FTX pursues $244M clawback from ‘wildly inflated’ Embed acquisition deal

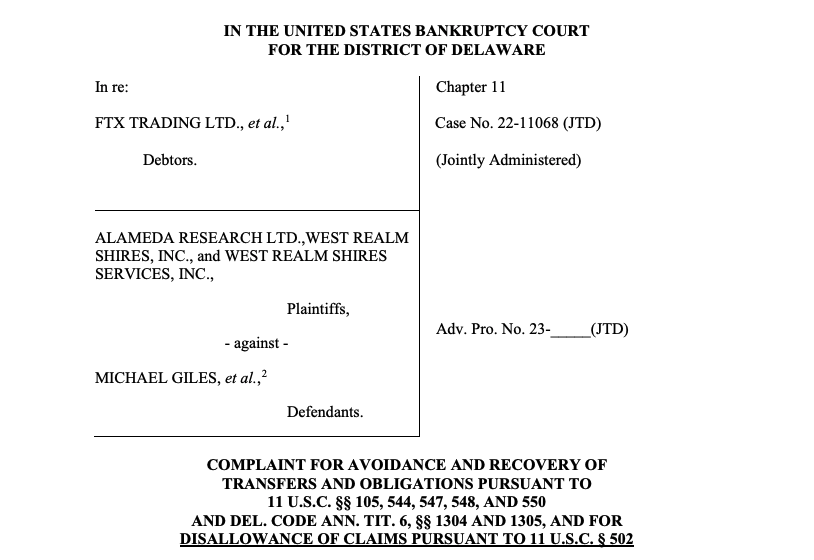

FTX lawyers want to claw back $243.7 million from Embed insiders and executives, claiming its former leadership paid a “wildly inflated” price for the company.

FTX’s leadership is looking to claw back more than $240 million from insiders and executives that benefited from FTX’s “wildly inflated” acquisition of stock-clearing platform Embed in September.

Cointelegraph reported yesterday that a lawsuit was filed against former FTX CEO Sam Bankman-Fried and other top FTX insiders on May 17 concerning the Embed acquisition, which they allege was conducted without enough due diligence.

However, on the same day, a separate lawsuit was filed seeking to claw back funds from Embed’s CEO Michael Giles and its shareholders, accusing FTX of paying a “wildly inflated” price of $220 million for the stock-trading platform.

According to the filing, Embed’s own Chief Technology Officer Laurence Beal was stunned that FTX paid so much for the company after one short meeting with Giles. In correspondence with another senior employee at Embed, Beal described FTX’s due diligence process with a cowboy emoji.

“I get a sense that they are [cowboy emoji] over there.”

As part of the purchase, FTX also paid Embed employees a total of $70 million in retention bonuses. The majority of that sum — $55 million — was paid to Giles, who later became concerned about how he would justify this amount to other employees.

Between the day that Giles signed the acquisition agreement on June 10, 2022, and the closing of the acquisition on September 30, 2022, he was being paid a staggering $490,000 each day, assuming that he worked seven days every week. He was also awarded an additional $103 million when the deal closed, due to his standing as Embed’s largest shareholder.

Back at you @Brett_FTX @SBF_FTX @ramnikarora and team. Excited for @Embedded to join @FTX_Official https://t.co/LttYxEFR7L

— Michael Giles (@Harland) June 21, 2022

This amount stands in stark contrast to Giles’ normal salary of $12,500 per month as Embed’s CEO.

Despite a number of Embed employees being awarded retention payment agreements, Giles was the only one who was paid his full retention bonus on the closing date. The other employees were obligated to remain at Embed for two years if they wished to receive their full bonuses.

As a result of these disproportionate payouts to Embed insiders, FTX will now seek to claw back $236.8 million from Giles and Embed executives as well as an additional $6.9 million from Embed’s smaller shareholders.

Related: Lawsuit against FTX celebrity promoters gets backup from former exec

Additionally, lawyers accused FTX insiders of taking “advantage of the FTX Group’s lack of controls and recordkeeping to perpetrate a massive fraud” by using misallocated funds to facilitate the purchase of Embed, while being fully aware that the company was insolvent when finalizing the deal.

FTX filed for Chapter 11 bankruptcy protection on Nov. 11, 2022. The firms’ new leadership — headed by bankruptcy attorney John Ray III — has been focused on clawing back funds to repay customers and creditors. More recently, FTX lawyers considered a possible reboot of the exchange.

Cointelegraph contacted Embed CEO Michael Giles for comment did not receive a response by time of publication.

Magazine: Cryptocurrency trading addiction — What to look out for and how it is treated

Go to Source

Author: Tom Mitchelhill