Mastercard has announced a pilot program with Circle, the payment technology company behind the widely-used stablecoin USDC. Mastercard is testing USDC on its platform. The trial is designed to facilitate crypto-to-fiat conversions. It will allow customers to spend their crypto assets more easily as card issuers and crypto businesses settle payments to Mastercard. Circle co-founder […]

The post Mastercard Is Eying This Stablecoin’s $785,000,000,000 Transaction Volume appeared first on The Daily Hodl.

Visa is reportedly set to approve Australian crypto startup Cryptospend’s issuance of debit cards for spending bitcoin and several other cryptocurrencies. “We have a lot of demand for the card,” the company claims. Global card giant Visa is expected to announce later this week the approval of the issuance of a physical debit card that […]

Visa is reportedly set to approve Australian crypto startup Cryptospend’s issuance of debit cards for spending bitcoin and several other cryptocurrencies. “We have a lot of demand for the card,” the company claims. Global card giant Visa is expected to announce later this week the approval of the issuance of a physical debit card that […]

Crypto debit cards continue to catch on as an Australian digital assets start-up gets approval from Visa to release a spending card down under.

Global payment giant Visa is moving forward with its commitment to digital currency adoption by approving the issuance of a new Bitcoin (BTC) debit card in Australia.

Sydney-based crypto spending app CryptoSpend announced Wednesday that Visa has approved the issuance of a physical debit card that will allow Australians to spend their Bitcoin at local merchants.

CryptoSpend co-founders said in an interview with the Australian Financial Review that the new card will be issued by major local payments company Novatti and is expected to hit the market in September. Visa is expected to announce the approval later this week.

According to the report, the upcoming crypto debit card will allow users to spend a set of major cryptocurrencies including Bicoin, Ether (ETH), XRP, and Bitcoin Cash (BCH). Users’ crypto holdings will be custodied by BitGo.

CryptoSpend co-founder Andrew Grech said that the card will give Australians a way to cash out their Bitcoin profits as opposed to selling the cryptocurrency, stating:

“Spending it directly is a more convenient way of selling it. If the market is green, someone could say it’s time to spend some of my profits. On the other side of the fence, another person might say it’s going to keep going up, I’ll hold onto it. But we have seen more spending volume when the price is going up.”

Related: Visa reports over $1 billion in crypto spending in H1 2021

According to the Financial Review, Visa has already approved the issuance of crypto spending cards in Australia for some global crypto exchanges like Binance, but they are not yet available in the country. Crypto exchange Crypto.com also received approval to be a direct issuer of Visa debit cards in Australia and is preparing to launch a card soon.

Visa did not immediately respond to Cointelegraph’s request for comment.

Tesla CEO Elon Musk is still talking about Dogecoin’s future, discussing what the meme currency must achieve to stay relevant in the digital payments world. This week, the tech billionaire took to Twitter to share his thoughts on how to improve Dogecoin’s digital payments system. If Dogecoin (DOGE) aims to build a faster and less […]

The post Elon Musk Says Dogecoin Won’t Need To Match Visa’s Speed To Be Useful – Here’s Why appeared first on The Daily Hodl.

Backed by American investment bank Goldman Sachs, Circle is a major stablecoin partner of payment giant Visa.

Circle, a Goldman Sachs-backed fintech company focused on stablecoin development, has reportedly announced plans to go public.

The company said it would go public through a merger with an unnamed blank-check company in a deal that values at $4.5 billion, Reuters reported Thursday.

Circle is principal developer of USD Coin (USDC), the second-largest stablecoin after Tether (USDT). In late May, the company raised $440 million in private investment from an array of private equity, institutional and strategic investors.

Earlier this year, Circle co-founder and CEO Jeremy Allaire predicted that the company’s USDC is on track to surpass payments giant PayPal in terms of transacted dollar value.

This article is developing and will be updated.

Payment giant Visa will continue connecting the crypto economy to its “network of networks” to support the broader digital transformation of financial services.

Global payments giant Visa will continue to support the development and adoption of the cryptocurrency industry as part of its business, the company said in its latest crypto update.

In an official statement on Wednesday, Visa announced that its crypto-enabled cards processed more than $1 billion in total spending in the first half of 2021.

The company noted that Visa is partnering with 50 major companies in the crypto industry as well as crypto card programs enabling users to convert and spend digital currency at 70 million merchants worldwide. Given the size of spending on Visa crypto-linked cards, the company said that “it’s clear that the crypto community sees value in linking digital currencies to Visa’s global network.”

Visa emphasized that its digital currency support does not require global merchants to accept cryptocurrencies like Bitcoin (BTC) directly though. As previously reported, Visa has been working with major crypto players like cryptocurrency exchange platform Crypto.com to enable a crypto settlement system for fiat transactions. The company has also been closely working with other major crypto companies like FTX exchange, Coinbase, CoinZoom, and others.

The firm also stated that stablecoins — cryptocurrencies pegged to the value of other assets or fiat currencies like the United States dollar — are “starting to live up the promise of digital fiat,” outlining its developer-friendly features combined with the reliability of fiat-backed reserves. “Stablecoins are on track to become an important part of the broader digital transformation of financial services, and Visa is excited to help shape and support that development,” the company wrote, adding:

“We’ve been busy at Visa, connecting the crypto economy to our ‘network-of-networks,’ a strategy designed to add value to all forms of money movement, whether on the Visa network, or beyond.”

Related: BlockFi starts shipping Visa-backed Bitcoin rewards credit cards

One of the world’s largest payment companies, Visa made a major move into the crypto industry last year, partnering with Goldman Sachs-backed blockchain company Circle in order to make its USD Coin (USDC) stablecoin compatible with certain credit cards. The company has since reaffirmed its commitment to crypto payments and fiat on-ramps, as well as its particular focus on stablecoin-based integrations.

Cardholders will earn a percentage back in Bitcoin instead of airline miles or other cashback rewards

New York-based crypto loans and savings startup BlockFi launched its Bitcoin (BTC) rewards credit card today. The card is available to select approved customers on the United States waitlist.

Officially named BlockFi Rewards Visa Signature Credit Card, the card was first announced at the end of last year by Visa and BlockFi. Available to use anywhere Visa is accepted, the card allows its recipients to earn 1.5% back in Bitcoin instead of airline miles or other cashback rewards. Earned Bitcoin rewards will be transferred to cardholders’ BlockFi Interest Account.

Initial reports were saying that the card would have a $200 annual fee. But BlockFi took a U-turn on that decision in May, and the card launched with no annual fee. Cardholders are eligible to earn 2% in Bitcoin on annual expenses exceeding over $50,000. For example, if a customer spends $60,000 within a year, they will receive 2% of the $10,000 expenditure in BTC.

BlockFi’s credit card also offers familiar perks for the crypto ecosystem, such as trading bonuses and a referral program. The card is issued by Evolve Bank & Trust.

Terry Angelos, SVP and global head of fintech at Visa, noted that crypto rewards programs are a compelling way to welcome users to the crypto economy, and Visa is excited to see more examples of them.

Related: Institutional exchange launches crypto debit card

Almost everyone knows cryptocurrencies’ role in reshaping the financial space, added BlockFi Co-founder Flori Marquez: “This card will make it easier than ever for people to earn Bitcoin back while making day-to-day purchases.”

Visa is a known explorer of cryptocurrencies to broaden the adoption of digital currencies in general. As Cointelegraph analyzed in detail, Visa’s public affirmation of its positive stance toward cryptocurrency payment services reflects its drive to remain a leading player in the global payment network.

Despite the drop in value during the last three months, the leading crypto asset bitcoin is still the ninth most valuable asset in the world in terms of market capitalization. Moreover, bitcoin could flip some of the world’s most valuable assets in the future, as the crypto asset is 67% away from turning over tech […]

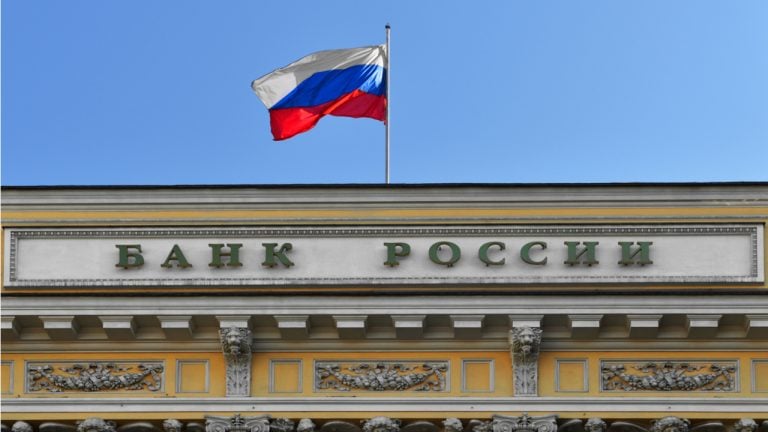

Despite the drop in value during the last three months, the leading crypto asset bitcoin is still the ninth most valuable asset in the world in terms of market capitalization. Moreover, bitcoin could flip some of the world’s most valuable assets in the future, as the crypto asset is 67% away from turning over tech […] The Central Bank of Russia (CBR) has set out to examine the risks associated with cryptocurrency investments. The regulator is going to conduct a dedicated study with the participation of major banks and payment processors operating in the Russian market. CBR Adds Crypto to Its Survey Program for 2021 Russia’s central bank, known as Bank […]

The Central Bank of Russia (CBR) has set out to examine the risks associated with cryptocurrency investments. The regulator is going to conduct a dedicated study with the participation of major banks and payment processors operating in the Russian market. CBR Adds Crypto to Its Survey Program for 2021 Russia’s central bank, known as Bank […]