FTX advisors billed the bankrupt firm for a whopping $103M in Q1

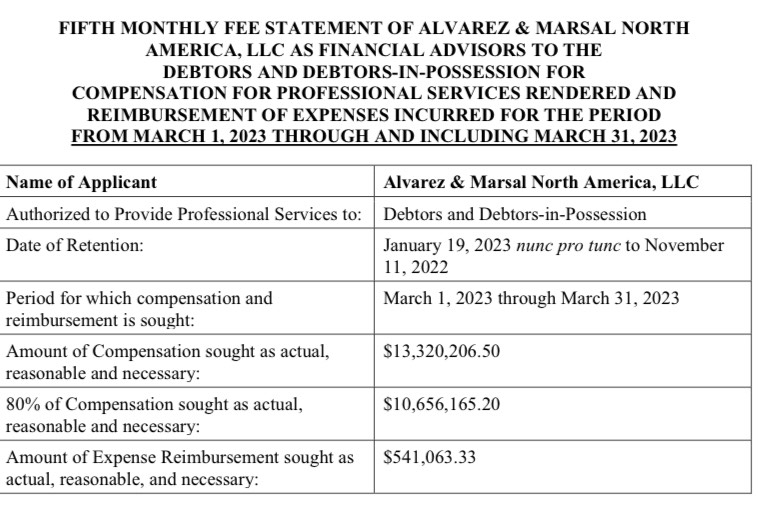

After Sullivan & Cromwell, Consulting firm Alvarez & Marsal billed the second largest invoice for its finance and accounting work.

The lawyers and consulting firms assisting cryptocurrency exchange FTX through its bankruptcy proceedings are set to cash in a total of $103 million over the first quarter.

March saw five firms — Sullivan & Cromwell, Alvarez & Marshal, AlixPartners, Quinn Emmanuel Urquhart & Sullivan and Landis Rath & Cobb — bill FTX a combined $36.4 million according to several court filings between April 28 and May 2.

The invoices from March were slightly higher than January and February’s figures of $34.2 million and $32.5 million respectively.

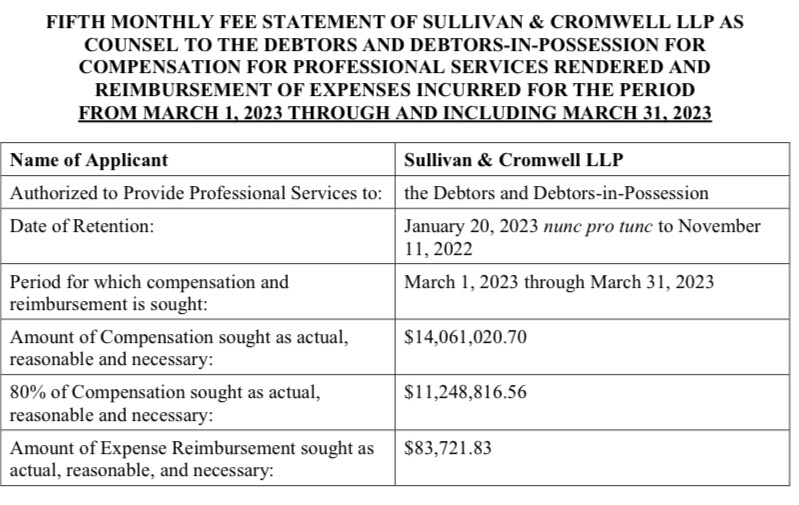

New York-based law firm Sullivan & Cromwell again walked away with the biggest paycheck, billing $14.1 million in fees and expenses for March, adding to a total of $44.4 million over the first quarter.

Partners at the firm took home $2,165 per hour while paralegals and legal analysts were paid $425 and $595 per hour for their contributions.

Consulting firm Alvarez & Marsal came in next, invoicing over $13.8 million in March for the tens of thousands of hours it collectively committed to avoidance actions, financial analysis and accounting procedures.

It was the third successive billing of over $10 million for the firm, which has served as FTX’s restructuring advisor since Sam Bankman-Fried’s former empire filed for bankruptcy on Nov. 11.

Fellow law firms Quinn Emmanuel Urquhart & Sullivan and Landis Rath & Cobb respectively billed FTX $3.19 million and $644,000 in March for respective totals of $7.3 million and $1.9 million over the first quarter.

As Landis Rath & Cobb serve as FTX’s special counsel, the firm has spent most of its hours in the courtroom attending court hearings and undergoing litigation procedures.

Over 180 lawyers from Sullivan & Cromwell, Quinn Emmanuel Urquhart & Sullivan and Landis Rath & Cobb have been assigned to work on the FTX case.

Related: Sam Bankman-Fried’s holding company files for bankruptcy

Forensics consulting firm AlixPartners invoiced its largest bill at $4.51 million in March, totaling $10.2 million over the quarter for the firm’s work in analyzing decentralized finance products and tokens in FTX’s possession.

Despite a severely troubled six months, FTX hasn’t put the nail in the coffin yet.

With $7.3 billion in assets recovered FTX’s legal team is eyeing a potential reboot of the trading platform as early as April 2024.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

Go to Source

Author: Brayden Lindrea