NFT marketplace tokens soar in 2023, and Blur’s recent airdrop may extend the trend

NFT marketplace tokens are gaining the market’s attention, and Blur’s recent airdrop could extend the trend.

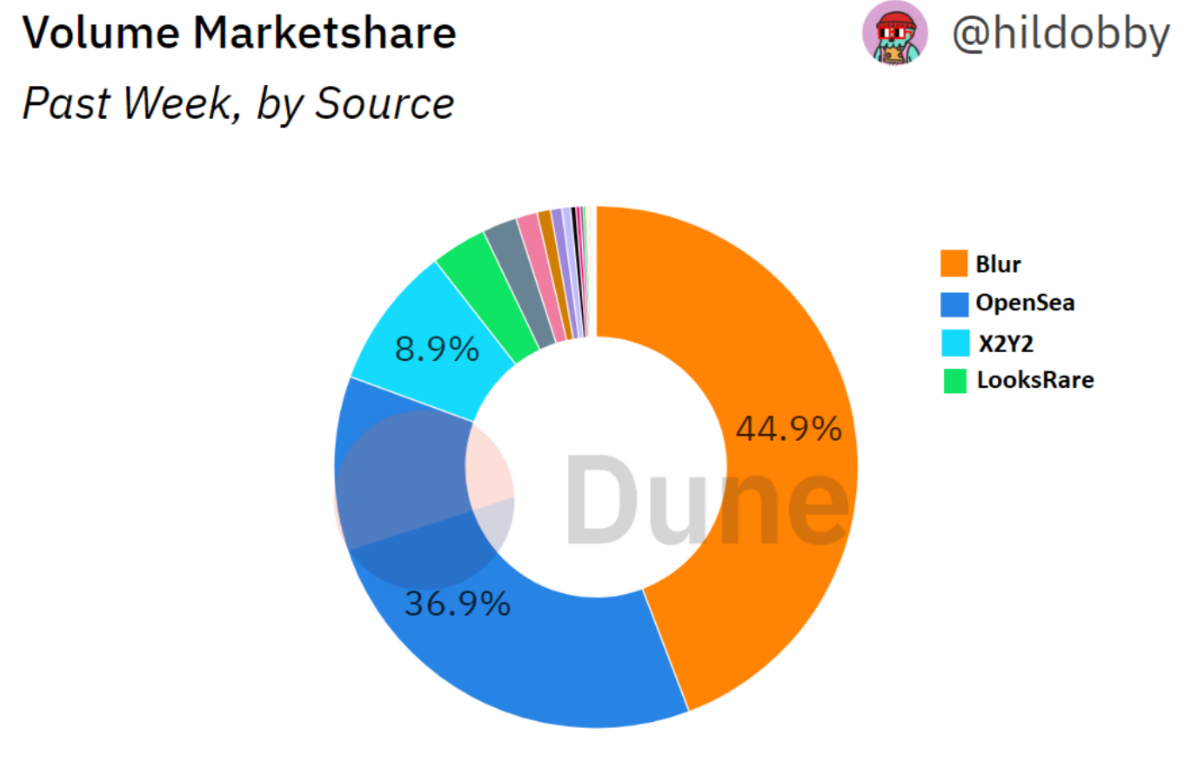

Cumulative nonfungible token (NFT) trading volume trended higher in January, and data from a recent Delphi Digital report showed monthly volumes reaching an eight-month high above $1 billion.

The key factor that influenced NFT trading was the Blur token airdrop on Feb. 14. Since its launch last year in Q3 2022, Blur has rewarded users with “care packages,” which can be redeemed for tokens starting Feb. 14 at 12 pm ET.

Many users have tried to farm these airdrops, increasing the platform’s trading volume. Since the start of 2023, Blur’s trading volume has surpassed that of OpenSea, the market leader in the NFT trading space.

Airdrops often create excitement in the market of thrilled users who receive free money and FOMO from those who missed out. It’s likely that the next step for the Blur team will be to launch new liquidity mining campaigns, similar to Optimism, to retain its volume and users. Moreover, users will also move on to other opportunities in the space, similar to Blur.

On-chain data shows whales are accumulating NFT tokens

The top NFT trading platforms on Ethereum with a native token are LooksRare (LOOKS) and X2Y2 (X2Y2). The year-to-date increase in the price of their tokens is 100% and 260%, respectively. The tokens have outperformed the market’s average gain, suggesting buyers are paying more attention to these tokens.

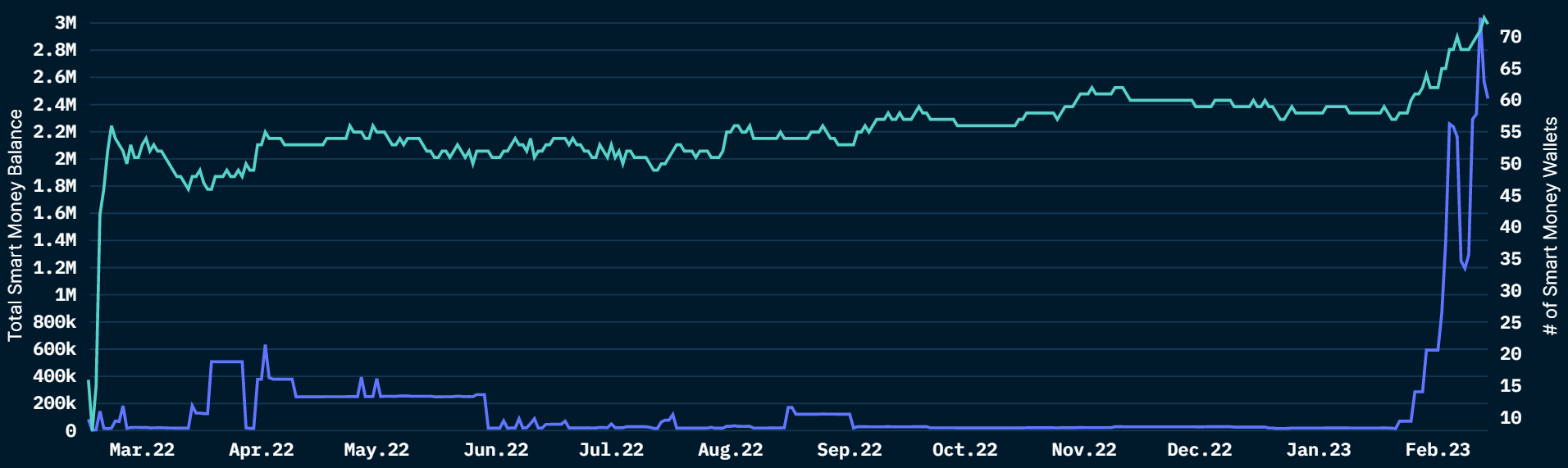

Independent on-chain analyst The Data Nerd found that Taureon Capital is accumulating NFT marketplace tokens. Ethereum wallets identified as “smart money” by Nansen have also significantly increased holdings of X2Y2 and LOOKS. It shows a rising trend among sophisticated investors toward NFT marketplace tokens.

Let’s look at each platform more closely:

X2Y2

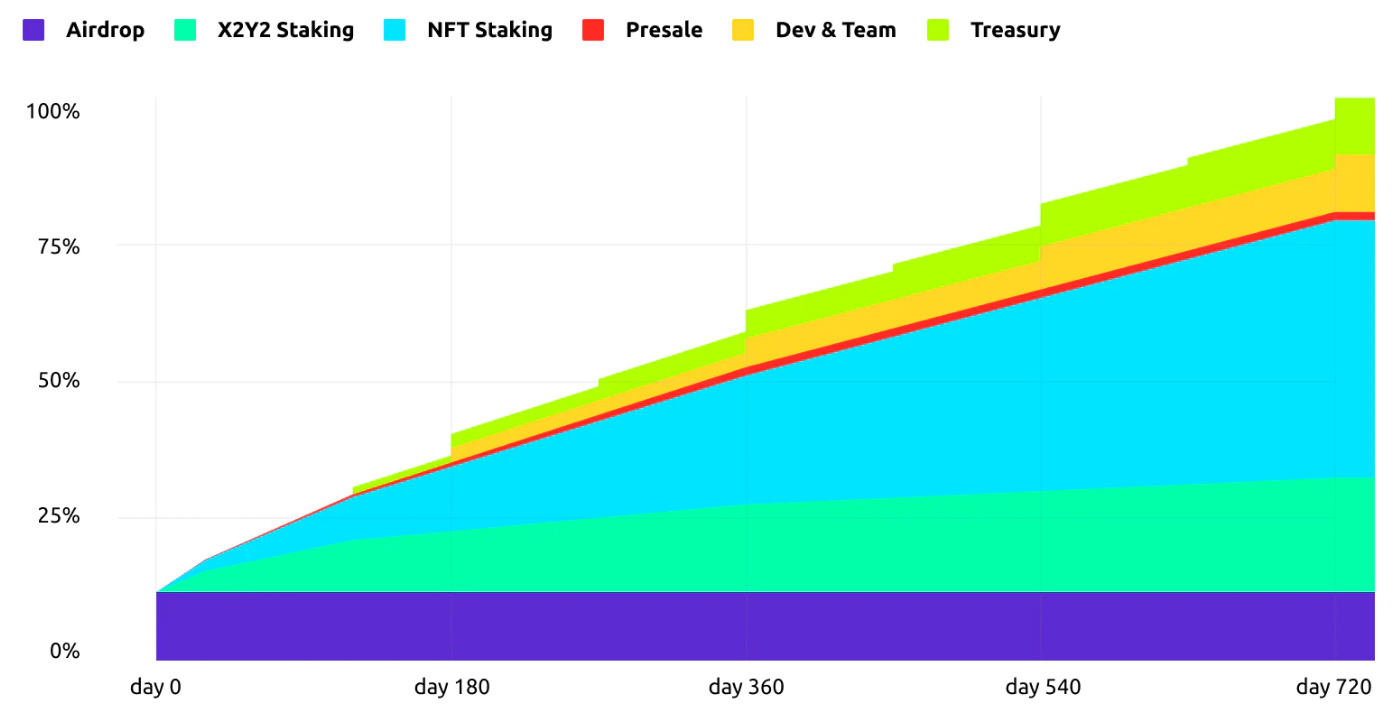

X2Y2 ranks third concerning NFT trading volumes on Ethereum. The platform launched its token in February 2022 and has since seen steady usage. It distributes the platform’s trading fees among X2Y2 stakers and incentivizes trading through X2Y2 incentives.

The platform has a price-to-earnings (PE) ratio of around 14, which is in the lower range of other decentralized finance (DeFi) tokens whose PE ranges between 10 and 250.

Recently, 37.5 million LOOKS tokens, representing 17% of the circulating supply, were unlocked for the developing team and treasury at the start of February. The team reassured investors, claiming, “The X2Y2 team will NOT sell any token from this upcoming unlock or any tokens unlocked thus far for the foreseeable future.”

Nevertheless, the token faces risk due to inflation, which will see its circulating supply nearly double by the year’s end. The team has also placed a monthly burn mechanism to counteract the dilution.

The token is trading near its 2022 range highs of around $0.20. If buyers can break out and consolidate above this level, there is a likelihood of more gains in X2Y2.

LooksRare

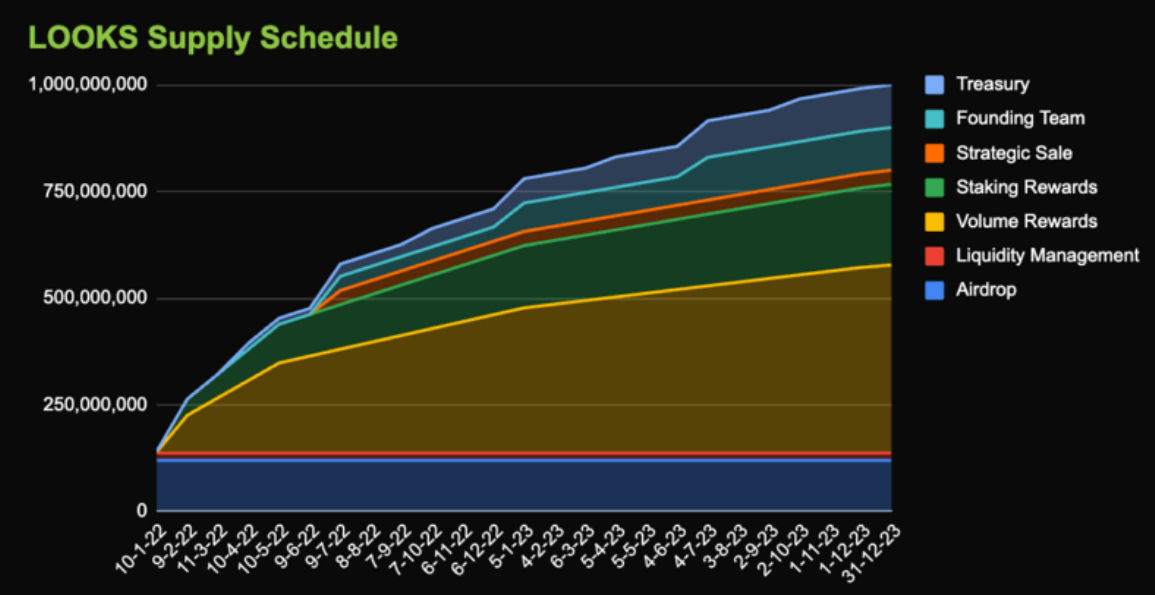

LooksRare is another competitor of OpenSea that offers token stakers with the platform’s trading fees in Ether (ETH) and Wrapped Ether (wETH). The marketplace has a competitive PE ratio of 11.7, which is less than X2Y2.

On-chain analytics platform Lookonchain revealed that prominent trader and BitMEX founder Arthur Hayes owns 3.62% of the token’s total supply. Confidence among whale investors like Hayes motivates retail and other funds to follow in their footsteps.

Like X2Y2, the LOOKS token went through significant unlocks toward the end of 2022, but there are no major unlocks of the token until Q2 2023.

The price action of LOOKS suggests that the market has absorbed the recent dilution. Based on its 2022 trading levels, the token has the potential for significant upside toward $0.35 and $0.50. However, the platform must show an increase in usage to support further rallies.

Related: ApeCoin leads in NFT and metaverse market share, but are APE’s hefty staking rewards sustainable?

Rarible

Rarible’s native token differs from LooksRare and X2Y2 in that it doesn’t share the platform’s trading yield. The RARI token only serves as a governance token used in voting on proposals in the Rari Foundation.

The team adopted Curve’s voting escrow-styled tokenomics, which hasn’t seen any real staking tracking yet. Besides that, RARI can be used to trade on the platform, but its usage as a payment token is limited compared to ETH and stablecoins.

The token’s price performance has reflected its poor tokenomics. Unless the Rari Foundation moves to enhance the token’s utility, RARI’s performance may remain subdued compared to the rest of the market.

There also could be some hidden opportunities in DeFi–NFT platforms like JPEG’d and Pine, which enable loans against NFTs as collateral.

The total NFT trading volume is less than 1% of the volume of cryptocurrency exchanges. However, it’s a growing segment that is projected to produce revenues near $5.9 billion by 2025. Thus, early investments in decentralized marketplaces that share a portion of their income may reap handsome rewards in a couple of years.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: Nivesh Rustgi