Coinbase plans to tokenize $COIN stock in renewed security token push

Key Takeaways

- Coinbase is reviving plans to tokenize its $COIN stock and other securities in the US following the SEC’s creation of a new crypto task force.

- Tokenized securities offer investors benefits such as voting rights and profit-sharing while improving transaction efficiency.

Share this article

Coinbase is renewing its effort to tokenize its own stock $COIN as part of a broader push to bring security tokens to the US market, an initiative it first attempted in 2020 but abandoned due to regulatory hurdles.

With a newly formed crypto task force at the SEC, the company sees a renewed opportunity to integrate blockchain-based securities into traditional finance.

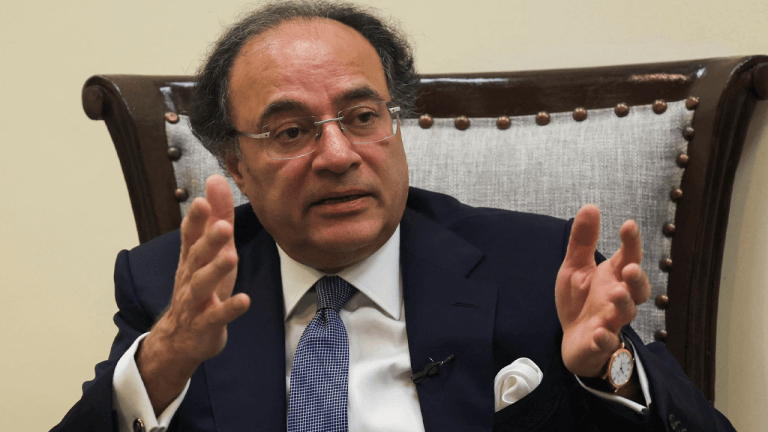

The crypto exchange company’s Chief Financial Officer Alesia Haas expressed optimism about regulatory developments during the Morgan Stanley TMT Conference.

“I now believe that our US regulators are looking for product innovation and looking to move forward,” Haas said.

Haas revealed that Coinbase had initially planned to go public by issuing a security token representing its $COIN stock, aligning with its vision of integrating blockchain into traditional finance.

However, regulatory hurdles, including the lack of US exchanges licensed to trade security tokens and the need for additional approvals, forced the company to abandon the plan in favor of a traditional direct listing in April 2021.

The company now sees potential to expand its offerings, with Haas suggesting that they could introduce internationally available products to the US market, which are already widely used by crypto traders globally.

Security tokens, which operate like traditional securities but trade on blockchain networks, can provide investors with voting rights and profit-sharing mechanisms while improving transaction efficiency.

This renewed push follows earlier regulatory challenges, including the SEC’s lawsuit against Coinbase, which accused the company of operating as an unregistered exchange, broker, and clearing agency.

However, the SEC officially requested to dismiss the case with prejudice, meaning it cannot be refiled, signaling a major shift in regulatory sentiment.

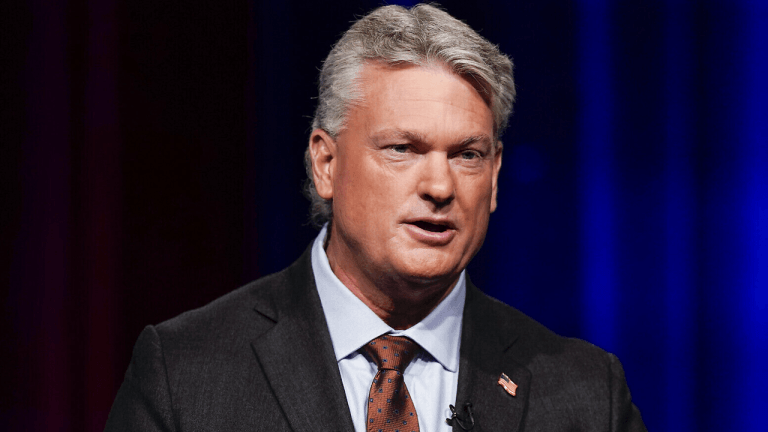

Coinbase CEO Brian Armstrong has highlighted the potential benefits of tokenized securities, stating that they could offer consumers the ability to trade around the clock.

The company previously detailed its commitment to digital securities infrastructure in its 2020 S-1 filing and has developed a Blockchain Token Securities Law Framework for compliance purposes.

Armstrong is set to participate in the first White House Crypto Summit with President Donald Trump on Friday, highlighting the growing dialogue between the crypto industry and policymakers.

Share this article

Go to Source

Author: Estefano Gomez