$9 trillion Charles Schwab survey finds 45% of respondents plan to invest in crypto ETFs

Key Takeaways

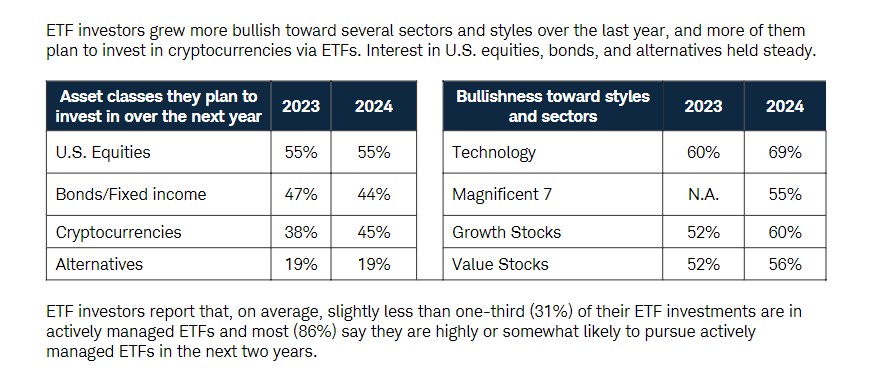

- 45% of ETF investors plan to invest in cryptocurrency ETFs in 2024.

- Millennials show a higher risk appetite with a major shift towards equities and crypto.

Share this article

A new survey conducted by Charles Schwab, a leading publicly traded US brokerage managing over $9 trillion in client assets, has shown that 45% of respondents expressed intentions to invest in Bitcoin and crypto ETFs over the next year.

Bullish sentiment towards crypto assets has increased among ETF investors compared to the previous year. In 2023, only 38% of respondents said they planned to invest in crypto ETFs in the following year.

The shift in ETF investment trends reflects growing investor confidence in crypto assets. Still, US equities are investors’ top picks, with 55% planning investments in 2025. Meanwhile, interest in bonds remains relatively stable, with 44% of investors saying they plan to pour money into bond ETFs.

Investment strategies also diverge among generations, according to the findings. Millennials show a higher propensity for risk with 62% of respondents in this group planning to invest in crypto ETFs over the next year.

Gen X also showed interest in crypto ETFs, with 44% of respondents planning to invest in these products. In contrast, only 15% of Boomers care about these ETFs.

The millennial generation is also more likely to invest with their values and customize their portfolios. Compared to other generations, they are more likely to invest in direct indexing next year due to their higher interest in direct indexing.

The surge in crypto ETF interest comes at a time when the ETF market has enjoyed rapid adoption, likely influenced by the launch of US spot Bitcoin and Ethereum ETFs. These ETFs have reported growing holdings over the past eight trading months.

These approved crypto ETFs provide investors with an additional regulated avenue to gain exposure to Bitcoin. According to Bloomberg ETF analyst Eric Balchunas, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Bitcoin ETF (FBTC) rank among the top 10 ETF launches this year.

Share this article

Go to Source

Author: Vivian Nguyen