Rich Dad Poor Dad author Robert Kiyosaki has shared a story involving Iraqi Dinars and an unexpected divine endorsement. In response, the famous author cautioned investors to “be extra careful” about who is giving them investment advice, emphasizing that “even if it is Jesus.” Kiyosaki’s Take on a Strange Investment Pitch Robert Kiyosaki, financial educator […]

Rich Dad Poor Dad author Robert Kiyosaki has shared a story involving Iraqi Dinars and an unexpected divine endorsement. In response, the famous author cautioned investors to “be extra careful” about who is giving them investment advice, emphasizing that “even if it is Jesus.” Kiyosaki’s Take on a Strange Investment Pitch Robert Kiyosaki, financial educator […] The Federal Bureau of Investigation (FBI) has warned cryptocurrency users about scammers impersonating crypto exchange employees to steal funds through unsolicited messages or calls. These fraudsters create urgency, claiming issues with accounts to trick victims into providing login details, clicking links, or sharing identification information. FBI Alerts Public to Cryptocurrency Exchange Scams The Federal Bureau […]

The Federal Bureau of Investigation (FBI) has warned cryptocurrency users about scammers impersonating crypto exchange employees to steal funds through unsolicited messages or calls. These fraudsters create urgency, claiming issues with accounts to trick victims into providing login details, clicking links, or sharing identification information. FBI Alerts Public to Cryptocurrency Exchange Scams The Federal Bureau […]

US banking giant Goldman Sachs just issued an alert to investors. In a new note to clients, the firm’s strategists say a series of fundamental factors suggest a market correction is on the horizon, reports Investing.com. Goldman points to declining real income growth, a slowdown in the nation’s GDP growth and weakening consumer sentiment as […]

The post US Banking Giant Issues Alert To Investors, Says Ominous ‘Warning Signal’ Now Flashing: Report appeared first on The Daily Hodl.

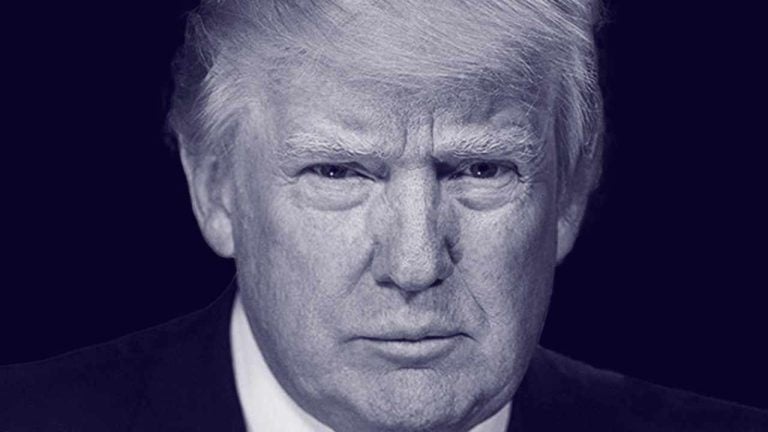

Sixteen Nobel Prize-winning economists have voiced concerns about the potential risks to the U.S. economy if Donald Trump secures a second term as president, emphasizing threats to economic stability and the rule of law. “The outcome of this election will have economic repercussions for years, and possibly decades, to come,” they cautioned. Nobel Economists Predict […]

Sixteen Nobel Prize-winning economists have voiced concerns about the potential risks to the U.S. economy if Donald Trump secures a second term as president, emphasizing threats to economic stability and the rule of law. “The outcome of this election will have economic repercussions for years, and possibly decades, to come,” they cautioned. Nobel Economists Predict […]

Security researchers are issuing an urgent alert about a new malware attack that’s targeting Android users’ bank accounts. The malware, which has been nicknamed “Brokewell,” takes the form of a fake Google Chrome browser update webpage that mimics Google’s own messaging style, reports ThreatFabric. When users are directed to the page, they see a message […]

The post New ‘Brokewell’ Smartphone Attack Drains Bank Accounts and Leaks Location, Posing ‘Significant Threat to Banking Industry’: Report appeared first on The Daily Hodl.

Amid ongoing global tensions, the price of gold remains robust at $2,391 per troy ounce, while bitcoin continues to trade at a 12% deficit from its peak value. Recently, the U.S. House of Representatives approved a series of funding bills for Ukraine, Israel, and Taiwan. Following the bill’s passage, Russian Foreign Ministry spokeswoman Maria Zakharova […]

Amid ongoing global tensions, the price of gold remains robust at $2,391 per troy ounce, while bitcoin continues to trade at a 12% deficit from its peak value. Recently, the U.S. House of Representatives approved a series of funding bills for Ukraine, Israel, and Taiwan. Following the bill’s passage, Russian Foreign Ministry spokeswoman Maria Zakharova […]

Security experts are warning millions of Apple users about a new scam designed to extract your sensitive personal and banking information. The scam comes in the form of several fake iCloud text messages containing malicious links, reports Trend Micro. Here’s a look at the fake alerts: CLOUD SERVICE TERMINATION. Upgrade now or lose your stored […]

The post Apple Security Alert Issued As New Scam Drains Bank Accounts, Steals Personal Info appeared first on The Daily Hodl.

"Fake" regulatory and dispute resolution entities are being used to make some crypto providers look legitimate, warns the Canadian Securities Administrators.

Canadian citizens are being advised to double-check crypto trading service providers, as the platforms may be using “fictitious” regulatory bodies to boost their credibility.

According to a June 20 Investor Alert from the Canadian Securities Administrators, some “purported” crypto platforms are claiming to be approved by certain regulatory authorities or dispute resolution organizations in “an effort to appear legitimate.”

“The websites appear to be credible at first glance, with references to complaint processing, dispute resolution and providing redress to aggrieved investors,” the CSA said in a statement.

Investor Alert: Some crypto websites use fake regulatory and dispute resolution organizations to appear legitimatehttps://t.co/Ptqx3RHjfg pic.twitter.com/2QIpwnJdcB

— CSA_News (@CSA_News) June 20, 2023

One such website even said its “fictitious certification makes it ‘a reliable and trustable online trading platform,’” according to the CSA, adding:

“But upon closer inspection, the websites’ language can be awkward and unpolished, with errors in spelling, grammar or syntax — a common ‘red flag’ of illegitimate entities.”

Some “fictitious” regulatory bodies and organizations, as listed by the CSA, include the Financial Standard Commission FSC Canada, Financial Commission/Finacom PLC Ltd., and its associated entity, Blockchain Association.

The CSA claims none of the listed entities are “known,” while also suggesting any entity claiming to be a member of the organizations is “likely fraudulent.”

Cointelegraph found a list of crypto firms that are touted as members of the “Blockchain Association” on its website — the entity is one of the dispute resolution organizations the CSA accused of being illegitimate.

Cointelegraph contacted Etheralabs, Gallant Exchange, SmartDec, StormGain, YouHodler and Finacom PLC Ltd., Cointelligence and Asia Blockchain for comment but did not receive a response by the time of publication.

“Anyone considering using a crypto firm that claims to be certified or a member of a dispute resolution organization should try to independently verify that the referenced organization actually exists,” said the CSA in a statement.

Related: Binance calls it quits in Canada, blames new rules

The regulator also advised that citizens considering investing in crypto should check the firms against those registered with the CSA. There are currently 12 crypto trading platforms authorized to do business in Canada, while there are 11 that have filed pre-registration undertakings.

Though the regulator’s statement does not address this, it should be noted that the crypto firms themselves may be victims of the “fake” certifications, and the listing of certification does not necessarily mean a platform is “fraudulent.”

The full list of regulatory bodies and entities that have been accused of being "fake" by the CSA include:

Asia Express: Yuan stablecoin team arrested, WeChat’s new Bitcoin prices, HK crypto rules

MetaMask posted a warning on its Twitter after coming across rumors of an upcoming MetaMask snapshot or airdrop on social media.

Web3 wallet provider MetaMask has warned its users of “false rumors” of a purported MetaMask airdrop, which appears to have been making the rounds on social media.

According to a March 28 tweet from MetaMask, there have "quite a few rumors going around" of a MetaMask snapshot or airdrop on March 31.

There are quite a few false rumors going around about a MetaMask snapshot/airdrop/etc. on March 31.

— MetaMask (@MetaMask) March 28, 2023

These rumors are not only false, but they are dangerous. They create opportunities for scammers and phishers.

Please be on the lookout for fake sites in the coming days

“These rumors are not only false, but they are dangerous. They create opportunities for scammers and phishers,” warned MetaMask.

Cointelegraph has identified a number of Twitter accounts purporting to be related to MetaMask or a MetaMask token airdrop.

In its Twitter post, MetaMask has denied the rumors of an upcoming airdrop and has urged users to stay vigilant for fake sites in the coming days.

The recent rumors may be linked to a “fireside chat” session with ConsenSys CEO and Ethereum co-founder Joe Lubin at ETHDenver 2023 on March 14, who reiterated his firm is “actively working to decentralize” MetaMask. He later reportedly confirmed that they were intending to launch a token.

Lubin also first hinted at a MetaMask token in a Nov. 8 Tweet from 2021, saying “Wen $MASK? Stay tuned.”

Andrew, ConsenSys has thousands of tokens on our balance sheet. ConsenSys is vigorously controlled by its employees, which includes me. And we are driving towards decentralization of several of our projects. Wen $MASK? Stay tuned. Wen objective journalism, ser?

— Joseph Lubin (@ethereumJoseph) November 8, 2021

While MetaMask has debunked an imminent airdrop, many of the replies from the community suggest they are still hopeful that an airdrop may still occur, but just at a later date.

Cointelegraph has contacted MetaMask’s parent company ConsenSys for clarification about whether there were plans for a future airdrop but was yet to hear back at the time of publication.

Related: Arbitrum’s ARB token signifies the start of airdrop season — Here are 5 to look out for

Activity on MetaMask nearly tripled on the back of the rumors, with data from DappRadar showing that the number of transactions on March 27 reached 21,460 from a baseline of approximately 8,000.

MetaMask saw a similar flurry of activity due to rumors of an airdrop back in November 2021, following recent airdrops from both the Ethereum Name Service and Lubin’s mention of a token.

Magazine: The secret of pitching to male VCs: Helping female crypto founders blast off

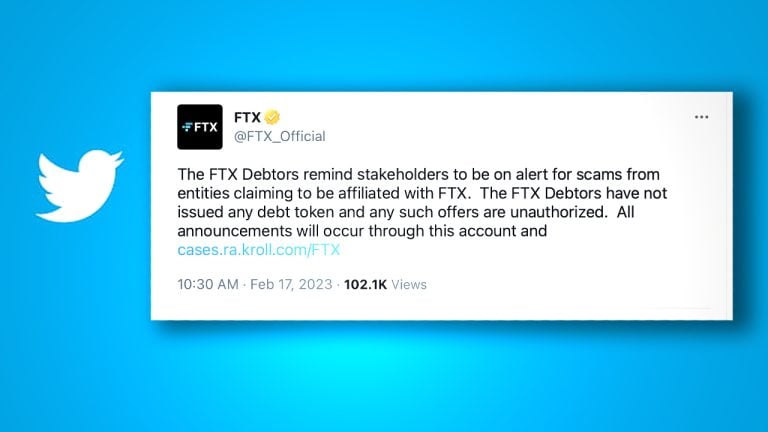

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […]

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […]