Grayscale Investments adds Aave trust to its crypto product suit

Key Takeaways

- Grayscale’s Aave Trust offers a novel approach to investing in decentralized finance.

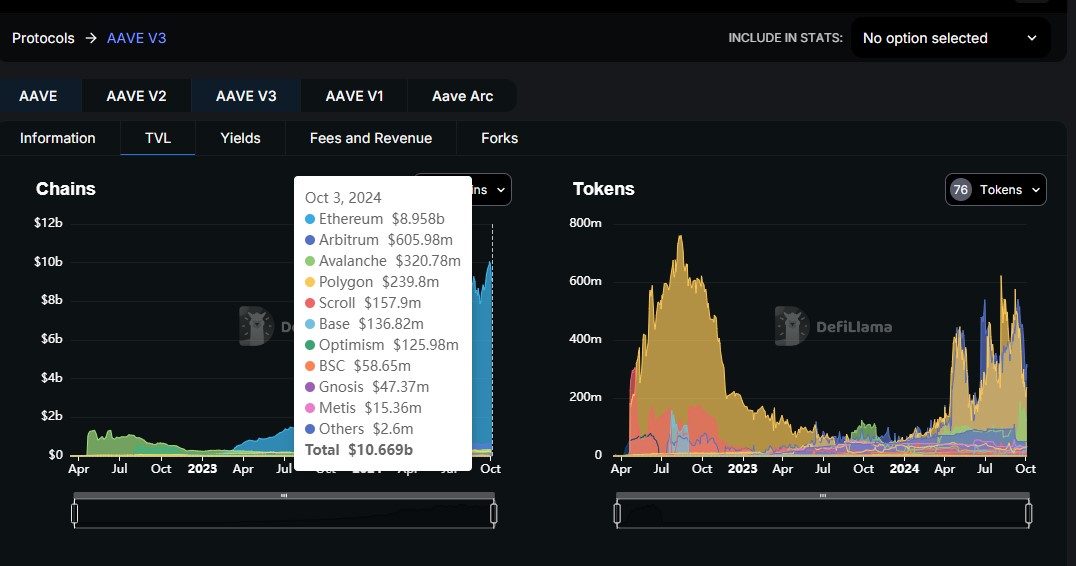

- Aave’s platform leads in crypto lending with significant total value locked.

Share this article

Grayscale announced today it is launching the Grayscale Aave Trust, a new investment product that provides investors with access to AAVE, the governance token for Aave’s platform.

The AAVE token is on Grayscale’s list of the top 20 tokens expected to excel this quarter. The list also includes Sui (SUI) and Bittensor (TAO), for which Grayscale just launched trust products in August, namely the Grayscale Sui Trust and the Grayscale Bittensor Trust.

Grayscale believes Aave has the potential to revolutionize traditional finance by leveraging blockchain technology and smart contracts.

“Grayscale Aave Trust gives investors exposure to a protocol with the potential to revolutionize traditional finance,” Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary, said. “By leveraging blockchain technology and smart contracts, Aave’s decentralized platform aims to optimize lending and borrowing while removing intermediaries and reducing reliance on human judgment.

Grayscale is known for its diverse range of crypto investment products. Aave Trust follows the debut of numerous single-asset investment trusts earlier this year, including Avalanche Trust, Near Trust, Stacks Trust, and XRP Trust.

The Aave Trust is now open for daily subscription to eligible individual and institutional accredited investors. It functions similarly to Grayscale’s other single-asset investment trusts.

Grayscale’s Aave Trust launched amid the strong growth of Aave V3. According to data from DefiLlama, Aave V3’s total value locked has surpassed $8.9 billion on Ethereum, up over 160% from around $3.3 billion at the start of the year.

Aave V3 features several key improvements to enhance Aave’s functionality and user experience. New functionalities like isolation mode and high-efficiency mode help users optimize capital usage while mitigating risks by limiting exposure to less liquid assets. In addition, cross-chain functionality allows liquidity to flow between different Aave markets across various networks, enhancing interoperability.

Share this article

Go to Source

Author: Vivian Nguyen