The bank predicts the private equity market to become the most “tokenized” asset class because it is more liquid and can be fractionalized.

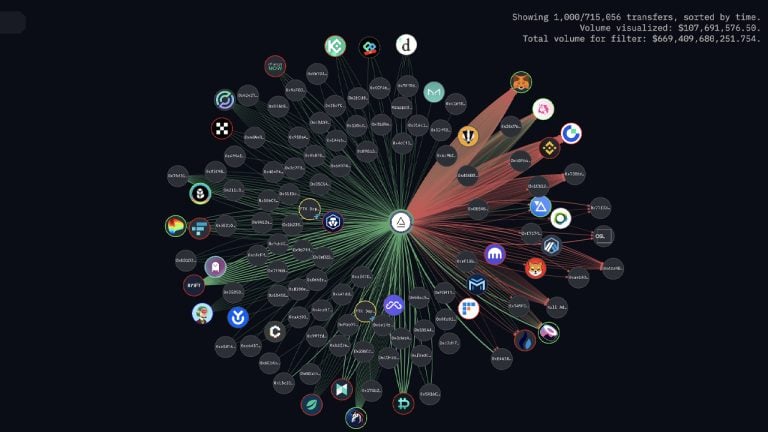

Investment bank Citi is betting on the blockchain-based tokenization of real-world assets to become the next “killer use case” in crypto, with the firm forecasting the market to reach between $4 trillion to $5 trillion by 2030.

That would mark an 80-fold increase from the current value of real-world assets locked on blockchains, Citi explained in its “Money, Tokens and Games” March report.

“We forecast $4 trillion to $5 trillion of tokenized digital securities and $1 trillion of distributed ledger technology (DLT)-based trade finance volumes by 2030,” the firm's analysts said.

Of the up to $5 trillion tokenized, the bank estimates $1.9 trillion will come in the form of debt, $1.5 trillion from real estate, $0.7 trillion from private equity and venture capital and between $0.5-1 trillion from securities.

The research suggests that private equity and venture capital funds will become the most tokenized asset class, capturing 10% of its total addressable market, with real estate coming in next at 7.5%.

Private equity markets will likely see faster adoption rates because of their favorable liquidity, transparency and fractionalization properties, the bank said.

KKR, Apollo and Hamilton Lane are three private equity firms that have already set up tokenized versions of their funds on platforms like Securitize, Provenance Blockchain and ADDX.

Citi said that blockchain tokenization would supersede legacy financial infrastructure because it is technologically superior and it provides more investment opportunities in private markets.

“Traditional financial assets are not broken, but sub-optimal as they are limited by traditional systems and processes,” it said. “Certain financial assets — such as fixed income, private equity, and other alternatives — have been relatively constrained while other markets — such as public equities — are more efficient.”

Citi argues that blockchain tokenization negates the need for expensive reconciliation, prevents settlement failures and makes tedious operations ever more efficient:

“What DLT and tokenization offer is an entirely new tech stack that lets all stakeholders do all activities on the same shared infrastructure as one golden source of data — no more expensive reconciliation, settlement failures, waiting for the faxed documents or ‘originals to follow’ by post, or investment choices being restricted by operational difficulty in access.”

The investment bank did, however, acknowledge that there are drawbacks at present, such as a lack of legal and regulatory framework, challenges with building the infrastructure and obtaining a widely followed set of interoperability standards.

Related: Asset tokenization: A beginner’s guide to converting real assets into digital assets

Citi also noted that some industry players remain “skeptical” too, particularly in light of the Australian Securities Exchange (ASX) recently scrapping its failed $165 million DLT project in November.

There are many more “growing pains” to come, Citi added. But the bank remains confident that the ecosystem will mature as the technology develops:

“Once this intermediate, skeuomorphic ‘straddle’ state is crossed, the new disruptive technology breaks free from the old and ideally directionally trends towards the envisioned end-state.”

Citi envisions this “end state” as a “digitally native financial asset infrastructure, globally accessible, operating 24x7x365 and optimized with smart contract and DLT-enabled automation capabilities, which enable use cases impractical with traditional infrastructure.”

Magazine: Building blocks: Gen Y can use tokens to get on the property ladder