Are DAOs overhyped and unworkable? Lessons from the front lines

Many contend that DAOs have failed to deliver on their promises, but developers are coming up with novel solutions.

Ask 10 different people to define a decentralized autonomous organization (DAO), and youll likely get 10 different definitions. But there is at least one thing most agree on: DAO governance is a mess. At best, its an experiment in the works.

According to

Senate founder Paulo Fonseca tells Magazine, At present, its cumbersome for most DAOs to see off-chain and on-chain voting separately on different platforms. One of our products key value-adds is simply for users to consume all the information on one page.

Because governance proposals typically open to vote for a limited duration, Goverland, in turn, is putting a strong emphasis on mobile integration so voters are notified in time. It all starts with an in-time notification. With mobile, its far more convenient to help boost voter participation, Goverland founder Andrey Scherbovich tells Magazine.

Others believe that for DAO governance to improve, it needs to go beyond pure token-based voting based on duty. JokeRace, a voting protocol that aims to make governance fun, was designed with this goal in mind.

Instead of expecting thousands of tokenholders to vote, JokeRace is exploring the use of incentivized contests that allow governors to gate voting proposals in any way possible via a highly customizable allowlist, from a fully public forum to select DAO participants. Co-founder Sean McCaffery tells Magazine:

Many DAO projects want to give non-financial utility to their token. What we are doing is opening a horizon on top of simple token voting and incentivizing people to hold tokens for more than just speculative reasons.

For a highly technical proposal that wants to draw on the wisdom of experts or loyal fans, a creator can gate the vote around criteria, such as minimum liquidity provision for three months or holders who have held the token for at least a year. It enables everything from low-commit fun GM contests to serious proposals where only active contributing DAO participants can vote, he adds.

In short, JokeRace strives to reimagine governance right down to the bottom social layer.

Delegate voting

To thwart low voter turnouts, DAOs are also turning to the real world of public governance for wisdom. One such tried-and-true method that has caught on in the past year is delegation, where tokenholders entrust voting rights to delegated politicians or stewards who would vote on their behalf.

From a PR perspective, delegation is nice in that DAOs get to have their cake and eat it, too. It allows the DAO to scale faster without having to pass all decisions through months of debate. DAOs also get to deflect the criticism of insufficient decentralization since tokenholders are technically expressing a demonstrated preference to vote, albeit indirectly.

Most major DAOs today have embraced delegation voting, and while its helped voter apathy to some extent, its hardly a silver bullet. Delegation voting in itself has surfaced with problems. For instance, delegation can descend into a popularity contest where voters simply assign tokens to popular Twitter influencers or familiar company names.

An experiment that could be worth trying is to have delegates vote specifically on their domain expertise rather than making them responsible for voting on every single DAO decision which range from complex technology to finance too wide of a range for robust decision making, Kate Beecroft, governance lead at Centrifuge, tells Magazine.

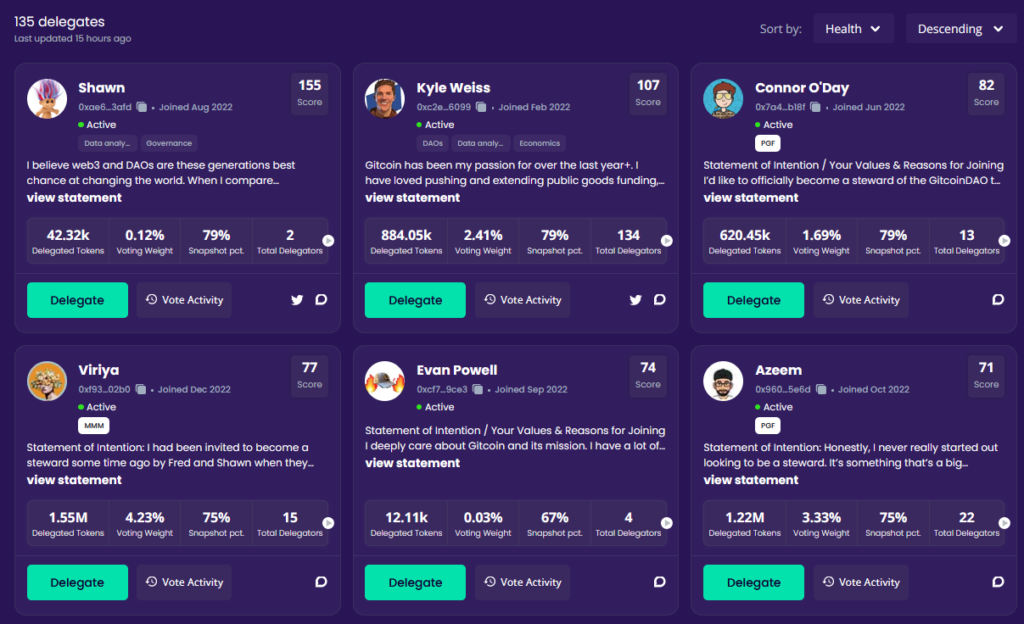

Moreover, delegate voting suffers from apathy in itself. Delegates themselves dont turn up on election day. According to Karmas research, at least 53% of delegates in major DAOs have failed to even cast a single vote. Or it could lead to situations where voting decisions are the result of collusion made behind closed doors for mutual political gain.

For instance, a16z famously delegates voting powers to blockchain university clubs. While the venture fund claims that student clubs are free to participate in governance however they see fit, its not immediately clear what the relationship between these entities is.

Gitcoin founder Kevin Owocki insists that delegating voting is a step forward for DAO governance but also acknowledges its shortcomings. Gitcoin launched a fairly egalitarian airdrop to around 25,500 holders in 2021, but its decision to incorporate delegate voting saw a concentration of voting power back into the hands of only about 100 delegates. On top of that, delegates cycle in and out of activity over time, and even getting tokenholders to reallocate their delegation from inactive delegates every half a year was difficult.

The problem that confronted us was keeping delegates engaged, accountable and slowly changing the DAO into a liquid democracy of dedicated Gitcoin community members that cared about our core vision of decentralized public funding, Owocki states.

These problems are being recognized by builders in the DAO tooling, trying to improve delegate accountability. For example, tools like Karma have emerged to create transparency around delegation voting by aggregating all the information about delegates, including their voting weight, forum activity and voting history, on one page.

The DAOmeter dashboard, a DAO maturity rating index by StableLab, also serves as a useful DAO public good for assessing the decentralization journey of DAOs.

StableLab founder Gustav Arentoft tells Magazine, During the bull market, lots of DeFi DAOs branding themselves as decentralized finance suffered exploits because they lacked even basic governance. The operational structure of these protocols was extremely opaque. As an individual, assessing the decentralization of DAOs was difficult and requires some form of standardized parameters, which is what DAOmeter tries to provide.

Ultimately, despite the popular notion that DAOs are autonomous, the reality is that much of it can never be fully autonomous and enforceable on-chain.

You can have all the on-chain votes youd like, but lots of DAO operations come down to the social layer. Who owns the GitHub account? Who controls the DNS [domain name system]? Who is in-charge of handing over a password to the elected personnel? says JokeRaces McCaffery.

Growth

While DAOs struggle to decentralize, many seem to forget that they are still fundamentally profit-oriented organizations. That means that DAOs cant afford to forget about revenue and growth.

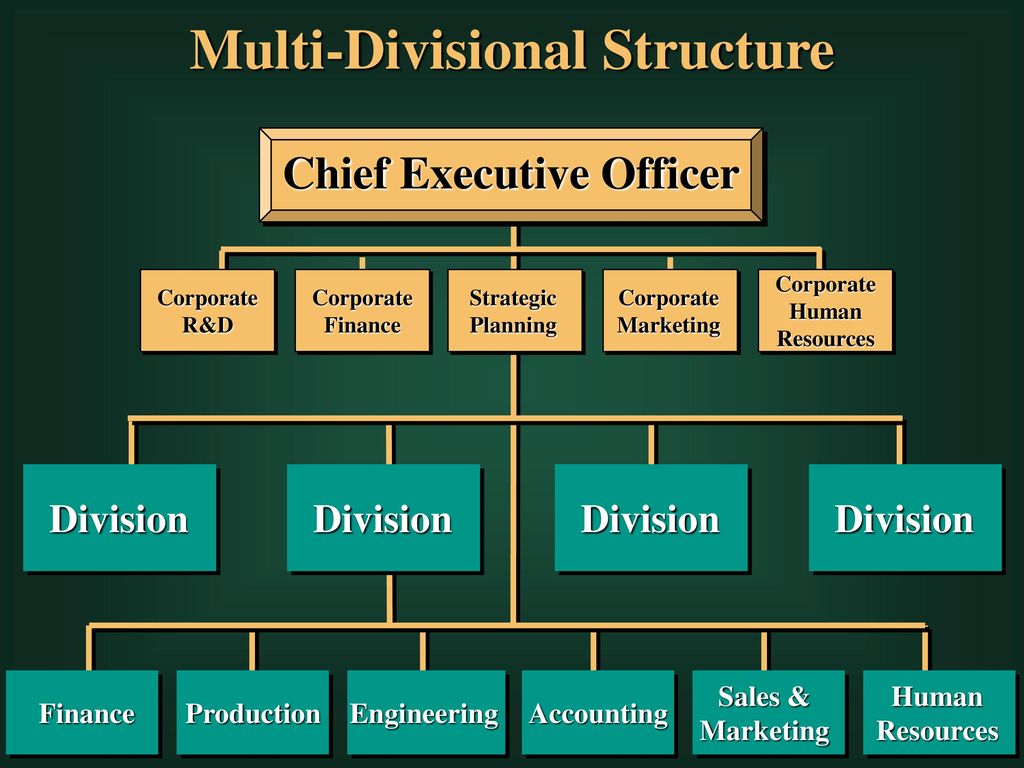

To scale, DAOs centralize some decision-making in the hands of experts. One trendy idea in the past year that DAOs have been experimenting with is working groups. In DAO nomenclature, they also go by subDAOs. Metropolis (previously Orca Protocol) calls them pods. Maker calls them core units, and Gitcoin calls them workstreams.

These structures resemble the ubiquitous M-shaped organizational structures in modern capitalism today. Historically, the capitalist firm was a centralized U-shaped firm with decision-making power concentrated in the hands of a few top executives. As the firm expanded into regional markets, it grew increasingly incapable of managing the rapidly increasing scope of complex administrative decisions.

To remain nimble and adapt as the firm grew, the modern capitalist firm underwent a structural decentralization, empowering mid-level managers with the autonomy to run the local branch as they deem fit. Pioneered by General Motors president Alfred Sloan in the 1920s, this crucial organizational innovation allowed firms to overcome knowledge problems and also aligned the incentives and rewards to lower management, effectively allowing them to work as mini-entrepreneurs within a large corporation.

DAOs are witnessing the same tendency toward a similar organizational structure, except that its evolving bottom-up from a dispersed, decentralized status quo.

James Waugh, co-founder of Fire Eyes DAO, tells Magazine, In advising many DAOs, we sometimes recommend the setup of working groups to focus on certain areas that are hypercritical, particularly those involving technical work where smart contracts need timely upgrading.

Yet its entirely common for redundant working groups to exist and to be a complete waste of time, however. Whether or not theyre efficient really depends on the kinds of people in them.

Decentralization maxis also complain that too many working groups and managerial experts might mean less transparency over how DAOs operate. Its a complaint that isnt completely without merit.

In the early days of Bankless DAO, many internal project managers requested for funds then delivered work of questionable value. We implemented a variety of solutions like reputational systems within Discord, KPI-based funding and timelocks to deter rent seeking, Frogmonkee, an early core contributor of Bankless DAO, tells Magazine.

Ultimately, DAO governance boils down to the fact that DAOs are made up of a pluralistic archipelago of individuals with different value preferences and priorities. Some wish to pump their holdings in the short-term, while others are interested in the long-term health of the project. Some are genuinely altruistic actors, and then there are delegates exchanging favors under the table by agreeing to vote on each others proposals.

Dual governance structures

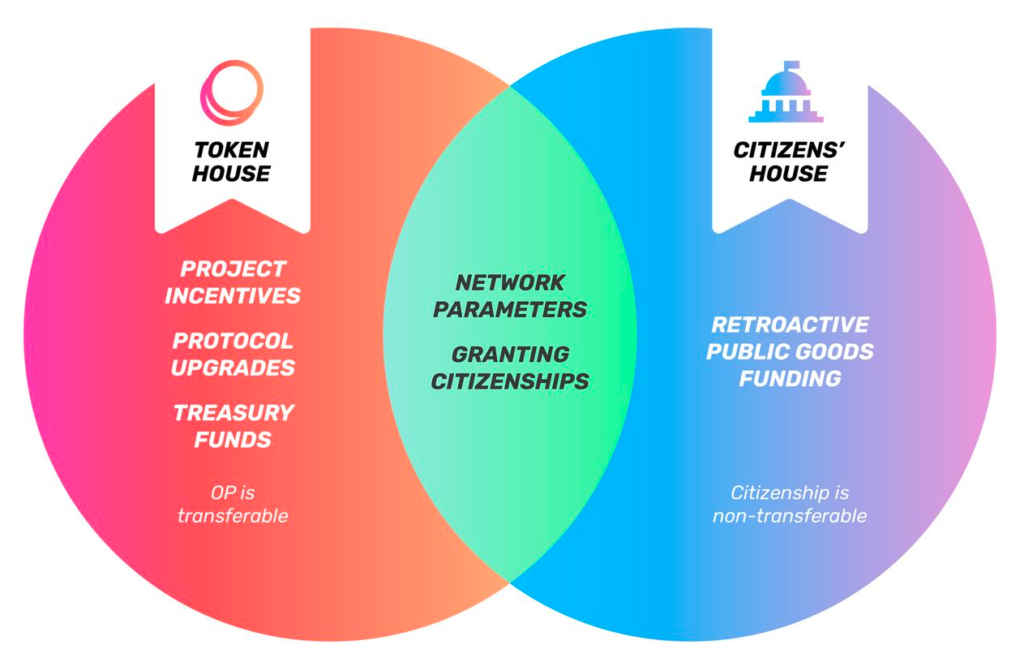

In such a marketplace of conflicting values, a clear separation of powers can help foil potential insider collusion. Some DAOs are actively experimenting with such dual governance models, such as Optimisms Token House and Citizen House. OP tokenholders and delegates occupy the former, while the latter is an identity-based community of citizens with soulbound tokens that acts as a check and balance on the Token House.

Shawn Grubb, a delegate at Gitcoin, tells Magazine, Optimisms experiment with bicameral houses is a smart way to segregate the various stakeholder groups: the tokenholders who care about pumping their bags, the active contributors with a job, and the broader community who believes in Optimism and seeks project funding. The key is balancing the power of different stakeholder groups rather than the plutocratic status quo, where plutocratic tokenholders reserve only the power.

Optimism isnt alone. In recent months, a group of Lido insiders have taken it upon themselves to push for a similar dual-governance model. The problem stems from Lidos wildly successful liquid staking product, stETH, which controls a market share of 32% staked ETH. This poses a looming threat to the underlying security of the Ethereum layer 1, as it comes dangerously close to the 33% consensus threshold, which could theoretically allow Lido to exercise control over Ethereums consensus layer. In June 2022, Lido DAO proved that self-regulation was not forthcoming after it unanimously shot down a vote to self-limit its stake flow.

Lidos proposed dual governance structure would, in theory, bring the DAO back into alignment with the interests of the Ethereum protocol. This is done by granting Lido users (stETH holders) veto power against the DAO, a feature that competitor liquid staking protocol Yearn.finance has also implemented.

For Lido, dual governance (and implementing staking routers) should be its next logical steps. It alleviates many of the current concerns around the DAO, said Hasu on the Bell Curve podcast.

Finding a balance

In sum, DAO governance isnt easy. Driving growth while committing to decentralization is no small feat, and it will take many years before governance reaches equilibrium.

Yet the philosophical principles that blockchain organizations embody decentralization, transparency, egalitarianism are all values very much worth striving for. After all, its unheard of for a multimillion-dollar company in the traditional business world to be debating operational strategies openly on a forum or that allows anyone to enter and begin contributing without going through a tedious interview process.

Even in its imperfect state, the open and transparent context in which DAOs operate is perhaps the biggest bulwark against the centralization of power.

Go to Source

Author: Donovan Choy