Congressman Warren Davidson has introduced the Evaluating Defi Opportunities Act to foster data-driven regulations for decentralized finance (defi). He stressed the importance of safeguarding innovation and user privacy while addressing concerns over potential overregulation. This proposed study by key financial regulators seeks to balance defi’s growth with oversight, ensuring the sector’s competitive edge and resilience […]

Congressman Warren Davidson has introduced the Evaluating Defi Opportunities Act to foster data-driven regulations for decentralized finance (defi). He stressed the importance of safeguarding innovation and user privacy while addressing concerns over potential overregulation. This proposed study by key financial regulators seeks to balance defi’s growth with oversight, ensuring the sector’s competitive edge and resilience […]

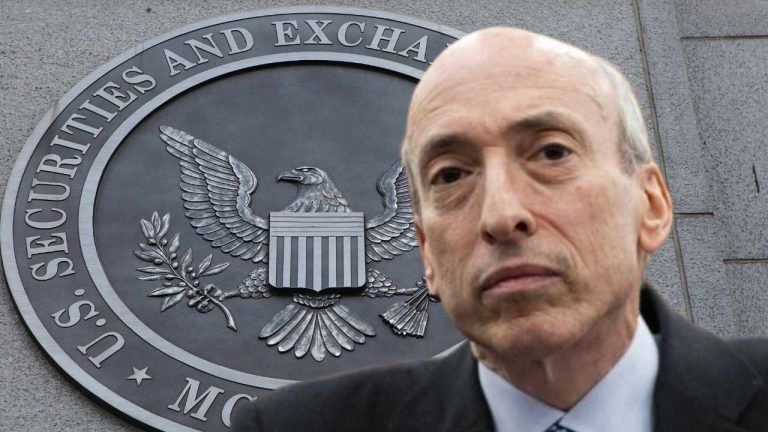

The United States Securities and Exchange Commission chief was asked whether the purchase of Pokemon trading cards is a security transaction and whether Bitcoin is a commodity.

Blamed for “kneecapping” the U.S. capital markets and slammed for dodging questions around Bitcoin and Pokemon cards, Gary Gensler appears to have had one hell of a grilling from Congress this week.

On Sept. 27, the United States Securities and Exchange Commission chief again found himself in front of lawmakers in a scheduled hearing to discuss his agency’s oversight of the markets.

Here are some of the highlights and lowlights of the hearing.

One of the more colorful analogies came from United States Representative Andy Barr, who accused Gensler of “kneecapping” the U.S. capital markets with regulatory red tape.

Barr referred to an old testimony from Gensler, where Gensler argued that the U.S. is the largest, most sophisticated and innovative capital market in the world and that it shouldn’t be taken for granted as “even gold medalists must keep training.”

“With all due respect Mr. Chairman, if the U.S. capital markets are a gold medalist, you are the Tonya Harding of securities regulations,” said Barr.

“You are kneecapping the U.S. capital markets with the avalanche of red tape coming out of your Commission.”

Barr is presumably referring to a scandal where U.S. ice skater Tonya Harding hired an assailant to attack her rival, Nancy Kerrigan, in the lead-up to the 1994 United States Figure Skating Championships and the Winter Olympics. Kerrigan ended up not competing in the U.S. championships.

Mr. Barr to Gensler:

— John Dickens (@johnLdickens) September 27, 2023

“If the US capital markets are a gold medalist, you are the Tonya Harding of securities regulation because you are kneecapping the US capital markets…”

pic.twitter.com/D9VOxtXAGC

Meanwhile, U.S. Representative Warren Davidson also ripped into Gensler, saying he hoped that the Biden administration would fire him.

“I wish the Biden administration would say you're fired,” said Davidson.

Davidson accused Gensler of pushing a “woke” political and social agenda and abusing his role as the SEC’s Chair.

Gary Gensler’s tenure at the SEC highlights two key problems.

— Warren Davidson (@WarrenDavidson) September 27, 2023

1) @GaryGensler problem

2) @SECGov structural problem

That’s why I introduced the SEC Stabilization Act to #FireGaryGensler and restructure the SEC. pic.twitter.com/Ud3giejKfZ

The U.S. representative added that he hopes the SEC Stabilization Act he introduced with U.S. Representative Tom Emmer could make that happen.

“You’re making the case for this bill [SEC Stabilization Act] every day you’re acting as the Chairman,” he concluded.

Gensler wasn’t given the chance to respond.

Asked by U.S. House Committee on Financial Services chair Patrick McHenry whether Bitcoin is a security, Gensler eventually relented, stating that Bitcoin didn’t meet the Howey Test.

“It does not meet the Howey test which is the law of the land,” Gensler said, implying that Bitcoin isn't a security.

McHenry then suggested Bitcoin must be a commodity, which Gensler avoided answering, saying the test for that is outside the scope of U.S. securities laws.

Gary Gensler says that #Bitcoin is NOT a security, but he refuses to say that it’s a commodity.

— The ₿itcoin Therapist (@TheBTCTherapist) September 27, 2023

He’s running out of time. When a powerhouse like BlackRock asks for a Bitcoin ETF you MUST deliver. pic.twitter.com/yhKcMzfzx6

Henry also suggested Gensler tried to “choke off the digital asset ecosystem” and refused to be transparent with Congress about the SEC’s connections with FTX and its former CEO Sam Bankman-Fried.

Gensler also wasn’t given the chance to respond to the claims made by McHenry.

U.S. Representative Ritchie Torres used his time to quiz Gensler about his interpretation of what constitutes an investment contract.

Torres put Gensler to the test by asking whether purchasing a physical Pokemon trading card constitutes a securities transaction.

I cross-examined @SECGov Chair Gary Gensler about the term 'investment contract', which is key to determining his authority over crypto.

— Rep. Ritchie Torres (@RepRitchie) September 27, 2023

Gensler struggled to answer basic questions like whether an investment contract requires a contract. His evasions are deafening and damning. pic.twitter.com/EJcZEHiKGL

“Suppose I was to purchase a Pokemon card. Would doing so constitute a security transaction?”

Gensler responded — “I don’t know what the context is” — before eventually concluding it isn’t a security if it is purchased in a store. Torres then asked:

“If I were to purchase a tokenized Pokemon card on a digital exchange via a blockchain, is that a security transaction?”

“I’d have to know more,” replied Gensler.

Related: Coinbase crypto lobbying campaign to focus on 4 swing states

Gensler then explained that it’s when the investing public can anticipate profits based upon the efforts of others — that’s the core of the Howey Test. Representative Torres called Gensler's "evasions" as "deafening and damning."

Meanwhile, among the back-and-forth cross-examinations between Gensler and U.S. Representatives, eagle-eyed observers noticed a Coinbase “Stand With Crypto” logo behind the SEC Chair.

BREAKING: Coinbase Stand with Crypto logo displayed at Gary Gensler hearing pic.twitter.com/IAwqyDEQea

— Miss Teen Crypto (@missteencrypto) September 27, 2023

The Coinbase-led initiative is a 14-month-long campaign that launched in August. It aims to push for cryptocurrency legislation in the U.S.

Coinbase also ran a “Stand with Crypto Day,” which took place in Washington, D.C. on Sept. 27 to advocate for better cryptocurrency innovation and policy.

Magazine: Binance, Coinbase head to court, and the SEC labels 67 crypto-securities: Hodler’s Digest, June 4-10

Republican Congressman Warren Davidson is calling for an outright ban on central bank digital currencies (CDBCs) as he foresees the government using the asset to exert more control over the general population. In response to a job advertisement by the Federal Reserve Bank of San Francisco seeking to recruit a senior crypto architect specializing in […]

The post Representative Warren Davidson Calls for Swift Ban of CBDCs, Says Fed Creating ‘Financial Equivalent of Death Star’ appeared first on The Daily Hodl.

“Money should not be programmable by a central authority,” argues Republican Representative Warren Davidson.

United States Republican Representative Warren Davidson has spoken out against Central Bank Digital Currencies (CBDCs), urging Congress to ban them and criminalize its development.

In a July 23 Twitter post, Congressman Davidson accused the Federal Reserve of “building the financial equivalent of the Death Star," stating that CBDCs corrupts money into a tool for coercion and control, adding:

“Congress must swiftly ban then criminalize any effort to design, build, develop, test or establish a CBDC.”

Davidson’s comments came in response to a position advertised by San Francisco’s Federal Reserve Bank for a “senior crypto architect” to work on a CBDC project.

The Federal Reserve is building the financial equivalent of the Death Star.

— Warren Davidson (@WarrenDavidson) July 23, 2023

Central Bank Digital Currency (CBDC) corrupts money into a tool for coercion & control.

Congress must swiftly ban then criminalize any effort to design, build, develop, test or establish a #CBDC. pic.twitter.com/9JWiyj5H2f

Responding to a comment from a Twitter user, Davidson argued that money should be a stable store of value, and should not be programmable by a central authority.

“Sound money should facilitate permission-less peer-to-peer transactions,” he added.

The Federal Reserve has been actively researching the technology for a potential digital dollar but has not made any decisions on whether to issue one. The possibility of a digital version of the U.S. dollar has stirred controversy in the country and is expected to be a key talking point in the upcoming presidential election.

Congressman Davidson is also not alone in his concern over a potential Fed-controlled digital dollar.

On July 14, U.S. presidential candidate and Florida Governor Ron DeSantis said he would “nix any central bank digital currency” if he became president. In May, DeSantis signed a bill restricting the use of CBDCs in the state.

Related: IMF’s CBDC push gets feedback from the crypto community — ‘No one wants this’

Republican Tom Emmer has also been vocal in his warnings over state-controlled digital money. In March, the libertarian think tank said a programmable CBDC would be “easily weaponized” as a spying tool to “choke out politically unpopular activity.”

Emmer introduced the CBDC Anti-Surveillance State Act in February to “halt efforts of unelected bureaucrats in Washington, DC from stripping Americans of their right to financial privacy.” The bill was endorsed by Texas Senator Ted Cruz who introduced his own CBDC blocking bill in March.

Magazine: Crypto regulation — Does SEC Chair Gary Gensler have the final say?

"U.S. capital markets must be protected from a tyrannical Chairman, including the current one," Congressman Warren Davis wrote in reference to SEC head Gary Gensler.

United States Congressman Warren Davidson has introduced the "SEC Stabilization Act" into the House of Representatives, announced June 12. One of the bill's main provisions is to fire Securities and Exchange Commission (SEC) chair Gary Gensler.

Davidson said in a statement:

"U.S. capital markets must be protected from a tyrannical Chairman, including the current one. That's why I'm introducing legislation to fix the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come. It's time for real reform and to fire Gary Gensler as Chair of the SEC."

Davidson declared his intention to introduce the bill earlier this year.

This is a breaking news story, and further information will be added as it becomes available.

References to the tax were removed from the U.S. debt bill, but that doesn’t mean it’s gone for good.

Bitcoin (BTC) miners in the United States can breathe a sigh of relief after a proposed tax on crypto mining did not make it into a bill to raise the U.S. debt ceiling that appears set to pass.

The Digital Assets Mining Energy (DAME) excise tax proposal sought to charge crypto miners a tax equal to 10% of the cost of the electricity they used for mining in 2024, before scaling up to 30% in 2026.

The tax was highly controversial, with critics arguing that it had the potential to increase global emissions as a result of miners being forced to go overseas where countries may produce more emissions during energy production.

Additionally, Bitcoin miners seek out cheap energy, and as one of the cheapest sources of energy is excess renewable energy, Bitcoin miners can actually incentivize its production by providing utilities with a buyer for energy that would otherwise be wasted.

The news broke after Bitcoin miner Riot Platforms vice president of research Pierre Rochard noted on May 28 that the proposed bill did not include any mention of the DAME tax, which Representative Warren Davidson replied was “one of the victories” of the bill.

Yes, one of the victories is blocking proposed taxes.

— Warren Davidson (@WarrenDavidson) May 29, 2023

While much of the online discussion around the news suggested the proposal was “dead,” others, such as Coin Metrics co-founder Nic Carter, highlighted that it was only temporarily defeated, alluding to the possibility of it being included in future bills.

Bitcoin mining "DAME" tax defeated (for now)

— nic carter (@nic__carter) May 29, 2023

Biden CEA, specifically Heather Boushey, hold this L https://t.co/hJgZ7oUGub

Carter suggested later in a May 29 Twitter thread that the administration would likely attempt to sneak it into some omnibus bill and would already have done so if it had the political currency to do so.

But bills are required to pass both through Congress and the House, and considering the Republican party is generally opposed to increases in taxes and currently controls the House, it seems unlikely such an omnibus bill would be able to make it to the president’s desk.

While speaking to Chamber of Digital Commerce founder and CEO Perianne Boring during a May 20 fireside chat at the Bitcoin 2023 conference in Miami, Senator Cynthia Lummis assured viewers that the DAME tax “isn’t going to happen.”

Lummis added that ensuring Bitcoin mining firms remain in the U.S. was important for both national security and energy security, highlighting how Bitcoin mining can both reduce gas flaring emissions and help stabilize the energy grid.

Cointelegraph contacted the White House asking whether it planned to continue pursuing the DAME tax but did not receive a response.

In response to questions from Cointelegraph, Bitcoin miner Marathon Digital Holdings CEO Fred Thiel suggested that, regardless of whether President Joe Biden’s administration decides to keep pursuing the DAME tax, it will continue its anti-crypto agenda, saying:

“I think it is clear that this administration will continue to broadly oppose the crypto sector, and even if this specific tax is no longer on the table, it is likely not the last of misguided, targeted efforts to bring this industry down.”

Many from within the crypto industry and even some U.S. lawmakers agree with this take, arguing that, among other measures, the U.S. government is making a coordinated effort to discourage banks from working with crypto firms — aka Choke Point 2.0 — under the guise of ensuring the financial system remains stable and safe.

When businesses make long-term decisions, they generally seek to reduce risk. So, given the choice of operating in a region with clear, crypto-friendly policies compared to one where regulations are unclear, and there is a greater potential for policies that hurt the competitiveness of U.S.-based activity, firms will generally choose the former.

Thiel highlighted how the actions of the U.S. government and regulators weigh in on business decisions while speaking to Cointelegraph, saying, “Regardless of the DAME tax’s likelihood of passing, Marathon has already begun diversifying the locations of our operations.”

Asia Express: Yuan stablecoin team arrested, WeChat’s new Bitcoin prices, HK crypto rules

Thiel added that “with regulation around mining being so nebulous,” his firm has made the strategic decision not to concentrate its footprint in the U.S. but rather diversify its operations.

He pointed to a May 9 announcement from his firm, which said it would be building two new mining facilities in Abu Dhabi.

Abu Dhabi is a region that has made a concerted effort to attract crypto-related investment via its clear regulatory regime, which has been hailed as pro-market.

A U.S. lawmaker has announced that he is introducing legislation to remove the Securities and Exchange Commission (SEC) chairman in order to “correct a long series of abuses.” The SEC, under Chair Gary Gensler, has been heavily criticized for its enforcement-centric approach to regulating the crypto industry. Lawmaker Seeks to Remove SEC’s Chairman U.S. Congressman […]

A U.S. lawmaker has announced that he is introducing legislation to remove the Securities and Exchange Commission (SEC) chairman in order to “correct a long series of abuses.” The SEC, under Chair Gary Gensler, has been heavily criticized for its enforcement-centric approach to regulating the crypto industry. Lawmaker Seeks to Remove SEC’s Chairman U.S. Congressman […]

Congressman Warren Davidson (R-Ohio) is introducing legislation aimed at replacing Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC). The congressman took to Twitter to respond to a quote from SEC Commissioner Hester Peirce, who recently announced her dissent against Chair Gensler’s anti-crypto agenda. Says Davidson, “To correct a long series of abuses, […]

The post Ohio Senator Moves To Fire SEC Chair Gary Gensler After ‘Long Series of Abuses’ in New Bill appeared first on The Daily Hodl.

Several U.S. lawmakers and a commissioner with the U.S. Securities and Exchange Commission (SEC) have voiced concerns about the securities regulator expanding its crypto enforcement unit. “The SEC is a regulatory agency with an enforcement division, not an enforcement agency.” Lawmakers Oppose SEC’s Crypto Enforcement Focus A number of lawmakers and a commissioner with the […]

Several U.S. lawmakers and a commissioner with the U.S. Securities and Exchange Commission (SEC) have voiced concerns about the securities regulator expanding its crypto enforcement unit. “The SEC is a regulatory agency with an enforcement division, not an enforcement agency.” Lawmakers Oppose SEC’s Crypto Enforcement Focus A number of lawmakers and a commissioner with the […] Eight U.S. lawmakers have sent a letter to the chairman of the U.S. Securities and Exchange Commission (SEC) regarding how the agency collects information from crypto companies. According to the crypto community, the SEC’s “requests” for information “are overburdensome, don’t feel particularly voluntary, and are stifling innovation.” US Lawmakers Want Answers From SEC U.S. Representatives […]

Eight U.S. lawmakers have sent a letter to the chairman of the U.S. Securities and Exchange Commission (SEC) regarding how the agency collects information from crypto companies. According to the crypto community, the SEC’s “requests” for information “are overburdensome, don’t feel particularly voluntary, and are stifling innovation.” US Lawmakers Want Answers From SEC U.S. Representatives […]