Beyond crypto: Zero-knowledge proofs show potential from voting to finance

An emerging cryptographic technology may provide help with two gaping 21st-century needs: Privacy and truth.

In a world increasingly

If privacy is a top priority, ZK-proofs should be considered, Remo Nyffenegger, a co-author of the St. Louis Fed paper cited above and research assistant at the Center for Innovative Finance at the University of Basel, tells Magazine.

Indeed, the European Central Bank published a regulatory proposal for the digital euro in late June and states therein that zero-knowledge proofs should be considered in the CBDC tech stack, he adds.

Again, there may be limits on what exactly ZK-proofs can do by themselves. I dont see using ZK-proofs [alone] as sufficient because ongoing political discussions show that not all CBDC-related data will be obfuscated if ZK-proofs are used, Gross comments. High privacy also needs to be supported by regulation and educational efforts around the actual degree of privacy of a CBDC.

Exposing an altered photo

AI apps are now so powerful that distinguishing between machine-generated images or documents and those created by human beings is already problematic. Things will only get worse, but ZK-proofs may offer at least a partial remedy.

Blockchain tech and ZK-proofs could be used as built-in safeguards in these systems to verify the origin, authenticity, and ownership of AI-generated files and manage some of the risks associated with AI-generated content, says Malkhi, while Groth adds:

There is interesting new research showing applications of ZK-proofs to demonstrate, for example, youve not altered a photo too much i.e., combating fake news.

High-end cameras that digitally sign photos along with metadata like location and timestamp are already on the market and can establish authenticity, continues Malkhi. The current problem is that these digital files are often enormous much too large to post on a news services website, for instance.

But with ZK-proofs, their file size can be substantially reduced, making them practical to use online while preserving critical verification elements. It could prove that the recording or image has not been altered, maybe [including] even the date, without revealing identity or location or whatever, adds Baylina.

Proof-of-solvency with ZK-proofs?

Many believe that finance will be the first major business sector to be impacted by ZK-proofs. Indeed, 41% of respondents in Mina Foundations State of Zero-knowledge Report 2022 agreed that finance was the industry most in need of ZKPs, far ahead of healthcare (12%), social media (5%) and e-commerce (3%).

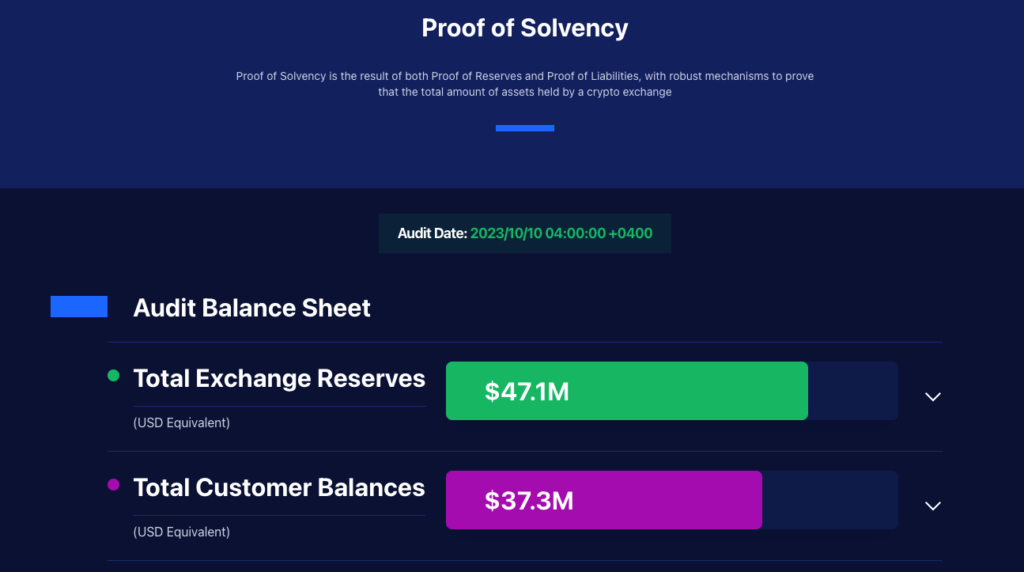

In March, Mexican cryptocurrency exchange Bitso announced a partnership with tech firm Proven to implement a proof of solvency solution that relies on ZK-proofs. This protocol will soon enable investors, regulators and others to know whether the exchange is solvent i.e., its obligations are less than its assets based on daily reports.

One of the more ingenious aspects of Provens protocol is that it involves the exchanges customers in the process of keeping the exchange honest. Its a sort of crowd-sourcing version of auditing.

Co-founders Dewey and Agustin Lebron tell Magazine that every day, an exchange (e.g., Bitso) publishes a cryptographic proof-of-solvency attestation. And when it does, each individual client/user of the exchange is issued a receipt that reflects that individuals unique holdings. Millions of digital receipts might be issued on a daily basis.

What if one day a customer doesnt receive a daily receipt, or its wrong? That user might take to Twitter or some other social media venue and complain or ask questions. Have others experienced something similar? A thread might grow.

This protocol relies on the law of big numbers. Bitso, for instance, has some five million users, and the presumption is that a critical mass of complainants might surface quickly, collectively waving a red flag that might prompt further investigation.

This ZK-proofs-based protocol has another advantage, too, according to Bitso. It provides a proof-of-solvency that can be confirmed without revealing all of that information to a third party. All an auditor needs to do is run the zk-SNARK protocol to come to the conclusion that the proof is true.

According to Groth, the use of ZK-proofs to demonstrate financial solvency gained more traction after the FTX implosion. Indeed, if such a protocol had been available last year, the Bahamas-based exchanges meltdown might have been avoided, some say or at least its wrongdoing would have come to light sooner.

Interestingly, FTX Japan, now rebranded as Liquid Japan, has been using Provens proof-of-solvency technology since its recent re-launch in early September. With the adoption of Proof of Solvency, we can now prove it [solvency] in a cryptographic manner that is verifiable by 3rd parties, notes the company, adding:

We are starting to work on increasing the frequency of publishing the Proof of Solvency to 1x day by the end of 2023.

Immutable tracking of goods

ZK-proofs can become very relevant in the context of digital identities, whether they are issued by the government or private entities, adds Nyffenegger. They could prove that you are not included on some government sanctions list without revealing who you are, for instance.

ZK-proofs potential use in supply chains is also frequently cited. But the difficulty here, as with e-voting, is that this requires connecting to a trustworthy real-world information source, which can authenticate the date an order was shipped from the factory, for instance.

ZK-proof-based supply chain tracking systems havent been battle-tested long enough in live environments, notes Malkhi, adding that that could soon change:

The potential of ZK-proofs here is vast helping to improve transparency and reduce the potential impact of fraud by enabling the immutable, real-time tracking of goods.

It should be added that while blockchains provide some of ZK-proof’s first exciting use cases, the technology does not require blockchain technology to work but they are surely helpful.

They are just a very suitable tool for blockchains because they provide proofs of correct computation which aligns well with the need for verifiability on blockchains while hiding as much information as possible, Johannes Sedlmeir, a researcher at the University of Luxembourgs Interdisciplinary Centre for Security, Reliability and Trust, tells Magazine.

With a blockchain platform, a verifier can check if a certain hash appears somewhere on the blockchain and hence binds me as a prover, he adds.

Blockchains arent required for Provens proof-of-solvency protocol to work, Lebron tells Magazine, though its always useful to have validators on-chain. It appears to be more of a like to have than a need to have circumstance.

Obstacles remain

What obstacles still need to be overcome before ZK-proofs become commonplace? Malkhi has already cited the challenges with bridging to the real world, and this would well prove the biggest hurdle to surmount before ZK technology becomes mainstream, in her view.

However, other barriers remain that might require laws and regulations to overcome. Will ZK claims be accepted in court, for instance?

Scaling also remains a challenge in many use cases given that there is, at present, no standardized way to program, says Malkhi, making it difficult for developers to integrate proofs into their apps.

To this last point, Provens protocol with Bitso requires some five million unique receipts to be issued monthly (though soon daily) to Bitso users, but Proven says this isnt an issue. We figured out how to scale, co-founder Lebron says.

Complexity is another potential sticking point. For small- to medium-size assertions, we already have a good ZK system, cryptographer Groth tells Magazine. For large assertions, we still need to improve efficiency. ZK-proofs like SNARKs can be cheap to verify, but the prover pays a large performance overhead compared to native computation, he adds.

Becoming magnitudes cheaper

The user experience needs to improve, too. Using a technology secured by ZK-proofs for an everyday activity like buying groceries should be so seamless that the user doesnt even know, says Baylina.

The other thing we need is time, Baylina says. Protocols like Polygons zk-Ethereum Virtual Machine are still new but are becoming more usable all the time. As Polygon zkEVM matures, over the next year, we anticipate it will become orders of magnitudes cheaper.

Given these potential roadblocks, how long might it take before the technology becomes commonplace?

I believe five years is too short of a time frame owing to the current TRLs [technology readiness levels] of ZK-proofs, says Sedlmeir, referencing the finance sector specifically. While ZK-proofs have matured rapidly in recent years, they are still complex to implement and prover performance is still a significant bottleneck.

There might be a transition period as ZK-proof works in tandem with traditional protocols, as in financial auditing. Provens Dewey envisioned working hand in glove with traditional Big Four audit firms for a time.

Vast potential

In sum, ZK-proofs still face challenges. They cant work in isolation. They still need to be attached to a truth source or oracle. Doubts about computational complexity, usability and scalability remain as well.

But if these hurdles are surmounted, ZK-proofs could offer a 21st-century solution to not only the fake news challenge but also the privacy quandary as with CBDCs, providing just enough anonymity for users to comfortably use state-issued digital money but enough accountability so governments can be assured fraudsters or money launderers arent infiltrating their networks.

As the technology and the underlying infrastructure improve, summarizes Malkhi, ZK-proofs have vast potential to enable an internet where the majority of contracts are underpinned by cryptographic guarantees.

Go to Source

Author: Andrew Singer