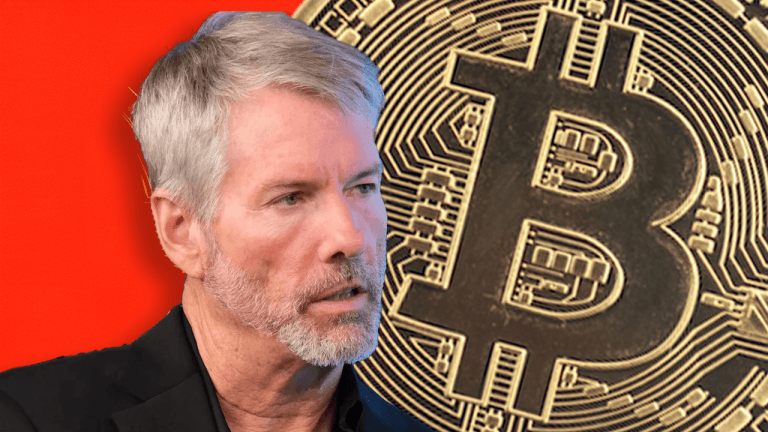

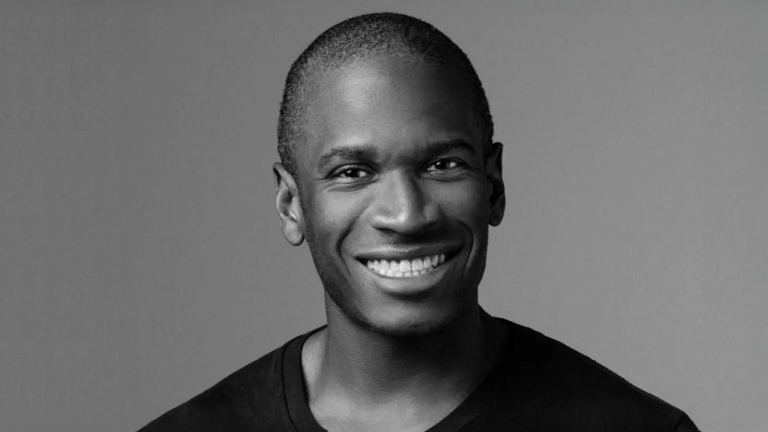

Ignorant Traders Avoiding Bitcoin Have ‘Catastrophic’ View on Markets, Says Fundstrat’s Tom Lee

Fundstrat chief investment officer Tom Lee says those who turn a blind eye to Bitcoin likely believe that BTC will eventually plunge all the way down to zero.

In an interview on the Global Money Talk YouTube channel, Lee says Bitcoin has proven its staying power after over a decade of existence.

He also notes that it’s now very unlikely for Bitcoin to vanish, given that the incoming Trump administration has repeatedly expressed its support for the largest crypto by market cap.

“I think that it’s probably better to just observe a few things. One is Bitcoin has now been around for 15 years, and there has not been a Bitcoin 2.0. So there’s no crypto 2.0, Bitcoin is the surviving chain.

And Bitcoin has become a $2 trillion asset which never in financial history has anything reached $2 trillion and then disappeared. It’s a different argument if it was $100 billion.

Third is the US government [has] reiterated its commitment to make Bitcoin a strategic reserve asset. That’s not bad for the price of Bitcoin. So if someone is watching this and said, ‘Well, they don’t understand Bitcoin so they decide not to own it.’

It’s a catastrophic way to look at markets.”

Lee also believes that the macroeconomic backdrop appears to be acting as a tailwind for risk assets like stocks and crypto, at least for the first half of the year. He adds that his bullish stance is supported by jittery market sentiment and the massive amount of cash still waiting in the wings.

“There is probably room for more positive surprises in the first half because we have an incoming president that’s very pro-business, probably the most pro-business president in modern times. And with, so far, the cabinet selections that the market is very happy with. So that should be providing room for investors to become optimistic which they call ‘animal spirits.’

And the second tailwind is that the Fed is dovish. And what that means is that the central bank is easing. So that’s positive for stocks.

The third is investors are cautious because almost everyone we talked to thinks valuations are expensive or because we’ve had two good years, [the next year] has to be bad. So we know sentiment is cautious. Usually when people are cautious, then you bet against the caution.

And the fourth is that we know mechanically there’s a lot of cash on the sidelines. There’s a lot of firepower – $7 trillion of cash on the sidelines.

So I would see this as positive for the first half of [this] year.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/WhiteBarbie/DDevecee

The post Ignorant Traders Avoiding Bitcoin Have ‘Catastrophic’ View on Markets, Says Fundstrat’s Tom Lee appeared first on The Daily Hodl.

Go to Source

Author: Henry Kanapi