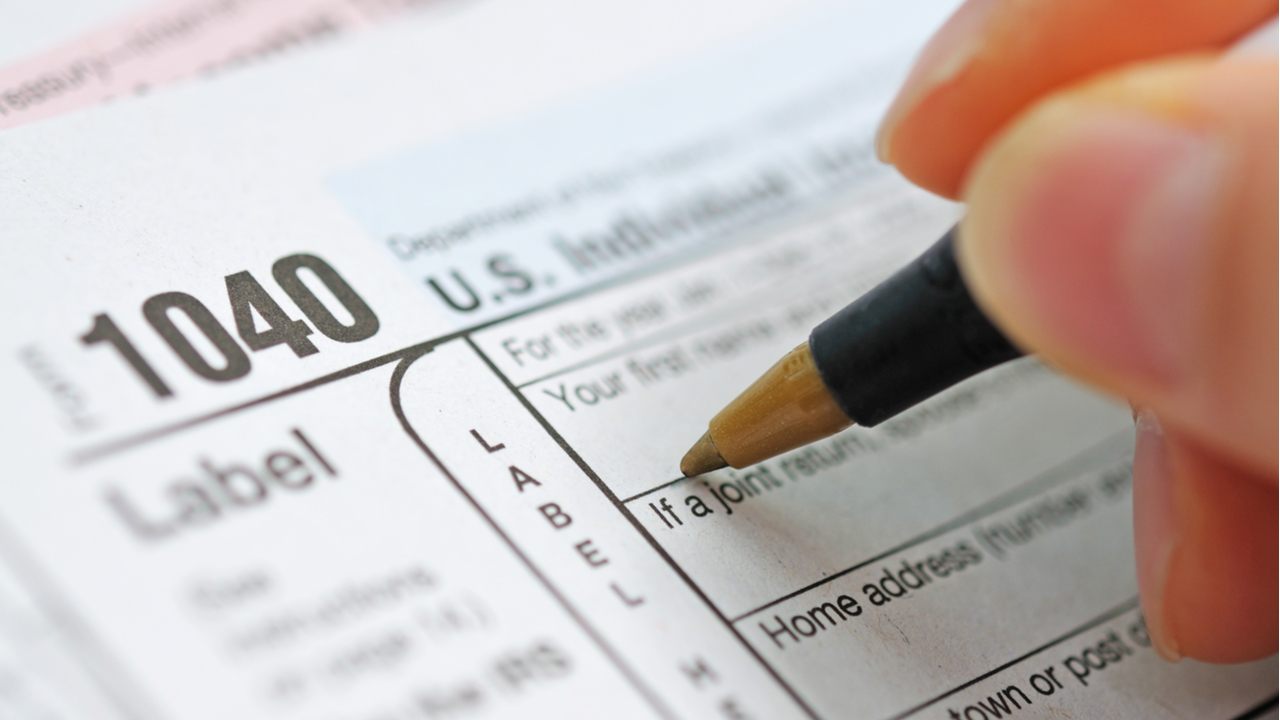

The U.S. Department of the Treasury and the IRS have released final regulations for tax reporting on digital asset sales, as part of the Biden-Harris administration’s implementation of the Infrastructure Investment and Jobs Act. Additionally, the Treasury and the IRS revealed that they anticipate issuing further rules later this year to establish reporting requirements for […]

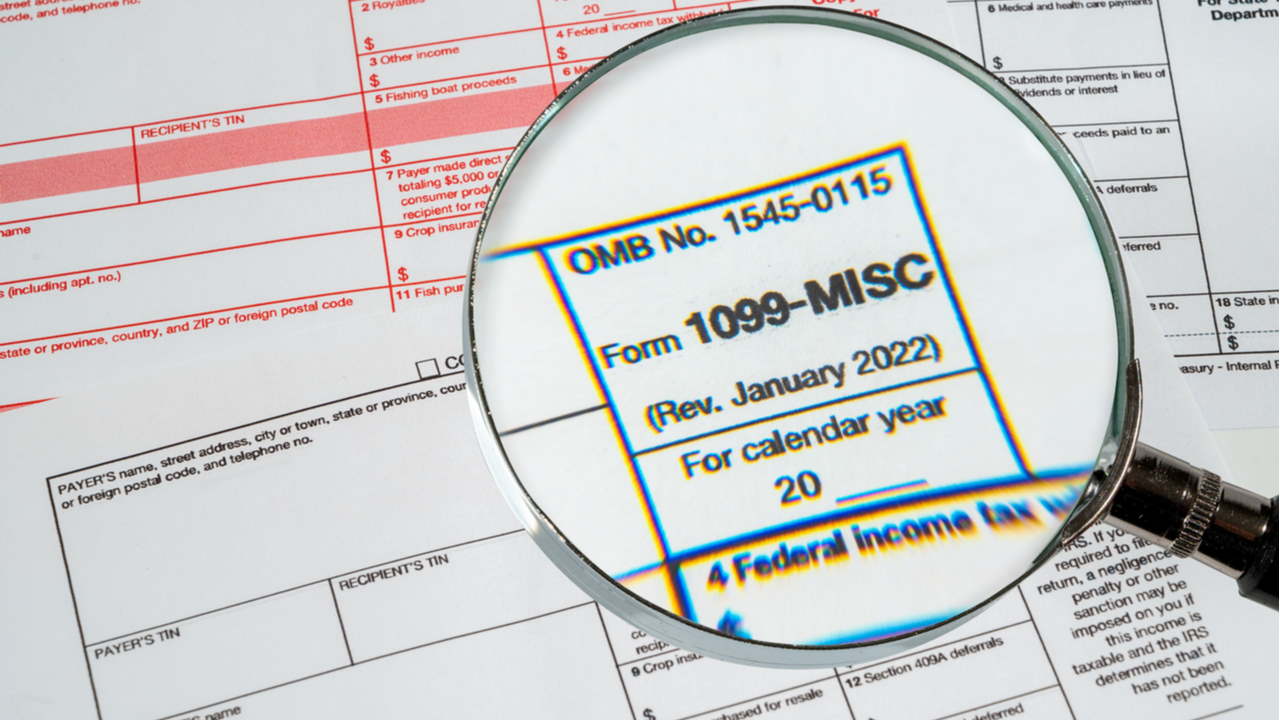

The U.S. Department of the Treasury and the IRS have released final regulations for tax reporting on digital asset sales, as part of the Biden-Harris administration’s implementation of the Infrastructure Investment and Jobs Act. Additionally, the Treasury and the IRS revealed that they anticipate issuing further rules later this year to establish reporting requirements for […] The U.S. Internal Revenue Service (IRS) has released a draft tax Form 1099-DA for reporting digital asset proceeds from broker transactions. Brokers, including unhosted wallet providers, are required to report proceeds from digital asset dispositions to the IRS. A crypto tax expert has highlighted that the collection of certain data points, such as wallet addresses, […]

The U.S. Internal Revenue Service (IRS) has released a draft tax Form 1099-DA for reporting digital asset proceeds from broker transactions. Brokers, including unhosted wallet providers, are required to report proceeds from digital asset dispositions to the IRS. A crypto tax expert has highlighted that the collection of certain data points, such as wallet addresses, […] Many crypto exchanges send tax forms to the IRS, each with their own list of supported tokens and info that doesn’t necessarily match up. This can create a lot of confusion for U.S. taxpayers. Luckily, Cointelli can swiftly and reliably create a unified tax report with the push of a button. And if there are […]

Many crypto exchanges send tax forms to the IRS, each with their own list of supported tokens and info that doesn’t necessarily match up. This can create a lot of confusion for U.S. taxpayers. Luckily, Cointelli can swiftly and reliably create a unified tax report with the push of a button. And if there are […] The 2022 U.S. tax season is upon us and cryptocurrency traders need all the help they can get. Here are five common crypto tax misconceptions you should look out for, courtesy of crypto tax software provider, Cointelli. “You don’t have to pay taxes on crypto” One very common mistake that people make is thinking they […]

The 2022 U.S. tax season is upon us and cryptocurrency traders need all the help they can get. Here are five common crypto tax misconceptions you should look out for, courtesy of crypto tax software provider, Cointelli. “You don’t have to pay taxes on crypto” One very common mistake that people make is thinking they […]

A court in northern California has ordered Kraken to provide info on users who traded more than $20,000 between 2016 and 2020 to the IRS.

Kraken has been ordered to provide information on its users to who conducted the equivalent of $20,000 in crypto transactions in any one year, between 2016 and 2020, to the Internal Revenue Service.

A federal court in northern California authorized the IRS to serve a “John Doe summons” on Kraken yesterday. The exchange is not alleged to have done anything wrong.

The IRS is after the records of an “ascertainable group or class of persons” who may have failed to comply with tax reporting and internal revenue laws

In addition, the IRS will check if Kraken has been compliant with its record-keeping obligations such as the Know-Your-Customer rules.

“This John Doe summons is part of our effort to uncover those who are trying to skirt reporting and avoid paying their fair share, ” said IRS Commissioner Chuck Rettig in the court’s press release.

Acting Assistant Attorney General David Hubbert of the Justice Department's Tax Division said:

"Those who transact with cryptocurrency must meet their tax obligations like any other taxpayer."

A John Doe summons is used by the IRS to get the names and information about all taxpayers from a specified description, such as the '$20,000 and over' class stated in the latest summons.

According to the supporting declaration, the IRS is after information on five different classes of U.S taxpayer. Some of the activities the IRS are looking into, include: reporting limited income despite trading crypto between a range of $5 million to $56 million, operating multiple accounts while exchanging fiat currency to digital assets and back to fiat for no apparent economic benefit.

The IRS is also keeping an eye on people who submitted delinquent tax returns in 2017 and 2018 with income more than $2 million each year, with activity consisting of more than $23 million in deposits and withdrawals at various crypto exchanges.

The road to this latest fishing expedition was reportedly paved by the first John Doe summons on Coinbase in 2016, in which the IRS obtained the information of 13,000 Coinbase customers.

Coinbase has been under scrutiny ever since, and in November 2020 tax lawyers of Coinbase warned customers that it had been tracking an increase in IRS enforcement against users who fail to comply with tax and reporting requirements.

Cointelegraph reported on April 18 that a Massachusetts federal court had entered an order authorizing the IRS to serve a “John Doe summons” on Circle Internet Financial Inc.