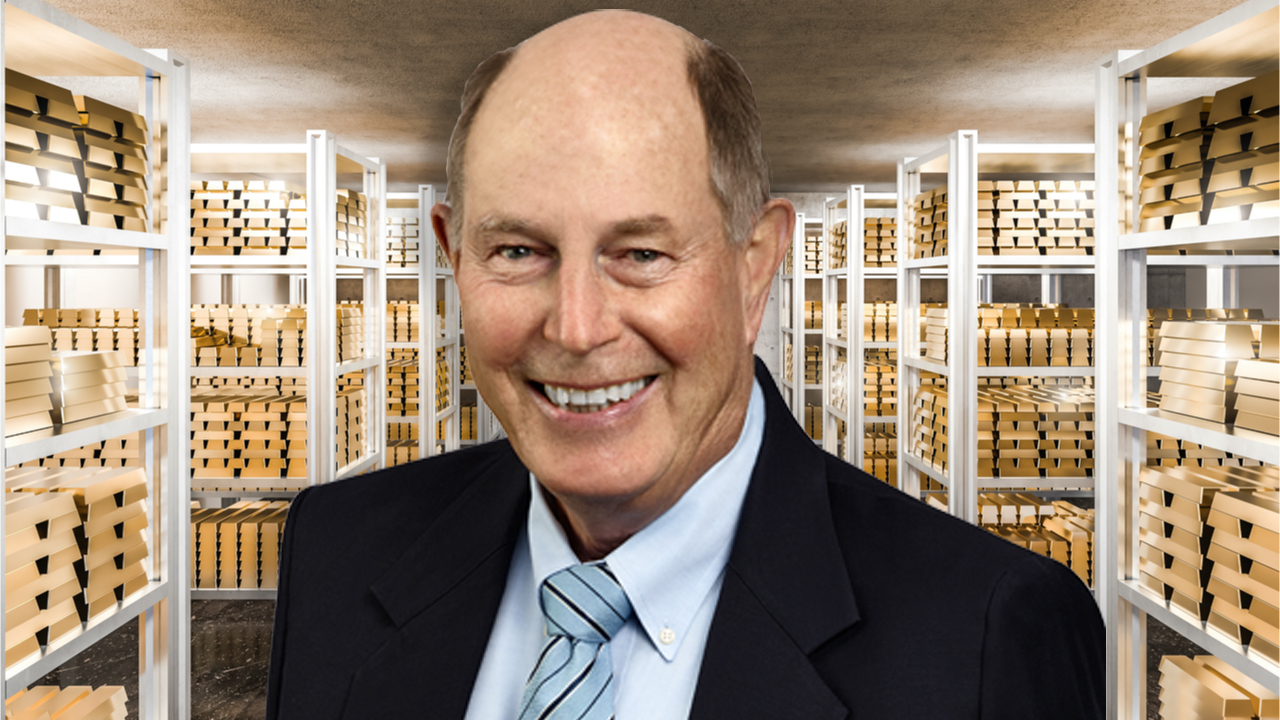

Economist David Dodge Says Gold Is an ‘Antique Instrument,’ Thinks Digitizing the Canadian Dollar Is Interesting

The economist David Dodge, the former seventh governor of the Bank of Canada, says gold is an “antique instrument,” and he believes Canada’s central bank got rid of its gold reserves for this very reason. Despite saying gold is an outdated financial tool, Dodge said that the leading crypto asset bitcoin (BTC) has no place in the Bank of Canada’s reserves.

David Dodge: The Bank of Canada ‘Holding This Antique Instrument of Stability Called Gold Really Didn’t Make Any Sense’

David Dodge, the former seventh governor of the Bank of Canada (BofC), thinks gold is an antiquated payment tool and that it’s costly to store. Dodge spoke with Kitco News correspondent David Lin on Thursday and discussed the shiny yellow precious metal.

According to Dodge, gold is an archaic instrument and Canada’s central bank was correct to get rid of it all. Canada is the only G7 nation that does not hold any gold reserves. The Canadian central bank’s gold-selling trend started in the early 2000s and by 2016, Ottawa had sold most of its gold reserves.

“[The] issue is quite clear, that it costs to hold gold, whereas holding U.S. or Chinese or Euro bonds yields you a return,” Dodge told Lin on Thursday afternoon. “…That was a strong view. And a view that our international monetary system was in a place that was sufficiently robust, that holding this antique instrument of stability called ‘gold’ really didn’t make any sense.”

Dodge Believes in Reducing Transaction Costs, Says the Issue of Digital Currencies ‘Is a Very Important Issue’

Canada followed in the footsteps of the United Kingdom when the region sold half of its gold holdings, or 395 tonnes of gold, between 1999 and 2002. U.K. citizens called the event “Brown’s Bottom,” named after the Chancellor of the Exchequer from 1997 to 2007, Gordon Brown. Canada getting rid of gold was dubbed “Poloz’s Bottom,” named after the ninth BofC governor, Stephen Poloz. Dodge also touched upon digital currencies like bitcoin during his discussion with Kitco News on Thursday.

Dodge doesn’t believe bitcoin (BTC) deserves a spot in the BofC’s reserves, but the former central bank governor did not dismiss crypto assets. “The issue of digital currencies is a very important issue,” Dodge said. “[What] we would like to do, globally and [in Canada], is to reduce transaction costs… [The] Bank and the Department of Finance are working hard… on this issue of digitalizing our financial system to reduce transaction costs… The financial system is interested in digitizing the Canadian dollar.”

What do you think about David Dodge speaking about gold and digital currencies? Do you agree with his opinions? Let us know what you think about this subject in the comments section below.

Go to Source

Author: Jamie Redman