Ethereum reaches all-time high volume of $38B as Eric Trump voices bullish sentiment

Key Takeaways

- Ethereum reached a record daily spot trading volume of $38 billion.

- Eric Trump publicly expressed optimism about Ethereum’s investment potential.

Share this article

Ethereum reached a record $38 billion in daily spot trading volume, while Bitcoin logged its third-highest volume at $49 billion, according to David Lawant, Head of Research at FalconX.

Unsurprising but for the record:

ETH hits an all-time high spot volume of $38b yesterday, while BTC notches its third-highest at $49b pic.twitter.com/KiL8H9VPE6

— David Lawant (@dlawant) February 4, 2025

The surge in trading activity coincided with a volatile price movement for Ethereum, which dropped to an intraday low of $2,152 before recovering to $2,919.

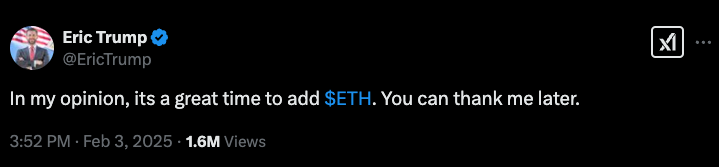

Eric Trump, son of the current US president, expressed optimism about Ethereum on social media, stating, “In my opinion, it’s a great time to add $ETH. You can thank me later.”

In this context, the volume spike for both leading crypto assets aligns with broader market dynamics.

While Ethereum set a new all-time high in spot trading volume, Bitcoin’s activity remained below its historical peak.

The chart, tracking trusted spot exchange volumes from 2017 to February 2025, highlights these movements.

Ethereum’s recent surge stands out as it surpasses its previous records, reflecting heightened interest from investors and traders.

Bitcoin’s volume, although substantial, stayed within familiar ranges, suggesting steady demand rather than a major breakout event.

This divergence emphasizes Ethereum’s growing role in the market as a focus of speculative activity during periods of increased volatility.

In November, Ethereum’s onchain volume soared to $7.1 billion amid a market uptick, the highest in 2024, fueled by significant ETF inflows and a US electoral outcome.

Yesterdays Eric Trump’s positive bull-post on Ethereum coincided with World Liberty Finance transferring significant ETH amounts to Coinbase.

Share this article

Go to Source

Author: Germán Frers