Solana DePIN io.net announces tokenomics with inflation model and burn mechanism

Share this article

io.net, a Solana-based decentralized physical infrastructure network, has announced tokenomics for its IO token, featuring an inflation model and a token burn mechanism.

As noted in the project’s documentation, the IO token’s total supply is capped at 800 million coins, with an initial distribution of 500 million coins at launch. The remaining 300 million coins will be allocated as hourly rewards to suppliers and their stakers over 20 years.

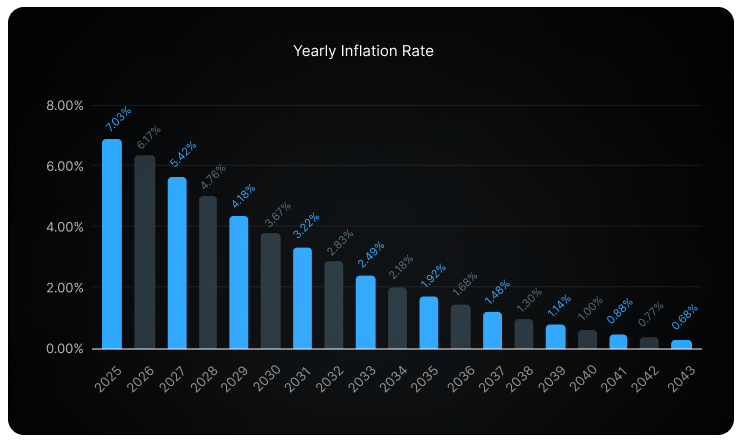

This emission of rewards follows a disinflationary model, starting at an 8% annual rate and decreasing by approximately 1.02% each month, leading to an estimated 12% reduction per year.

To create deflationary pressure, io.net will use network-generated revenues to purchase and burn IO tokens, thereby reducing the circulating supply.

According to io.net, the IO token serves as the native cryptocurrency for the IOG Network, aimed at streamlining economic exchanges within its ecosystem, which includes GPU Renters, GPU Owners, and the IO Coin Holder community.

The network’s economic activities involve GPU Renters, who utilize the tokens for deploying GPU clusters or cloud gaming, and GPU Owners, who offer GPU power. IO Coin Holders secure the network through staking and receive rewards.

Users can make payments in IO tokens, USDC, fiat, or other supported tokens, with incentives for using IO tokens, such as lower or no fees. A 2% fee is applied to USDC payments, while IO token transactions are fee-free. Supplier earnings from compute jobs in USDC also include a 2% fee.

IO Research, the team behind io.net, recently secured $30 million in Series A funding led by Hack VC, with participation from prominent backers including Multicoin Capital, 6th Man Ventures, Solana Ventures, OKX Ventures, Aptos Labs, Delphi Digital, and The Sandbox, among others.

The team plans to use the fresh fund to fuel team growth, meet customer demands, and accelerate the development of its network.

Share this article

Go to Source

Author: Vivian Nguyen