Mastercard unveils its ‘name service’ for crypto transactions

Share this article

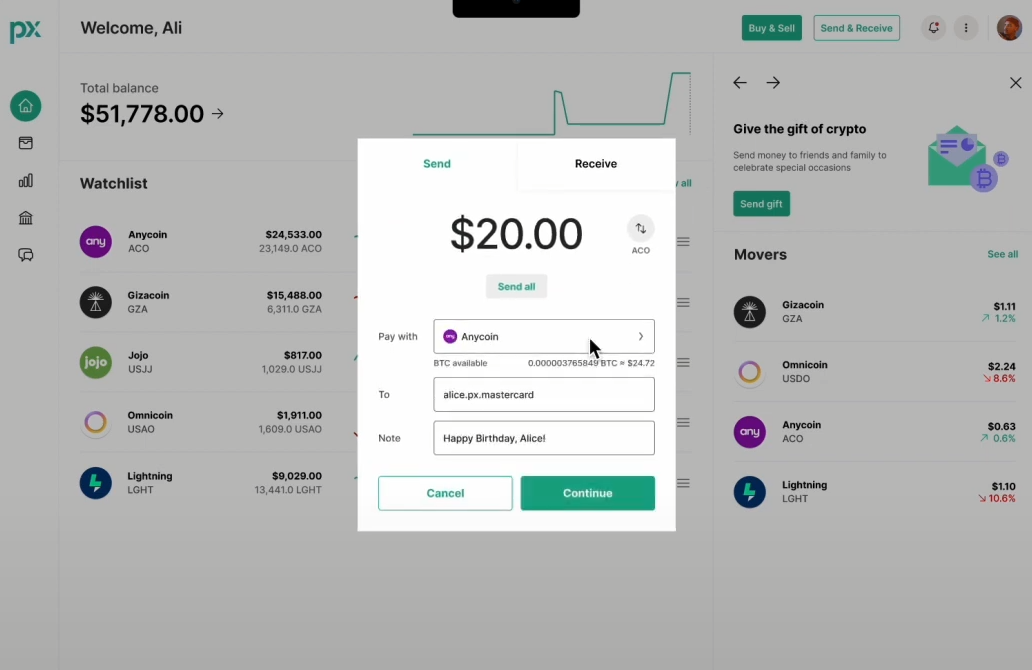

Mastercard has announced today the “Mastercard Crypto Credential”, a feature that allows crypto exchange users to send and receive crypto through aliases, similar to name services solutions, such as the Ethereum Name Service.

A video in the announcement displays the process, similar to a wire transfer: the user receives an alias to send and receive funds across supported exchanges, and this alias’ wallet compatibility is verified, preventing transactions if the wallet does not support the asset or blockchain, thus safeguarding against loss of funds.

The live transaction capabilities have been enabled on exchanges such as Bit2Me, Lirium, and Mercado Bitcoin, facilitating blockchain transactions across Latin American and European corridors.

“Mastercard continues to invest in its technology, standards and partnerships to bring safe, simple and secure payments to the forefront,” said Walter Pimenta, executive vice president, Product and Engineering, Latin America and the Caribbean at Mastercard. “As interest in blockchain and digital assets continues to surge in Latin America and around the world, it is essential to keep delivering trusted and verifiable interactions across public blockchain networks. We’re thrilled to work with this dynamic set of partners to bring Mastercard Crypto Credential closer to realizing its full potential.”

Users in countries including Argentina, Brazil, Chile, France, and several others can now perform cross-border and domestic transfers across multiple currencies and blockchains. The expansion continues as Brazilian crypto exchange Foxbit joins the Mastercard Crypto Credential pilot ecosystem, and Lulubit users gain access through Lirium integration.

Mastercard Crypto Credential ensures that interactions on blockchain networks are verified, confirming that users meet a set of verification standards and that the recipient’s wallet supports the transferred asset. This system simplifies transactions by exchanging metadata, which eliminates the need for consumers to know which assets or chains the recipient supports, thereby enhancing trust and certainty.

Additionally, Mastercard Crypto Credential supports the exchange of Travel Rule information, a regulatory requirement for cross-border transactions to maintain transparency and prevent illegal activities.

The announcement highlights that peer-to-peer transactions are just the beginning, with potential future use cases including NFTs, ticketing, and other payment solutions.

Share this article

Go to Source

Author: Gino Matos