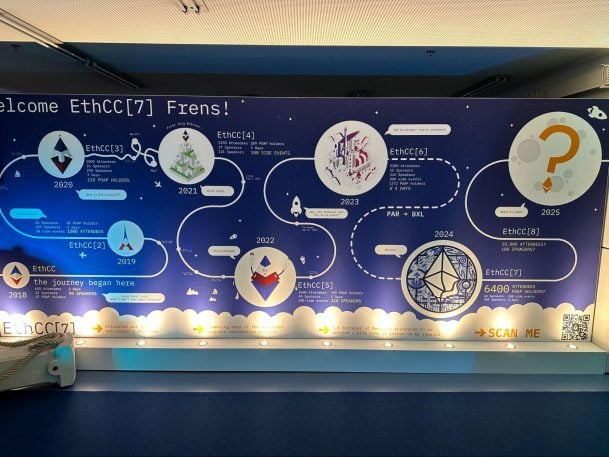

EthCC(7) – The quest for adoption continues

Share this article

Disclaimer. This article is an opinion piece. The views expressed here are those of the author and do not necessarily represent or reflect the views of Crypto Briefing.

EthCC(7) was a conference of contradictions. On the one hand, the market has grown significantly year over year, and so has the conference’s brand. On the other hand, the energy on the floor felt extremely muted.

The bull market vibes have dissipated as Bitcoin dipped below $60,000 and Ethereum spent some time under $3,000. With the overall market cap still sitting over $2 trillion, teams hesitate to return to bear market builder mode, but have struggled with what to do next.

Infrastructure crowds the floor

L1 and L2 took up, what felt like, the majority of the space. There were some old-timers like Starknet and ICP, as well as some others like Mantel and Fuel. If someone felt like taking a trip down memory lane, one could walk by Aragon’s booth.

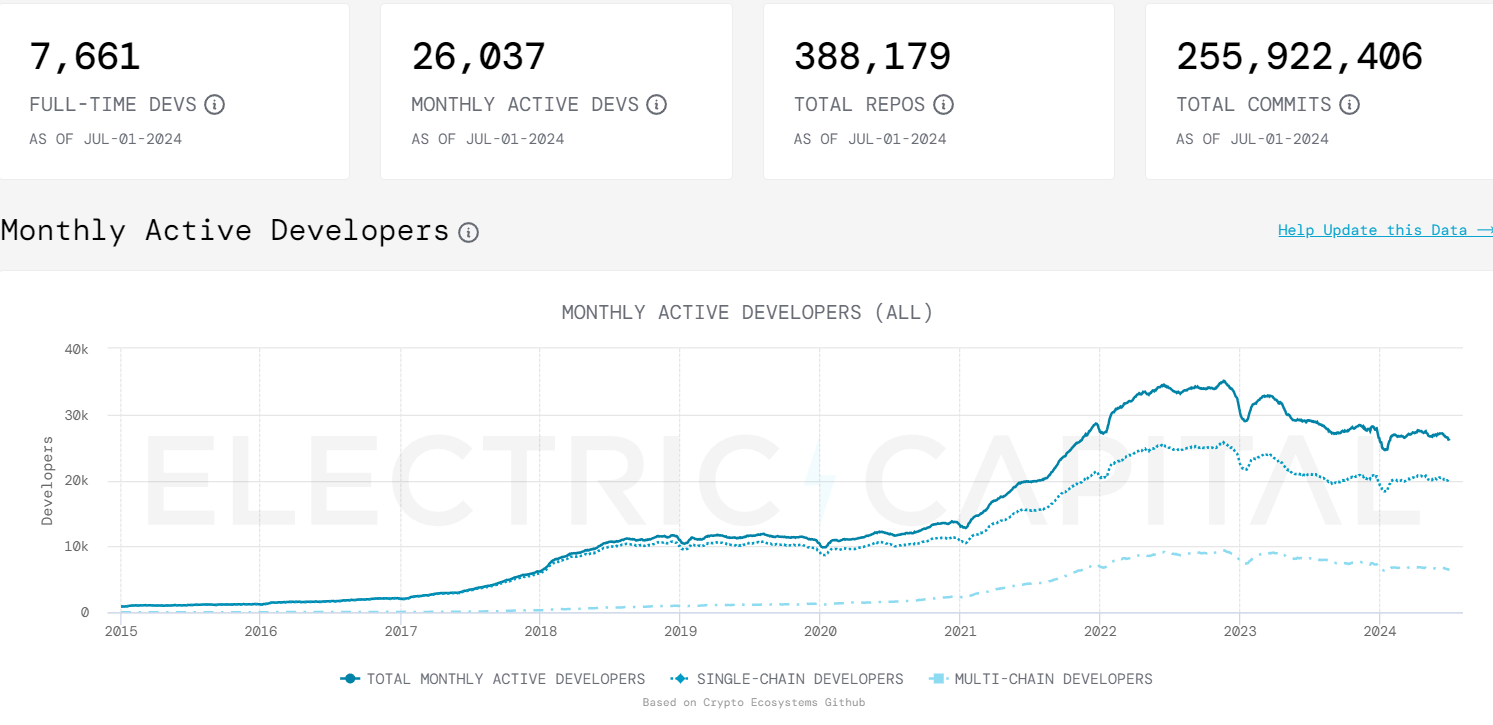

The theme was clear: there is a lot of infrastructure vying for developer attention. Looking at the latest developer report numbers from Electric Capital, there are just over 26K monthly active developers, and with foundations dedicating millions to incentives, this feels like their market.

At the same time, there is not much direction as far as what to build. AI remains a popular buzzword, but AI on its own does not make a consumer application. 1inch was actually one of the few retail-facing companies to make a big appearance, and that was troubling.

AI on everyone’s mind

Combining AI and web3 has been a hot trend over the past 12 months. However, you could hear at ETHCC that the narrative was starting to evolve. If previously a lot of the proposed utilization focused on DePIN and data markets, this week there was talk of model execution.

This could potentially create an opening for ecosystems like ICP and Near, which have been drifting a bit out of the industry’s view. A focus on AI can once again justify architecture choices and bring them to the forefront of developers’ minds.

Right now a lot of AI use cases, as far as web3, are either hypothetical or B2B focused, which may limit the impact of progress in the area on the ecosystem as a whole. Nevertheless, AI remains a key narrative for the industry.

The games have disappeared

Notably, while most ecosystems have put together some form of a gaming strategy, there were very few games at the conference itself. This is understandable as studios are struggling with user acquisition and token launches.

Many of the conference rooms were named after games, but ironically these were names of old school web2 games. The absence of gaming studios combined with this homage was like a silent commentary on the state of the sector.

The biggest exception was the fully onchain gaming (FOCG) segment. Not only was FOCG represented heavily at the Starknet booth, but there were plenty of side events and a builder house to visit outside of the main venue.

The enthusiasm of the teams coupled with game demos created a sense of progress that was much needed at the conference. It feels like years of R&D exercises and iterations are finally leading us somewhere.

FHE is the shiny new thing

The crypto community seems to always be looking for the next big thing. With DePIN, AI, and modularity stalling somewhat, FHE is looking to bring back the feeling of paradigm-shifting technology.

Zama, which had a booth on the floor, looked well positioned to play on the narrative. The team is well capitalized, by some of the top VCs, and it managed to get Fhenix and Inco to use its tech, positioning itself as the dominant entity in the space.

While current capabilities are not very scalable, the team says there are already companies building with the product. This gives hope that as the scalability limitations are addressed, the technology could find more widespread adoption.

Looking for users

Widespread consumer adoption remains an elusive goal, but Telegram and TON could offer a way forward. While TON had no booth at the conference, the trending Telegram mini apps seemed to be on everyone’s mind.

The impressive success of idle clickers on TON, has teams looking at Telegram as the new go-to user acquisition platform. During the conference it was announced that 1inch, Notcoin and Sign have partnered to run a TON accelerator program.

Excited to be part of @ton_blockchain‘s first builder-driven acceleration program alongside @thenotcoin and @ethsign 🦾🧠 https://t.co/YqH7wl7GD1

— 1inch Network (@1inch) July 10, 2024

The current trend has mini-apps onboarding millions of users at low cost in a very short amount of time. However, retention rates appear to be low, and converting these new users to other applications has not been properly tested yet.

If Telegram and TON succeed in onboarding millions of new users to web3, we may finally see the rise of consumer applications in the industry. This in turn, would catalyze the organic utilization of the infrastructure that was being pushed so heavily during the conference.

Where do we go from here

The next EthCC, set to be hosted in Cannes, raises expectations for a major event. However, 12 months is a long time, and there is a cloud of uncertainty hanging over the industry. We need to find consumer adoption soon.

However, there is a sense of greater acceptance in the space that can help drive the search for product market fit. The presence of Solana, Polkadot, ICP, TON and others brought back, if only a little, the sense that we all share the same goal.

The industry keeps moving forward, and hopefully now, we can start showing the rest of the world what we’ve been so excited about all these years because a great user experience is worth more than a thousand words about “why blockchain?”.

Ilya Abugov (@AbugovIlya)

Disclaimer: This commentary is not investment advice. It does not purport to include any recommendation as to any particular investment, transaction or investment strategy, or any recommendation to buy or sell any investment. It does not reflect any attempt to effect any transactions or render any investment advice.

This post is solely for informational and entertainment purposes. It is inherently limited and does not purport to be a complete discussion of the issues presented or the risks involved. Readers should seek their own independent legal, tax, accounting, and investment advice from professional advisors. The views reflected in this commentary are subject to change at any time without notice.

The authors or their affiliates have ownership or other economic interests or intend to have interests in BTC, ETH, SOL, and may have ownership or other economic interests or intend to have interests in other organizations and/or crypto assets discussed as well as other crypto assets not referenced.

Share this article

Go to Source

Author: Ilya Abugov