Nifty News: ‘Degen’ season returns with feet NFTs, disappointing Game of Thrones NFTs and more

Foot fetishists and crypto degens have taken interest in an NFT collection boasting 10,000 unique pixelated trotters with over $1 million in trading volume.

‘Degen’ season smells like pixelated feet

Feetpix.wtf’s newly launched nonfungible token (NFT) collection, “Feetpix” has seemingly taken the NFT community by storm with surging trading volumes, prompting some to suggest the return of “degen” season.

Feetpix.wtf’s collection soared ahead of the likes of Bored Ape Yacht Club (BAYC) on Jan. 11 with the fifth-highest trading volume recorded on NFT marketplace OpenSea.

The project — which released 10,000 Feetpix NFTs — has traded over 825 Ether (ETH)($1,157,000) across nearly 18,000 transactions since its release on Jan. 8.

Crypto Twitter is still split on what inspired the surge in foot fetish-NFT trading volumes, though Feetpix noted the absence of a roadmap, promise and marketing scheme suggested a “love for feet” is not just legitimate but also clearly monetizable through the use of digital art.

0 Roadmap

0 Promises

0 Marketing

0 Paid influencers

1 Common love for feet pic.twitter.com/Z8R8BWTXFh— feetpix (@feetpixwtf) January 10, 2023

Several Twitter users highlighted the absurd, short-term success of the project, suggesting a return of “degen szn” (season) which entailed a mass trading volume of high-risk NFT collectibles at the peak of the bull market in 2021.

But even the creators themselves implied something could be mentally wrong with collectors, suggesting buyers “stop buying feetpix” and instead “use that money for therapy.”

Game of Thrones NFTs: ‘Worst thing I’ve ever seen’

Game of Thrones’ highly anticipated “Build Your Realm” NFT collection launch has received a hefty dose of criticism despite completely selling out in seven hours on the NFT marketplace Nifty’s.

The collection was described by the pseudonymous co-founder of Web3 gaming project Treeverse, Loopify, on Jan. 11 as the “worst thing I’ve ever seen.”

Game Of Thrones NFT reveal

this is the worst thing I’ve ever seen pic.twitter.com/sMudsJgP2z

— Loopify ♂️ (@Loopifyyy) January 11, 2023

Loopify told their 200,000 Twitter followers in a separate post that some of the avatars possessed “salad fingers.”

NFT enthusiast Justin Taylor shared his criticism with his nearly 60,000 Twitter followers stating the launch lacked “creative vision” and was outright “terrible.”

This Game of Thrones NFT collection is just like the the last season of the show.

No creative vision and terrible pic.twitter.com/I0v7cXai5N

— Justin Taylor (@TheSmarmyBum) January 11, 2023

The first series NFT collection was born from a collaboration between Nifty’s and NFT production company Daz 3D, where each NFT is minted on Palm — an Ethereum-compatible sidechain — allowing collectors to create their own unique realms and avatars.

While the fast sellout came as little surprise due to the popularity of the show, many collectors reported issues with the minting process in addition to the widespread disappointment of the poorly designed avatars.

Yuga Labs announces skill-based NFT mint

Yuga Labs — the creative team behind the BAYC — is set to expand its NFT ecosystem with the launch of a skill-based NFT game called “Dookey Dash.”

In order to participate, BAYC and Mutant Ape Yacht Club (MAYC) holders will need to mint a “Sewer Pass” on Jan. 17 in order to start playing the game on Jan. 18.

Apes, stretch your eyeballs and warm up your scroll muscles — lots of new info about next week. Short version: monkey butthole, Sewer Pass January 17, skill-based mint begins January 18, new power sources. Video explainer coming soon, more at https://t.co/h8JXeLkC57, and the pic.twitter.com/bF1h2qAXrM

— Bored Ape Yacht Club (@BoredApeYC) January 12, 2023

The aim of the game will be to navigate the sewer, claim as many NFT rewards as possible and record the highest score until Feb. 8 when the leaderboard freezes.

“Sewer Pass holders will compete for the highest score and earn their new power source,” the BAYC wrote, adding “the highest single-run score on your specific Sewer Pass and accompanying wallet that achieved the run will determine what it reveals.”

However, it’s not clear what the prizes will consist of with Yuga stating on BAYC’s Twitter account that prizes will “evolve throughout 2023.”

The four-week Dookey Dash experiment also appears to be the first part of a narrative experience, with segments “It’s Alive!” and “Chapter 1” expected to proceed with the “Sewer Close” on Feb. 8, according to a roadmap set out by Yuga.

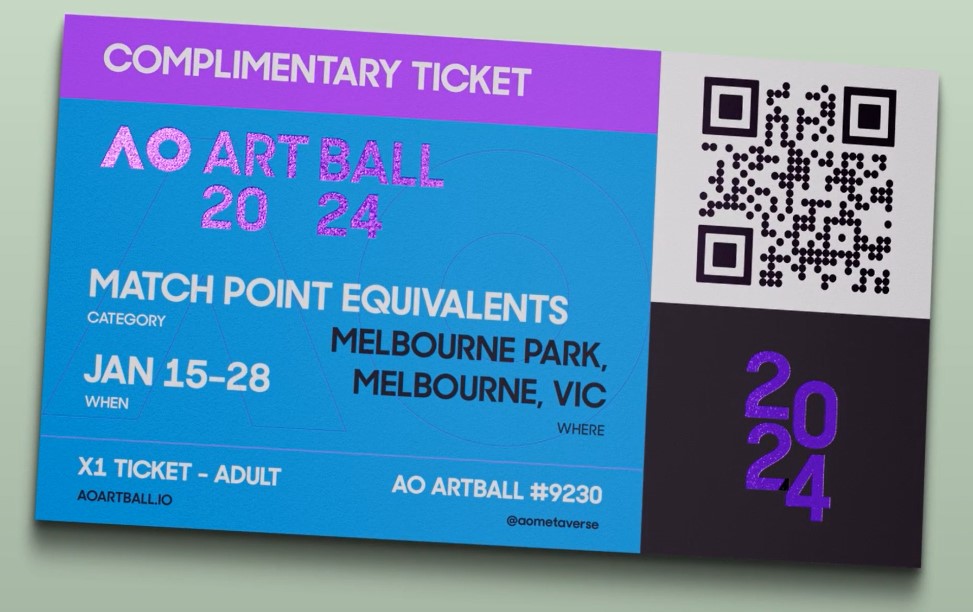

Tennis Australia still playing ball with NFTs

Tennis Australia has confirmed it’s still investing in the NFT space, by continuing its Australian Open (AO) Artball NFT collection it created last year as a means to engage NFT collectors and tennis fanatics.

The Artball NFT serves to “leverage live match data to deepen global fan engagement beyond a tournament” through the digital realm, according to the Artball website.

(1)

Players ready?Want to get your hands on the ball that has it all? The #AO23 collection mints soon, with brand new plots on the court and a Membership Multiplier https://t.co/5djxX1Sm1b

Let’s swing into it pic.twitter.com/B3oxu5pfU2— AOmetaverse (@AOmetaverse) January 10, 2023

With 6776 Australian Open Artballs sold in last year’s collection, an additional 2,454 Artballs will hit the market in time for the 2023 tournament, which officially kicks off next Monday, Jan. 16 in Melbourne.

According to the website each Australian Open ArtBall is linked to live match data corresponding to a 17cm by 17cm plot on the court.

If a winning shot from any match lands on a collector’s plot the NFT metadata will be updated in real time and the collector will be rewarded.

One of the special ArtBalls is Artball SuperSight which enables an entire suite of exclusive 360-degree front-row viewing tools, a 3D stats explorer and personalized streams that has been “custom built” for members.

Collectors will also be in the running to win two free tickets to the equivalent live match in AO24 if their Artball scores a “Match Point” in AO23 in addition to being granted access to “exclusive behind-the-scenes streams.”

Artball minting is currently subject to a waitlist, according to the AOmetaverse Twitter page.

Other Nifty News:

NFT platform Upshot has created a trading tool that scores and classifies wallets based on their trading success, which will enable crypto newcomers to get a closer look into the strategies adopted by successful collectors.

Blockchain security firm SlowMist revealed a sneaky trick scammers used in 2022 to steal NFTs was a “zero dollar purchase” scam where victims were tricked into signing over NFTs for basically no cost in a fake sales order, with scammers able to purchase the NFTs through a marketplace at a price they determined.

Go to Source

Author: Brayden Lindrea