Qatar Financial Centre unveils new ‘blueprint’ for crypto regulation

Key Takeaways

- Qatar’s new digital assets framework covers tokenization and smart contracts.

- Over 20 startups have joined the QFC Digital Assets Lab for crypto product development.

Share this article

The Qatar Financial Centre (QFC) has released a comprehensive regulatory framework for digital assets, establishing clear rules for crypto activities in the region. The “QFC Digital Assets Framework 2024” provides a legal and regulatory foundation for various aspects of the crypto industry.

The new framework, announced on Sunday, covers a wide range of digital asset activities including tokenization, property rights in tokens, custody arrangements, transfer and exchange. It also provides legal recognition for smart contracts, aiming to foster trust and confidence among consumers, service providers, and industry stakeholders.

QFC officials emphasized the framework’s high standards for asset tokenization processes and the establishment of a trusted technology infrastructure. The regulations were developed after extensive consultation with an advisory group comprised of 37 domestic and international organizations, reflecting a collaborative approach to crypto governance.

Third Financial Sector Strategy

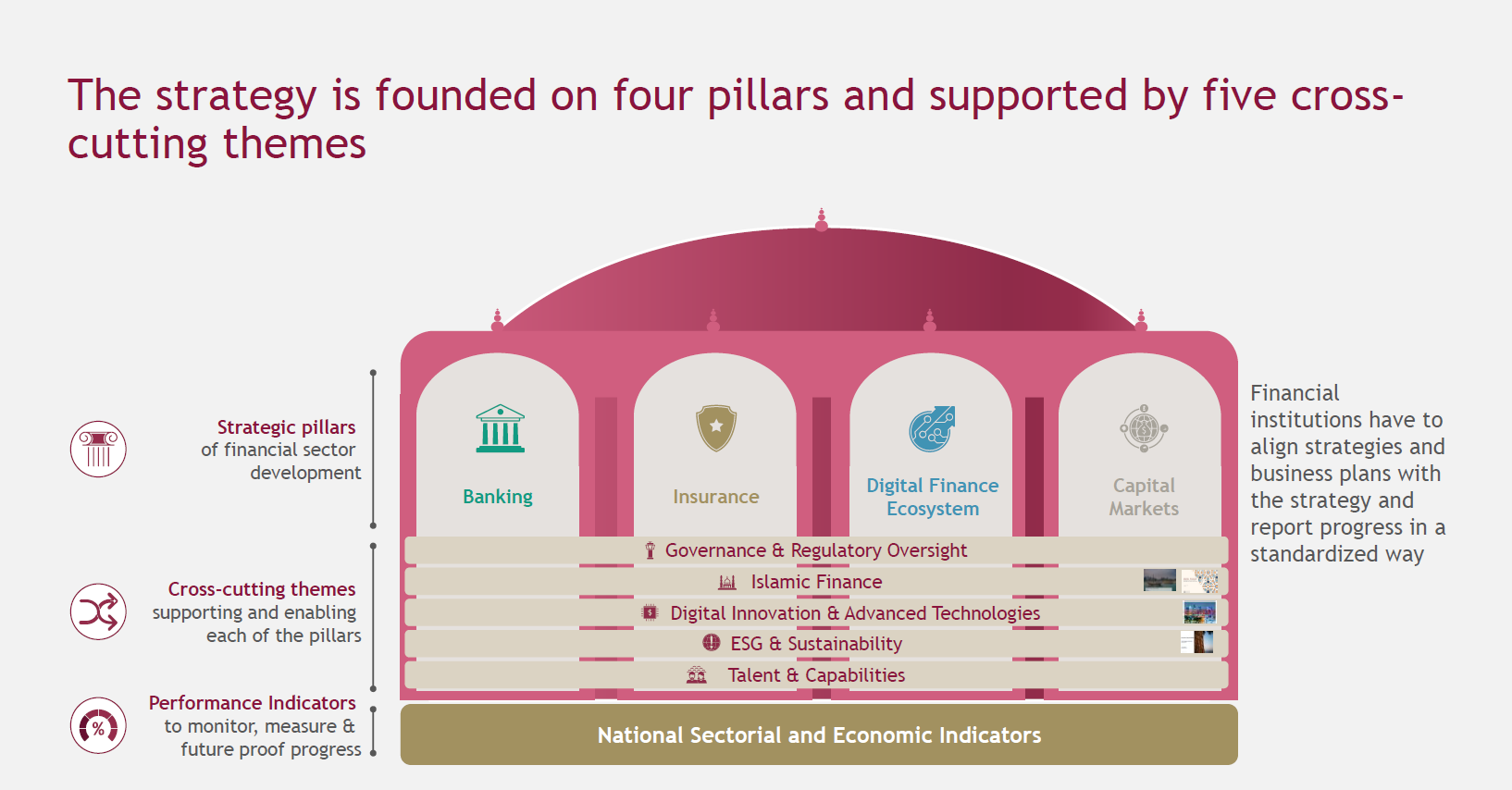

This regulatory initiative is part of Qatar’s broader “Third Financial Sector Strategy,” which aims to position the country as a regional leader in financial innovation.

By providing clear guidelines, the QFC seeks to attract crypto businesses and promote the growth of the digital asset sector within its jurisdiction.

In conjunction with the new regulations, the QFC has been actively supporting crypto innovation through its Digital Assets Lab, launched in October 2023. Over 20 startups and fintech firms have been accepted into this program to develop and commercialize their crypto asset products, demonstrating Qatar’s commitment to nurturing blockchain technology and digital finance.

The QFC, an onshore business and financial center in Doha, offers a unique operating environment for companies. Its special status allows for 100% foreign ownership and full profit repatriation, with a competitive 10% corporate tax rate on locally sourced profits.

This business-friendly ecosystem, combined with the new digital asset regulations, positions Qatar as an attractive destination for crypto firms.

With the launch of the Digital Assets Framework, the QFC has opened applications for companies seeking licenses to operate as token service providers. This move is expected to attract a diverse range of crypto businesses to Qatar, potentially establishing the country as a significant hub for digital asset activities in the Middle East.

Qatar’s introduction of a comprehensive digital asset framework reflects the growing global trend of jurisdictions developing specialized regulations for the crypto industry. By providing regulatory clarity, the QFC aims to balance innovation with consumer protection and market integrity, addressing key concerns that have hindered widespread crypto adoption in many regions.

Geopolitical conflicts and safe haven flows

The implementation of these regulations could have far-reaching implications for the crypto sector in the Middle East, despite ongoing complications and conflicts in the region which have triggered slides across crypto markets. An analysis from Kaiko Research covered by Crypto Briefing suggests that Bitcoin has failed to draw “safe haven” investment flows as the Middle East crisis escalates.

With Qatar positioning itself as a crypto-friendly jurisdiction, it may influence neighboring countries to develop similar frameworks, potentially leading to increased regional competition in attracting crypto and digital asset businesses and investments.

Share this article

Go to Source

Author: Vince Dioquino