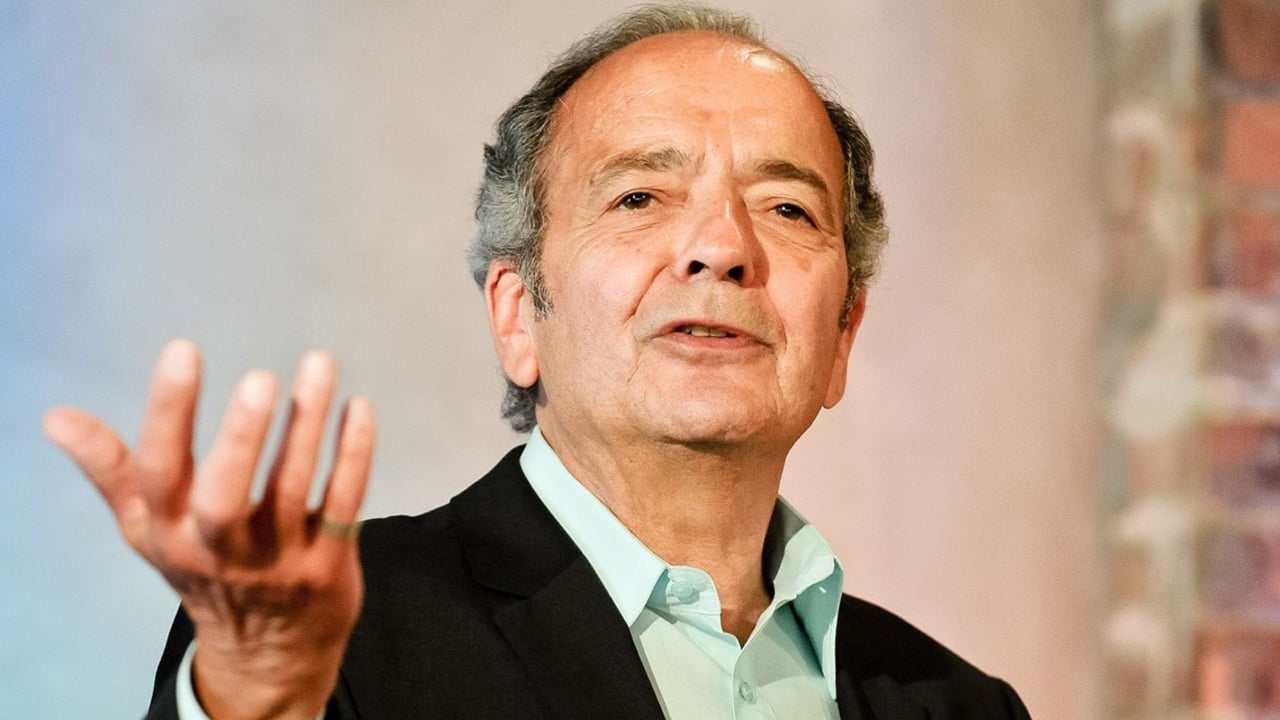

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon […]

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon […] As Americans continue to deal with rising inflation, on Tuesday the spread between 2-year and 10-year Treasury yields inverted, signaling the U.S. economy may be headed for a recession. This week, a myriad of financial reports have noted that the U.S. dollar’s reserve currency status could be undermined. Moreover, there’s also the possibility of crude […]

As Americans continue to deal with rising inflation, on Tuesday the spread between 2-year and 10-year Treasury yields inverted, signaling the U.S. economy may be headed for a recession. This week, a myriad of financial reports have noted that the U.S. dollar’s reserve currency status could be undermined. Moreover, there’s also the possibility of crude […] On October 5, the youth fashion and retail brand Pacsun announced the company is now accepting cryptocurrencies via Bitpay’s payment services. Pacsun says the company has a youthful audience that is “very tech-oriented” and the firm has seen an “increasing desire towards cryptocurrency.” Pacific Sunwear of California Goes Crypto The American retail clothing brand, Pacific […]

On October 5, the youth fashion and retail brand Pacsun announced the company is now accepting cryptocurrencies via Bitpay’s payment services. Pacsun says the company has a youthful audience that is “very tech-oriented” and the firm has seen an “increasing desire towards cryptocurrency.” Pacific Sunwear of California Goes Crypto The American retail clothing brand, Pacific […]

Since the introduction of Bitcoin, Google has become an excellent popularity indicator for cryptocurrencies.

Google, the leading indicator used to track the popularity of Bitcoin (BTC) and other cryptocurrencies, celebrated its 23rd anniversary on Sept. 27, 2021.

Founded by Larry Page and Sergey Brin when both were students at Stanford University, the search engine has spent the majority of its 23 years of existence being one of the primary entry points to the internet.

Following the inception of cryptocurrencies, Google has been widely used as the primary method to search for new coins, track market trends, and learn how to buy crypto.

Since internet search statistics are an excellent way track user behavior, Google Trends has became a reliable source for understanding user interest in a near real-time fashion. Traders use the tool, which analyzes the popularity of search queries in a specific period, to identify emerging patterns.

Initial coin offerings, or ICOs, decentralized finance, or DeFi, and nonfungible tokens, or NFTs, all experienced a spike in Google Trends before taking the main stage in the crypto ecosystem.

A quick search for Bitcoin shows that internet user interest almost overlaps with the price volatility of the largest cryptocurrency. A similar overlap can be seen in Dogecoin (DOGE) charts.

Related: Google partners with NFT leader Dapper Labs to support Flow blockchain

Neutral statistics aside, Google’s stance on cryptocurrencies mimics the perception of the mainstream. In March 2018, following the infamous ICO boom, Google banned cryptocurrency-related advertising on its platform via an update to its Financial Services policy.

Since then, the search giant has softened on the subject, announcing that crypto ads by regulated entities are good to go again. While the company still does not allow DeFi ads or celebrity endorsements related to crypto, advertisers registered with the Financial Crimes Enforcement Network can advertise their crypto exchange and wallet services.

The notorious dogecoin has been moving northbound in value once again climbing more than 17% during the last 24 hours and 32% over the course of the week. Currently, across social media platforms like Twitter, Tiktok, and Facebook, the hashtag #dogecointo1dollar has been trending. Meanwhile, a number of other meme-based digital assets that leverage the […]

The notorious dogecoin has been moving northbound in value once again climbing more than 17% during the last 24 hours and 32% over the course of the week. Currently, across social media platforms like Twitter, Tiktok, and Facebook, the hashtag #dogecointo1dollar has been trending. Meanwhile, a number of other meme-based digital assets that leverage the […] This week a number of digital assets saw significant gains, but the meme-themed digital asset dogecoin has seen a significant rise during the last 48 hours. Dogecoin tapped a high of $0.143 per unit on Wednesday and has spiked more than 104% during the last week. Meanwhile, the billionaire investor and television personality, Mark Cuban, […]

This week a number of digital assets saw significant gains, but the meme-themed digital asset dogecoin has seen a significant rise during the last 48 hours. Dogecoin tapped a high of $0.143 per unit on Wednesday and has spiked more than 104% during the last week. Meanwhile, the billionaire investor and television personality, Mark Cuban, […]

Bitcoin's last six monthly candles have closed green, tying its previous record streak for bullish monthly candles.

Bitcoin has just closed six consecutive monthly green candles for the first time since April 2013. Should history repeat, Bitcoin may enjoy further parabolic gains this year.

In April 2013, Bitcoin closed at roughly $140 after posting six green monthly candles. While the markets would retrace to less than $100 over the next two months, Bitcoin would then surge 700% over the following six months and tag prices above $1,000 for the first time.

Bitcoin posted a similar pattern in the lead up to its parabolic bull run in 2017, with the markets posting five consecutive green monthly candles heading into September. While September saw BTC post range-bound consolidation, Bitcoin surged into new all-time highs in October to rallied from $5,000 to almost $20,000 by the end of the year.

According to Bloomberg strategist, Mike McGlone, Bitcoin could be trading for more than $400,000 by 2022, should the markets follow the trends previously witnessed during 2013 and 2017. McGlone recently claimed that Bitcoin is "well on its way to becoming a global digital reserve asset."

Veteran trader and market analyst, Peter Brandt, is also bullish on Bitcoin, predicting BTC could gain a further 250% to break above $200,000. "I think we're in that midpoint pause where in 2017 Bitcoin swirled around for a month or two before we saw the final move up," he said.

However, past trends do not guarantee future performance and the history of green candles is a little murky. Despite Bitcoin posting five green monthly candles in a row during late 2015, the early weeks of 2016 saw BTC crash by 20% before producing several months of tightening consolidation.

Similarly, the five consecutive months of bullish momentum that kicked of 2019 was followed by a protracted downtrend, with BTC having fallen more than 60% from its 2019 highs amid the "Black Thursday" crash of March 2020. Bitcoin did not reclaim its 2019 price-highs until December 2020.

If you are in the blockchain and crypto space, there’s a high chance you might have heard about NFTs (Non-Fungible Tokens). If you haven’t yet, maybe very soon you will....

The post NFTs – The Most Powerful Narrative in The Blockchain Space appeared first on WazirX Blog.