MicroStrategy buys 1,070 Bitcoin for $101M, yield reaches 74%

Key Takeaways

- MicroStrategy bought 1,070 Bitcoin for $101 million, raising its total holdings to 447,470 BTC.

- The company’s Bitcoin yield reached 74% in 2024.

Share this article

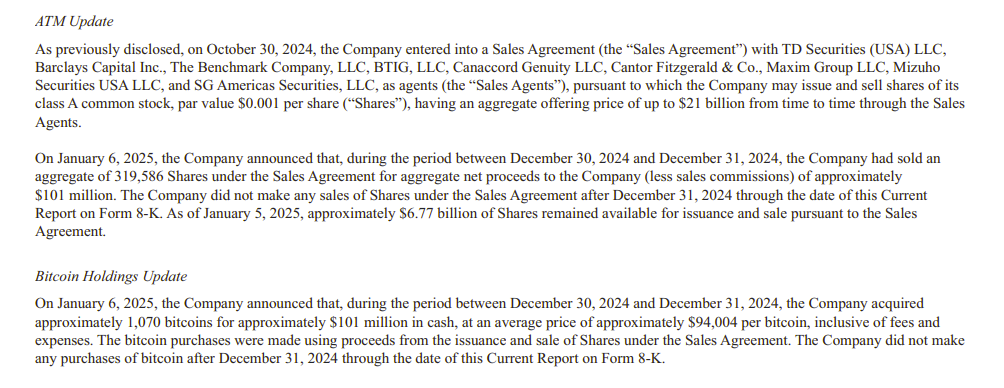

MicroStrategy said Monday it had acquired 1,070 Bitcoin for $101 million between Dec. 30 and 31, 2024, boosting its total holdings to 447,470 BTC, valued at around $44.3 billion at current market prices.

MicroStrategy has acquired 1,070 BTC for ~$101 million at ~$94,004 per bitcoin and has achieved BTC Yield of 48.0% in Q4 2024 and 74.3% in FY 2024. As of 01/05/2025, we hodl 447,470 $BTC acquired for ~$27.97 billion at ~$62,503 per bitcoin. $MSTR https://t.co/CkLrLSkB5M

— Michael Saylor⚡️ (@saylor) January 6, 2025

According to a recent SEC filing, the Tysons, Virginia-based company funded its latest purchase through the sale of f 319,586 shares during the same period. It acquired the digital asset at an average price of $94,004 per BTC. MicroStrategy also reported its Bitcoin yield reached 74.3% in 2024, with the metric standing at 48% for the period from Oct. 1 to Dec. 31.

The announcement came after Michael Saylor, MicroStrategy’s co-founder and executive chairman, teased the purchase on Jan. 5, referencing the lines on the Saylor Tracker, a monitoring tool for the company’s Bitcoin acquisitions.

Something about https://t.co/Bx3917zMqi is not quite right. pic.twitter.com/vRTAH2xTCX

— Michael Saylor⚡️ (@saylor) January 5, 2025

Last Friday, MicroStrategy announced plans to raise up to $2 billion through public offerings of perpetual preferred stock to strengthen its balance sheet and fund additional Bitcoin purchases. This offering is aimed at its “21/21 Plan,” which targets raising $21 billion in equity and $21 billion through fixed income instruments over three years.

The company filed with the SEC on Dec. 23 to increase its authorized Class A common stock from 330 million to 10.33 billion shares, and its preferred stock from 5 million to more than 1 billion shares, seeking greater flexibility for future share issuance.

The latest purchase marks MicroStrategy’s ninth consecutive week of Bitcoin acquisitions since Oct. 31, when the company first announced its “21/21 Plan.” Saylor-led firm has acquired 195,250 BTC since initiating the plan, representing about 45% of its investment target. At current market prices, these holdings are valued at $19.3 billion.

Share this article

Go to Source

Author: Vivian Nguyen