FTX 2.0 coming up, Multichain FUD and Worldcoin raises six figures: Hodler’s Digest, May 21-27

FTX reboot is in the works, Multichain issues spark uncertainty and Sam Altman’s crypto project Worldcoin raises millions of dollars.

Top Stories This Week

Binance suspends deposits for bridged tokens, seeks clarity from Multichain team

Crypto exchange Binance

Fahrenheit wins bid to acquire assets of crypto lender Celsius

Crypto consortium Fahrenheit won the bidding war for insolvent crypto lender Celsius Network. The bid incorporates Celsius assets previously valued at nearly $2 billion, including institutional loan portfolio, staked cryptocurrencies, mining unit, alternative assets, and over $450 million in liquid cryptocurrency. Behind the consortium are the venture capital firm Arrington Capital and crypto miner US Bitcoin Corp. While Celsius and its creditors have accepted the bid, regulatory approval is still required to complete the acquisition. Celsius filed for bankruptcy protection in July 2022, contributing to a prolonged crypto winter in the industry.

Bitcoin Pizza Day 2023: Community celebrates anniversary of first known BTC transaction

Earlier this week, the crypto community celebrated the 13th anniversary of the first Bitcoin transaction when developer Laszlo Hanyecz made the first documented purchase of a good with BTC. The exchange involved 10,000 BTC worth $41 at the time and two pizzas from a local restaurant in Florida. The milestone turned into an annual celebration for the crypto space, with community members reminiscing on how far the industry has come since the transaction. Over a decade on, the pioneer cryptocurrency network faces a new wave of disruption thanks to the advent of Ordinals, highlighting the need for developers and capital to build layer-2 solutions.

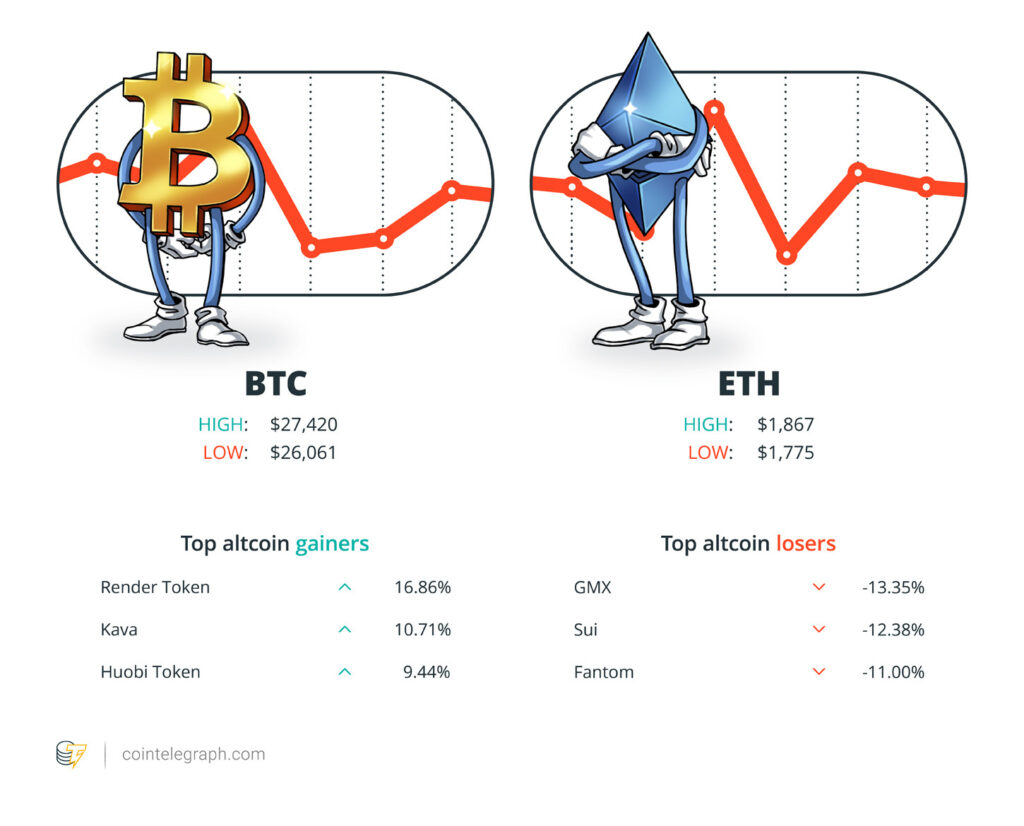

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $26,737, Ether (ETH) at $1,831 and XRP at $0.46. The total market cap is at $1.12 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Render Token (RNDR) at 16.86%, Kava (KAVA) at 10.71% and Huobi Token (HT) at 9.44%.

The top three altcoin losers of the week are GMX (GMX) at -13.35%, Sui (SUI) at -12.38% and Fantom (FTM) -11.00%.

For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

I dont think many people understand the concept of other people owning their data, so I think blockchain will be a big deal in the future.

Gary Vaynerchuck, crypto entrepreneur

Dont overload Ethereums consensus.

Vitalik Buterin, co-founder of Ethereum

You have every right to do Bitcoin. The only reason these people in Washington dont like it, is because they dont control it.

Ron DeSantis, governor of Florida

This experience [with Ledger Recover] has been very humbling. […] We understand the communitys direction and apologize for the miscommunication.

Pascal Gauthier, CEO of Ledger

[Bitcoin is] so decent. There is no marketing department, there is no foundation, theres no incentive. Thats why it is grassroots decentralized and most decentralized driven.

Muneeb Ali, CEO of Trust Machines

By embracing AI responsibly, we can transform policies to better serve our societies.

Sabin Dima, CEO of Humans.ai

Prediction of the Week

Bitcoin holds $20K realized price as analyst eyes big moves coming

Bitcoin is at 10-week lows, but one longtime analyst is telling investors to ignore the panic.

In a Twitter update on May 25, Philip Swift, creator of data resource LookIntoBitcoin and co-founder of trading suite DecenTrader, eyed a BTC price breakout still in progress. A lot of panic in the market today, Swift summarized.

BTC/USD is currently testing the mettle of key moving averages against a backdrop of traders downside targets extending to $25,000 and below, Cointelegraph reported. Even Swift believes that Bitcoin could still return to as low as $20,000 in the coming months, despite remaining bullish on higher timeframes.

Zooming out, bitcoin is actually performing well and as expected for this stage of cycle. A clear BTC breakout above Realized Price, he added, referring to the aggregate price at which the BTC supply last moved. It currently sits at just above $20,000, according to LookIntoBitcoin.

FUD of the Week

DeFi protocol WDZD Swap exploited for $1.1M: CertiK

DeFi protocol WDZD Swap was recently exploited for $1.1 million worth of Binance-Pegged Ether. According to a report from blockchain security firm CertiK, a known exploiter labeled Fake_Phishing750 by BSCScan created the contract that later drained the tokens from the protocol. Once the malicious contract was created, the attacker used it to perform nine transactions that drained the funds from the Swap LP contract where the ETH had been deposited. Fake_Phishing750 was responsible for an attack on another protocol called Swap X, CertiK stated.

ETH can be both a security and a commodity, former CFTC commissioner says

Ethereum’s native token, Ether, may be both a commodity and a security, the former commissioner of the United States Commodities Futures Trading Commission, Dan Berkovitz, has claimed. The CFTC regulates futures and swaps on commodities, while the SEC solely regulates securities. However, if something is a commodity in the eyes of the CFTC as well as a security under the SECs definition, its entirely possible for both regulatory bodies to have jurisdiction over it.

Binance denies fund mismanagement allegations, calls it conspiracy theory

Binance denied allegations of mismanagement of customers funds, in response to a Reuters report claiming the crypto exchange commingled customers funds with company revenue. As per Reuters’s sources, Binance allegedly blended billions of dollars of corporate revenue and customer funds between 2020 and 2021, with the majority of commingling taking place on accounts held at now-bankrupt Silvergate Bank. On Twitter, Binance chief of communication Patrick Hillmann called the report 1000 words of conspiracy theories.

Best Cointelegraph Features

Getting a home loan using crypto collateral: Insane or just risky?

Crypto investors are often wealthy on paper but can’t get a home loan from a bank. But putting your Bitcoin up as collateral for a mortgage is super risky.

Ethereum is woefully undervalued but growing more powerful: DeFi Dad, Hall of Flame

DeFi Dad has dabbled in everything from selling cameras to delivering food, but it was his crypto insights that amassed him a whopping 152,100 followers on Twitter.

Crypto City: Guide to Osaka, Japans second-biggest city

Decentralized ledger technology is arguably everything that AI is not: transparent, traceable, trustworthy and tamper-free. Could it offset the opaqueness of AIs black-box solutions?

Go to Source

Author: Editorial Staff