Swift says blockchain integration ‘more plausible’ than unifying CBDCs

Swift claims that interlinking existing systems with blockchains is better for the short term than bringing CBDCs together with tokenized assets in a single ledger.

Bank messaging network Swift has recently shared a report highlighting how Swift can connect with blockchains and solve the issue of interoperability between different blockchain networks.

In a report titled “Connecting blockchains: Overcoming fragmentation in tokenised assets,” Swift concluded that a more incremental approach that interlinks existing systems to blockchains is “more plausible” for market development in the near term, compared to bringing together central bank digital currencies (CBDCs), tokenized deposits and assets in a single unified ledger.

Swift highlighted in the report that there’s a “lack of secure interoperability” between different blockchain networks. The financial giant said that this leads to various inefficiencies and poor user experience. However, the financial institution believes that there’s potential for Swift to solve the interoperability problem.

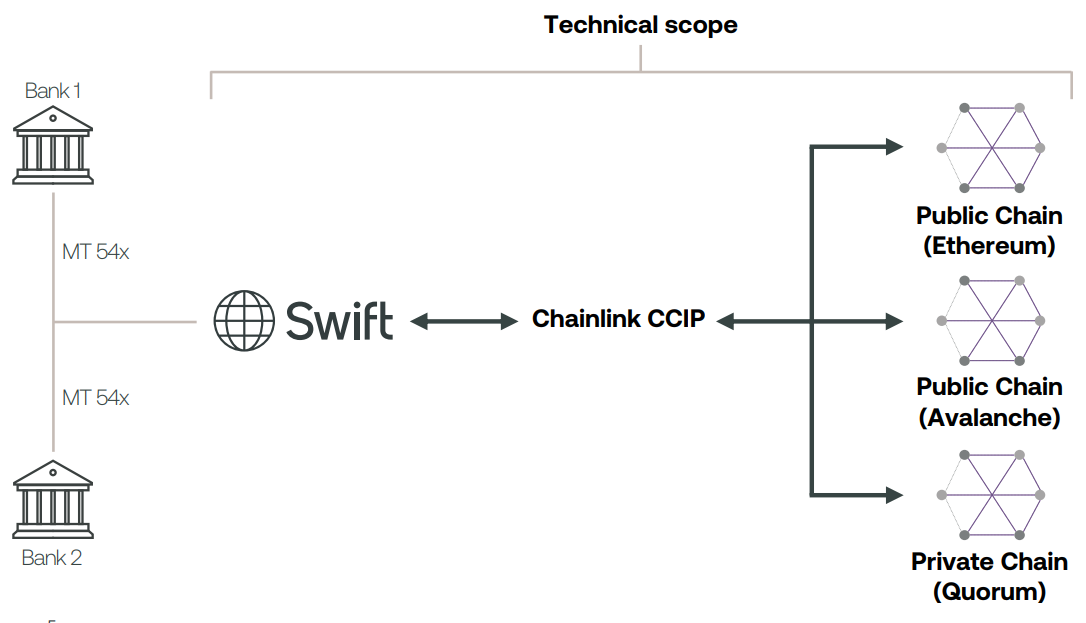

Working with various financial institutions and blockchain oracle network provider Chainlink, Swift said that it was able to showcase its ability to provide a single point of access to multiple networks using existing infrastructure. According to Swift, this significantly reduces operational challenges and costs for institutions to support tokenized assets.

Related: Singapore central bank says three business days is ‘timely transfer’ for stablecoins

In a press release, Swift’s chief innovation officer Tom Zschach said that tokenization can reach its full potential once institutions can connect to the whole financial ecosystem. Zschach explained:

“Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenization and unlocking its potential.”

Within the report, Swift pointed toward many potential benefits of tokenization, which include increased liquidity and automation as well as enhanced transparency and security.

Apart from these, the banking infrastructure highlighted that while tokenization has its benefits, it also has significant hurdles such as legal and regulatory frameworks being still under development. According to Swift, this remains a challenge for institutions when diving into making tokenized asset transactions.

Magazine: SEC reviews Ripple ruling, US bill seeks control over DeFi, and more: Hodler’s Digest, July 16-22

Go to Source

Author: Ezra Reguerra