JOJO Exchange debuts zk-proofs to enhance on-chain derivatives

Share this article

Decentralized exchange for perpetuals trading (perp DEX) JOJO implemented zero-knowledge proof (zk-proofs) technology for funding rates in their platform to keep perpetual contracts aligned with the spot market prices. According to Jotaro Kujo, JOJO’s co-founder, this is a fundamental development for on-chain derivatives trading.

JOJO tapped into Brevis zk-proofs technology, which is a coprocessor able to read from and utilize the full historical on-chain data from any chain, and run customizable computations in a completely trust-free way.

“With Brevis’ zk-proofs, we have the ability to do any calculation based on the transactions, the events, on any block time in any timeframe, and generate proofs validated on-chain. It’s pretty suitable for us because we have a very open liquidity layer, which means that people can build different liquidity structures on top of JOJO and they may also have their own impact on the price. That means if you calculate our rates on-chain, will be a very hard work to do,” explained Jotaro.

Therefore, zk-proofs allow JOJO to calculate the funding rates off-chain and register them on-chain, avoiding the very demanding process of calculating it. The result is an “efficient and secure” solution to the industry.

This development by JOJO and Brevis is important given the importance of funding rates to the design of perpetual contracts, highlighted Jotaro. Funding rates keep the perpetual contracts’ prices tied to the spot market, making them more accurate for traders.

“When our perpetual contract has a higher price than the spot, the funding rate will charge from the long positions and pay to the short positions. So that creates an incentive for people to close their long positions and open short positions. That means people will sell the perpetual contract and start to buy, dumping the price and making the perpetual price back to the same as the spot price.”

Consequently, this mechanism encourages the arbitrageurs and the traders to make de perpetual price keep following the spot price. Without a funding rate, the perpetual contract is “just a shitcoin” and doesn’t make sense, added Jotaro.

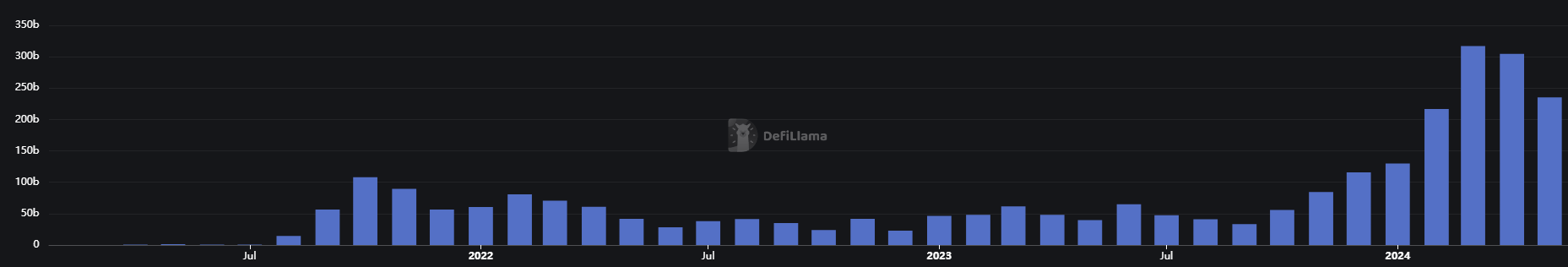

Despite a monthly 23% fall, the trading volume of on-chain derivatives is still at its highest levels. The gradual growth of this decentralized finance sector depends on capital efficiency, Jotaro stated, and developments such as accurate funding rates are one of the fundamental contributions to this industry’s expansion.

“The funding rate is very important for decentralized exchanges, and we need to calculate it efficiently, but at the same time in a safe way. And now we see a lot of other exchanges showing that they calculate the final rate by centralized oracles. Well, that is not the right way to do it, although they may have faced some temporary difficulties with the on-chain calculation. We think this zk-proof model can make the on-chain derivatives advance a lot, so we can make it verifiable by anyone.”

Share this article

Go to Source

Author: Gino Matos