Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, wishes crypto would be banned immediately. He says the government made “a huge mistake” to allow cryptocurrencies, like bitcoin. “It’s like a venereal disease,” he opined. Charlie Munger Says ‘It Was a Huge Mistake’ to Allow Crypto at All Charlie Munger, Warren Buffett’s right-hand man […]

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, wishes crypto would be banned immediately. He says the government made “a huge mistake” to allow cryptocurrencies, like bitcoin. “It’s like a venereal disease,” he opined. Charlie Munger Says ‘It Was a Huge Mistake’ to Allow Crypto at All Charlie Munger, Warren Buffett’s right-hand man […]

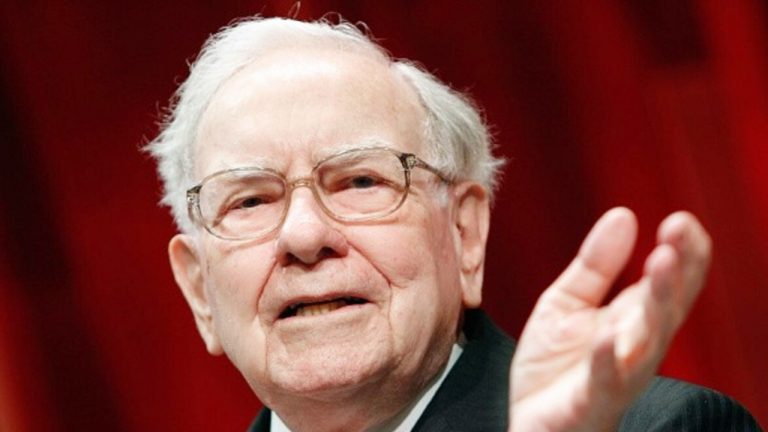

The "Oracle of Omaha" now has more companies in his portfolio that have direct/indirect exposure to Bitcoin and similar cryptocurrencies.

Warren Buffett's Berkshire Hathaway dumped a portion of its Visa and Mastercard holdings and increased exposure in Nubank, the largest fintech bank in Brazil that's also popular among the country's Bitcoin investors.

In a securities filing late Monday, the industrials conglomerate disclosed that it had purchased $1 billion worth of Nubank Class A stock in Q4/2021. On the other hand, it sold $1.8 billion and $1.3 billion worth of Visa and Mastercard stock, respectively, signaling a shift away from credit companies to gain exposure in their fintech rivals.

Buffett, the so-called "Oracle of Omaha," is popular for his cautious approach to investing, particularly in the market's hottest sectors such as fintech. The veteran investor had also downplayed emerging decentralized finance solutions like Bitcoin (BTC), ridiculing it as an asset that "does not create anything."

But Berkshire's new stake in Nubank shows that Buffett has been softening up to fintech lately. In detail, the firm had invested $500 million in the startup in July 2021. Its returns on the said investment amounted to $150 million in Dec. 2021 after Nubank debuted on the New York Stock Exchange (NYSE).

$NU Buffett-backed Nubank stock set for NYSE debut as IPO pricing valued company at about $41.5 Billion.

— InvestingDesk (@InvestingDesk) December 9, 2021

The company raised $2.60 Billion as it sold 289.15 Million shares in IPO. Berkshire bought 10% of the shares in the offering.#fintechnews pic.twitter.com/HTujZZvCtJ

So far, Buffett has not shown any intention to sell his position in Nubank.

Buffett's additional investment into Nubank shows his acknowledgment of the fintech sector's underlying theme: the digitization of financial services, as well as his willingness to associate with companies that are involved in the cryptocurrency sector.

In detail, Easynvest, a trading platform that Nubank acquired in September 2020 has been actively offering a Bitcoin exchange-traded fund (ETF) since June 2021. Dubbed QBTC11, the ETF is backed by QR Asset Management and is listed on the B3 stock exchange, the second-oldest bourse in Brazil.

Thus, it appears that Nubank, which remains exposed to the emerging crypto sector via Easynvest, could use the additional revenue opportunities to benefit its top investor, Warren Buffett, despite his views that Bitcoin is a "rat poison squared."

That is primarily because of the growth of crypto-related investment products in 2021. Notably, their numbers doubled in the year, rising from 35 to 80, as per Bloomberg Intelligence data, while the total valuations of the assets they held reached $63 billion versus $24 billion at the start of 2021.

Emily Portney, chief financial officer at Bank of New York Mellon Corp. — another firm in Buffett's investment portfolio, noted that digital assets could become a "meaningful source of revenue" for investment banking firms in the future as Bitcoin investment vehicles become more mainstream.

Related: Bitcoin’s 30% recovery in two weeks has BTC whales back in accumulation mode

Meanwhile, Leah Wald, chief executive of crypto-asset manager Valkyrie Investments, predicted an increase in the capital flows into crypto-related investment vehicles, saying they have become a "phenomenon that's starting to take off." Wald:

"If you look at inflows from a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in."

While Buffett might not invest in Bitcoin directly, he is already gaining indirect exposure as companies in his portfolio foray into the crypto sector.

For instance, in October 2021, just a month before Bitcoin reached its all-time high of $69,000, fifth-largest U.S. bank, U.S. Bancorp, launched a cryptocurrency custody service for its institutional investment managers, noting that they witnessed an increase in demand from their "fund services clients" over the last few years.

Similarly, in another announcement made October 2021, Bank of America launched a cryptocurrency research initiative, citing "growing institutional interest."

Months before, BNY Mellon announced that it would hold, transfer, and issue Bitcoin and similar cryptocurrencies for its asset-management clients.

Announcing the creation of the BNY Mellon Digital Assets unit - A team dedicated to building the first multi-asset custody and administration platform for traditional and digital assets, including #cryptocurrencies. https://t.co/aZ7wMfAXqg pic.twitter.com/L54TFVpJNv

— BNY Mellon (@BNYMellon) February 11, 2021

"The Nubank investment can be tagged as Buffett's way of supporting the fintech/crypto world without taking back his criticisms of the past," asserted Greg Waisman, co-founder and COO of crypto wallet service Mercuryo, adding that the Berkshire boss is now backing the "digital currency ecosystem indirectly."

"Even an indirect exposure is bound to increase the positive sentiment that may push more investors into the space."

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, says China did the right thing to “ban” cryptocurrencies, including bitcoin. He wishes that cryptocurrencies had never been invented, emphasizing that he will not participate in the crypto boom. He considers “this era even crazier than the dot-com era.” Warren Buffett’s Right Hand Man, Charlie […]

Berkshire Hathaway Vice Chairman Charlie Munger, Warren Buffett’s right-hand man, says China did the right thing to “ban” cryptocurrencies, including bitcoin. He wishes that cryptocurrencies had never been invented, emphasizing that he will not participate in the crypto boom. He considers “this era even crazier than the dot-com era.” Warren Buffett’s Right Hand Man, Charlie […] The CEO of cryptocurrency exchange Binance says that he and Berkshire Hathaway CEO Warren Buffett share a similar investment strategy. However, he said he would not convince the Oracle of Omaha to invest in cryptocurrency. “I get worried if he uses crypto. He may not have the necessary skills or the knowledge on how to […]

The CEO of cryptocurrency exchange Binance says that he and Berkshire Hathaway CEO Warren Buffett share a similar investment strategy. However, he said he would not convince the Oracle of Omaha to invest in cryptocurrency. “I get worried if he uses crypto. He may not have the necessary skills or the knowledge on how to […] Nubank, a Brazilian digital bank backed by Warren Buffett’s Berkshire Hathaway, is reportedly planning an initial public offering (IPO) on Nasdaq. Nubank is crypto-friendly and offers investments in a bitcoin exchange-traded fund (ETF). The bank said, “The cryptocurrency ETF can be a way to further democratize access to the crypto market.” Digital Bank Backed by […]

Nubank, a Brazilian digital bank backed by Warren Buffett’s Berkshire Hathaway, is reportedly planning an initial public offering (IPO) on Nasdaq. Nubank is crypto-friendly and offers investments in a bitcoin exchange-traded fund (ETF). The bank said, “The cryptocurrency ETF can be a way to further democratize access to the crypto market.” Digital Bank Backed by […] Elon Musk went after Bitcoin hater Warren Buffett recently, sharing what looked like a bullish crypto quote attributed to the billionaire investor. The tech entrepreneur, whose comments on social media have been moving crypto markets this year, later removed the post with the obviously fake Buffett statement. Elon Musk Finds Buffett’s ‘Best Financial Advice’ Tesla […]

Elon Musk went after Bitcoin hater Warren Buffett recently, sharing what looked like a bullish crypto quote attributed to the billionaire investor. The tech entrepreneur, whose comments on social media have been moving crypto markets this year, later removed the post with the obviously fake Buffett statement. Elon Musk Finds Buffett’s ‘Best Financial Advice’ Tesla […] Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Though its billionaire owner has personally spoken out against digital assets many times, Berkshire Hathaway's investment may indicate the firm is more open to the idea.

Brazilian digital bank Nubank has raised $500 million from Berkshire Hathaway, a multinational holding company run by billionaire Warren Buffett.

In an announcement from Nubank on Tuesday, the digital bank said the $500 million investment would be used to continue its international expansion — the company recently launched in Colombia — as well as attract new executives from major tech companies. Nubank reported it has more than 40 million customers in Brazil, Mexico and Colombia.

Nubank CEO David Vélez said the funding would help in “democratizing access to financial services” across Latin America. He said that only half the people in the region have bank accounts, with roughly 21% using credit cards.

“No one thought it was possible to change the financial system, but we were always convinced that there was room for disruption and innovation and, more importantly, that customers deserved better service,” said Vélez.

Buffett has personally spoken on Bitcoin (BTC) and other cryptocurrencies previously, saying they “basically have no value” and that he will never own any himself. In a shareholders meeting last month, vice chair Charlie Munger referred to crypto as “useful to kidnappers and extortionists.”

However, over the last year, the multinational conglomerate has invested in more firms related to technology and beyond, including cloud technology company Snowflake. Berkshire Hathaway also holds billions of dollars worth of Apple and Amazon stock as of March 31.

Former Governor of California Arnold Schwarzenegger has confirmed that he does not invest in bitcoin or any other cryptocurrencies. He says that he is “like Warren Buffett” in that he does not invest in things he does not understand. The CEO of Berkshire Hathaway thinks bitcoin is “rat poison squared.” Arnold Schwarzenegger Not Investing in […]

Former Governor of California Arnold Schwarzenegger has confirmed that he does not invest in bitcoin or any other cryptocurrencies. He says that he is “like Warren Buffett” in that he does not invest in things he does not understand. The CEO of Berkshire Hathaway thinks bitcoin is “rat poison squared.” Arnold Schwarzenegger Not Investing in […]

Berkshire Hathaway CEO Warren Buffett and company vice chairman Charlie Munger are sending a clear message that they are not fans of cryptocurrencies despite the meteoric rise of the emerging asset class. During the company’s recent annual shareholder meeting, the Oracle of Omaha dodges a question regarding the $2 trillion valuation of cryptocurrencies as he […]

The post Warren Buffett Dodges $2 Trillion Crypto Question As Partner Munger Says Bitcoin Is Bad for Civilization appeared first on The Daily Hodl.