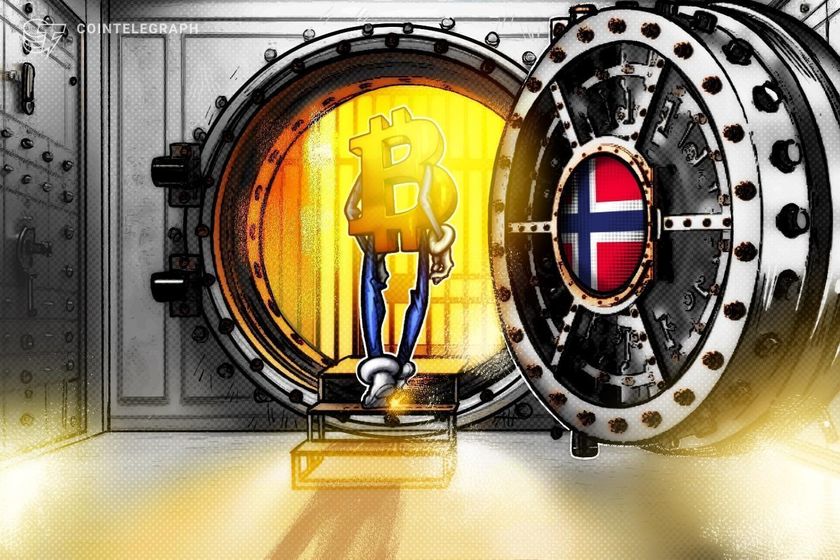

World’s largest sovereign wealth fund grows indirect BTC exposure by 153%

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management, has positions in MicroStrategy, Square, Tesla, MARA Holdings, Riot Platforms and Coinbase.

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), has accumulated a sizable exposure to Bitcoin (BTC) through indirect investments in a diversified portfolio of cryptocurrency-friendly companies.

According to K33 Research, NBIM’s indirect exposure to the digital asset grew to 3,821 BTC, or $356 million, at the end of 2024, reflecting a yearly gain of 153%.

Norway’s sovereign wealth fund saw its indirect exposure to Bitcoin grow by 1,375 BTC between June and December 2024. Source: Vetle Lunde

Go to Source

Author: Sam Bourgi

Related posts:

- Americans reinvesting stimulus checks in Bitcoin made $4.5k in profit

- Chamber of Digital Commerce says ‘the time has come’ for the SEC to approve a Bitcoin ETF

- CFTC calls ETH a commodity in Binance suit, highlighting the complexity of classification

- Why financial infrastructure needs to be open-source — Hyperledger