Warren Buffett-backed Nubank, a Brazil-based neobank that debuted crypto trading options back in May 2022 on its platform, has announced the launch of nucoin, its own cryptocurrency. Part of the first batch of the currency, issued on top of Polygon’s network, will be issued to its customers as an airdrop, and for cashback purposes. Nubank […]

Warren Buffett-backed Nubank, a Brazil-based neobank that debuted crypto trading options back in May 2022 on its platform, has announced the launch of nucoin, its own cryptocurrency. Part of the first batch of the currency, issued on top of Polygon’s network, will be issued to its customers as an airdrop, and for cashback purposes. Nubank […] Warren Buffett’s right-hand man and the vice chairman of Berkshire Hathaway, Charlie Munger, has urged the U.S. government to ban cryptocurrencies like China has done. “A cryptocurrency is not a currency, not a commodity, and not a security. Instead, it’s a gambling contract with a nearly 100% edge for the house,” he stressed. Berkshire Vice […]

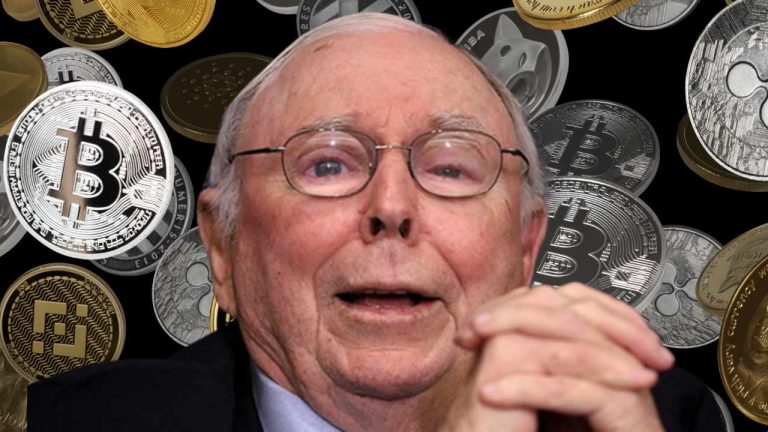

Warren Buffett’s right-hand man and the vice chairman of Berkshire Hathaway, Charlie Munger, has urged the U.S. government to ban cryptocurrencies like China has done. “A cryptocurrency is not a currency, not a commodity, and not a security. Instead, it’s a gambling contract with a nearly 100% edge for the house,” he stressed. Berkshire Vice […] The Warren Buffett-led Berkshire Hathaway has issued a statement warning that a cryptocurrency exchange website is using its name. The company stressed that the crypto firm has no affiliation with Berkshire Hathaway Inc. or its chairman and CEO, Warren E. Buffett. Berkshire Hathaway Warns About a Crypto Website Berkshire Hathaway Inc. warned Friday that a […]

The Warren Buffett-led Berkshire Hathaway has issued a statement warning that a cryptocurrency exchange website is using its name. The company stressed that the crypto firm has no affiliation with Berkshire Hathaway Inc. or its chairman and CEO, Warren E. Buffett. Berkshire Hathaway Warns About a Crypto Website Berkshire Hathaway Inc. warned Friday that a […] Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, has commented on the collapse of crypto exchange FTX, stating that “it is partly fraud and party delusion.” Noting that “the country did not need a currency that’s good for kidnappers,” he stressed: “I basically like the existence of the Fed … I hate bitcoin […]

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, has commented on the collapse of crypto exchange FTX, stating that “it is partly fraud and party delusion.” Noting that “the country did not need a currency that’s good for kidnappers,” he stressed: “I basically like the existence of the Fed … I hate bitcoin […]

MATIC price could sustain bullish momentum on cues from a mix of optimistic fundamental and technical indicators.

A sharp rebound in the Polygon (MATIC) market in the last four months has increased its price by 200% when measured from its June 2022 bottom of $0.31. And now, the token is showing signs of undergoing another major market rally.

Notably, the MATIC supply held by all crypto exchanges fell to 802.15 million on Oct. 26, its lowest level since January 2022. The plunge came as a part of a broader downtrend that has witnessed over 600 million MATIC leaving exchanges in the last four months, data on Santiment shows.

A declining crypto balance across exchanges is perceived as bullish by the market since traders typically withdraw their funds from trading platforms when they want to hold the tokens long term.

The MATIC chart above shows a similar albeit erratic negative correlation between its price and supply on exchanges. As a result, a period of decline in MATIC reserves at exchanges has historically coincided with an uptrend in price, and vice versa.

Therefore, the latest plunge in MATIC supply across exchanges hints at more upside for the token in the coming weeks.

More cues for a potential MATIC price rally come from the news of Polygon's adoption by mainstream fintech companies.

Notably, Nubank, a Brazilian neobank bank backed by Warren Buffett's Berkshire Hathaway, picked Polygon to build its native Web3 ecosystem. Since the Oct. 20 announcement, MATIC price has rallied by nearly 12% and was trading for $0.95 as of Oct. 26.

Furthermore, the massive MATIC outflow from exchanges coincides with the soaring trading and sales volume of Reddit nonfungible token (NFT) avatars. These digital collectibles are minted as NFTs on the Polygon blockchain.

From a technical perspective, MATIC has broken out of a bullish continuation pattern, dubbed a bull flag, whose profit target sits almost double the token's current valuation, as shown below.

MATIC also shows similar strength against Bitcoin (BTC), according to a technical setup shared by Kaleo, an independent market analyst.

"The predominate structure is a HTF [higher timeframe] flag dating back to May of '21 that looks ready for another leg higher," the analyst wrote while citing the chart below.

"I'm expecting a small retrace before breaking out / continuing higher," he added.

Related: Bitcoin will shoot over $100K in 2023 before ‘largest bear market’ — Trader

The MATIC/BTC setup could propel the pair to 0.000065 BTC by early 2023 versus the current price of 0.0000458 BTC, a 30% price rally.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

MATIC has painted a bull flag setup with a profit target sitting nearly 100% higher than its current price.

The price of Polygon’s MATIC (MATIC) coin could double by the end of 2022 or early 2023 due to a mix of extremely bullish fundamental and technical indicators.

MATIC rose by nearly 6.5% four days after Nubank, a Brazilian fintech company backed by Warren Buffett’s Berkshire Hathaway and Softbank, confirmed that it selected Polygon’s “Supernets technology” for its blockchain and digital token, dubbed Nucoin.

“Nubank plans to airdrop the digital token to its customers in the first half of 2023,” the official announcement read, adding:

“These tokens will serve as the basis for its customers loyalty rewards program and will have benefits such as discounts and other advantages.”

#Polygon is taking @Nubank from #Web2 ➡️ #Web3!

— Polygon - MATIC (@0xPolygon) October 19, 2022

In a strategic partnership with Polygon, Nubank is launching its own chain using #PolygonSupernets & thus its digital token Nucoin #onPolygon

This move will open the gateway for 70 mn+ Nubank users to the #Web3 space pic.twitter.com/Fu06Vi7IpV

As a result of the rally, MATIC was changing hands for $0.90 on Oct. 24, its highest level in three weeks.

Polygon Supernets is an enterprise-level solution that removes the complexity of blockchain development for companies looking to build their native chains. Interestingly, before Nubank, gaming company GameSwift employed the product to launch its custom blockchain.

The growing demand for Polygon products may bring a similar boom for its native token, MATIC, which serves as a utility and staking asset within the Polygon blockchain ecosystem.

The Nubank news surfaces as MATIC paints what appears to be a bullish continuation pattern on its lower-timeframe chart.

Dubbed a “bull flag,” the pattern emerges when the price consolidates inside a parallel, descending channel after a strong move upward. As a rule, it resolves after the price breaks out of the range to the upside and rises by as much as the previous uptrend’s height.

Therefore, MATIC’s breakout above the flag’s upper trendline could have it test $1.85 as its primary upside target. In other words, it could see a 100% price rally by the end of 2022 or at the beginning of 2023.

Related: 3 reasons why DeFi investors should always look before leaping

Conversely, a pullback from the flag’s upper trendline could lead MATIC toward the lower trendline near $0.67.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Berkshire Hathaway now allocates 60% of its cash portfolio to T-bills, leaving individual investors with the potential to mirror a similar strategy.

Warren Buffett has put most of Berkshire Hathaway's cash in short-term U.S. Treasury bills now that they offer as much as 3.27% in yields. But while the news does not concern Bitcoin (BTC) directly, it may still be a clue to the downside potential for BTC price in the near term.

Treasury bills, or T-Bills, are U.S. government-backed securities that mature in less than a year. Investors prefer them over money-market funds and certificates of deposits (COD) because of their tax benefits.

Related: Stablecoin issuers hold more US debt than Berkshire Hathaway: Report

Berkshire's net cash position was $105 billion as of June 30, out of which $75 billion, or 60%, was held in T-bills, up from $58.53 billion at the beginning of 2022 out of its $144 billion total cash reserves.

The move is likely a response to bond yields jumping massively since August 2021 in the wake of the Federal Reserve's hawkish policies aimed at curbing inflation, which was running at 8.4% in July.

For instance, the three-month U.S. T-bill returned a 2.8% yield on Aug. 22 compared to a near-zero yield a year ago. Similarly, the yield on U.S. one-year T-bill climbe from zero to 3.35% in the same period.

Meanwhile, non-yielding assets like gold and Bitcoin have dropped roughly by 2.5% and 57% since August 2021. The U.S. stock market benchmark S&P 500 likewise saw a decline, losing nearly 7.5% in the same period.

Related: BTC to lose $21K despite miners’ capitulation exit? 5 things to know in Bitcoin this week

Such a difference in performance presents T-bills as an ultra-safe alternative for investors when compared to gold, Bitcoin and stocks. Buffett's T-bill strategy suggests the same, namely a bet on more downside for risk-on assets in the near term — particularly as the Fed gears up for more rate hikes.

"Buffett is a value investor, so he won't allocate much when the equity markets are as overvalued as they have been for the last five years," said Charles Edwards, founder of quantitative crypto fund Capriole Investments.

Meanwhile, Andrew Bary, an associate editor at Barron's, underscored the market's potential to tail Buffett's strategy, saying:

"Individual investors may want to consider following Buffett's lead now that they are yielding as much as 3%."

Positive-yielding debts risk are dampening the demand for other potential safe-havens, Bitcoin included. In other words, increasingly risk-averse investors could be opting for assets that offer fixed yields over those that don't.

The performance of Bitcoin-focused investment funds in August supports this argument with capital outflows for three weeks in a row, including a $15.3 million exit in the week ending Aug. 19.

Overall, these funds have lost $44.7 million on a month-to-date basis, according to CoinShares' weekly report. In total, digital asset investment products, including BTC, have witnessed month-to-dat outflows totaling $22.2 million.

Does that mean Bitcoin will continue to lose its sheen against positive-yielding U.S. government debts? Edwards does not agree.

"Allocation to treasuries and other low-yield cash products is really a decision that needs to be made case-by-case depending on an individual's goals and risk appetite," he explained, adding:

"In the short-term, there are times it makes sense to hedge against Bitcoins volatility with cash, the best cash being the US Dollar. But, in the long-term, I think all fiat currencies tend towards zero against Bitcoin.

Edwards also points out that Buffett's long-term strategy remains largely risk-on. Notably, Berkshire deployed 34% of its cash holdings to buy equities in May and that over 70% of its portfolio is still made up of risk-on assets.

"Looking at Buffett's 75% risk allocation; and knowing that Bitcoin has been the best performing asset of all asset classes in the last decade, having the highest risk-adjusted returns, I know where I would be putting my money," he add.

Buffett's portfolio, however, will likely continue to eschew direct BTC investment as the "oracle of Omaha" remains a fierce critic. In February 2020, he said that it "does not create anything," adding:

“I don’t own any cryptocurrency. I never will… You can’t do anything with it except sell it to somebody else.”

Earlier this year, however, Buffett's Berkshire Hathaway increased exposure in a Bitcoin-friendly neobank while reducing its stake in Visa and Mastercard.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, has a message for investors considering cryptocurrency. “Never touch it,” he stressed, adding that everyone should follow his example and avoid crypto “as if it were an open sewer, full of malicious organisms.” Charlie Munger Reaffirms His Anti-Crypto Stance Charlie Munger, Warren Buffett’s right-hand man […]

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, has a message for investors considering cryptocurrency. “Never touch it,” he stressed, adding that everyone should follow his example and avoid crypto “as if it were an open sewer, full of malicious organisms.” Charlie Munger Reaffirms His Anti-Crypto Stance Charlie Munger, Warren Buffett’s right-hand man […] Warren Buffett-backed Nubank, one of the world’s largest digital banking platforms, is now offering cryptocurrency trading to all of its 54 million customers. Nubank also holds bitcoin on its balance sheet. Nubank’s Crypto Service Now Available to All Customers Nubank, one of the world’s largest digital banking platforms, now offers cryptocurrency trading to all clients, […]

Warren Buffett-backed Nubank, one of the world’s largest digital banking platforms, is now offering cryptocurrency trading to all of its 54 million customers. Nubank also holds bitcoin on its balance sheet. Nubank’s Crypto Service Now Available to All Customers Nubank, one of the world’s largest digital banking platforms, now offers cryptocurrency trading to all clients, […]