Microsoft shareholders to vote on Bitcoin investment proposal in an hour, what we should expect?

Key Takeaways

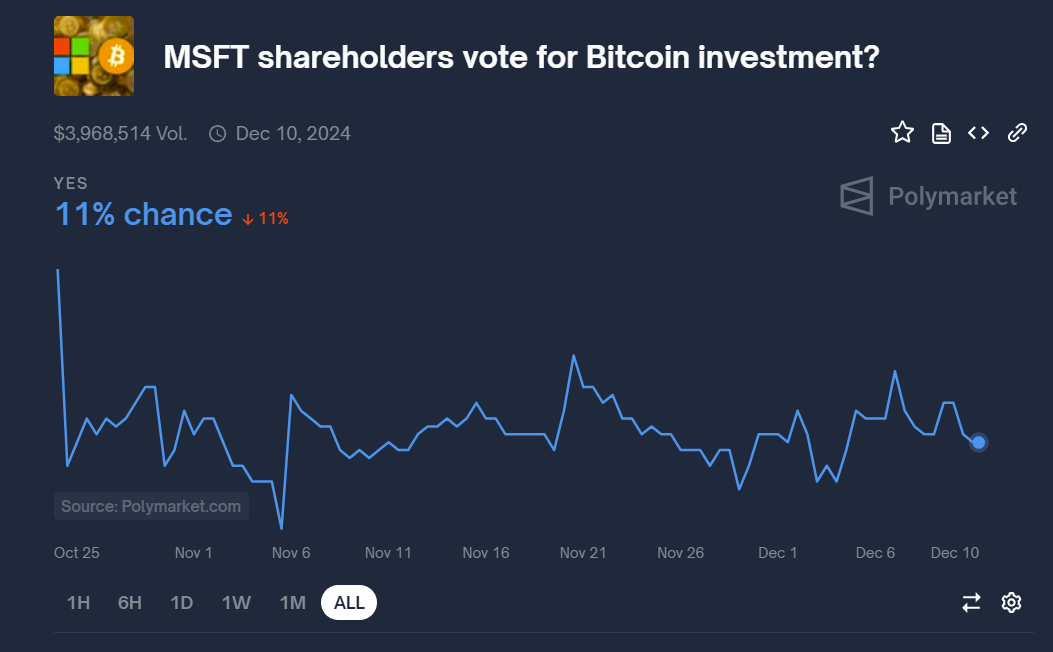

- Polymarket traders anticipate that Microsoft shareholders are unlikely to support the Bitcoin investment proposal.

- If approved, a 1% allocation to Bitcoin would make Microsoft the 10th largest public company holding Bitcoin.

Share this article

Microsoft’s shareholder vote on the Bitcoin investment proposal is approaching, but prediction market traders see only a small chance that it will pass.

Polymarket bettors predict that Microsoft shareholders will not approve the Bitcoin investment proposal, estimating only a 11% likelihood of a favorable vote. The odds of approval initially peaked at 22% when the poll was launched, but have since declined.

According to an October filing with the SEC, the highly anticipated vote will take place at 8:30 AM PS today, with the results expected to be announced soon after the conclusion of the meeting.

Microsoft’s board of directors has recommended that shareholders vote against the proposal, initiated by the National Center for Public Policy Research (NCPPR), which advocates Bitcoin as a hedge against inflation.

The board stated that the company had already evaluated a wide range of investment options, including Bitcoin, as part of its financial strategy.

What do we know about shareholders?

The outcome of the Microsoft Bitcoin vote will largely depend on the stance of its shareholders, but who are they?

Microsoft shareholders include a mix of institutional investors, individual shareholders, and the company’s board members and executives.

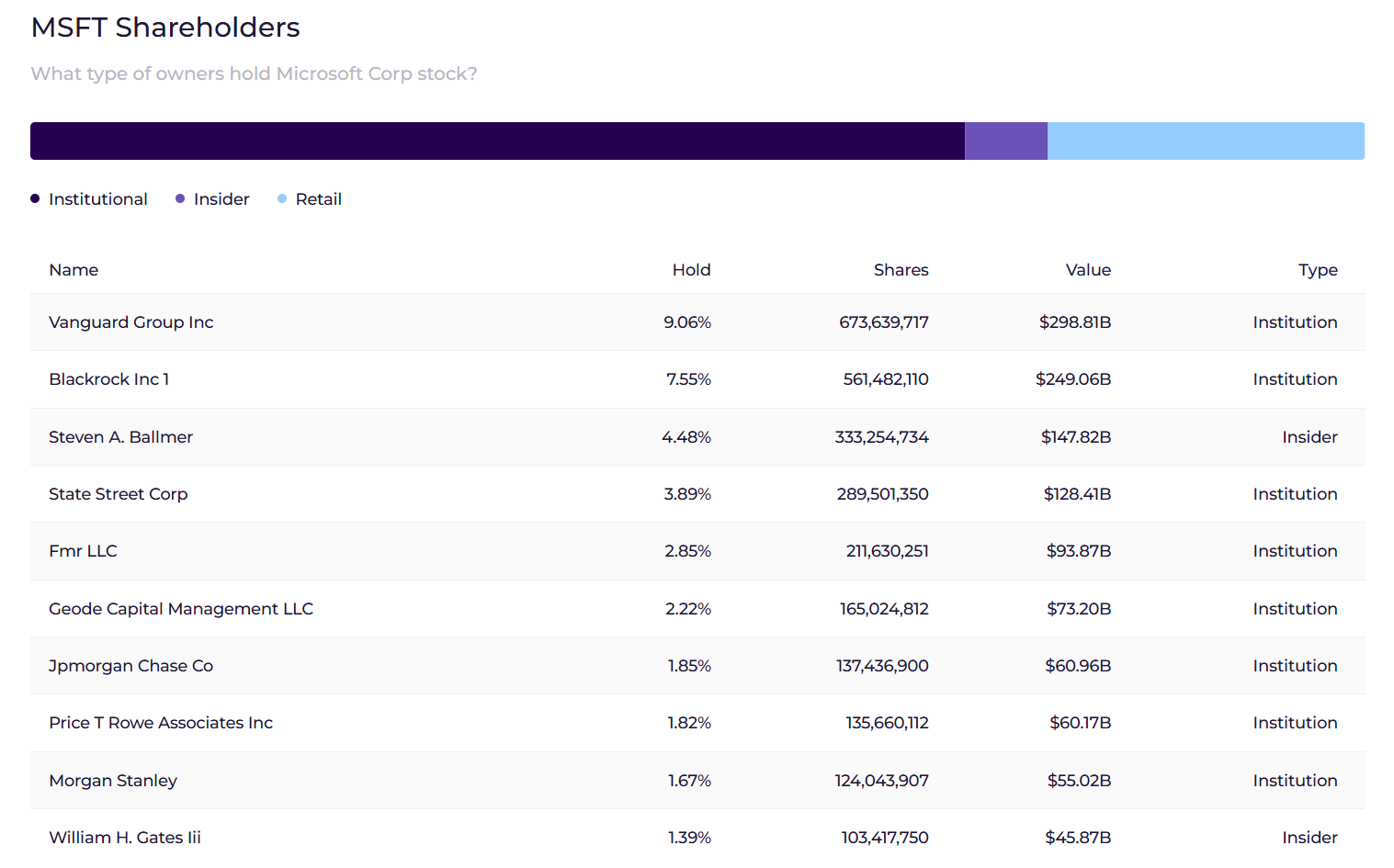

Approximately 70% of Microsoft shares are held by institutional investors, with Vanguard Group, BlackRock, and State Street taking the major stakes, according to data from Wall Street Zen.

While many institutional investors in this group have a supportive stance on Bitcoin, they typically prioritize stability and long-term growth, which may lead them to align with the board’s recommendation against the proposal due to concerns over Bitcoin’s volatility.

Retail investors account for about 23.5% of Microsoft’s ownership. This group of investors may have varied opinions. Some may support the proposal, seeing Bitcoin as a potential hedge against inflation and a way to enhance shareholder value, while others might share the board’s cautious view.

Insiders, including executives and board members, hold over 6% of the company’s shares. However, it’s worth reminding that Microsoft’s board members are skeptical about the proposal.

Microsoft is big on AI, not crypto

Microsoft is currently focusing more on artificial intelligence (AI) than on crypto. The company has made significant investments in AI and machine learning for 2024, aiming to integrate these technologies across its product ecosystem.

The tech giant is committed to advancing natural language processing and computer vision, which are essential for enhancing human-computer interactions. Microsoft has committed a total of approximately $13 billion to OpenAI since their partnership began in 2019. This includes multiple rounds of funding, with a notable investment of $10 billion made in January 2023, which valued OpenAI at around $86 billion at that time.

While there are few indicators suggesting that Microsoft will adopt Bitcoin as part of its reserve strategy, there remains a possibility that the company might consider investing a small percentage of its treasury in Bitcoin. This could potentially lead to favorable outcomes for Microsoft’s stock performance, similar to MicroStrategy’s.

MicroStrategy’s shares have experienced some recent fluctuations; however, year-to-date, the company’s stock has outperformed most S&P 500 indices with an impressive increase of nearly 500%, according to Yahoo Finance data. Microsoft’s stock has risen approximately 20% over the same period.

With Microsoft holding over $78 billion in cash and cash equivalents, allocating just 1% of these holdings to Bitcoin would amount to a $784 million investment, positioning the company as the 10th largest public company holding Bitcoin.

Beyond MicroStrategy, several other public companies are also exploring Bitcoin investments. Plus, under the incoming Trump administration, there are expectations for the US to establish a national Bitcoin stockpile.

If Microsoft shareholders don’t approve a Bitcoin investment proposal at the forthcoming meeting, their next opportunity to vote will likely occur at the company’s 2025 Annual Shareholders Meeting, typically held in December.

Microsoft conducts annual meetings to address various shareholder proposals, and any new proposals regarding Bitcoin or other investments could be introduced at that time.

Share this article

Go to Source

Author: Vivian Nguyen