Upcoming House budget bill could restrict SEC’s funding for SAB 121

Share this article

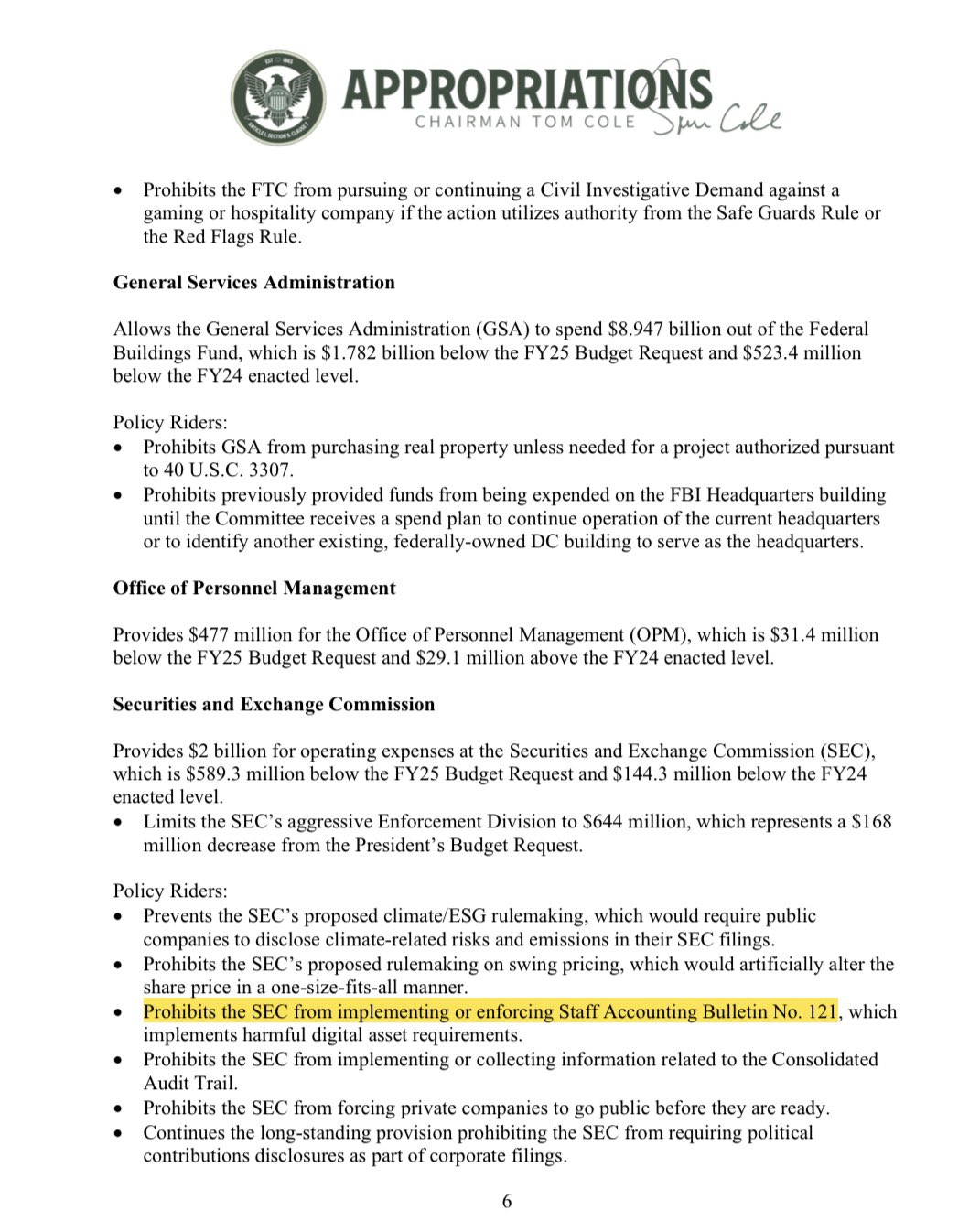

The House Appropriations Subcommittee on Financial Services and General Government, scheduled for 8:30 AM ET today, could prohibit the US Securities and Exchange Commission (SEC) from using allocated funds to implement SAB 121 and its climate disclosure rule, according to FOX Business journalist Eleanor Terrett.

Terrett said the bill proposes to allocate only $2 billion for the SEC’s overall funding for fiscal year 2025, short of the $2.59 billion budget proposed by SEC Chair Gary Gensler in March.

Additionally, funding for the SEC’s Enforcement Division, described as “aggressive,” is being cut by $168 million.

While the House is likely to pass the bill, the Senate’s stance remains uncertain. However, the outlook is still optimistic since some Senate Democrats, including notable figures like Senator Schumer, have previously voted to overturn SAB 121, Terrett noted. Further, a similar past resolution, H.J. Res. 109, gained some Democratic support.

This bipartisan support increases the likelihood that the provision to block funding for SAB 121 will remain in the final version of the bill.

According to Terrett, SEC Commissioner Mark Uyeda has publicly supported overturning SAB 121, criticizing the SEC’s method of introduction as bypassing proper rulemaking procedures and undermining checks and balances.

Issued in March 2022, Staff Accounting Bulletin No. 121 (SAB 121) requires banking and financial associations performing custodial activities to include disclosures in the notes to the financial statements.

Financial entities have argued that the on-balance sheet requirement coupled with the need to hold capital and liquidity reserves makes it prohibitively expensive for them to offer these services.

In May, the US House and Senate passed H.J. Res. 109, aiming to overturn the SEC’s controversial rule, with the Senate finalizing their approval on May 16.

However, President Biden vetoed this resolution on May 31, citing concerns that it would undermine the SEC and pose risks to consumers and investors.

Share this article

Go to Source

Author: Vivian Nguyen