Global crypto trading volume set to surpass $108 trillion in 2024: Coinwire

Key Takeaways

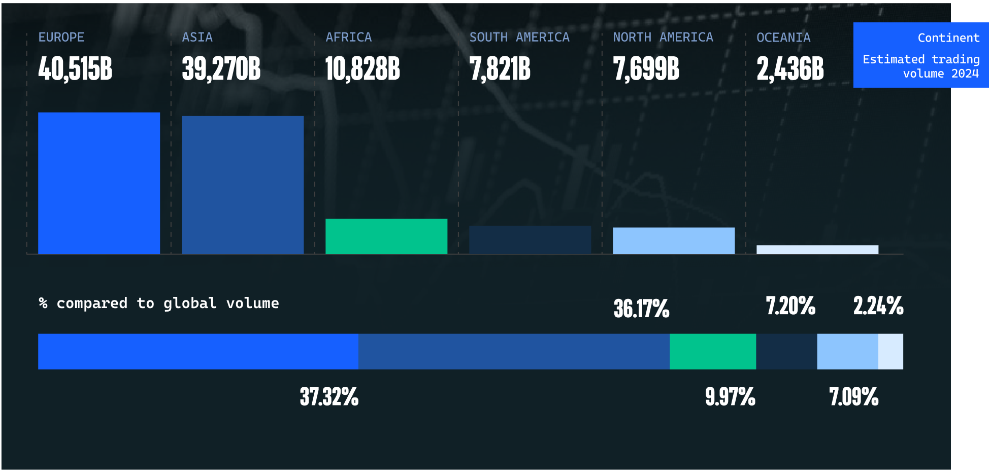

- Global crypto trading volume estimated to exceed $108 trillion in 2024, up 90% from 2022.

- Europe leads global crypto transaction value at 37.32%, followed by Asia at 36.17%.

Share this article

Global crypto trading volume in 2024 is estimated to exceed $108 trillion, nearly 90% higher than in 2022, according to a Coinwire report. The US holds the top spot for the highest estimated crypto trading volume in 2024, surpassing $2 trillion.

Crypto trading volume has increased by 42% since 2023, with the market expanding by 89% over the past three years. This growth reflects the increasing acceptance and adoption of digital assets worldwide, the report highlighted.

Europe leads in crypto trading, accounting for 37.32% of global transaction value, with Russia and the United Kingdom amounting to the largest volumes in the region. Turkey and India rank 2nd and 3rd globally, respectively, with both countries boasting trading volumes exceeding $1 trillion.

Asia ranks second in global crypto transaction value, contributing 36.17%. The region’s rapid uptake is attributed to high mobile penetration, robust tech infrastructure, and rising institutional interest.

Binance maintains its position as the most widely used crypto exchange, dominating in 100 out of 136 countries. The exchange reported a trading volume of $2.77 trillion, significantly outpacing its competitors.

Other notable exchanges include OKX and CEX.IO, leading in 93 and 92 countries respectively, with trading volumes of $759 billion and $1.83 billion. Coinbase Exchange and Bybit follow, dominating 90 and 87 countries, with volumes of $662 billion and $1.14 trillion respectively.

These figures highlight the competitive landscape of crypto exchanges and the growing importance of digital assets in the global financial system.

Earlier this year, crypto funds achieved a record $30 billion in trading volume, predominantly influenced by US spot bitcoin ETFs.

Last month, bitcoin’s value surpassed $67,000, nearing the $1.38 trillion market cap of silver, with significant contributions from Ether and BlackRock’s bitcoin ETF.

Recently, an economist discussed how investments in AI might lead to subdued crypto returns, yet highlighted a potential $20 trillion economic boost from combining AI and crypto by 2030.

Earlier this month, the transaction volume of the top three stablecoins exceeded Visa’s 2023 monthly average of $1.2 trillion, underscoring the rising prominence of stablecoins.

Crypto Briefing reported that despite the FTX collapse and regulatory hurdles, centralized exchanges dominated 2023’s $36 trillion crypto trading, fueled by optimism for US Bitcoin ETFs.

Share this article

Go to Source

Author: Gino Matos