The ROI roadmap for a white label exchange: profiting from market momentum

Share this article

As we move into 2025, with Bitcoin surpassing $85K and a shifting regulatory environment boosting the crypto sector, market conditions are creating fresh profit potential for emerging exchanges. Crypto exchange software continues to make strides, with advancing trading functionality opening up widened revenue streams for exchange owners. These developments make launching a white label crypto exchange a compelling and lucrative opportunity. This article sheds light on the core components that drive ROI, required for building a profitable exchange, from initial setup costs to operational considerations that shape sustainable growth.

Initial costs of launching a white label exchange

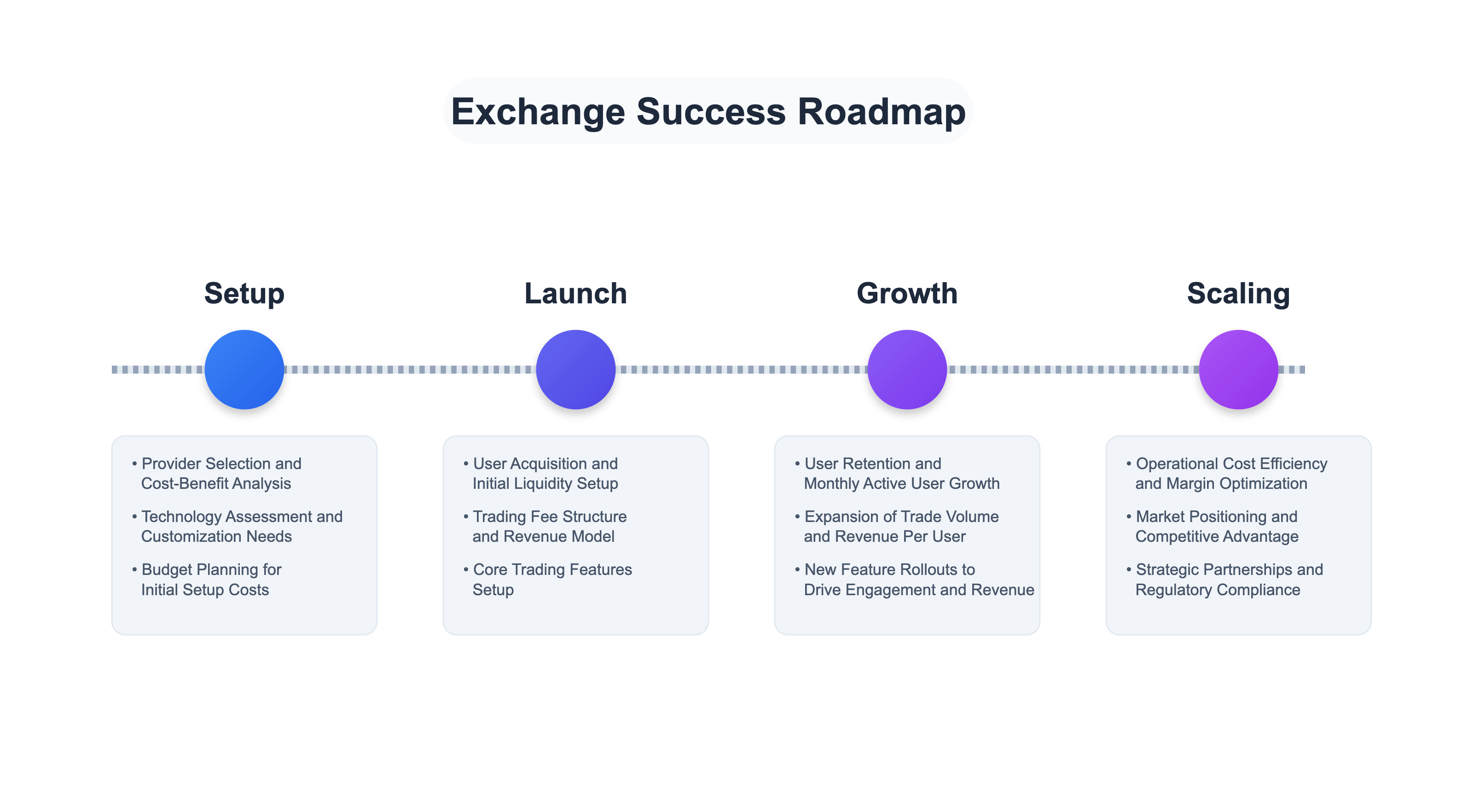

The initial costs of launching an exchange platform start with choosing the right provider—a step that calls for a thorough comparison of technology capabilities, setup costs, hosting expenses, liquidity fees, and revenue splits. While setup fees can be a hard pill to swallow, opting for a provider that doesn’t enforce revenue splits above all else will be the most beneficial in the long run, especially for those planning to operate their platform long term. Technology features like derivatives trading functionality, smart order routing, and aggregated order books are all important capabilities for providing a competitive trading environment. Above all, selecting a provider with high-level trading functionality and a flexible revenue model builds a solid foundation for growth and profitability.

Core variables for a successful exchange platform

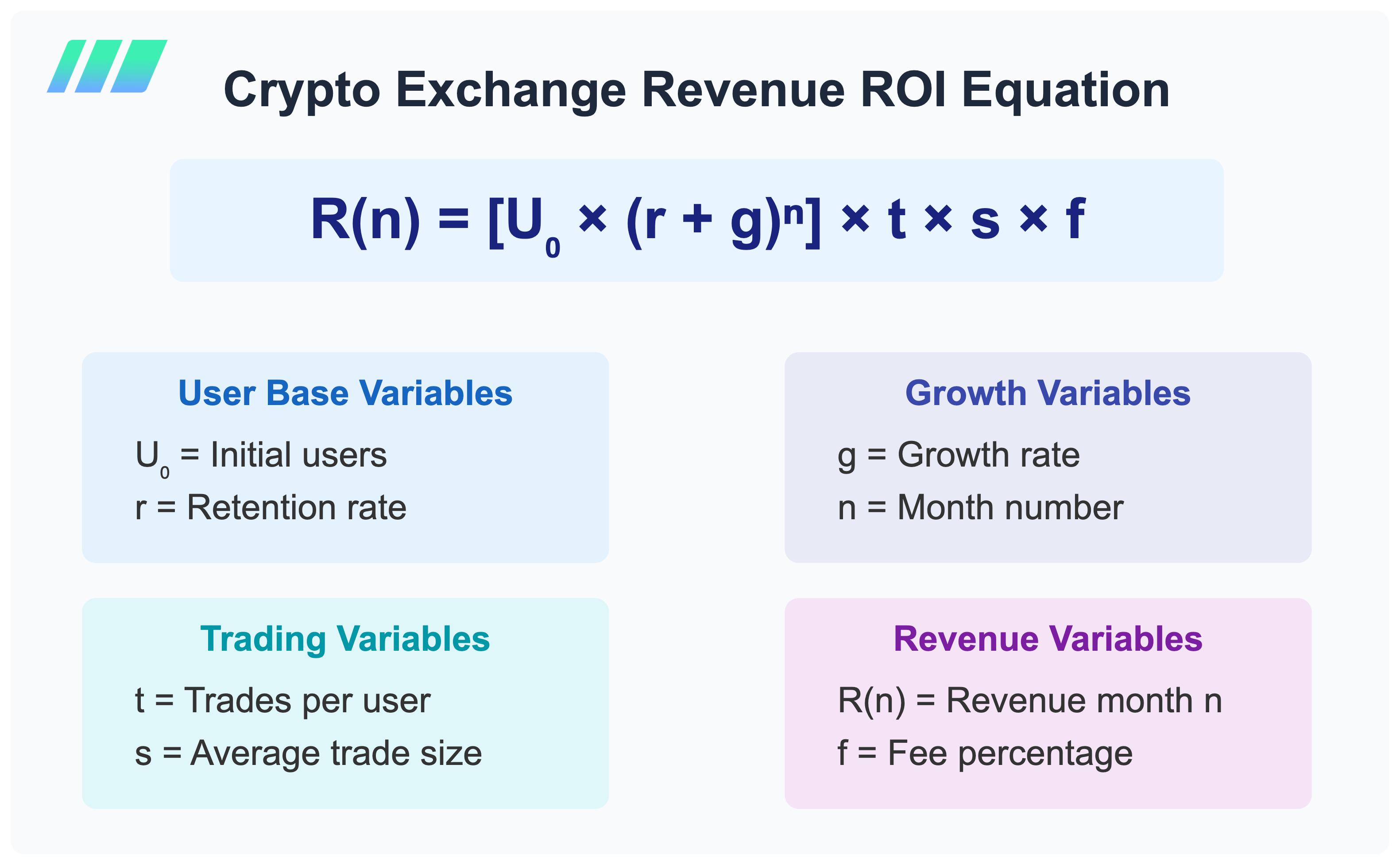

To determine ROI, exchange operators should focus on variables that affect profitability beyond the initial launch date. These include initial monthly active users, average trade size, trades per user, and trading fee percentage. Monthly user growth and retention rates are also key in projecting sustained revenue over time. Together, these metrics provide a framework for assessing and optimizing the platform’s financial performance.

Simply put, this equation shows how much money your crypto exchange will generate each month. It starts with your initial number of users and calculates how that number grows every month – some existing users stay around (retention) while new users join (growth). For example, if you start with 1,000 users and 92% stick around while you also add 10% new users each month, your user base will grow steadily over time.

Then it’s just simple multiplication to find your revenue: take your number of users, multiply by the average number of trades the collective users make per month, multiply by the average amount of money in each trade, and multiply by your fee percentage. So if 1,000 users each make 10 trades of $1,000 with a 0.2% fee, you’ll make $20,000 that month. The equation helps you see how these numbers add up as your user base grows over time.

See this equation in action: get an interactive view into determining ROI with our revenue calculator here.

Managing operational costs

Operational costs play a significant role in shaping the profitability of an exchange platform, with factors like staffing, liquidity provisioning, and partner services (such as crypto custody, KYC/KYT, security, etc.) directly impacting overall expenses. Keeping operational costs as lean as possible early on is pivotal for long-term success, as it allows for reinvestment in growth. A lean cost structure from the start provides a solid foundation, enabling the exchange to scale profitably over time.

Closing thoughts

Launching a crypto exchange is a complex journey that goes well beyond the initial investment. Success requires a clear understanding of both upfront and ongoing costs, as well as the factors driving revenue and user growth over time. Carefully evaluating initial setup costs, tracking core variables, and managing operational expenses enables operators to maximize their platform’s return on investment. With a well-thought-out roadmap, exchange operators can build a sustainable (and profitable) platform that meets the advancing needs of the crypto trading community.

As market conditions align for a historic growth period, now is the time to act. If you’re ready to launch a crypto exchange in 2025, partner with Shift Markets for a modular platform offering advanced trading tech, like native derivatives trading and control over market making, all without revenue splits. Build with the leading provider in crypto infrastructure and seize the momentum.

Share this article

Go to Source

Author: Diego Almada Lopez