The Hedera blockchain’s first-ever layer two solution “UP” was announced in October 2024. Polygon protocol Agglayer will now facilitate interoperability between UP and Karate Combat’s official token. Agglayer to Power Karate Combat Token Launch on UP The Karate Combat token (KARATE) which is already available on Hedera and Ethereum is now slated to launch on […]

The Hedera blockchain’s first-ever layer two solution “UP” was announced in October 2024. Polygon protocol Agglayer will now facilitate interoperability between UP and Karate Combat’s official token. Agglayer to Power Karate Combat Token Launch on UP The Karate Combat token (KARATE) which is already available on Hedera and Ethereum is now slated to launch on […]

A crypto strategist known for accurately calling the 2021 digital asset cycle top says the real-world asset (RWA) sector is showing a lot of market strength. The analyst pseudonymously known as Pentoshi tells his 854,800 followers on the social media platform X that Chintai (CHEX), Ondo Finance (ONDO) and Clearpool (CPOOL) are three RWA altcoins […]

The post Trader Says Real-World Asset (RWA) Tokens Looking Better Than Most of the Crypto Market – Here Are His Top Picks appeared first on The Daily Hodl.

Onchain data reveals how a group of alleged insiders raked in profits after selling $10.2 million worth of the Venice token immediately after it launched. Venice Insiders Accused of Dumping Over $10M Worth of Tokens Amir Ormu, an onchain analyst with crypto marketing firm Castle Labs revealed that insiders at crypto artificial intelligence (AI) startup […]

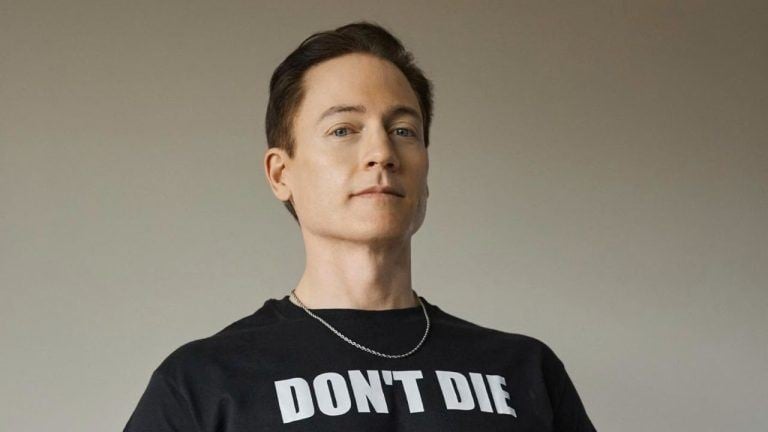

Onchain data reveals how a group of alleged insiders raked in profits after selling $10.2 million worth of the Venice token immediately after it launched. Venice Insiders Accused of Dumping Over $10M Worth of Tokens Amir Ormu, an onchain analyst with crypto marketing firm Castle Labs revealed that insiders at crypto artificial intelligence (AI) startup […] The millionaire founder of Braintree who spent $2 million to reverse his biological age by more than five years now wants to try his hand at crypto. Longevity Extraordinaire Ponders Token Launch Bryan Johnson, star of the new Netflix documentary “Don’t Die: The Man Who Wants to Live Forever,” hasn’t just been contemplating the impact […]

The millionaire founder of Braintree who spent $2 million to reverse his biological age by more than five years now wants to try his hand at crypto. Longevity Extraordinaire Ponders Token Launch Bryan Johnson, star of the new Netflix documentary “Don’t Die: The Man Who Wants to Live Forever,” hasn’t just been contemplating the impact […]

AI agents could launch their own brands, products, music and movies, driving value to social media platforms, the researchers wrote.

Several artificial intelligence-based tokens have surged following a new Franklin Templeton report predicting that AI agents will revolutionize content generation on social media.

“We can envision a future where AI agents revolutionize content generation on social media and play an integral role across various industries and platforms,” wrote Franklin Templeton in a report on AI agents on Jan. 14.

“Like today’s human influencers, these agents could launch their own brands, products, music, movies and more, driving significant economic value to their ecosystems,” it added.

Pump Science partially blamed Solana-based software firm BuilderZ for leaving the private key to the dev wallet address on GitHub for the public to see.

Decentralized science platform Pump Science has apologized to its users after its private key was leaked on GitHub — allowing a “known attacker” to create fraudulent tokens using its Pump.fun profile.

“We do not want to diminish how much of a screw-up this was, we totally acknowledge that this is a huge issue and misstep on our part,” Pump Science’s Benji Leibowitz said in an ask-me-anything (AMA) session hosted on X on Nov. 27.

“This absolutely will not happen again,” he said, adding:

Pump.fun has halted its broadcast feature after significant backlash, while a legal expert warns the extreme content can open up criminal investigations and civil lawsuits.

Launchpad Pump.fun’s livestream feature has seemingly turned into a platform for developers to broadcast extreme shock content to promote their tokens — and it may result in civil or criminal lawsuits according to legal experts.

From suicide threats and animal abuse to pornography, developers pushing boundaries have faced little to no consequences beyond having their content removed.

Meanwhile, industry participants urged Pump.fun to pull the plug on its livestreams, which it did earlier today until such time as it can properly moderate content.

DeSci advocates say “traditional science” has fallen prey to regulatory capture and been maligned by corporate greed and now a blockchain-based update is in order.

Decentralized science (DeSci) — a new field that updates scientific research with blockchain and crypto — may hold the key to revolutionizing the future of science by bootstrapping new blockchain-based funding models and making research more accessible.

Speaking to Cointelegraph, Joshua Bate, the founder of DeSci World, said DeSci is a much-needed “update” to the broken software of trad science, which he says has become crippled by pointless incentives, including gatekept data, regulatory capture and corporate greed.

Bate said DeSci can be thought of as an extension of the “open science movement” — an initiative of researchers sharing data and publishing open research that began as far back as the 1600s.

After leaving crypto liquidity firm GSR in 2023, former Millennium and Pimco executives are coming back to crypto by launching a dedicated advisory firm.

Two former executives at major American investment management firms, Millennium Management and Pacific Investment Management Co (Pimco), are reentering the cryptocurrency space amid a major market rally.

Millennium’s ex-portfolio manager Benoit Bosc and Pimco’s former executive vice president Michael Bressler left their posts to set up a new crypto consultancy firm, x2B, Bloomberg reported on Nov. 11.

Expected to launch in November 2024, x2B will advise crypto projects on sectors like fundraising, tokenomics and market-maker strategy, exchange listing and treasury management.

New York’s financial regulator has a job opening for a Virtual Currency Senior Blockchain Analytics Analyst. The permanent position focuses on preventing financial crimes such as money laundering and fraud by ensuring compliance in the growing virtual currency sector. The role involves using blockchain analytics to monitor risks. Applications are due by Oct. 14. New […]

New York’s financial regulator has a job opening for a Virtual Currency Senior Blockchain Analytics Analyst. The permanent position focuses on preventing financial crimes such as money laundering and fraud by ensuring compliance in the growing virtual currency sector. The role involves using blockchain analytics to monitor risks. Applications are due by Oct. 14. New […]